Dominance of #Bitcoin supply has seen a dramatic shift over the last two years.

US entities are now holding 11% less $BTC than they were in June 2022, whilst investors active during Asian trading hours have picked up 9.9%.

This is a distinct reversal from the 2020-21 bull cycle

US entities are now holding 11% less $BTC than they were in June 2022, whilst investors active during Asian trading hours have picked up 9.9%.

This is a distinct reversal from the 2020-21 bull cycle

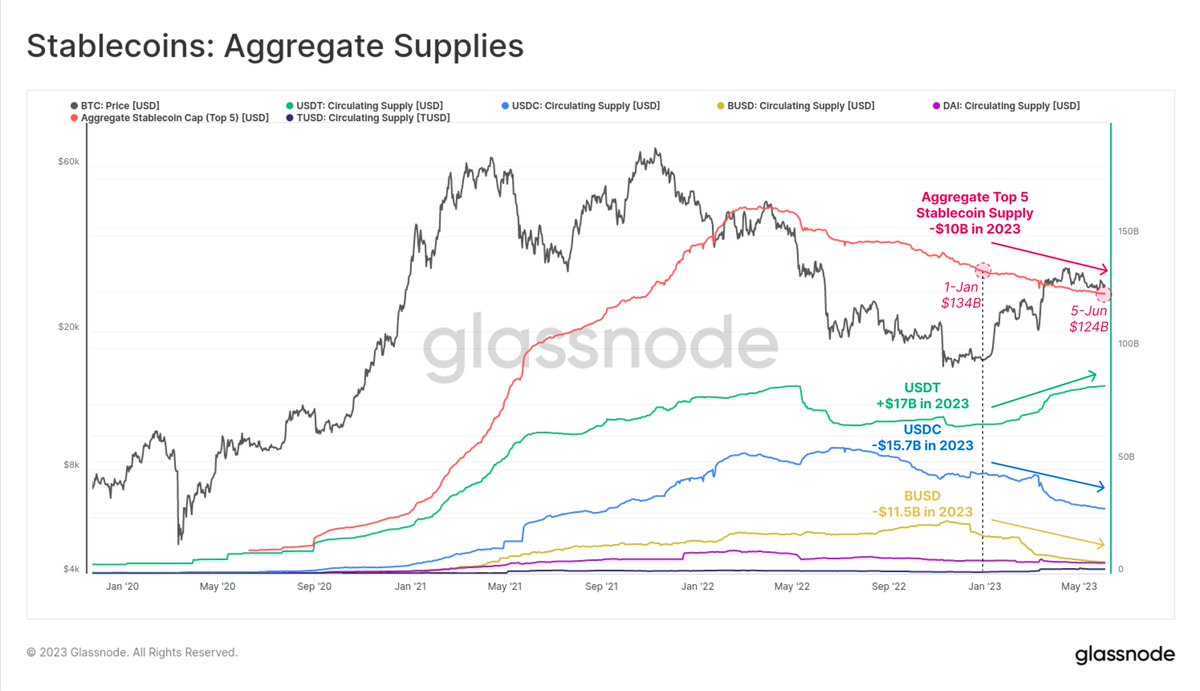

We can see major shifts underway in stablecoins, with #USDT supply at new ATHs, whilst #USDC and #BUSD fall to multi-year lows.

Given stablecoins are non-interest-bearing, and regulatory pressure in US is building, it suggests US capital is now less active in digital assets.

Given stablecoins are non-interest-bearing, and regulatory pressure in US is building, it suggests US capital is now less active in digital assets.

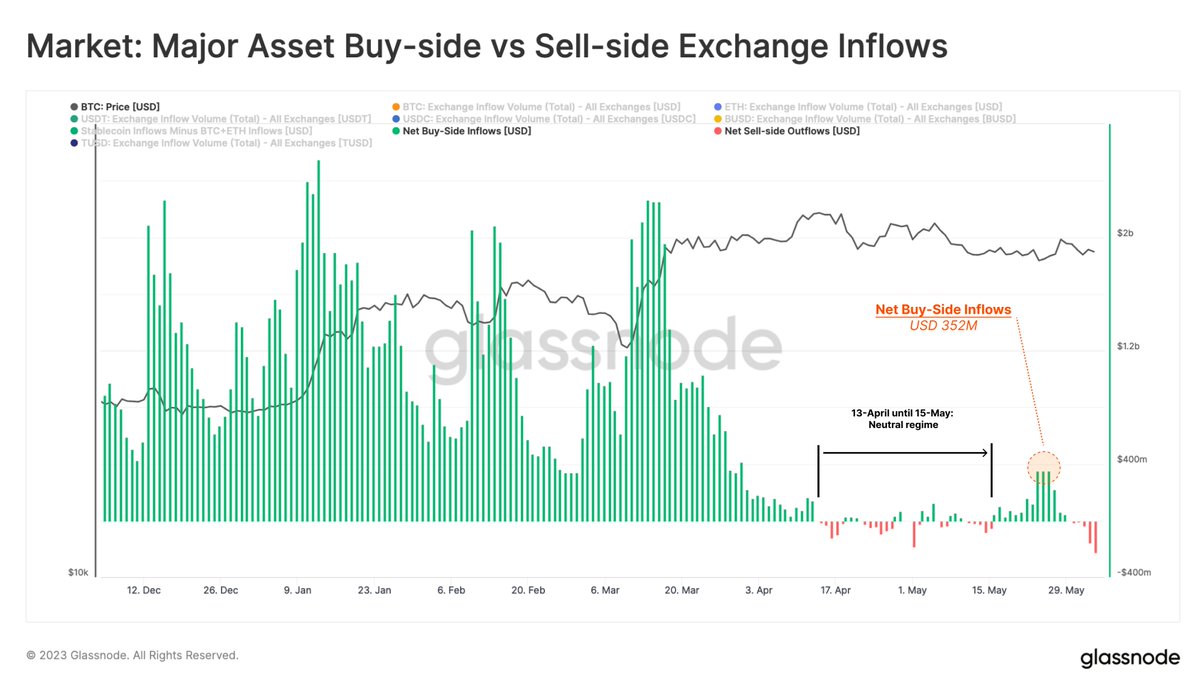

If we look at exchange on-chain flows, we also see considerably weaker demand since April.

Stablecoin inflows massively offset $BTC + $ETH inflows in Q1 🟩.

However we now see larger $BTC + $ETH inflows (assumed sell-side) relative to stablecoins🟥 as the market corrects lower

Stablecoin inflows massively offset $BTC + $ETH inflows in Q1 🟩.

However we now see larger $BTC + $ETH inflows (assumed sell-side) relative to stablecoins🟥 as the market corrects lower

Several undercurrents are in play, suggesting a net capital rotation, and migration of liquidity towards lower risk digital assets.

We have a comprehensive dashboard available to help track these on-chain flows, and gauge sentiment and market preference👇

glassno.de/3WRzsTR

We have a comprehensive dashboard available to help track these on-chain flows, and gauge sentiment and market preference👇

glassno.de/3WRzsTR

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter