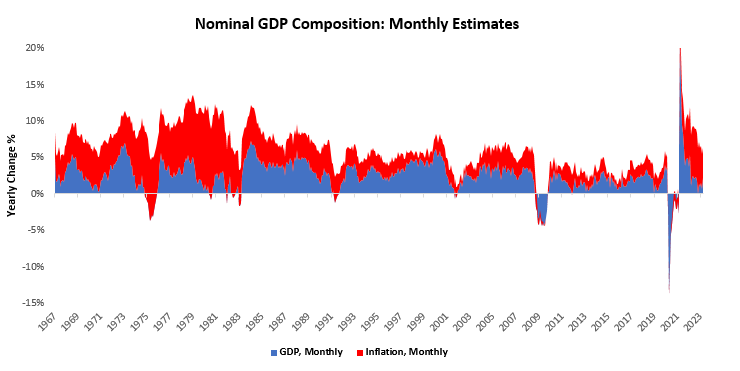

1. Our process tells us that we are likely headed towards a stagflationary environment, i.e., with growth contracting and inflation likely to be persistent. This regime tends to be one of the worst for passive investors, the reasoning for which is twofold.

2. Recessions are the primary risk to stocks as nominal spending collapses. At the same time, inflationary episodes are the primary risk to bonds as their fixed interest rate becomes less attractive relative to other nominal assets.

3. While we intend to provide a more in-depth commentary on both of these components separately in our upcoming Month in Macro report, we provide a sneak peek in what will be further elaborated on.

4. Currently we are witnessing significant pressure in the real economy. This is reinforced by the weakness highlighted in our nowcasts for Real Buiness Sales, Industrial Porduction, Resendential Investment.

5. However, at the same time nominal activity remains elevated, and debt services costs remain low relative to this activity. Additionally, labor markets also remain secularly tight.

6. This combination suggests that a recession is likely in the cards, with inflation still elevated. These dynamics will force policy to remain tighter for longer than is currently priced in bond markets & growth to come in lower than is currently priced by equity markets.

7. Therefore, in order to navigate this regime nimbly, we recently added a Stocks & Bond Long Only strategy to out 'Prometheus Cycle Strategies' toolkit. Additional details can be found in our latest note:

prometheusresearch.substack.com/p/the-observat…

prometheusresearch.substack.com/p/the-observat…

8. We recognize the importance of Long Only strategies for passive investors and our aim is to be able to provide the best regime tested startegies to our audience.

Over the coming months we will slowly unravel our stratgies and signals in a combined offering so stay tuned!

Over the coming months we will slowly unravel our stratgies and signals in a combined offering so stay tuned!

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter