#Fed Chair #Powell start the press conference with a strong message on banking

"Conditions in the banking sector have broadly improved since early March and the US banking system is sound and resilient. We will continue to monitor conditions in the sector"

"Conditions in the banking sector have broadly improved since early March and the US banking system is sound and resilient. We will continue to monitor conditions in the sector"

"Committed learning the right lessons from this episode and we will work to prevent these events from happening again. VC Barr's review underscores need to address our rules & supervisory practices to make for stronger & + resilient banking system & I'm confident we will do so"

#Fed Chair Powell:

"Looking ahead we will take a data dependent approach in determining additional policy affirming may be appropriate."

It will take time however for the full effects of monetary restraint to be realized, especially on inflation."

"Looking ahead we will take a data dependent approach in determining additional policy affirming may be appropriate."

It will take time however for the full effects of monetary restraint to be realized, especially on inflation."

"In addition, the economy is likely to face further head winds because of tight credit conditions.

Banking sector strains result in tighter conditions. These tighter credit conditions are likely to weigh on economic activity, hiring and inflation. Effects remains uncertain"

Banking sector strains result in tighter conditions. These tighter credit conditions are likely to weigh on economic activity, hiring and inflation. Effects remains uncertain"

#Fed Chair Powell:

"In determining the extent to which additional policy firming may be appropriate to return inflation to 2% over time, the committee will take in to account the tightening of monetary policy, affects economic activity, & financial developments"

"In determining the extent to which additional policy firming may be appropriate to return inflation to 2% over time, the committee will take in to account the tightening of monetary policy, affects economic activity, & financial developments"

#Fed Chair #Powell: (Excessively) data dependent flexibility

**We will make that determination meeting by meeting and the implications for the outlook for economic activity and inflation.

**We are prepared to do more if greater monetary policy restraint is warranted**

**We will make that determination meeting by meeting and the implications for the outlook for economic activity and inflation.

**We are prepared to do more if greater monetary policy restraint is warranted**

#Fed Chair #Powell to Q from @jeannasmialek:

"A decision on a pause was not made today."

"We will be driven by incoming data meeting by meeting and we will approach that question at the June meeting"

"A decision on a pause was not made today."

"We will be driven by incoming data meeting by meeting and we will approach that question at the June meeting"

#Fed Chair #Powell:

"It is essential that the #debtceiling be raised in a timely way so that the government can pay all of its bills when they're due. A failure to do that would be unprecedented. Consequences to the US economy could be highly uncertain and could be quite averse"

"It is essential that the #debtceiling be raised in a timely way so that the government can pay all of its bills when they're due. A failure to do that would be unprecedented. Consequences to the US economy could be highly uncertain and could be quite averse"

#Fed Chair #Powell to @steveliesman:

"In this particular case we have found that the monetary policy tools & financial stability tools are not in conflict. They're working well together. We have used our financial stability tools to support banks through our lending facilities"

"In this particular case we have found that the monetary policy tools & financial stability tools are not in conflict. They're working well together. We have used our financial stability tools to support banks through our lending facilities"

#Fed Chair #Powell to @vtg2:

"I don't have agenda to further consolidate banks... Regional banks serve very important purposes... We don't want the largest banks doing big acquisitions. That's the policy. But this is an exception for a failing bank"

"I don't have agenda to further consolidate banks... Regional banks serve very important purposes... We don't want the largest banks doing big acquisitions. That's the policy. But this is an exception for a failing bank"

#Fed Chair #Powell to @colbyLsmith:

"Impossible to have a precise estimate as to the effect of tighter credit conditions [in terms of equivalent rate hikes]... We won't have to raise rates quite as high as we would have if the banking sector stress had not happened"

"Impossible to have a precise estimate as to the effect of tighter credit conditions [in terms of equivalent rate hikes]... We won't have to raise rates quite as high as we would have if the banking sector stress had not happened"

#Fed Chair Powell to @colby on the idea of pause:

"The assessment of the extent to which additional policy firming may be appropriate is going to an ongoing one. Meeting by meeting..."

"The assessment of the extent to which additional policy firming may be appropriate is going to an ongoing one. Meeting by meeting..."

#Fed Chair #Powell to @hpschneider:

"The SLOOS report consistent with what we are seeing from other sources... beige book & various earning calls... Mid-sized banks have been tightening their lending standards. Banking data will show that lending has continued to slow"

"The SLOOS report consistent with what we are seeing from other sources... beige book & various earning calls... Mid-sized banks have been tightening their lending standards. Banking data will show that lending has continued to slow"

#Fed Chair #Powell to @NickTimiraos on why not pause now to assess lagged effects of policy:

"We always have to balance the risk of not doing enough. And not getting inflation under control against the risk of maybe slowing down economic activity too much..."

"We always have to balance the risk of not doing enough. And not getting inflation under control against the risk of maybe slowing down economic activity too much..."

#Powell adds:

"...And we thought that this 25bps rate hike along with the meaningful change in our policy statement was the right way to balance the risks"

"...And we thought that this 25bps rate hike along with the meaningful change in our policy statement was the right way to balance the risks"

Q from @NickTimiraos on #Fed assessment period potentially being longer than 6 weeks between meetings:

"...assessment will be an ongoing one"

Points to prior false signals from inflation

"We have the luxury, we have raised 500bps. I think that policy is tight"

"...assessment will be an ongoing one"

Points to prior false signals from inflation

"We have the luxury, we have raised 500bps. I think that policy is tight"

#Poswell to Q from @boes_ :

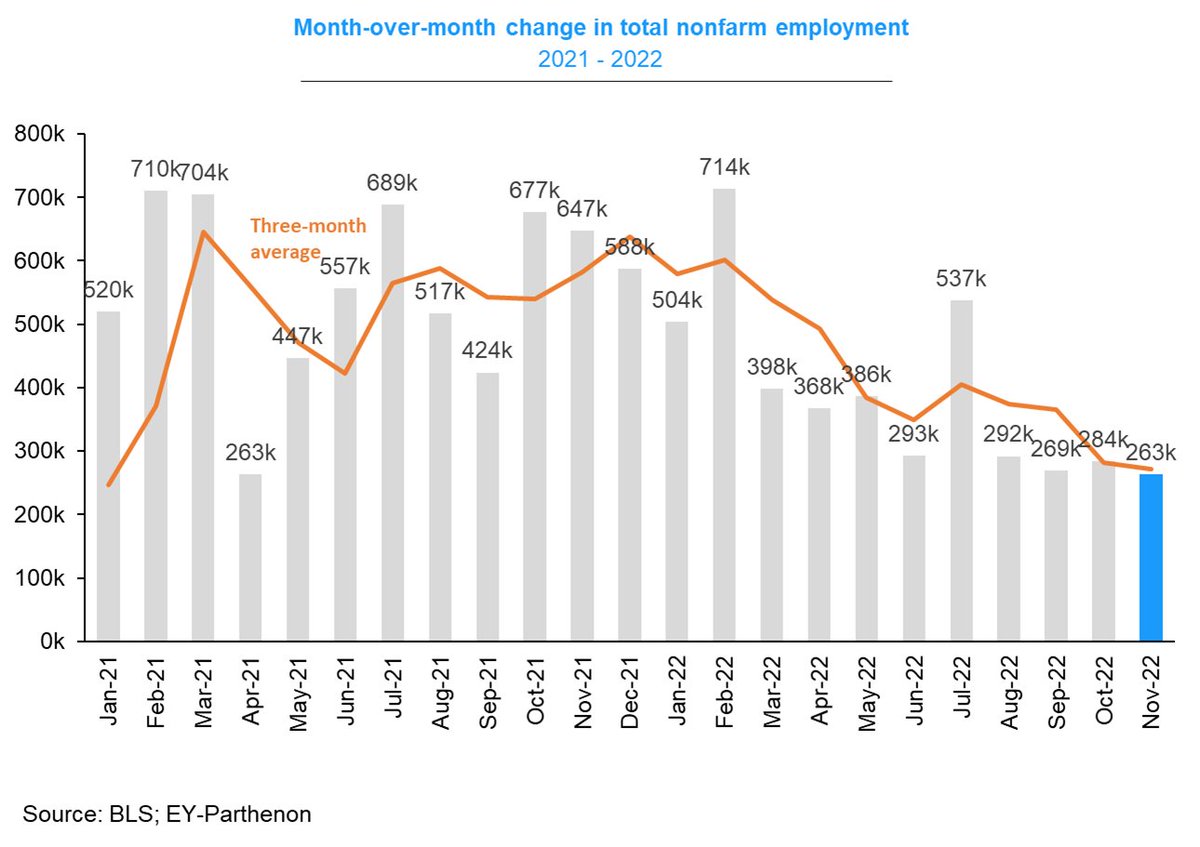

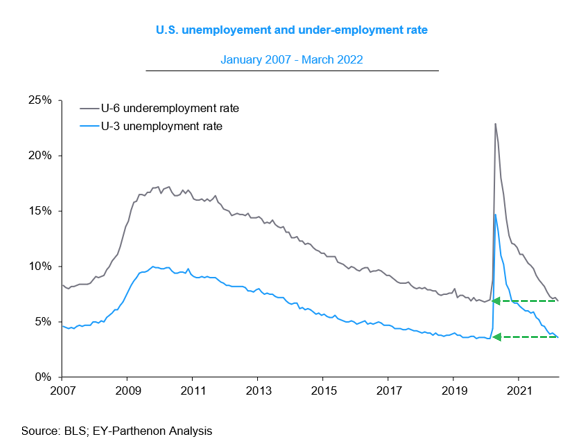

"It wasn't supposed to be possible for job openings to decline by as much as they have declined with our unemployment going up... Wage increases have been moving down. That's a good sign... "

"It wasn't supposed to be possible for job openings to decline by as much as they have declined with our unemployment going up... Wage increases have been moving down. That's a good sign... "

#Powell adds:

"Wage increases closer to 3% roughly is what it would take to get to be consistent with inflation over a longer period of time...

I do not think that wages are a principal driver of inflation. Tend to move together and it is very hard to say what's causing what"

"Wage increases closer to 3% roughly is what it would take to get to be consistent with inflation over a longer period of time...

I do not think that wages are a principal driver of inflation. Tend to move together and it is very hard to say what's causing what"

#Fed Chair #Powell to excessively backward looking data dependence:

"We look at a combination of data and forecasts. We're always looking at both. Particular focus is going to be what's happening with credit tightening, small/medium sized banks tightening credit standards."

"We look at a combination of data and forecasts. We're always looking at both. Particular focus is going to be what's happening with credit tightening, small/medium sized banks tightening credit standards."

#Fed Chair #Powell to @mckonomy:

"We've raised rates by 5 percentage points. We are shrinking the balance sheet and now we have credit conditions tightening. Have to assess whether our policy stance is sufficiently restrictive. Challenging given long and variable lags"

"We've raised rates by 5 percentage points. We are shrinking the balance sheet and now we have credit conditions tightening. Have to assess whether our policy stance is sufficiently restrictive. Challenging given long and variable lags"

#Fed Chair #Powell:

"FOMC view is that inflation is going to come down not so quickly. It will take some time. And in that world, if that forecast is broadly right, it would not be appropriate to cut rates. We won't cut rates."

"FOMC view is that inflation is going to come down not so quickly. It will take some time. And in that world, if that forecast is broadly right, it would not be appropriate to cut rates. We won't cut rates."

#Fed Chair #Powell on baking sector accountability (wink to Congress):

"The only thing that I'm focused on is to understand what went wrong. What happened and identify what we need to do to address that. I feel I'm accountable to do everything I can to make sure that happens."

"The only thing that I'm focused on is to understand what went wrong. What happened and identify what we need to do to address that. I feel I'm accountable to do everything I can to make sure that happens."

#Fed Chair #Powell:

"Congress establishing a 4yr term for someone else on the board (Vice Chair) who gets to set the agenda for supervision and regulation for the Board of Governors. Congress wanted that person to have political accountability for developing that agenda"

"Congress establishing a 4yr term for someone else on the board (Vice Chair) who gets to set the agenda for supervision and regulation for the Board of Governors. Congress wanted that person to have political accountability for developing that agenda"

#Fed Chair #Powell:

"Support for 25bps rate hike was very strong across the board... People did talk about pausing but not so much at this meeting. If you add up all the tightening that's going on through various channels we feel like we're getting close or maybe even there."

"Support for 25bps rate hike was very strong across the board... People did talk about pausing but not so much at this meeting. If you add up all the tightening that's going on through various channels we feel like we're getting close or maybe even there."

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter