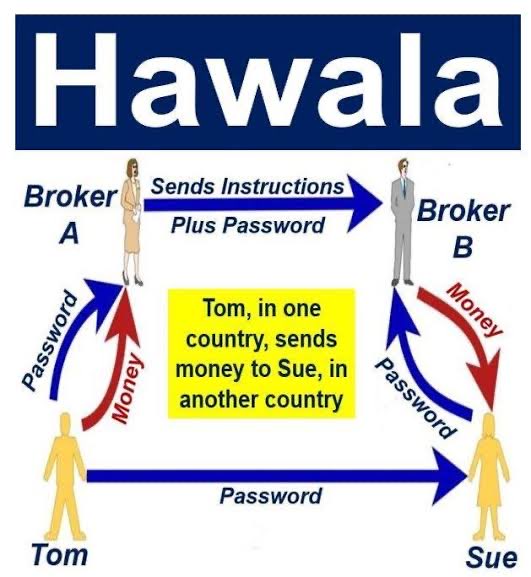

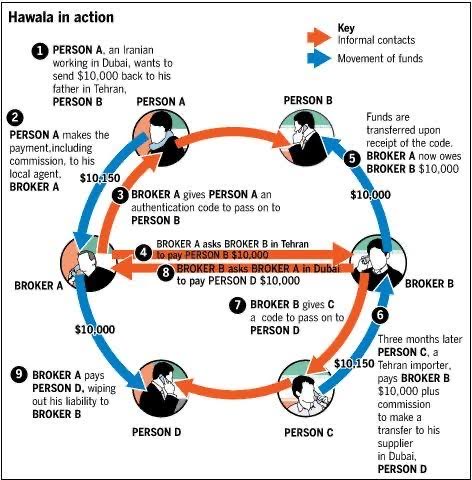

THIS IS #BIG ! #Hawala 2.0 Will EXPLODE in India post JULY 1st. Just My opinion:

By IMPLEMENTING 20% Tax Collected On Source (#TCS) on Foreign Spend (Currency, FX cards, Credit Cards, Debit Cards, Transfers), it becomes Increasingly more Cost Effective to Transfer Via #Hawala

By IMPLEMENTING 20% Tax Collected On Source (#TCS) on Foreign Spend (Currency, FX cards, Credit Cards, Debit Cards, Transfers), it becomes Increasingly more Cost Effective to Transfer Via #Hawala

If you try and BUY #Foreign Currency in the Black, that spread that used to be 2-3%, will now become 10% possibly

Unused Balances of Loaded Forex Cards will Go at a Premium of 10-12%

Unused Balances of Loaded Forex Cards will Go at a Premium of 10-12%

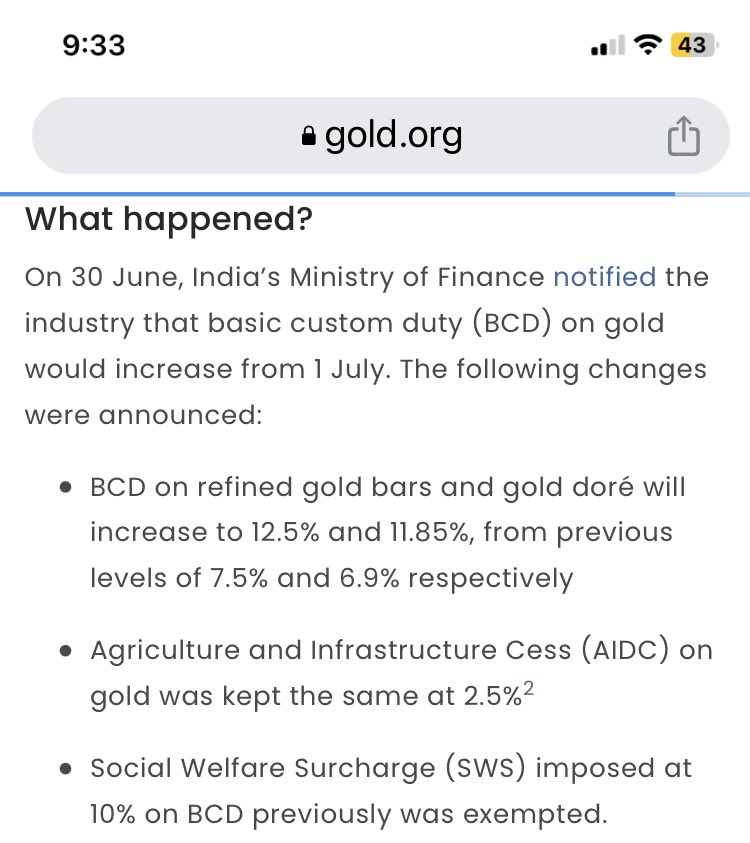

This REMINDS me of what happened in GOLD SMUGGLING in India post June 2022 when @nsitharaman decided to Raise IMPORT duty on GOLD to 12.5% from previous levels of 7.5%

Now the Total #Tax on GOLD becomes almost 18.45%.

As soon as this #GOLD Import DUTY hike got announced, #WorldGoldCouncil published - report saying that #GOLD #SMUGGLING will EXPLODE since it becomes very profitable to BUY in Black vs Formal which is 15% More Expensive

As soon as this #GOLD Import DUTY hike got announced, #WorldGoldCouncil published - report saying that #GOLD #SMUGGLING will EXPLODE since it becomes very profitable to BUY in Black vs Formal which is 15% More Expensive

Back in 2016, the GOVT RAISED the #PAN Requirement for #GOLD & #jewellery purchase from INR 50k to INR 200k. The limit for Mutual Funds, Insurance, Cash Deposits etc is INR 50k. Why will they RAISE the LIMIT on GOLD & JEWELLERY ago INR 200k

Let’s SUMMARISE

1) 20% Tax Collected at Source #TCS will revive #Hawala in a big way

2) GOLD Import Duty Hike in July 2022 resulted in HIGHER GOLD SMUGGLING

3) Raising the #PAN card Threshold on GOLD & JEWELLERY purchase to INR 200k implies REDUCED Disclosure of PURCHASE

1) 20% Tax Collected at Source #TCS will revive #Hawala in a big way

2) GOLD Import Duty Hike in July 2022 resulted in HIGHER GOLD SMUGGLING

3) Raising the #PAN card Threshold on GOLD & JEWELLERY purchase to INR 200k implies REDUCED Disclosure of PURCHASE

This is just a view. It sounds logical to me. If my understanding is wrong, am happy to be corrected.

Now how does International Smuggling happen?

VIA ENTRY POINTS to India …. PORTS & AIRPORTS

Who owns all these ?

🤔😜

VIA ENTRY POINTS to India …. PORTS & AIRPORTS

Who owns all these ?

🤔😜

• • •

Missing some Tweet in this thread? You can try to

force a refresh