Denison Mines $DNN $DML share price today represents a valuation of only~3.92USD/lb U3O8 DNN has in resources today compared to EV USD/lb valuation a couple companies had in February2007 (when #uranium spotprice was ~75USD/lb):

DNN: 21.42USD/lb= 5x

$PDN: 23.04

$FSY: 16.02

(1/5)

DNN: 21.42USD/lb= 5x

$PDN: 23.04

$FSY: 16.02

(1/5)

https://twitter.com/quakes99/status/1646159140107026441

Global Atomic $GLO (building 5Mlb/y DASA mine with possibility to 2x planned production if right price is paid,produce #uranium early2025 & signing contracts) share today represents valuation of only 1.26USD/lb U3O8🤣compared to PDN EV USD/lb in February 2007 of 23.04 =18x

(2/5)

(2/5)

https://twitter.com/napalm_1_/status/1654548303730688001

Am I pretending $GLO will do 18x from share price today? No! But GLO is stupidly cheap today. Imo 10x from here by 2025/2026 is possibility.

GLO has higher grades than PDN

GLO is also about to increase their #uranium resources and already created JV with government

(3/5)

GLO has higher grades than PDN

GLO is also about to increase their #uranium resources and already created JV with government

(3/5)

https://twitter.com/quakes99/status/1661424532631220224

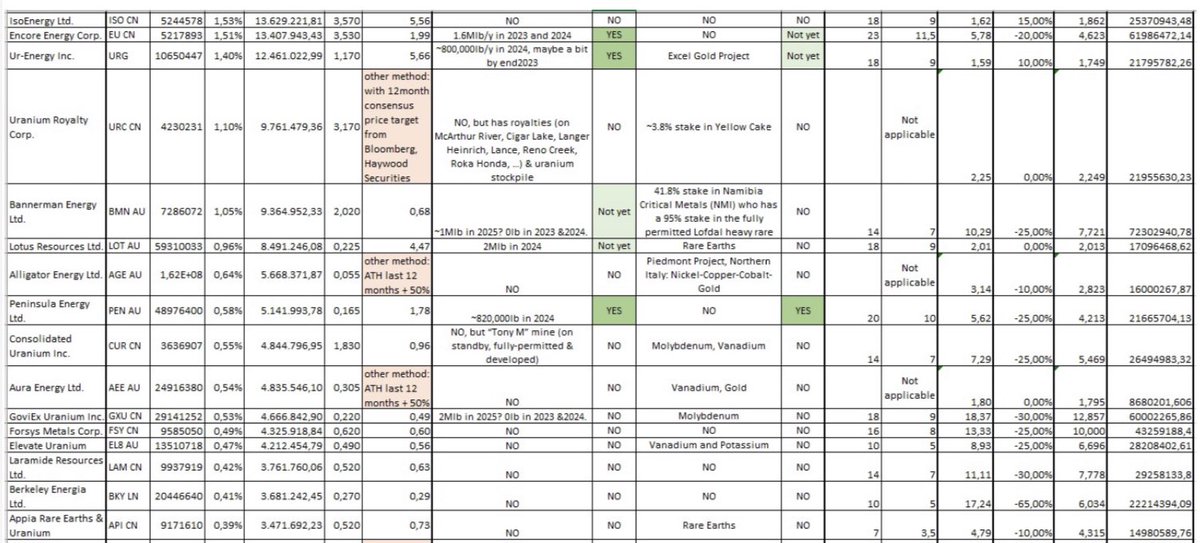

Even #uranium Energy Corp $UEC (several projects & mines in care-&-maintenance mainly in 🇺🇸&🇨🇦, bought >5Mlb cheap U3O8 in past for delivery between 2021-2025 that will have much higher value in future) share is cheap today.

UEC, $EU … important for US supply security

(4/5)

UEC, $EU … important for US supply security

(4/5)

https://twitter.com/quakes99/status/1633087597248647168

EnCore Energy $EU is ahead of schedule on planned #uranium prod restart of Rosita extension & Alta Mesa,and already sold 200,000lb to a client they bought in spot in 2022 (1 1000MW reactor consumes ~400,000lb/y😉). Yet EU share today represents valuation of only 2.49USD/lb

(5/5)

(5/5)

https://twitter.com/quakes99/status/1659184362167095296

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter