Binance Exchange On-Chain Analysis in the Context of CFTC-SEC-Binance Lawsuit Cases

On a nominal basis, Binance has experienced large net outflows of Bitcoin and Ethereum after today's SEC lawsuit announcement.

Details on the thread🧵

On a nominal basis, Binance has experienced large net outflows of Bitcoin and Ethereum after today's SEC lawsuit announcement.

Details on the thread🧵

1/4

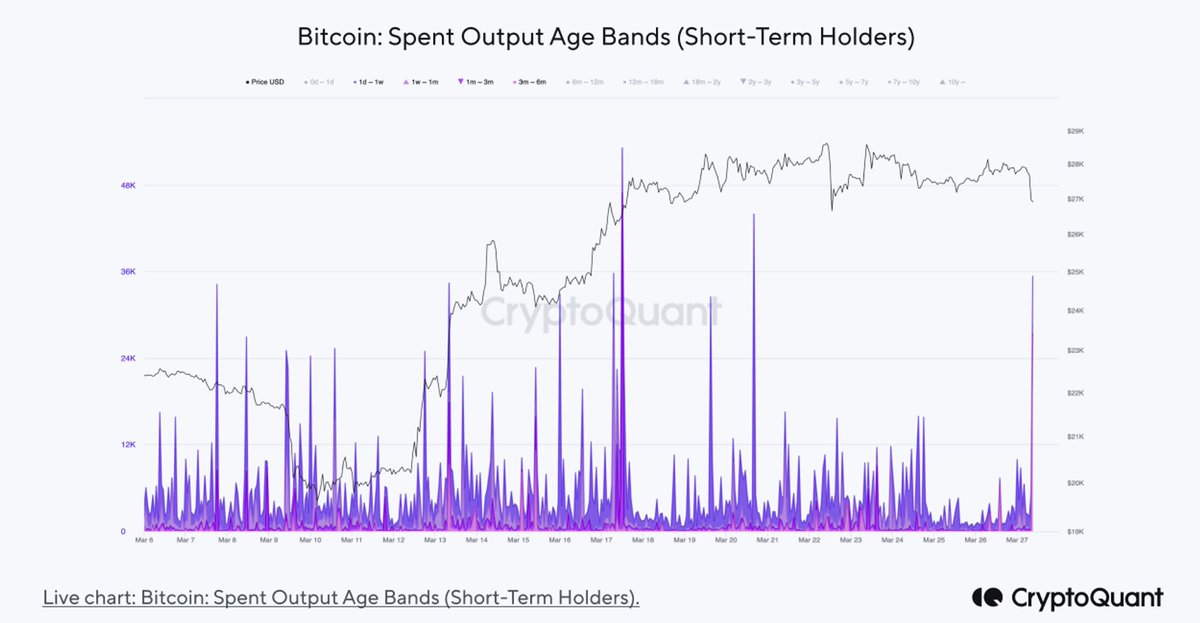

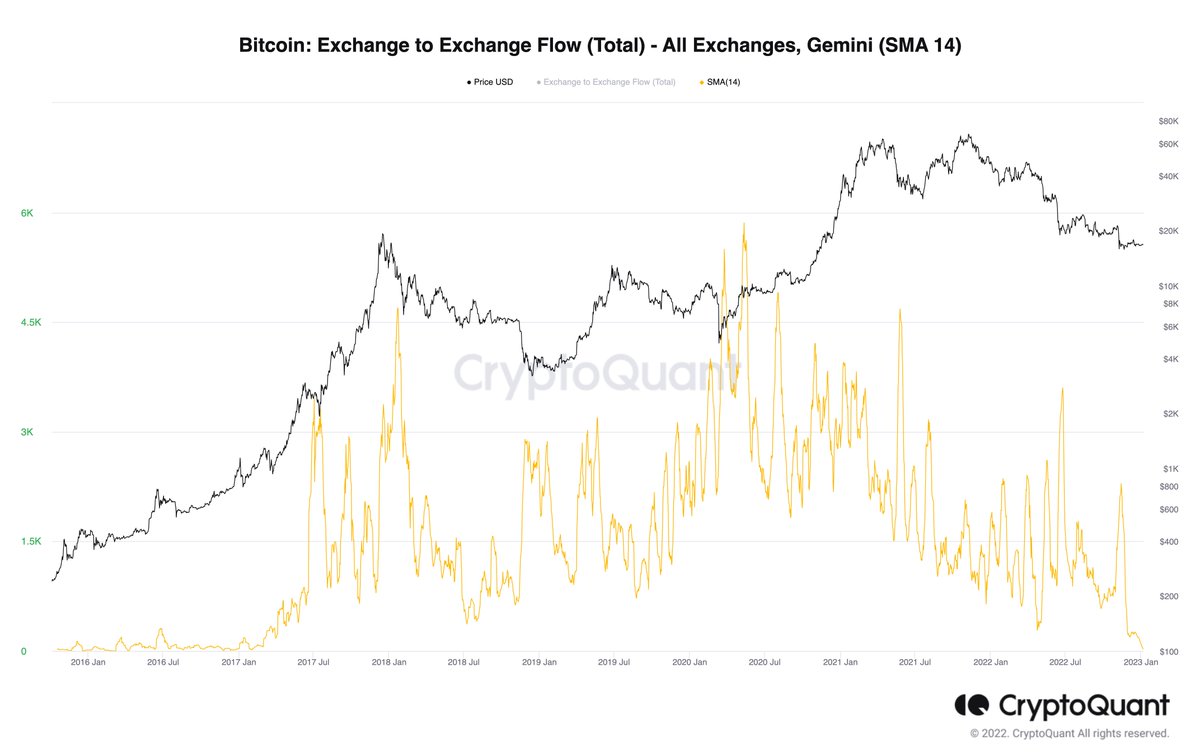

These net outflows are more significant than when the CFTC sued the exchange in March 2023. However, net outflows so far are smaller than what the exchange has experienced in other periods of "stress" (or regulatory FUD).

$BTC, $ETH, $Stablecoins

These net outflows are more significant than when the CFTC sued the exchange in March 2023. However, net outflows so far are smaller than what the exchange has experienced in other periods of "stress" (or regulatory FUD).

$BTC, $ETH, $Stablecoins

2/4

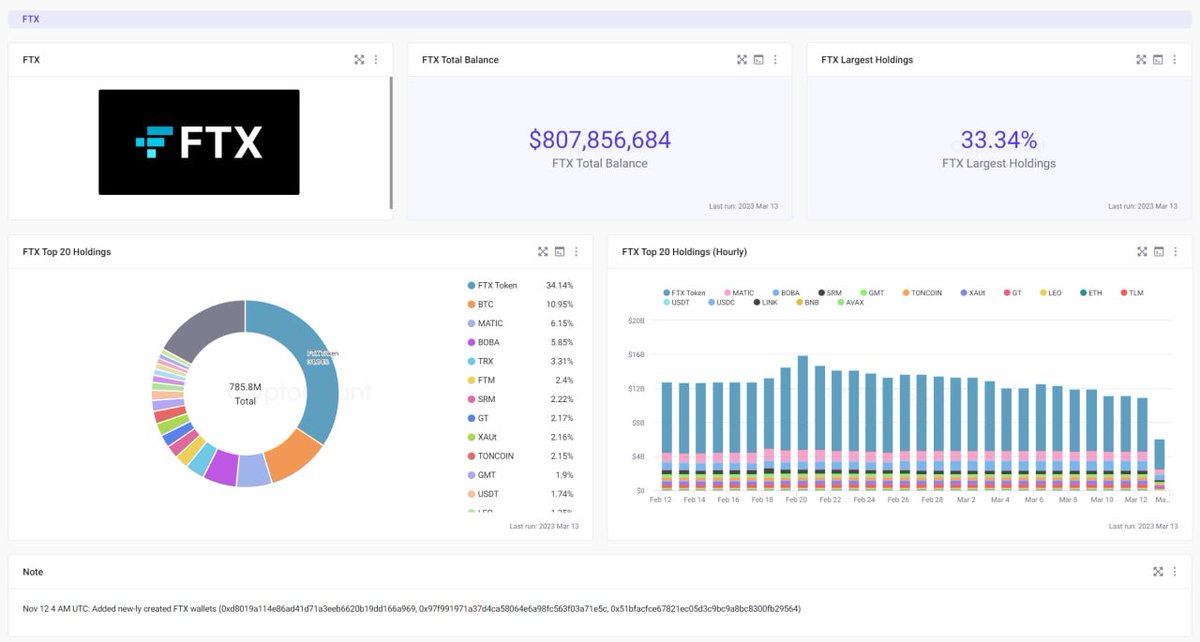

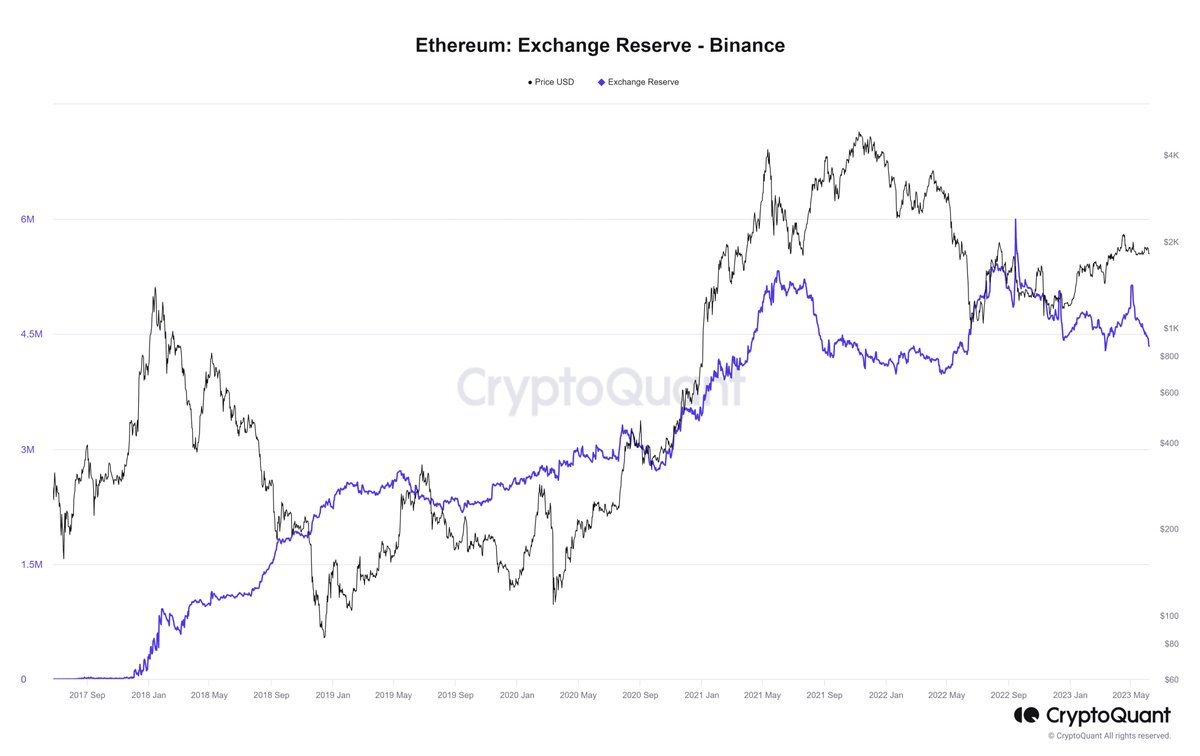

Moreover, these net outflows are small relative to the level of reserves in the exchange.

In the case of stablecoins(ERC20), reserves at Binance have been decreasing significantly, from $24.5B in Dec. 2022 to $8.2B. This has been mostly the result of a decrease in $BUSD.

Moreover, these net outflows are small relative to the level of reserves in the exchange.

In the case of stablecoins(ERC20), reserves at Binance have been decreasing significantly, from $24.5B in Dec. 2022 to $8.2B. This has been mostly the result of a decrease in $BUSD.

3/4

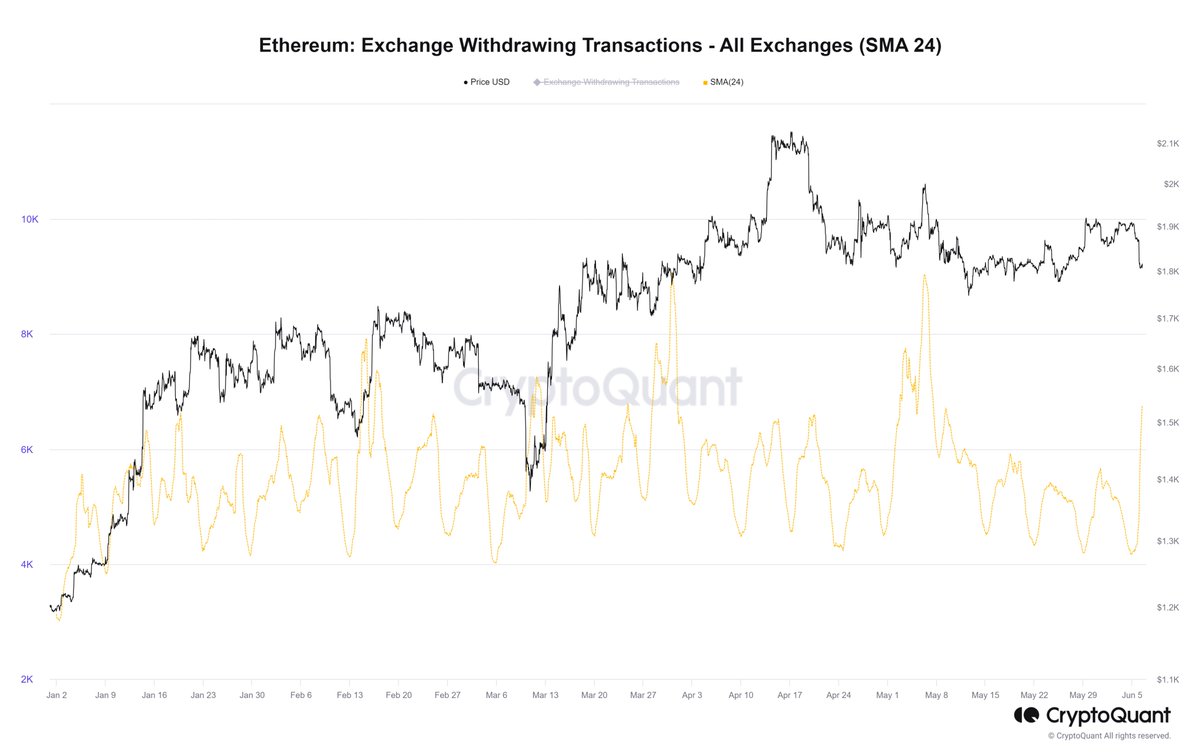

The total amount of user transactions to withdraw funds (#Bitcoin, #Ethereum, and #Stablecoins) has spiked after the SEC lawsuit announcement, but they are still within historical normal levels.

The total amount of user transactions to withdraw funds (#Bitcoin, #Ethereum, and #Stablecoins) has spiked after the SEC lawsuit announcement, but they are still within historical normal levels.

4/4

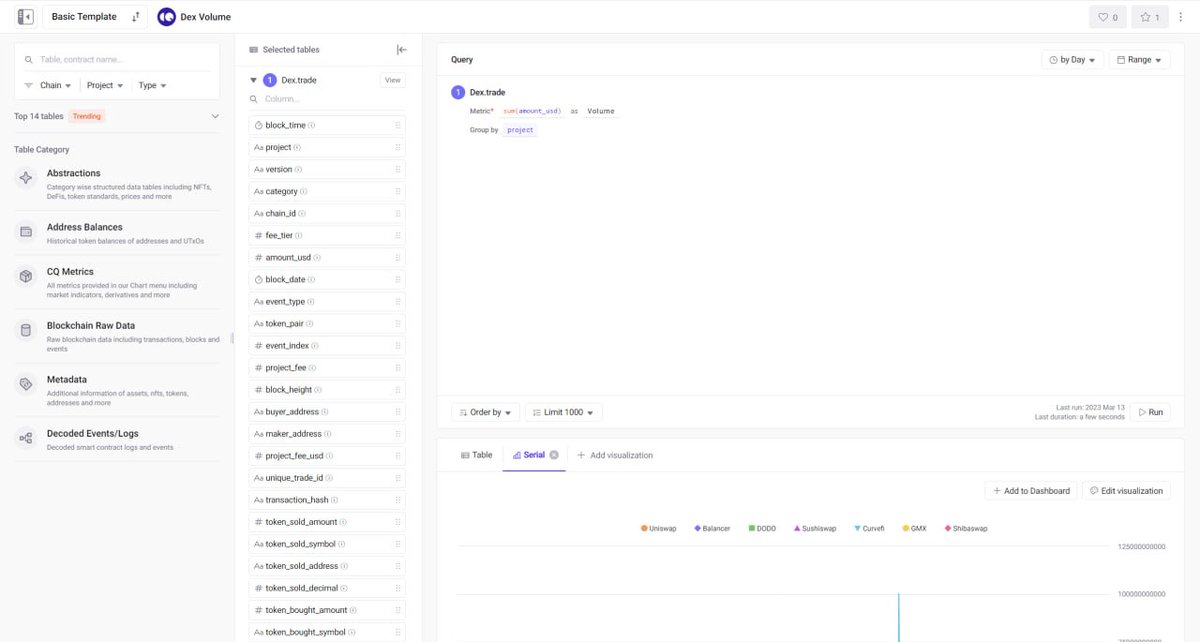

To follow the above and real-time data updates related to @binance, visit our Binance Exchange Analysis Dashboard created by @jjcmoreno

Real-time Dashboard👇

cryptoquant.com/analytics/dash…

To follow the above and real-time data updates related to @binance, visit our Binance Exchange Analysis Dashboard created by @jjcmoreno

Real-time Dashboard👇

cryptoquant.com/analytics/dash…

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter