On Wages, Profits & Interest Expense

1. The current macroeconomic picture remains where heightened nominal demand continues to press against the economy's capacity constraints, creating heightened inflation.

1. The current macroeconomic picture remains where heightened nominal demand continues to press against the economy's capacity constraints, creating heightened inflation.

2. We think these dynamics will

likely be resolved through the Fed's tightening cycle by raising interest burdens in the economy relative to incomes, creating pressure on profitability for companies, and leading to an eventual lay-off of

workers.

likely be resolved through the Fed's tightening cycle by raising interest burdens in the economy relative to incomes, creating pressure on profitability for companies, and leading to an eventual lay-off of

workers.

3. Therefore, the key to understanding whether the Fed's hiking cycle has been adequate is

whether profits will contract. This profit contraction will likely come from declining topline, sticky wages, and increasing debt service costs.

whether profits will contract. This profit contraction will likely come from declining topline, sticky wages, and increasing debt service costs.

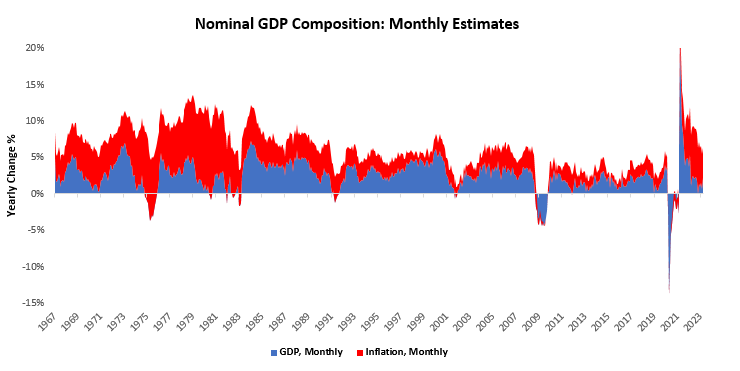

4. Currently, the first two conditions have come to fruition somewhat, i.e., revenues have decelerated while wages have held steady, Additionally, we also note that the declining revenue environment has been a function of moderating nominal GDP primarily driven by inflation.

5. Thus while revenue growth and wages have begun to move in a manner more consistent with a profit squeeze, we have yet to see any meaningful change in corporate interest payments.

6. Therefore, while we have seen some of the slowdown in the economy from the tightening cycle, we think that this is largely a function of a slowdown in new debt creation rather than from strain created by existing interest expense.

7. As we move forward in the cycle, we expect a rise in corporate debt service burdens more consistent with history. However, until this tightening is achieved, inflationary pressures will likely persist.

8. The Fed will have to lean on the duration of their tightening or increase the magnitude of their tightening. Either of these environments will likely be unsupportive of Treasuries notes and bonds.

#fed #macro #investing #markets #bonds #interest #Prometheus

#fed #macro #investing #markets #bonds #interest #Prometheus

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter