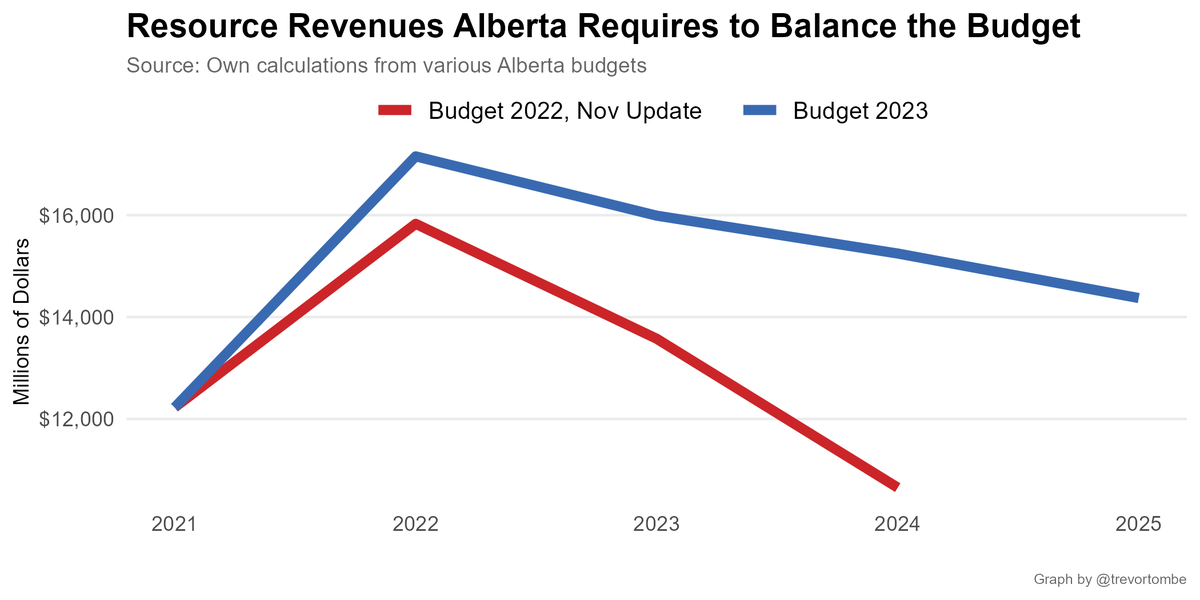

Oil again below $70/bbl. Alberta needs ~$75 to balance and was banking on $80 for the budget.

Hopefully we'll see some serious ideas from both parties around how to ease our dependence on this volatile revenue source. #abvotes

Hopefully we'll see some serious ideas from both parties around how to ease our dependence on this volatile revenue source. #abvotes

Tip: if a candidate or leader uses the words "economic diversification" in any statement about our reliance on resource revenues, that's a clue that they have no idea what's going on.

* correction: budget 2023 was based on 79 for the 2023/24 year, not 80

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter