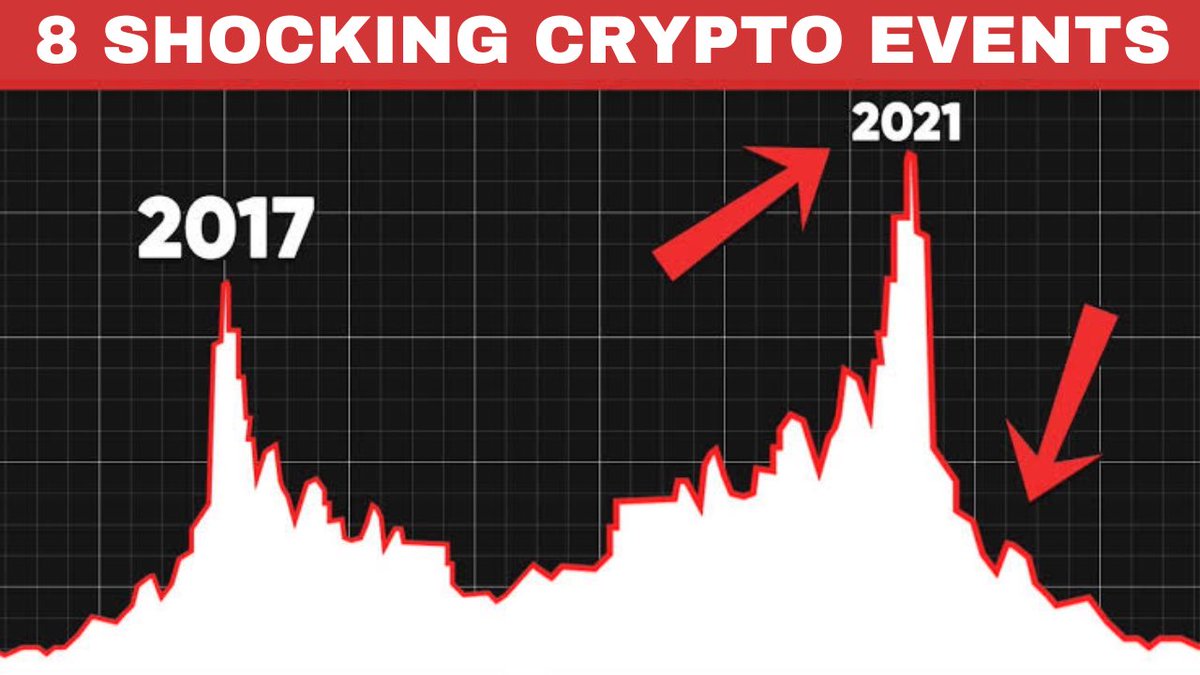

🚨 The 8 Events That Shook the #Crypto World 💥

Brace yourself for the jaw-dropping moments that shook the industry to its core 😱

A thread 🧵

Brace yourself for the jaw-dropping moments that shook the industry to its core 😱

A thread 🧵

1️⃣ Mt. Gox Hack (February 2014):

👉 The closure of Mt. Gox, once the largest #Bitcoin exchange, following a massive hack that resulted in the loss of 744,408 #BTC, leading to bankruptcy and investigations.

👉 The closure of Mt. Gox, once the largest #Bitcoin exchange, following a massive hack that resulted in the loss of 744,408 #BTC, leading to bankruptcy and investigations.

2️⃣ Bitcoin Cash Hard Fork (August 2017):

👉 A disagreement among #Bitcoin developers led to a hard fork, resulting in the creation of Bitcoin Cash (BCH), which aimed to address scalability concerns by increasing the block size.

👉 A disagreement among #Bitcoin developers led to a hard fork, resulting in the creation of Bitcoin Cash (BCH), which aimed to address scalability concerns by increasing the block size.

3️⃣ Covid Crash (March 2020):

👉 The COVID-19 pandemic caused a sharp decline in Bitcoin's price, challenging its perception as a safe-haven asset and raising doubts about its reliability during times of crisis.

👉 The COVID-19 pandemic caused a sharp decline in Bitcoin's price, challenging its perception as a safe-haven asset and raising doubts about its reliability during times of crisis.

4️⃣ Beeple $69M NFT (March 2021):

👉 Beeple's NFT artwork titled "Everydays: The First 5000 Days" was sold for a record-breaking $69.3 million at Christie's, bringing attention to the booming NFT market.

👉 Beeple's NFT artwork titled "Everydays: The First 5000 Days" was sold for a record-breaking $69.3 million at Christie's, bringing attention to the booming NFT market.

5️⃣ El Salvador #Bitcoin Legal Tender (June 2021):

👉 El Salvador became the first country to adopt Bitcoin as legal tender, sparking both support and opposition from global financial organizations and experts.

👉 El Salvador became the first country to adopt Bitcoin as legal tender, sparking both support and opposition from global financial organizations and experts.

6️⃣ Shiba Inu Parabolic Rally (October 2021):

👉 The memecoin #Shiba Inu (#SHIB) experienced an unprecedented surge in value, growing by 100,000,000% in just one year, driven by increased popularity and the launch of ShibaSwap.

👉 The memecoin #Shiba Inu (#SHIB) experienced an unprecedented surge in value, growing by 100,000,000% in just one year, driven by increased popularity and the launch of ShibaSwap.

7️⃣ DoKwon/Terra Collapse (May 2022):

👉 The collapse of the Terra ecosystem's stablecoin, UST, caused a significant crash, wiping out billions of dollars from the stablecoin market and impacting the broader #crypto sector.

👉 The collapse of the Terra ecosystem's stablecoin, UST, caused a significant crash, wiping out billions of dollars from the stablecoin market and impacting the broader #crypto sector.

8️⃣ SBF/FTX Failure (November 2022):

👉 This marked the downfall of FTX and its founder, SBF, as the third-largest #crypto exchange collapsed due to financial fraud. The industry witnessed a cascading effect, leading to bankruptcies and legal battles.

👉 This marked the downfall of FTX and its founder, SBF, as the third-largest #crypto exchange collapsed due to financial fraud. The industry witnessed a cascading effect, leading to bankruptcies and legal battles.

👉 From market crashes to regulatory hurdles, the #crypto industry has faced its share of challenges.

👉 But through it all, it emerged stronger and wiser.

👉 Lessons learned pave the way for a more transparent, responsible, and compliant future 🚀

👉 But through it all, it emerged stronger and wiser.

👉 Lessons learned pave the way for a more transparent, responsible, and compliant future 🚀

Liked the thread! Don’t forget to retweet the first tweet and follow for more 🔥👇

https://twitter.com/cryptokingkeyur/status/1665576499510931456

• • •

Missing some Tweet in this thread? You can try to

force a refresh