#Sopranos fans know the #BustOut as a mob tactic in which a business is taken over, loaded up with debt, and driven into the ground, wrecking the business's workers, customers and suppliers. When the mob does it, it's a bust out; when Wall Street does it, it's #PrivateEquity.

1/

1/

If you'd like an essay-formatted version of this thread to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

pluralistic.net/2023/06/02/plu…

2/

pluralistic.net/2023/06/02/plu…

2/

It used to be that we rarely heard about private equity, but then, as national chains and iconic companies started to vanish, this mysterious financial arrangement popped up with increasing frequency.

3/

3/

When a finance bro's presentation on why #OliveGarden needed to be re-orged when viral, there was a lot off snickering about the decline of a tacky business whose value prop was unlimited carbs.

4/

4/

But the bro was working for #StarboardValue, a hedge fund that specialized in buhying out and killing off companies, pocketing billions while destroying profitable businesses.

salon.com/2014/09/17/the…

5/

salon.com/2014/09/17/the…

5/

Starboard Value's game was straightforward: buy a business, load it with debt, sell off its physical plant - the buildings it did business out of - pay itself, and then have the business lease back the buildings, bleeding out money until it collapsed.

6/

6/

They pulled it with #RedLobster,and the point of the viral Olive Garden dis track was to soften up the company for its own bust out.

7/

7/

The bust out tactic wasn't limited to mocking middlebrow family restaurants. For years, the crooks who ran these ops did a brisk trade in blaming the internet.

8/

8/

Why did #Sears tank? Everyone knows that the 19th century business was an antique, incapable of mounting a challenge in the age of e-commerce.

9/

9/

That was a great smokescreen for an old-fashioned bust out that saw corporate looters make off with hundreds of millions, leaving behind empty storefronts and emptier pension accounts for the workers who built the wealth the looters stole:

prospect.org/economy/vultur…

10/

prospect.org/economy/vultur…

10/

Same goes for #ToysRUs: it wasn't Amazon that killed the iconic toy retailer - it was PE bosses who extracted $200m from the chain, then walked away, hands in pockets and whistling, while the businesses collapsed and the workers got zero severance:

washingtonpost.com/news/business/…

11/

washingtonpost.com/news/business/…

11/

It's a good racket - for the racketeers. Private equity has grown from a finance sideshow to Wall Street's apex predator, and it's devouring the real economy through a string of audactious bust outs, each more consequential and depraved than the last.

12/

12/

As PE shows that it can turn profitable businesses gigantic windfalls, sticking the rest of us with the job of sorting out the smoking craters they leave behind, more and more investors are piling in.

13/

13/

Today, the PE sector loves a #rollup, which is when they buy several related businesses and merge them into one firm. The nominal business-case for a rollup is that the new, bigger firm is more "efficient." In reality, a rollup's strength is in eliminating competition.

14/

14/

When all the pet groomers, or funeral homes, or urgent care clinics for ten miles share the same owner, they can raise prices, lower wages, and fuck over suppliers.

15/

15/

They can also *borrow*. A quirk of the credit markets is that a standalone small business is valued at about 3-5x its annual revenues. But if that business is part of a large firm, it is valued at 10-20x annual turnover.

16/

16/

That means that when a private equity company rolls up a comedy club, ad agency or water bottler (all businesses presently experiencing PE rollup), with $1m in annual revenues, it shows up on the PE company's balance sheet as an asset worth $10-20m.

17/

17/

That's $10-20m worth of collateral the PE fund can stake for loans that let it buy and roll up more small businesses.

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire.

18/

2.9 million Boomer-owned businesses, employing 32m people, are expected to sell in the next couple years as their owners retire.

18/

Most of these businesses will sell to PE firms, who can afford to pay more for them as a prelude to a bust out than anyone intending to operate them as a productive business could ever pay:

pluralistic.net/2022/12/16/sch…

19/

pluralistic.net/2022/12/16/sch…

19/

PE's most ghastly impact is felt in the health care sector. Whole towns' worth of emergency rooms, family practices, labs and other health firms have been scooped up by PE, which has spent more than $1t since 2012 on health acquisitions:

pluralistic.net/2022/11/17/the…

20/

pluralistic.net/2022/11/17/the…

20/

Once a health care company is owned by PE, it is significantly more likely to commit medicare fraud. It also cuts wages and staffing for doctors and nurses. PE-owned facilities do more unnecessary and often dangerous procedures.

21/

21/

Appointments get shorter. The companies get embroiled in kickback scandals. PE-backed dentists hack away at children's mouths, filling them full of root-canals.

pluralistic.net/2022/11/17/the…

22/

pluralistic.net/2022/11/17/the…

22/

The Healthcare Private Equity Association boasts that its members are poised to spend more than $3t to create "the future of healthcare."

hcpea.org/#!event-list

23/

hcpea.org/#!event-list

23/

As bad as PE is for healthcare, it's worse for long-term care. PE-owned nursing homes are charnel houses, and there's a particularly nasty PE scam where elderly patients are tricked into signing up for palliative care, which is never delivered.

24/

24/

It isn't needed, because the patients aren't dying! These fake "hospices" get huge payouts from medicare - and the patient is made permanently ineligible for future medicare, because they are recorded being in their final decline:

pluralistic.net/2023/04/26/dea…

25/

pluralistic.net/2023/04/26/dea…

25/

Every part of the health care sector is being busted out by PE. Another ugly PE trick, the "club deal," is devouring the medical supply business.

26/

26/

Club deals were huge in the 2000s, destroying rent-controlled housing, energy companies, Mervyn's department stores, Harrah's, and Old Country Joe. Now it's doing the same to medical supplies:

pluralistic.net/2021/05/14/bil…

27/

pluralistic.net/2021/05/14/bil…

27/

PE is behind the mass rollup of single-family homes across America. Wall Street landlords are the worst landlords in America, who load up your rent with junk fees, leave your home in a state of dangerous disrepair, and evict you at the drop of a hat:

pluralistic.net/2021/08/16/die…

28/

pluralistic.net/2021/08/16/die…

28/

As these houses decay through neglect, private equity makes a bundle from tenants and even more borrowing against the houses. In a few short years, much of America's desperately undersupplied housing stock will be beyond repair. It's a bust out.

29/

29/

You know all those exploding trains filled with dangerous chemicals that poison entire towns? Private equity bust outs:

pluralistic.net/2022/02/04/up-…

30/

pluralistic.net/2022/02/04/up-…

30/

Where did PE come from? How can these people live with themselves? Why do we let them get away with it? How do we stop them?

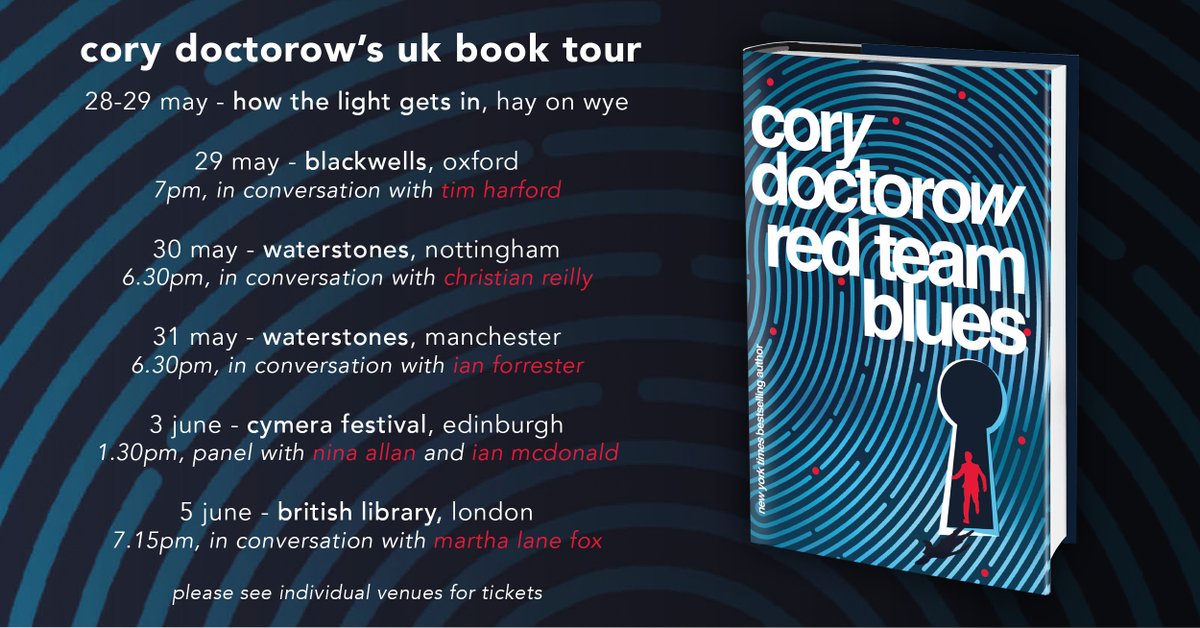

In @TheProspect, Maureen Tkacik reviews two books that try to answer these questions, but really only manage the first three:

prospect.org/culture/books/…

31/

In @TheProspect, Maureen Tkacik reviews two books that try to answer these questions, but really only manage the first three:

prospect.org/culture/books/…

31/

The first of these books is *These Are the Plunderers: How Private Equity Runs—and Wrecks—America* by @gmorgenson and @JoshRosner:

simonandschuster.com/books/These-Ar…

The second is *Plunder: Private Equity’s Plan to Pillage America*, by @brendanballou:

hachettebookgroup.com/titles/brendan…

32/

simonandschuster.com/books/These-Ar…

The second is *Plunder: Private Equity’s Plan to Pillage America*, by @brendanballou:

hachettebookgroup.com/titles/brendan…

32/

Both books describe the bust out from the inside. For example, #PetSmart - looted for $30 billion by #RaymondSvider and his PE fund #BCPartners - is a slaughterhouse for animals.

33/

33/

The company systematically neglects animals - failing to pay workers to come in and feed them, say, or refusing to provide backup power to run during power outages, letting animals freeze or roast to death.

34/

34/

Though PetSmart has its own vet clinics, the company doesn't want to pay its vets to nurse the animals it damages, so it denies them care. But the company is also too cheap to euthanize those animals, so it lets them starve to death.

35/

35/

PetSmart is also too cheap for cremation, so traumatized staff are ordered to smuggle the animals into random dumpsters.

All this while PetSmart's sales increased by 60%, matched by growth in the company's margins. That money went to the bust out.

forbes.com/sites/antoineg…

36/

All this while PetSmart's sales increased by 60%, matched by growth in the company's margins. That money went to the bust out.

forbes.com/sites/antoineg…

36/

Tkacik says these books show that we're finally getting wise to PE. Back in the Clinton years, the PE critique painted the perps as sharp operators who reduced quality and jacked up prices.

37/

37/

Today, books like these paint these "investors" as the monsters they are - crooks whose bust ups are crimes, not clever finance hacks.

Take the #CarlyleGroup, which pioneered nursing home rollups.

38/

Take the #CarlyleGroup, which pioneered nursing home rollups.

38/

As Carlyle slashed wages, its workers suffered - but its elderly patients suffered more. Thousands of Carlyle "customers" died of "dehydration, gangrenous bedsores, and preventable falls" in the pre-covid years.

washingtonpost.com/business/econo…

39/

washingtonpost.com/business/econo…

39/

PE loves to pick on people who can't fight back: kids, sick people, disabled people, old people. No surprise, then, that PE *loves* prisons - the ultimate captive audience.

40/

40/

#HIGCapital is a $55b fund that owns #TKCHoldings, who got the contract to feed the prisoners at 400 institutions. They got the contract after the prisons fired #Aramark, owned by PE giant #WarburgPincus, whose food was so inedible that it provoked riots.

