In webcast “Dust in the Crevices,” Jeffrey Gundlach shares his macro and market views and makes the case for an imminent dust-up, “in the next few years,” in Washington’s decades-long use of debt finance to skirt hard fiscal decisions.

#macro #markets #Fed #inflation #rates

#macro #markets #Fed #inflation #rates

“Here we are in an economy that is supposedly growing, and yet we have 7.3% budget deficit as a % of GDP,” DoubleLine CEO and founder Jeffrey Gundlach says.

That figure is probably headed much higher, especially if the U.S. enters recession.

That figure is probably headed much higher, especially if the U.S. enters recession.

In the wake of hikes of 525 bps in the fed funds rate and 400 bps along many parts of the Treasury curve, DoubleLine CEO Jeffrey Gundlach notes the burden of federal debt service has surged higher in dollar terms and as a percentage of GDP.

Watch:

Watch:

Fiscal reform of the U.S. government, including raising taxes and perhaps restructuring entitlement programs, Jeffrey Gundlach predicts, is “going to become a political issue as part of the 2024 presidential campaign.”

doubleline.com/markets-insigh…

doubleline.com/markets-insigh…

U.S. recession odds:

DoubleLine CEO and founder Jeffrey Gundlach notes the year-over-year and sixth-month annualized change in the Leading Economic Index is “full-on recessionary.”

doubleline.com/markets-insigh…

DoubleLine CEO and founder Jeffrey Gundlach notes the year-over-year and sixth-month annualized change in the Leading Economic Index is “full-on recessionary.”

doubleline.com/markets-insigh…

Consumer expectations of the future minus current situation, one of Jeffrey Gundlach’s favorite leading indicators for the economy, is one of the few gauges to hold up.

A contraction of the red-shaded area of the chart is a warning signal.

Watch:

A contraction of the red-shaded area of the chart is a warning signal.

Watch:

The inversion of the U.S. Treasury yield curve indicates a recession likely lies ahead.

Jeffrey Gundlach is looking for convincing evidence that the curve is de-inverting as another sign that recession is imminent.

Jeffrey Gundlach is looking for convincing evidence that the curve is de-inverting as another sign that recession is imminent.

The unemployment rate has exceeded its 12-month μ, nominally a sign of imminent recession, “but only by 4 bps,” Jeffrey Gundlach says.

“I don’t think we can call this a crossover in a really definitive way, but it does put us on watch.”

“I don’t think we can call this a crossover in a really definitive way, but it does put us on watch.”

A survey by the Fed shows a large increase in adults reporting deterioration in their financial situation versus a decrease in those reporting improvement in their financial condition.

A Bank of America study of households receiving unemployment benefits shows joblessness rising faster in higher-income than low- and middle-income groups, confirming Jeffrey Gundlach’s prediction of deterioration in middle-management jobs.

One of the reasons behind recent bank failures, per Jeffrey Gundlach:

“Loan growth is contracting, and also the interest rate paid on short-term loans for small business has, thanks to the Fed’s actions, clearly exploded higher.”

“Loan growth is contracting, and also the interest rate paid on short-term loans for small business has, thanks to the Fed’s actions, clearly exploded higher.”

2023 YTD, assets in bank failures, Jeffrey Gundlach notes, are above 2% of GDP. When bank failures exceeded that level, the U.S. experienced the Great Depression, the savings and loan crisis and the Great Financial Crisis.

As measured by the Fed’s M2 monetary aggregate, money supply growth, DoubleLine CEO and founder Jeffrey Gundlach notes, is “now the most negative that it’s been since the Depression.”

While monetary contraction spells trouble for economic growth, it suggests that “the CPI should be coming down” further, Jeffrey Gundlach says. “The M2 problem is no longer stoking inflation using this correlation.”

“Clearly interest rates are a lot higher now than 2.5 years ago. Bonds are much more attractive, and their inflationary nemesis has been in retreat,” Jeffrey Gundlach says. “That’s why I think bonds are the superior asset class right now.”

The copper-gold ratio, per Jeffrey Gundlach, suggests the 10-year Treasury yield might have fair value at around 2% or so. The 10-year Treasury has room “to rally, particularly based on copper-gold and the idea that inflation is declining.”

“Bonds are absolutely cheap to stocks at the present moment,” Jeffrey Gundlach says, “and would be a much more relaxing way of earning returns than white-knuckling it in a stock market in an economy that’s perhaps going to a recession.”

One danger zone in fixed income, Jeffrey Gundlach warns, is lower-tier bank loans: Recovery rates in the event of default are already running at 50% (in the absence of a recession), not the 70% predicted by most models.

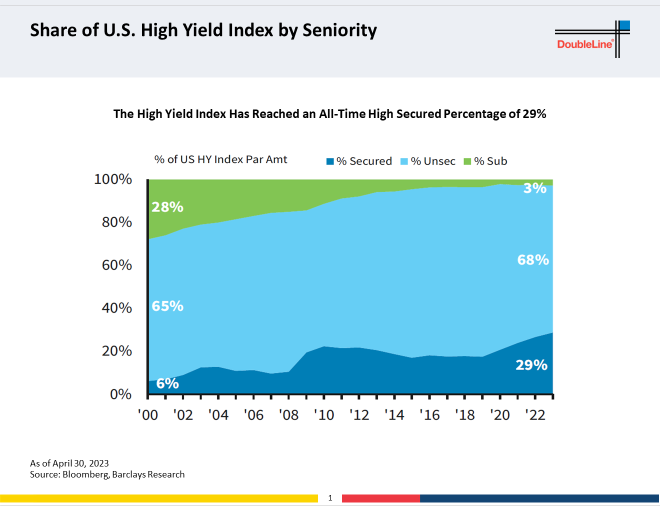

Robert Cohen, head of DoubleLine’s Global Developed Credit team, notes the share of the high yield corporate bond market that is secured has increased to 29% versus 6% two decades ago.

HY bonds “are vulnerable to recession,” Jeffrey Gundlach says.

“Spreads are a bit tight, but it’s true that the credit quality of the high yield bond market is better than it's been at any time in the existence of the high yield bond market.”

“Spreads are a bit tight, but it’s true that the credit quality of the high yield bond market is better than it's been at any time in the existence of the high yield bond market.”

Despite historical correlation between EM spreads and the dollar, Jeffrey Gundlach sees a possible divergence between the two, “an alligator jaws situation in the last couple of months,” with slight spread tightening against a slightly stronger $.

"So maybe emerging markets are about to perform a little bit better,” Jeffrey Gundlach says, “and the dollar index will probably start to go down, particularly in the next recession and particularly if we don't deal with our deficit problems.”

Jeffrey Gundlach says the U.S. dollar is vulnerable. He believes the U.S. Dollar Index will decline to past support at 89 and “take it out to the downside,” forming a “tailwind” for non-dollar investments and probably for emerging market debt.

Jeffrey Gundlach says EM currencies as tracked by the JP Morgan Emerging Market Currency Index “probably has bottomed.”

Agency and non-Agency RMBS represent to Jeffrey Gundlach compelling investments, including relative to corporate bonds, as they offer attractive yields and benefit from the absence of negative convexity, and with respect to non-Agencies, almost non-existent defaults.

“For Agency mortgages,” Jeffrey Gundlach notes, although “you're not going to get any, you’d like defaults because a lot of these securities are trading at a discount, and if it defaults, you're guaranteed at par.”

Given historic spreads over Treasuries and the absence of negative convexity, he says, “this could be one of the most attractive points to own the Agency mortgage market.”

With many homeowners in low-interest mortgages, Jeffrey Gundlach notes, many “might want to move,” but that would mean a new mortgage at ~7%.

”So there's just nothing for sale versus history in the mortgage industry in the United States.”

”So there's just nothing for sale versus history in the mortgage industry in the United States.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh

Read on Twitter

Read on Twitter