May employment report came in mixed with both NFP and UR increasing.

Again, no Wall Street analyst came nowhere close to guessing the headline number with the highest estimate missing it by 129K.

What does that all mean for the #Fed?

A thread.

1/11

Again, no Wall Street analyst came nowhere close to guessing the headline number with the highest estimate missing it by 129K.

What does that all mean for the #Fed?

A thread.

1/11

https://twitter.com/zerohedge/status/1664602070706470913?s=20

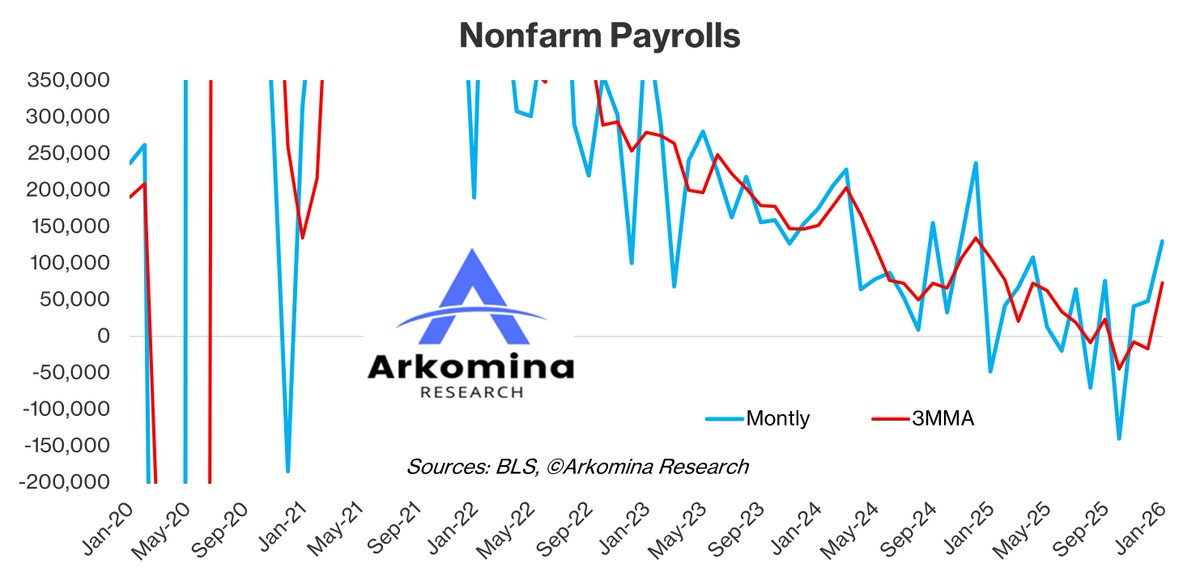

NFP rose for the 29th M in a row with +339K which is 149K above consensus (+190K).

Apr number was revised up by 41K from +253K to +294K.

Total gain in Apr and May is +633K, 190K higher than expected (+443K).

#employment

2/11

Apr number was revised up by 41K from +253K to +294K.

Total gain in Apr and May is +633K, 190K higher than expected (+443K).

#employment

2/11

At the same time UR jumped from 3.4% (cycle low) to 3.7%, the highest since Feb 2022 and the same as in Aug and Oct 2022.

#unemployment

3/11

#unemployment

3/11

0.3 pp jump in UR is highly intriguing.

It is literally the highest jump in UR since Apr 2020 when the #economy was in a deep #recession caused by lockdowns.

Before that we had 1M jumps of that magnitude in 2008, before that in 2001... you get the pattern.

#unemployment

4/11

It is literally the highest jump in UR since Apr 2020 when the #economy was in a deep #recession caused by lockdowns.

Before that we had 1M jumps of that magnitude in 2008, before that in 2001... you get the pattern.

#unemployment

4/11

In the details, gains were almost across the board with only manufacturing and IT recording net layoffs.

There was a noticeable pick-up in construction, transportation, education and health, leisure and hospitality, and government.

#employment

5/11

There was a noticeable pick-up in construction, transportation, education and health, leisure and hospitality, and government.

#employment

5/11

AHE were up +0.3% or +3.96% annualized while Apr was revised down from +0.5% or +5.8% annualized to +0.4% or +4.7% annualized.

As I expected a M ago, they did end up revising Apr number down.

6/11

As I expected a M ago, they did end up revising Apr number down.

https://twitter.com/MBjegovic/status/1654611201316253696?s=20

6/11

AHE is now closer to where the #Fed wants it to be, maybe a still a bit above the desired level.

However, there is a possibility we end up seeing further downside revisions in AHE sometime in the M ahead.

7/11

However, there is a possibility we end up seeing further downside revisions in AHE sometime in the M ahead.

7/11

What does that all mean for the #Fed?

This report supports a pause bc +0.3 pp upside in UR can be worrisome, especially if it persists.

As I explained in my macro/market analyses (Marko's Brain Daily),

I don't think the #Fed will use this report when deciding rates.

8/11

This report supports a pause bc +0.3 pp upside in UR can be worrisome, especially if it persists.

As I explained in my macro/market analyses (Marko's Brain Daily),

I don't think the #Fed will use this report when deciding rates.

8/11

Still, I think they will pause in 2W due to some other reasons mostly related to balancing a tricky path trying not to break anything in the coming W and M.

Now we come to the most important Q of them all - what will the #Fed do later in the year?

9/11

Now we come to the most important Q of them all - what will the #Fed do later in the year?

9/11

These threads take a lot of time and effort to make.

If you like the content, please love and retweet tweets in this thread to help me spread the message.

Thank you!

10/11

If you like the content, please love and retweet tweets in this thread to help me spread the message.

Thank you!

10/11

I'm currently writing my premium

Marko's Fed Report

where I'll, among other things, offer a detailed overview of the #Fed's actions going forward as well as when will the MP lags finally bite into the economy.

If you want to get it, message me.

11/11

Marko's Fed Report

where I'll, among other things, offer a detailed overview of the #Fed's actions going forward as well as when will the MP lags finally bite into the economy.

If you want to get it, message me.

11/11

• • •

Missing some Tweet in this thread? You can try to

force a refresh