41/

41/

TKC got a million bucks extra to take over the food at Michigan's Kinross Correctional, then, incredibly, made the food *worse*. A chef who refused to serve 100 bags of rotten potatoes ("the most disgusting thing I’ve seen in my life") was fired:

wzzm13.com/article/news/l…

42/

wzzm13.com/article/news/l…

42/

TKC doesn't just operate prison kitchens - it operates prison commissaries, where it gouges prisoners on junk food to replace the inedible slop it serves in the cafeteria.

43/

43/

The prisoners buy this food with money they make working in the prison workshops, for $0.10-0.25/hour. Those workshops are also run by TKC.

44/

44/

Tkacic traces private equity back to the "corporate raiders" of the 1950s and 1960s, who "stealthily borrowed money to buy up enough shares in a small or midsized company to control its biggest bloc of votes, then force a stock swap and install himself as CEO."

45/

45/

The most famous of these raiders was #EliBlack, who took over #UnitedFruit with this gambit - a company that had a long association with the CIA, who had obligingly toppled elected governments and installed dictators friendly to United's interests (hence "banana republic").

46/

46/

Eli Black's son is #LeonBlack, a notorious PE predator. Leon Black started out with junk-bond kingpin Michael Milken, optimizing Milken's operation, the most terrifying bust out machine of its day, buying, debt-loading and wrecking a string of beloved American businesses.

47/

47/

Milken bought 2,000 companies and put 200 of them through bankruptcy, leaving the survivors in a brittle, weakened state.

48/

48/

It got so bad that the *Business Roundtable* complained about the practice to Congress, calling Milken, Black, et al, "a small group is systematically extracting the equity from corporations and replacing it with debt, and incidentally accumulating major wealth."

49/

49/

Black backstabbed Milken, tanked his bank, then set out on his own. He destroyed #Samsonite, "subjecting it to 12 humiliating years of repeated fee extractions, debt-funded dividend payments, brutal plant closings, and schemes to induce employees to buy its worthless stock."

50/

50/

The money to buy Samsonite - and many other businesses - came through a shadowy deal between Black and #JohnGaramendi, then a California insurance commissioner, now a California congressman.

51/

51/

Garamendi helped Black buy a $6b portfolio of junk bonds from an insurance company in a wildly shady deal. Garamendi wrote down the bonds by $3.9b, stealing money "from innocent people who needed the money to pay for loved ones’ funerals, irreparable injuries, etc."

52/

52/

Black ended up getting all kinds of favors from powerful politicians - including former Connecticut governor John Rowland and Donald Trump. He also wired $188m to #JeffreyEpstein for reasons that remain opaque.

53/

53/

Black's shady deals are a marked contrast with the exalted political circles he moves in. Despite PE's obviously shady conduct, it is the preferred partner for cities and states, who buy everything from ambulances to infrastructure from PE, with disastrous results.

54/

54/

Federal agencies turn a blind eye to their ripoffs, or even abet them. 38 state houses passed legislation immunizing nursing homes from liability during the start of the covid crisis.

55/

55/

PE barons are shameless about presenting themselves as upstanding cits, unfairly maligned. When Obama made an empty promise to tax billionaires in 2010, Blackstone founder #SteveSchwarzman declared, "It’s a war. It’s like when Hitler invaded Poland in 1939."

56/

56/

Since we're on the subject of Hitler, this is a good spot to bring up #Monowitz, a private-sector satellite of #Auschwitz operated by #IGFarben as a slave labor camp to make rubber and other materiel it supplied at a substantial markup to the wermacht.

57/

57/

I'd never heard of Monowitz, but Tkacik's description of the camp is chilling, even in comparison to Auschwitz itself.

Farben used slaves from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves 4.5m each day to the facility.

58/

Farben used slaves from Auschwitz to work at its rubber plant, but was frustrated by the logistics of moving those slaves 4.5m each day to the facility.

58/

So the company bought 25,000 slaves - preferring children, who were cheaper - and installed them in a co-located death-camp called Monowitz:

commentary.org/articles/r-tan…

59/

commentary.org/articles/r-tan…

59/

Monowitz was - incredibly - worse than Auschwitz. It was so bad, the *SS guards* who worked at it complained to Berlin about the conditions. The SS demanded more hospitals for the workers who dropped from beatings and overwork - Farben refused, citing the cost.

60/

60/

The factory never produced a steady supply of rubber, but thanks to its gouging and the brutal treatment of its slaves, the camp was still profitable and returned large dividends to Farben's investors.

61/

61/

Apologists for slavery sometimes claim that slavers are at least incentivized to maintain the health of their captive workforce. This was definitely not true of Farben. Monowitz slaves died on average after three months in the camp.

62/

62/

And Farben's subsidiary, Degesch, made the special Zyklon B formulation used in Auschwitz's gas chambers.

63/

63/

Tkacik's point is that the Nazis killed for ideology and were unimaginably cruel. Farben killed for money - and they were *even worse*. The banality of evil gets even more banal when it's done in service to maximizing shareholder value.

64/

64/

As Farben historian Joseph Borkin wrote, the company "reduced slave labor to a consumable raw material, a human ore from which the mineral of life was systematically extracted":

scribd.com/document/51779…

65/

scribd.com/document/51779…

65/

Farben's connection to the Nazis was a the subject of *Germany’s Master Plan: The Story of Industrial Offensive*, a 1943 bestseller by Borkin, who was also an antitrust lawyer.

66/

66/

It described how Farben had manipulated global commodities markets in order to create shortages that "guaranteed Hitler’s early victories."

67/

67/

*Master Plan* became a rallying point in the movement to shatter corporate power. But large US firms like Dow Chemical and Standard Oil waged war on the book, demanding that it be retracted. Borkin was forced into resignation and obscurity in 1945.

68/

68/

Meanwhile, in Nuremberg, 24 Farben executives were tried for their war crimes, and they cited their obligations to their shareholders in their defense. All but five were acquitted on this basis.

69/

69/

Seen in that light, the plunderers of today's PE firms are part of a long and dishonorable tradition, one that puts profit ahead of every other priority or consideration. It's a defense that wowed the judges at Nuremberg, so should we be surprised that it still plays in 2023?

70/

70/

Tkacik is frustrated that neither of these books have much to offer by way of solutions, but she understands why that would be. After all, if we can't even close the #CarriedInterest tax loophole, how can we hope to do *anything* meaningful?

71/

71/

"Carried interest" comes up in every election cycle. Most of us assume it has something to do with "interest payments," but that's not true. The carried interest loophole relates to the "interest" that 16th-century sea captains had in their cargo.

72/

72/

It's a 600-year-old tax loophole that private equity bosses use to pay little or no tax on their billions. The fact that it's still on the books tells you everything you need to know about whether our political class wants to do anything about PE's plundering.

73/

73/

Notwithstanding Tkacik's (entirely justified) skepticism of the weaksauce remedies proposed in these books, there *is* some hope of meaningful action. Private equity's rollups are only possible because they skate under the $101m threshold for merger scrutiny.

74/

74/

However, there's good - but unenforced - law that allows antitrust enforcers to block these mergers.

75/

75/

Sec 7 of the #ClaytonAct says that a relatively small merger might not be big enough to trigger enforcement action on its own, but regulators can still block it if it creates an incipient monopoly.

pluralistic.net/2022/12/16/sch…

76/

pluralistic.net/2022/12/16/sch…

76/

The US has a new crop of aggressive - fearless - top antitrust enforcers and they've been systematically reviving these old laws to go after monopolies.

77/

77/

That's long overdue. Markets are machines for eroding our moral values: "In comparison to non-market decisions, moral standards are significantly lower if people participate in markets."

web.archive.org/web/2013060715…

78/

web.archive.org/web/2013060715…

78/

The crimes that monsters commit in the name of ideology pale in comparison to the crimes the wealthy commit for money.

eof/

eof/

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter