1/ I’m deeply concerned about the @solana inflation reduction SIMD-0228 being proposed by @TusharJain_ and @kankanivishal of @multicoincap and @MaxResnick1 in its current form, especially without addressing some key risks/questions.

forum.solana.com/t/proposal-for…

forum.solana.com/t/proposal-for…

2/ After listening to the latest @solana validator call, the arguments that were made for implementing this change are all very flawed, in my view.

3/ My summary of the arguments made are below and I’ll break down my rebuttals to each in the following Tweets.

1: High staking reward rates are bad for DeFi yields

2: Inflation increases selling pressure, which should be judged against network fees

3: High staking rewards reduce demand from ETFs

4: Staking returns aren’t US tax optimized like cap gains

5: Higher staking yields don’t lead to higher prices

6: The staking formula will optimize for % staked so it solves for security (this is the most important security risk and flawed approach, in my view)

1: High staking reward rates are bad for DeFi yields

2: Inflation increases selling pressure, which should be judged against network fees

3: High staking rewards reduce demand from ETFs

4: Staking returns aren’t US tax optimized like cap gains

5: Higher staking yields don’t lead to higher prices

6: The staking formula will optimize for % staked so it solves for security (this is the most important security risk and flawed approach, in my view)

4/

Claim 1: High staking rate is bad for DeFi yield.

Rebuttal 1: SOL Staking is the Solana risk free rate. Just like a higher treasury risk free rates lead to higher rates across the credit curve, higher staking yields leads to higher DeFi rates and profits.

Claim 1: High staking rate is bad for DeFi yield.

Rebuttal 1: SOL Staking is the Solana risk free rate. Just like a higher treasury risk free rates lead to higher rates across the credit curve, higher staking yields leads to higher DeFi rates and profits.

5/

Claim 2: Inflation increases selling pressure which should be judged against fees.

Rebuttal 2: This isn’t true just like unlocks don’t have to create selling pressure. It depends on the choice of the holder. Validators can choose to compound stake. Inflation is a smaller share of flows than other supply. The demand to compare selling pressure to is not fees but flows. Look at Solana ETP flows for one measurable proxy, but demand from funds and individuals is even largest and more important.

Claim 2: Inflation increases selling pressure which should be judged against fees.

Rebuttal 2: This isn’t true just like unlocks don’t have to create selling pressure. It depends on the choice of the holder. Validators can choose to compound stake. Inflation is a smaller share of flows than other supply. The demand to compare selling pressure to is not fees but flows. Look at Solana ETP flows for one measurable proxy, but demand from funds and individuals is even largest and more important.

6/

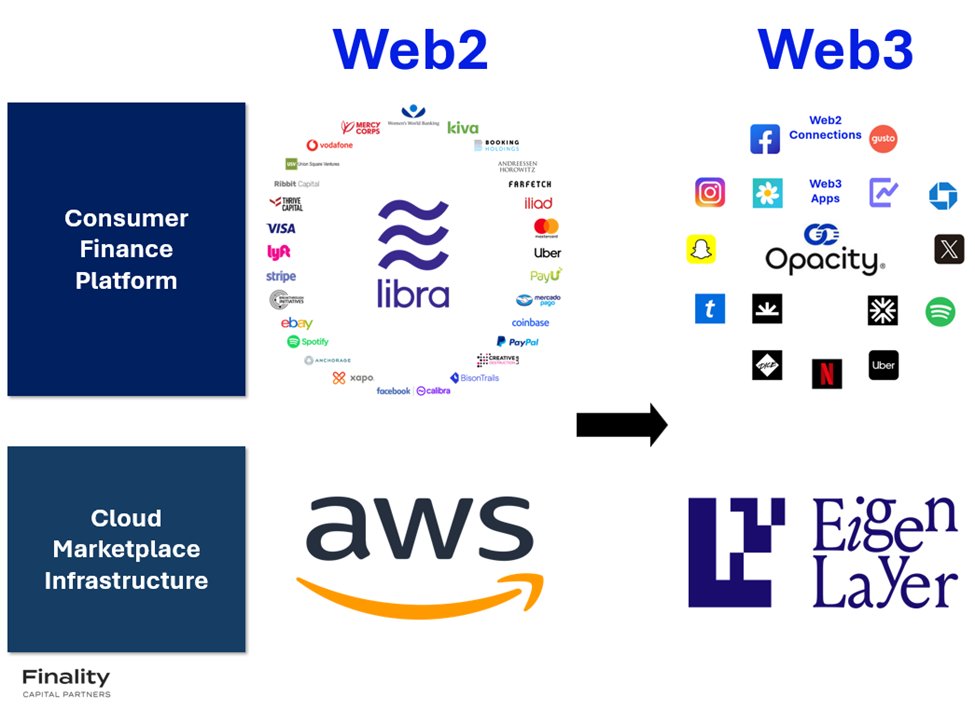

Claim 3: High staking rewards reduce demand from ETFs.

Rebuttal 3: Just because this was an argument made to try and explain weak ETH ETF demand doesn't mean it will be true for Solana. Look at many of the European SOL ETPs that take the entire staking yield and charge no fees. They have seen meaningful flows (see above). And the US ETFs are close to allowing staking so this isn’t a valid argument over the long term.

Claim 3: High staking rewards reduce demand from ETFs.

Rebuttal 3: Just because this was an argument made to try and explain weak ETH ETF demand doesn't mean it will be true for Solana. Look at many of the European SOL ETPs that take the entire staking yield and charge no fees. They have seen meaningful flows (see above). And the US ETFs are close to allowing staking so this isn’t a valid argument over the long term.

7/

Claim 4: Staking returns aren’t tax optimized like cap gains.

Rebuttal 4: Solana is a global decentralized network. We should not be optimizing for US taxes treatment, which could easily change. It’s the same reason equity investors look through tax changes for stock valuations.

Claim 4: Staking returns aren’t tax optimized like cap gains.

Rebuttal 4: Solana is a global decentralized network. We should not be optimizing for US taxes treatment, which could easily change. It’s the same reason equity investors look through tax changes for stock valuations.

8/

Claim 5: Higher staking yields don’t lead to higher prices.

Rebuttal 5: The real world says this isn’t true. Just look at how regular currencies are priced. One FX appreciates vs. another based on interest rate differentials. Higher relative rates lead to stronger currencies. Here’s a chart of the USD/JPY vs. the US 10Y - Japan 10Y spread as an example.

Claim 5: Higher staking yields don’t lead to higher prices.

Rebuttal 5: The real world says this isn’t true. Just look at how regular currencies are priced. One FX appreciates vs. another based on interest rate differentials. Higher relative rates lead to stronger currencies. Here’s a chart of the USD/JPY vs. the US 10Y - Japan 10Y spread as an example.

9/ Claim 6: The staking formula will optimize for % staked so it solves for security.

Rebuttal 6: It needs to also optimize for the number of validators and stake distribution. Running a Solana validator is expensive, and validators have already been declining.

solanacompass.com/statistics/dec…

Rebuttal 6: It needs to also optimize for the number of validators and stake distribution. Running a Solana validator is expensive, and validators have already been declining.

solanacompass.com/statistics/dec…

10/

Rebuttal 6 (continued): The analysis that someone who wants to pass this proposal safely needs to do, but I have not seen is:

Model out scenarios for how many of the currently active small validators will be unprofitable and fall off based on the new proposal. This needs to be done under different network activity and SOL price assumptions to stress test under a bear market scenario where MEV, base fees and prices all fall 80%. Then look at the current Solana validator list and see how many of the current validators would be unprofitable and fall off under those scenarios.

We can argue about how many validators Solana needs. Its probably not an artificially inflated 100k like ETH, but we don’t want Solana to turn into some Cosmos chain with 100 either.

And since proponents were making US tax arguments for doing this, we also don’t know what the SEC’s decentralization tests will look like, so we probably want to keep the number in the 1000’s so SOL to remain a commodity.

Full stop, this proposal should not go through until someone has at least done this analysis.

Rebuttal 6 (continued): The analysis that someone who wants to pass this proposal safely needs to do, but I have not seen is:

Model out scenarios for how many of the currently active small validators will be unprofitable and fall off based on the new proposal. This needs to be done under different network activity and SOL price assumptions to stress test under a bear market scenario where MEV, base fees and prices all fall 80%. Then look at the current Solana validator list and see how many of the current validators would be unprofitable and fall off under those scenarios.

We can argue about how many validators Solana needs. Its probably not an artificially inflated 100k like ETH, but we don’t want Solana to turn into some Cosmos chain with 100 either.

And since proponents were making US tax arguments for doing this, we also don’t know what the SEC’s decentralization tests will look like, so we probably want to keep the number in the 1000’s so SOL to remain a commodity.

Full stop, this proposal should not go through until someone has at least done this analysis.

11/ The proposal does ask the right question. How much inflation is needed? But we have other questions to answer before we make a change. I do agree the number is probably lower and should be more dynamic. Just like a company doesn't need to pay suppliers a fixed amount or financers a fixed return, the market should determine it, so I do support the direction. Let's just slow things down and do a little more work to understand the impacts.

12/ This might actually be a solution to fix this risk at a high level.

https://twitter.com/david_grid/status/1895922415269564608

13/ My sincere advice is that we should not be assuming and generalizing the impact of this. Run the numbers and show everyone the assumptions and the data.

https://x.com/TusharJain_/status/1895928357080219686

• • •

Missing some Tweet in this thread? You can try to

force a refresh