Original research @porkopolis_econ | Podcast @crypto_voices | est. 9 Jan 2017 | https://t.co/qr1Ftnc5by

How to get URL link on X (Twitter) App

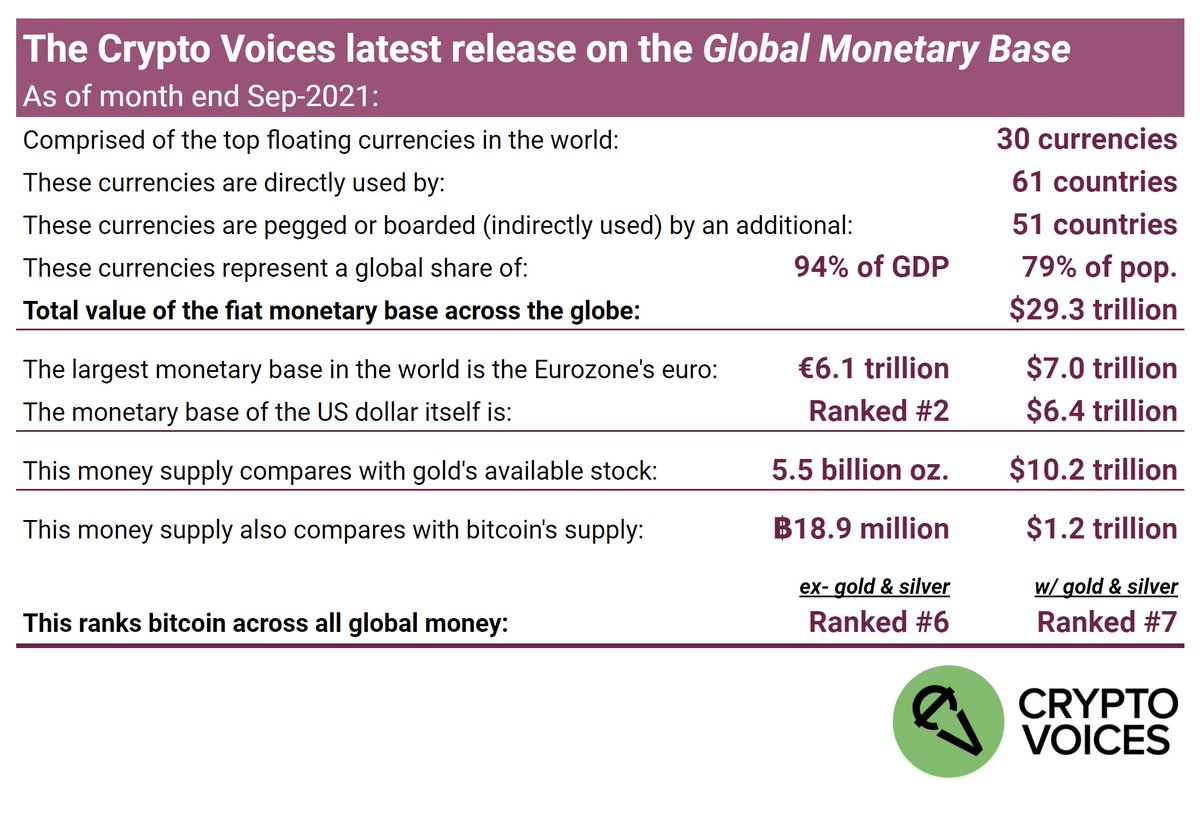

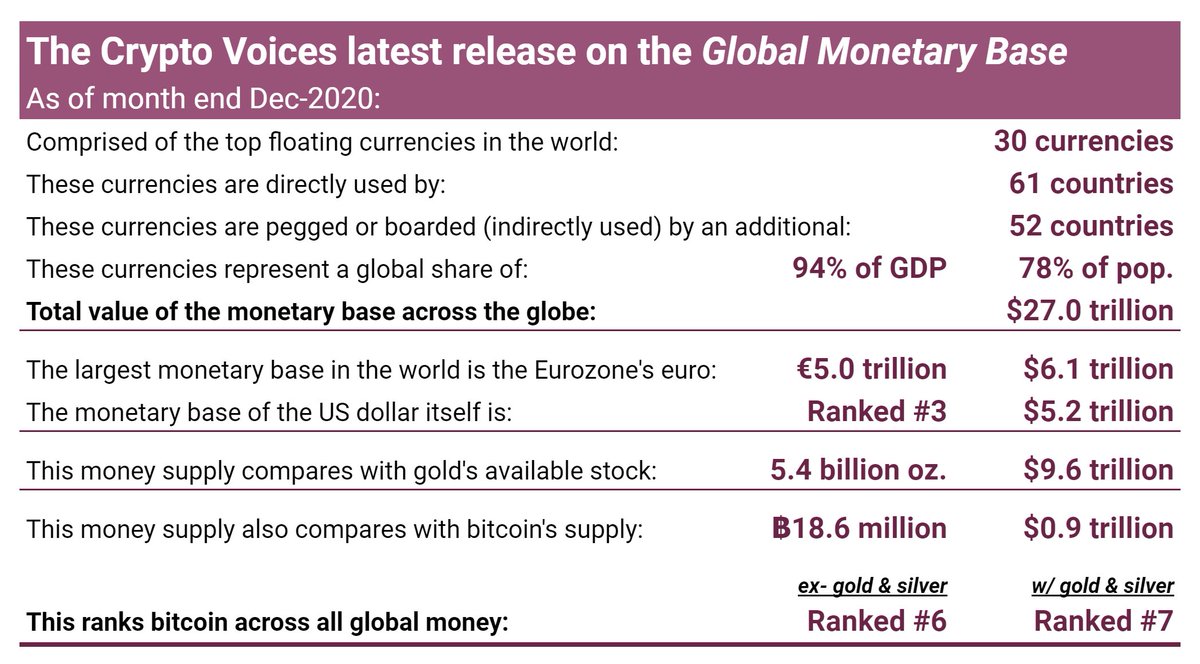

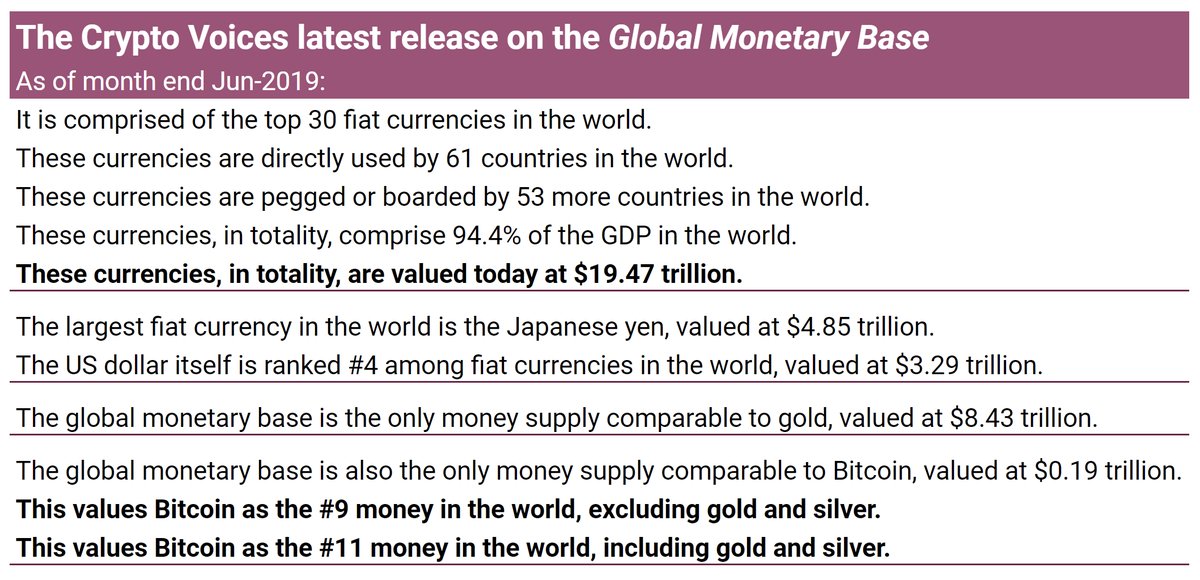

2/ World #basemoney is $27.8 trillion equivalent.

2/ World #basemoney is $27.8 trillion equivalent.

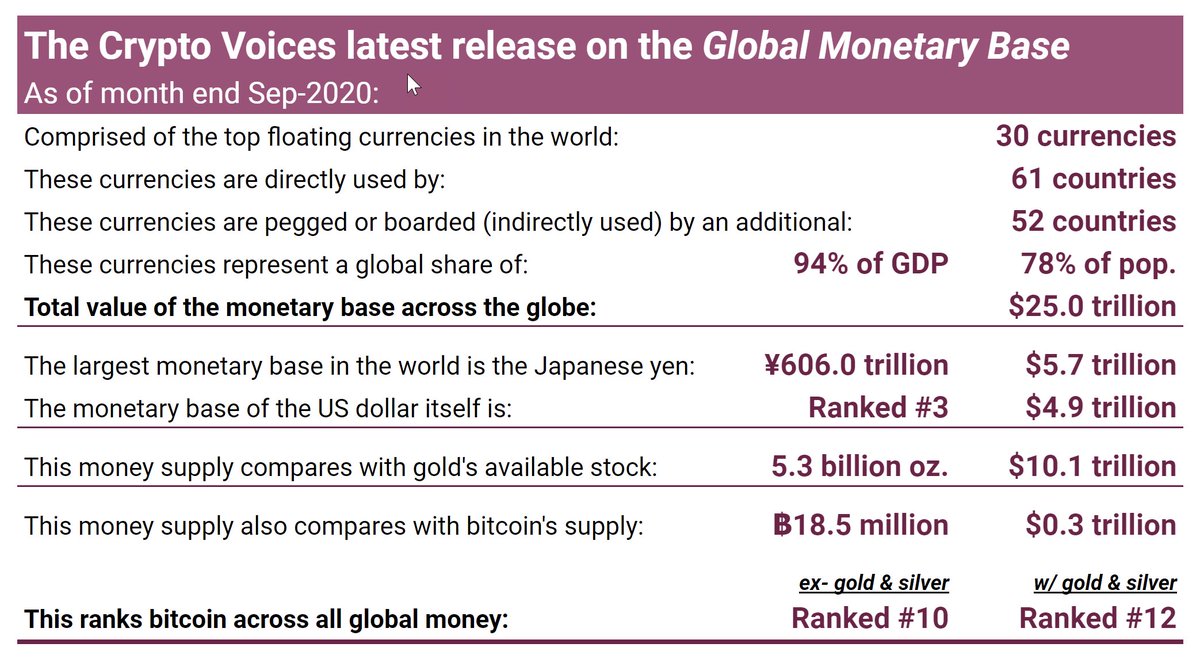

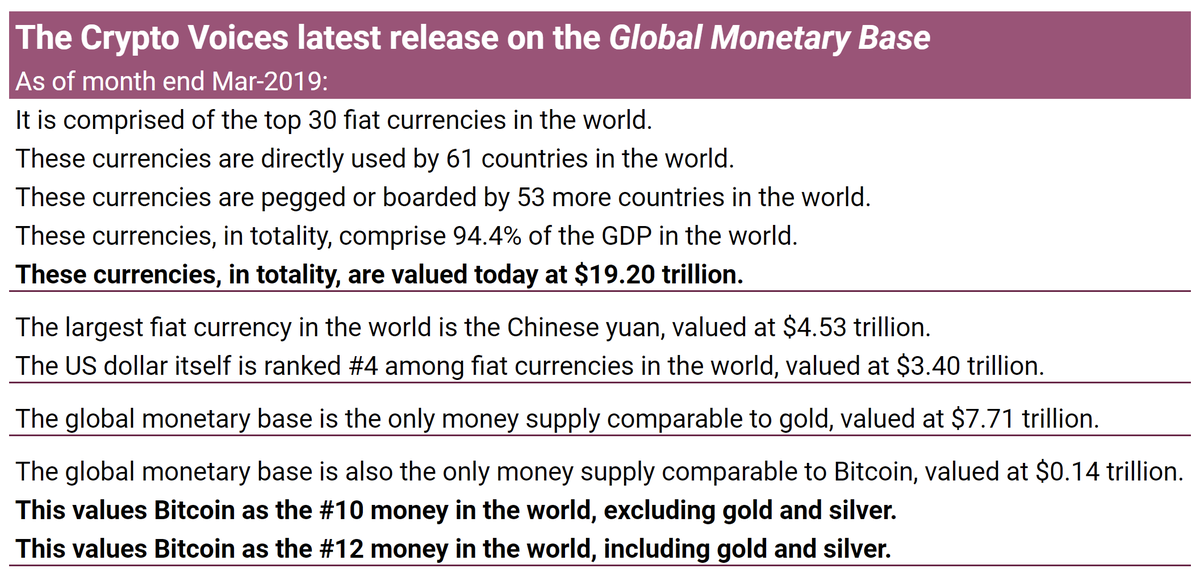

2/ The global #basemoney supply is $27.17 trillion equivalent.

2/ The global #basemoney supply is $27.17 trillion equivalent.

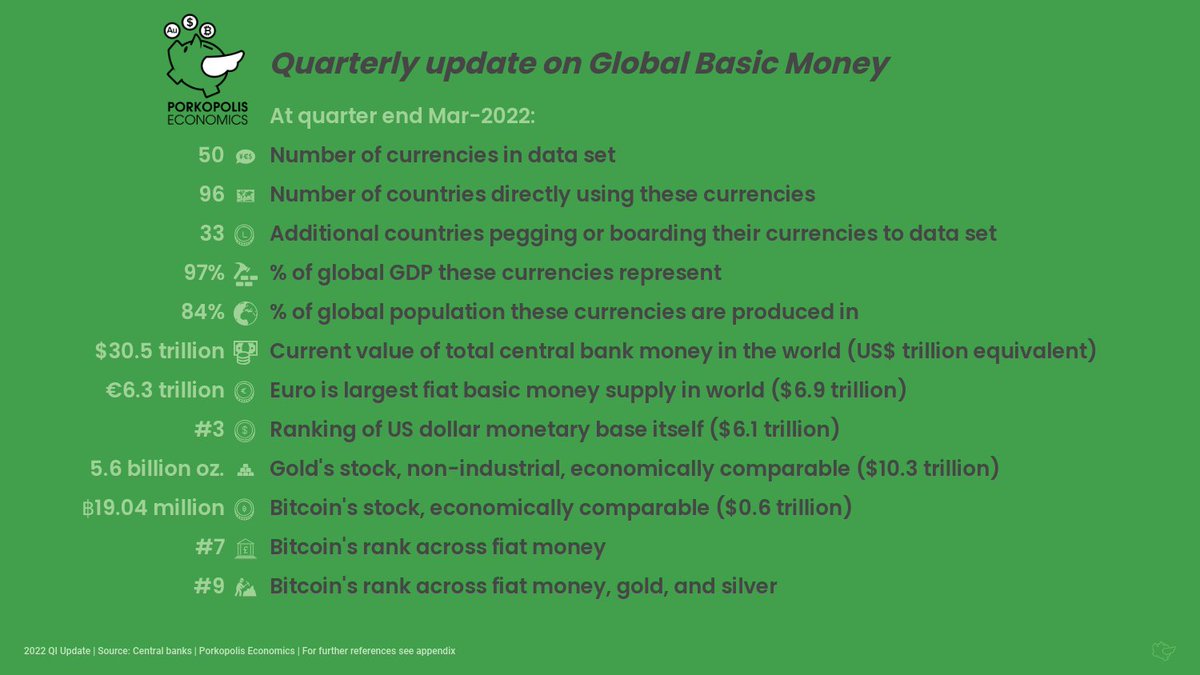

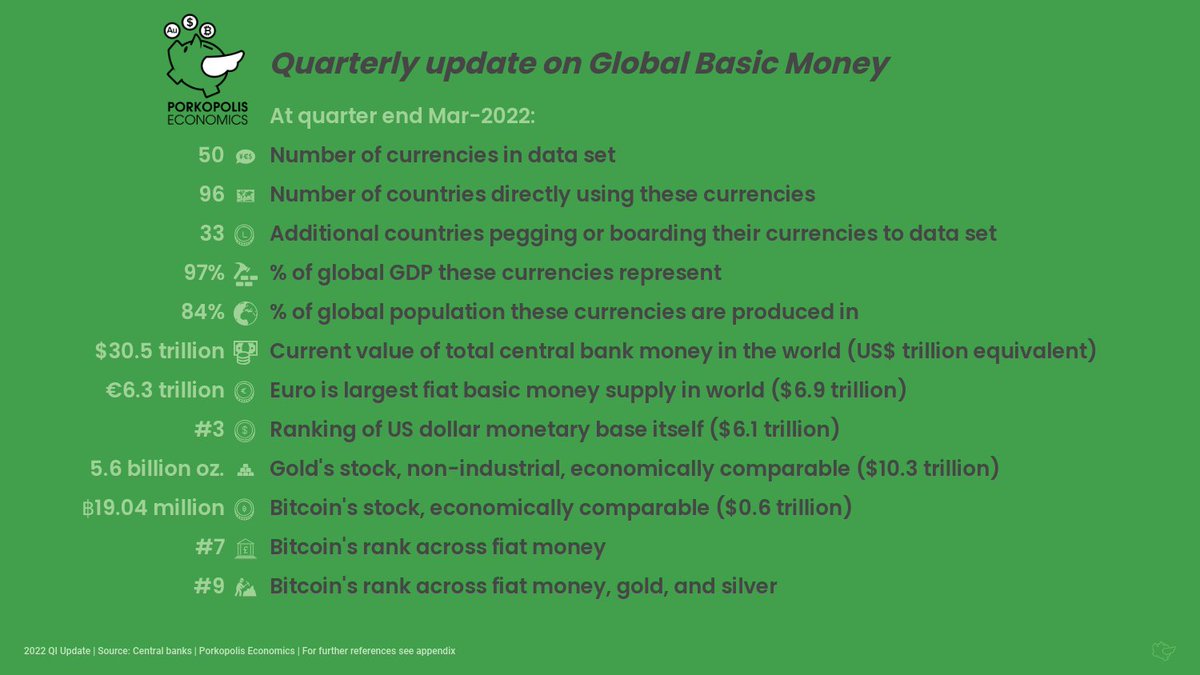

2/ This research covers the globe's top 50 fiat currencies, sourced directly from their central banks. You won't find this info anywhere else. Also we look at historical basic money stocks (i.e. gold & silver). Layer in BTC and we cover it all.

2/ This research covers the globe's top 50 fiat currencies, sourced directly from their central banks. You won't find this info anywhere else. Also we look at historical basic money stocks (i.e. gold & silver). Layer in BTC and we cover it all.

Firstly, the reigning “retail” tool of the central bank—physical banknotes—are more prevalent than you can imagine, vital to low income trade, and issuance grows much faster than global population.

Firstly, the reigning “retail” tool of the central bank—physical banknotes—are more prevalent than you can imagine, vital to low income trade, and issuance grows much faster than global population.

2/ This research covers the globe's top 50 fiat currencies, sourced directly from their central banks. You won't find this info anywhere else. Also we look at historical basic money stocks (i.e. gold & silver). Layer in #Bitcoin and we cover it all.

2/ This research covers the globe's top 50 fiat currencies, sourced directly from their central banks. You won't find this info anywhere else. Also we look at historical basic money stocks (i.e. gold & silver). Layer in #Bitcoin and we cover it all.

2/ We now have the globe's top 50 fiat currencies included in this research, sourced directly from their central banks. You won't find this info anywhere else. Also we look at historical basic money stocks (i.e. gold & silver). Layer in #bitcoins and we cover it all.

2/ We now have the globe's top 50 fiat currencies included in this research, sourced directly from their central banks. You won't find this info anywhere else. Also we look at historical basic money stocks (i.e. gold & silver). Layer in #bitcoins and we cover it all.

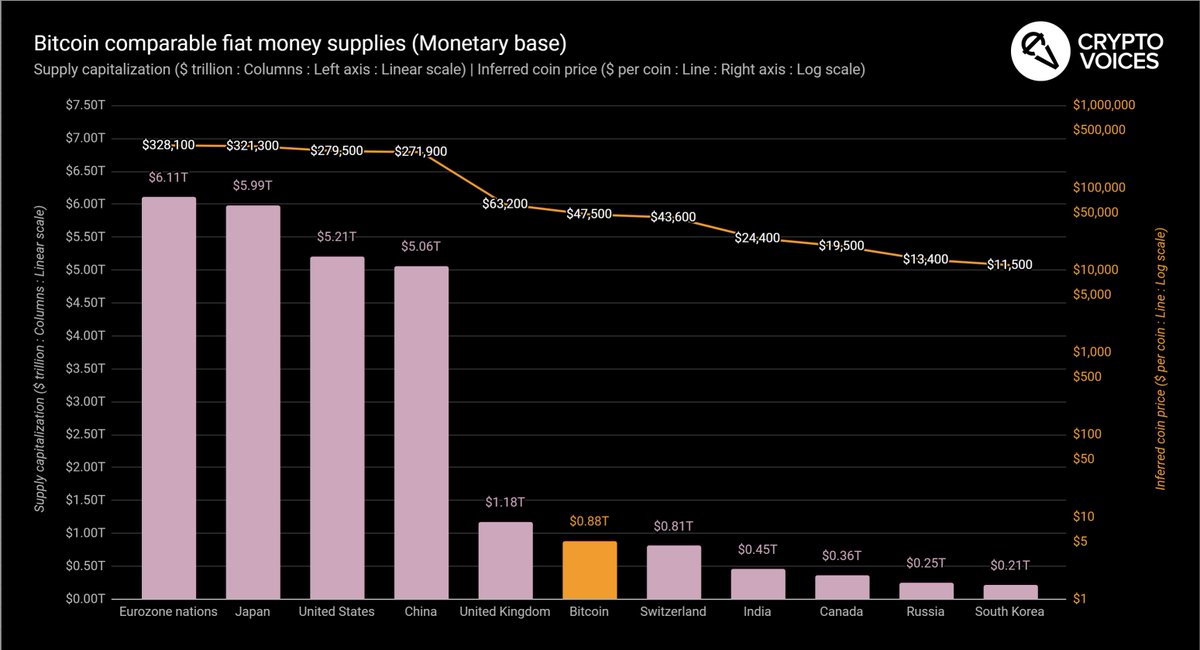

2/ #Bitcoin is on the cusp of surpassing the value of the British pound sterling - $GBP - the oldest fiat currency in the world. The Bank of England is the first "modern" central bank, and its pound sterling could be classified as a relatively "successful" fiat currency.

2/ #Bitcoin is on the cusp of surpassing the value of the British pound sterling - $GBP - the oldest fiat currency in the world. The Bank of England is the first "modern" central bank, and its pound sterling could be classified as a relatively "successful" fiat currency.

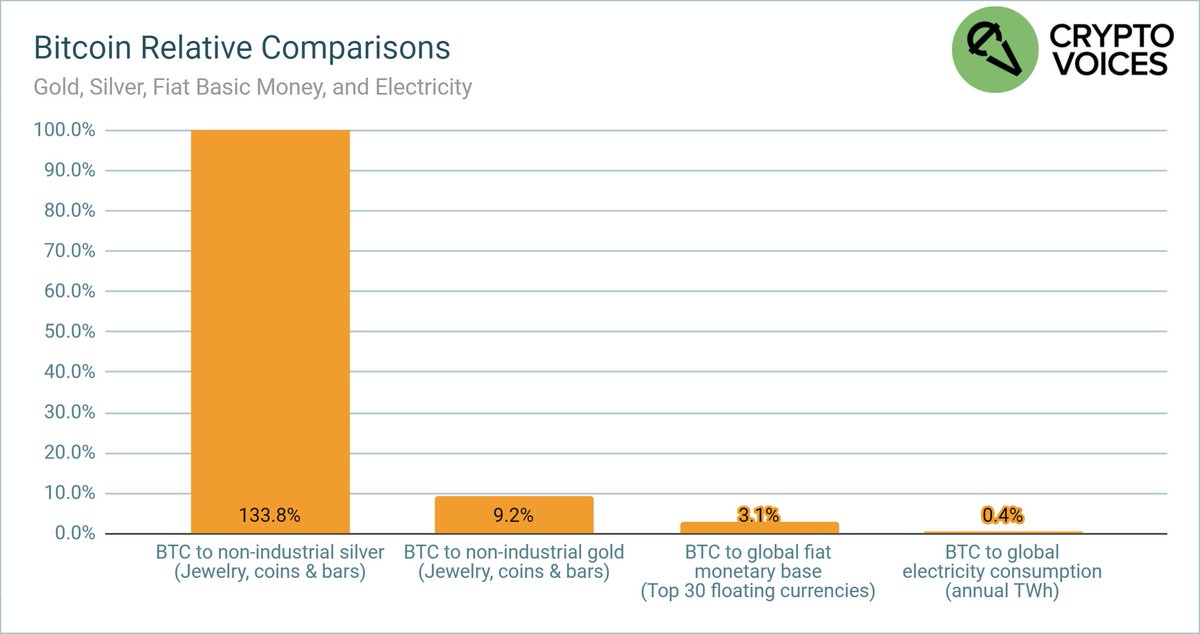

2/ Here's another way to look at #Bitcoin against its peers. Gold, silver, fiat base money, and thanks to the good people at @CambridgeAltFin, vs. global electricity (~100TWh vs. 23,000TWh). Interesting that #Bitcoin is accreting faster against money than electricity consumption.

2/ Here's another way to look at #Bitcoin against its peers. Gold, silver, fiat base money, and thanks to the good people at @CambridgeAltFin, vs. global electricity (~100TWh vs. 23,000TWh). Interesting that #Bitcoin is accreting faster against money than electricity consumption.

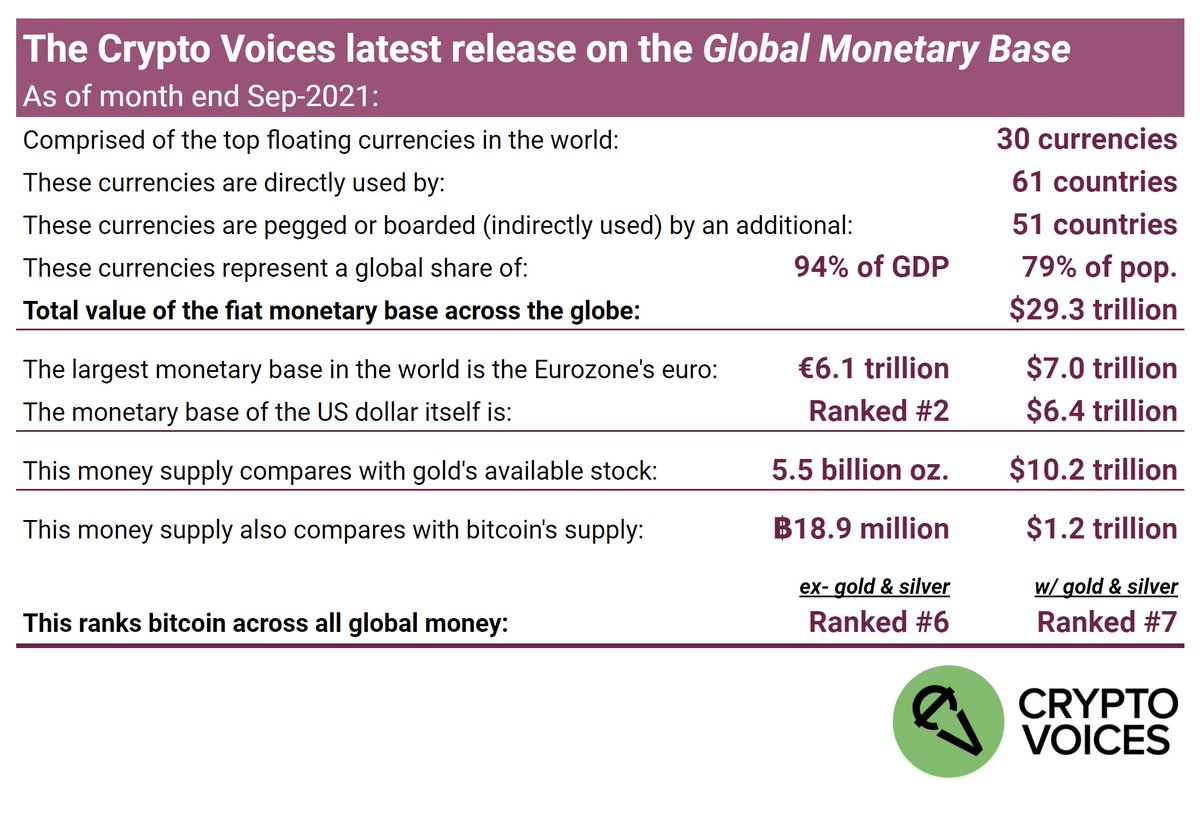

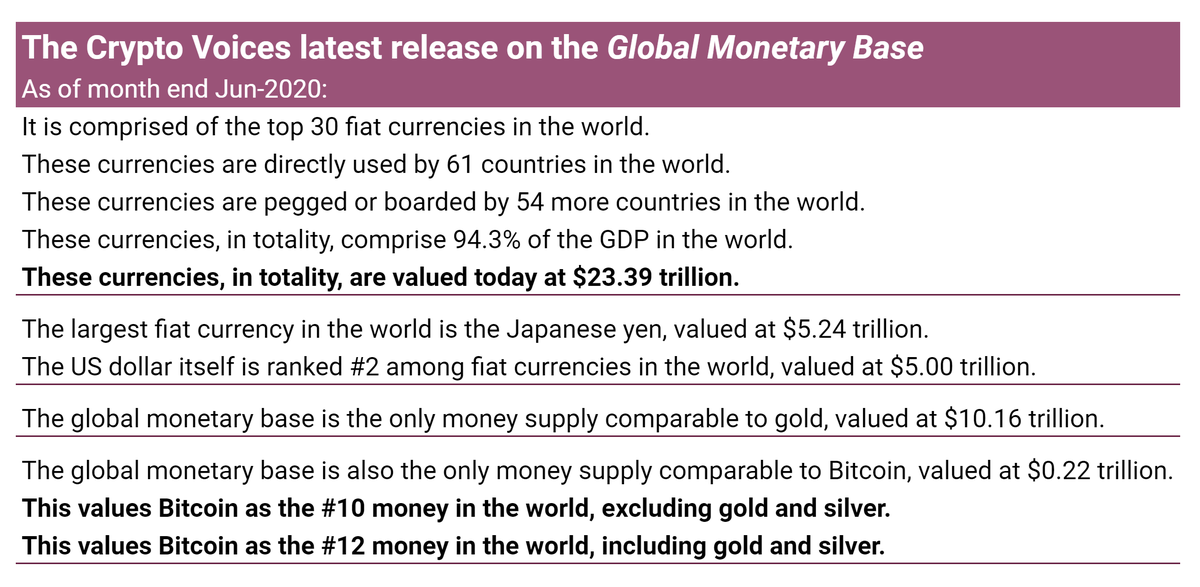

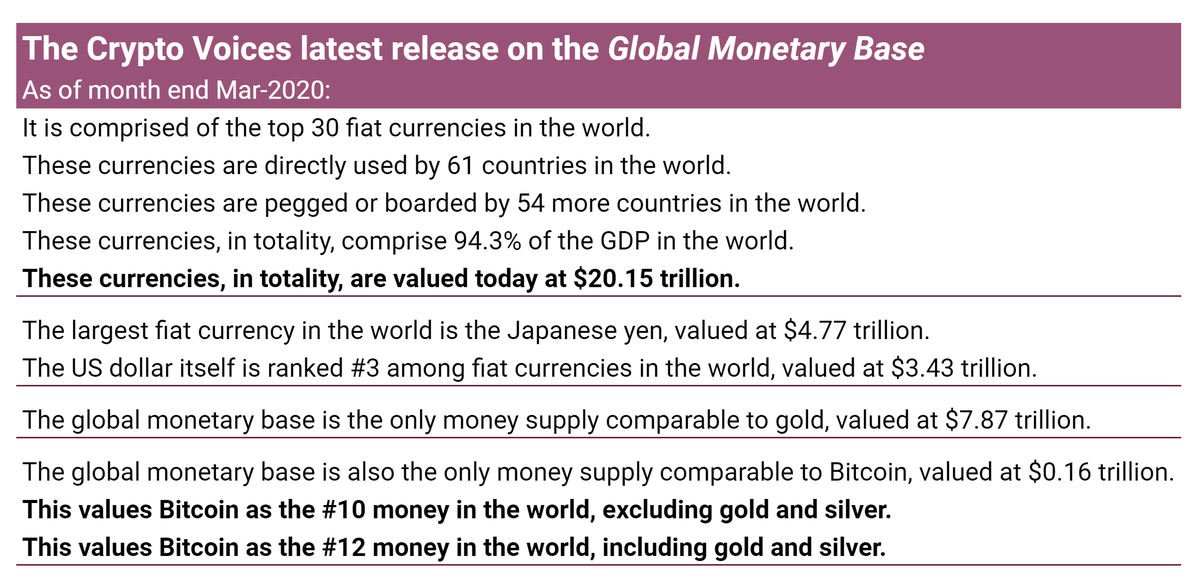

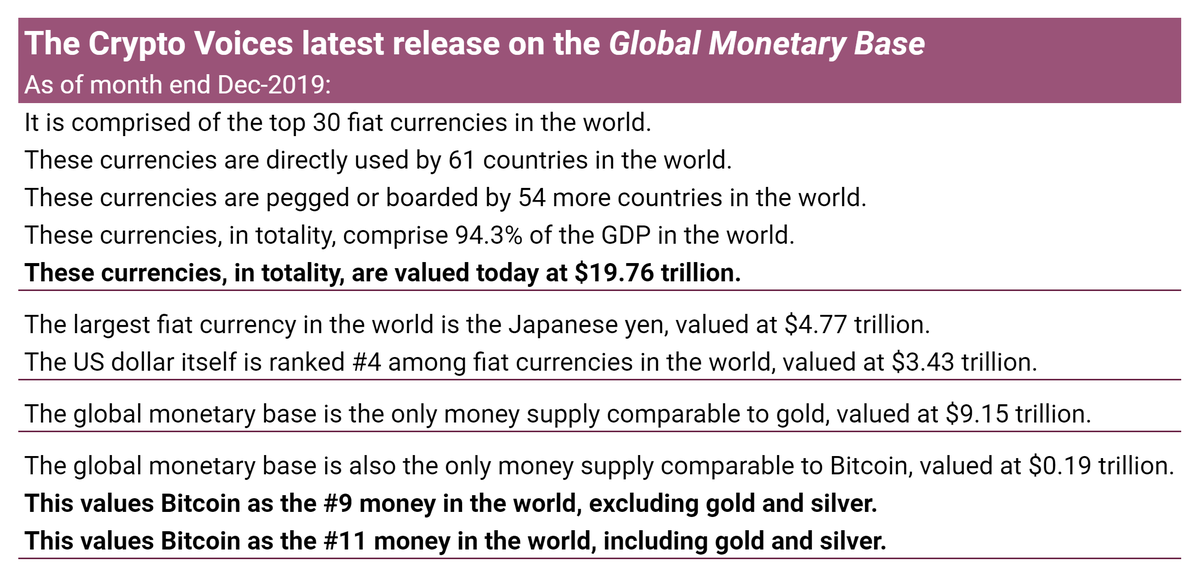

2/ For 12 years the world's been trying to understand #Bitcoin, forget Bitcoin, criticize Bitcoin, love Bitcoin, hate Bitcoin. Reminder Bitcoin still is a protocol, it does what it does. But if you want to speak of its value as money, you gotta understand the monetary base.

2/ For 12 years the world's been trying to understand #Bitcoin, forget Bitcoin, criticize Bitcoin, love Bitcoin, hate Bitcoin. Reminder Bitcoin still is a protocol, it does what it does. But if you want to speak of its value as money, you gotta understand the monetary base.

2/ For 12 years the world's been trying to understand #Bitcoin, forget Bitcoin, legitimize Bitcoin, criticize Bitcoin, love Bitcoin, hate Bitcoin. Bitcoin is a protocol, it does what it does. But if you want to speak of its value as money, you gotta understand the monetary base.

2/ For 12 years the world's been trying to understand #Bitcoin, forget Bitcoin, legitimize Bitcoin, criticize Bitcoin, love Bitcoin, hate Bitcoin. Bitcoin is a protocol, it does what it does. But if you want to speak of its value as money, you gotta understand the monetary base.

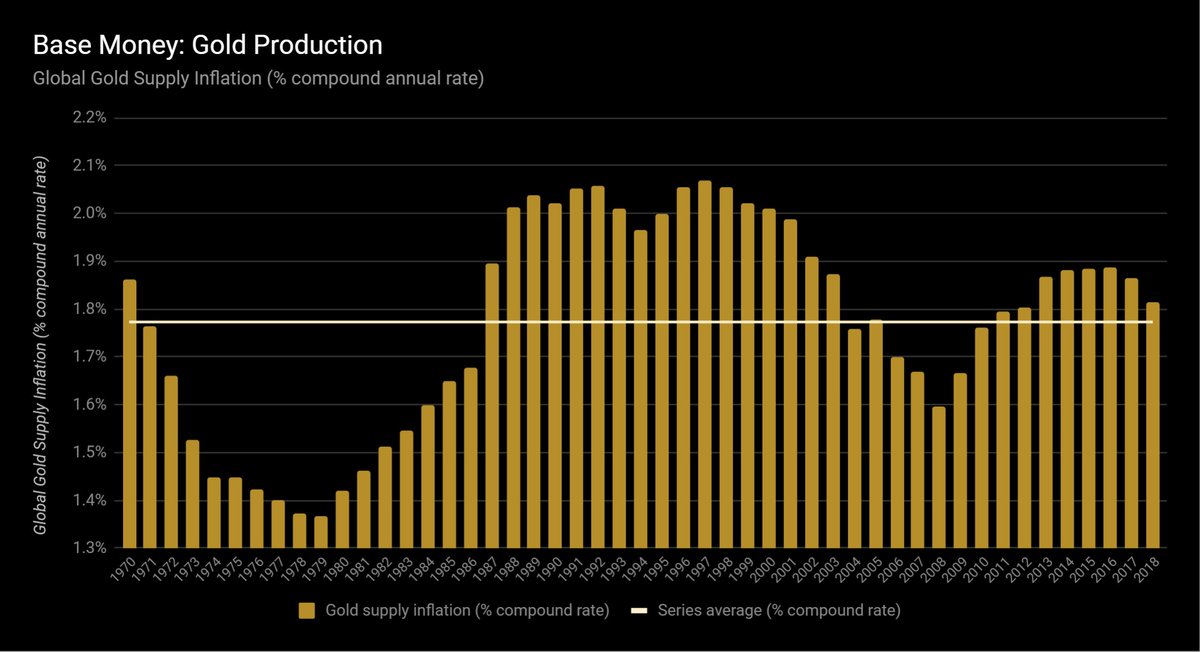

2/ Bitcoin's monetary system marches on its continuously-lowering coin emission; meanwhile, other world monetary systems' units inflate, either naturally (like gold & silver ounces), or via monopolistic privilege (like government fiat money "printing").

2/ Bitcoin's monetary system marches on its continuously-lowering coin emission; meanwhile, other world monetary systems' units inflate, either naturally (like gold & silver ounces), or via monopolistic privilege (like government fiat money "printing").

2/ Bitcoin's monetary system marches on its continuously-lowering coin emission; meanwhile, other world monetary systems' units inflate, either naturally (like gold & silver ounces), or via monopolistic privilege (like government fiat money "printing").

2/ Bitcoin's monetary system marches on its continuously-lowering coin emission; meanwhile, other world monetary systems' units inflate, either naturally (like gold & silver ounces), or via monopolistic privilege (like government fiat money "printing").

2/ Bitcoin's monetary system marches on its continuously-lowering coin emission; meanwhile, other world monetary systems' units inflate, either naturally (like gold & silver ounces), or via monopolistic privilege (like government fiat money "printing").

2/ Bitcoin's monetary system marches on its continuously-lowering coin emission; meanwhile, other world monetary systems' units inflate, either naturally (like gold & silver ounces), or via monopolistic privilege (like government fiat money "printing").

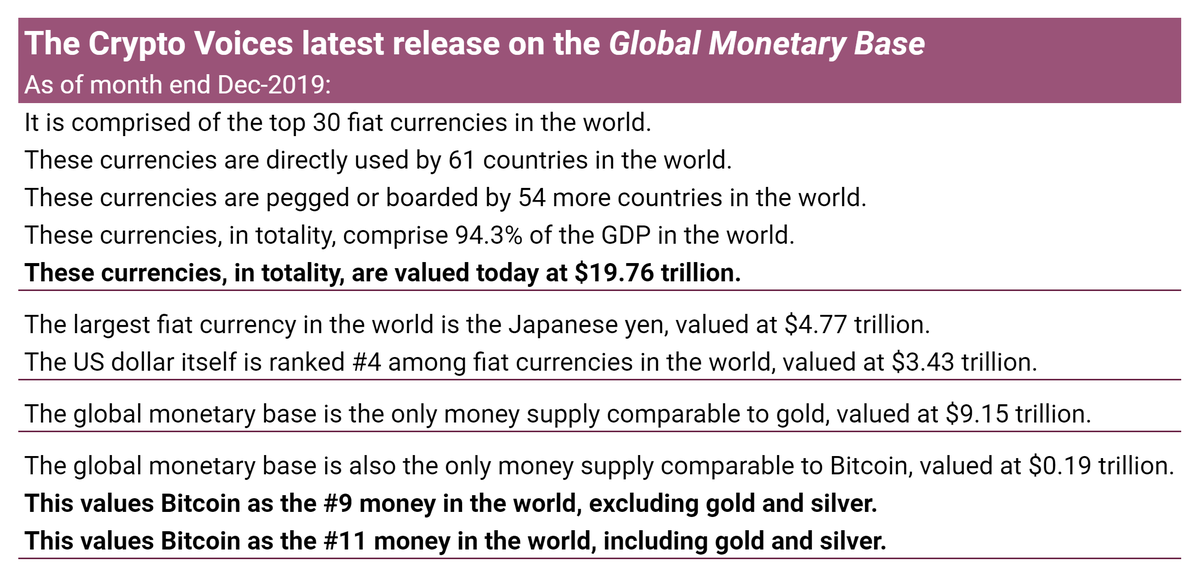

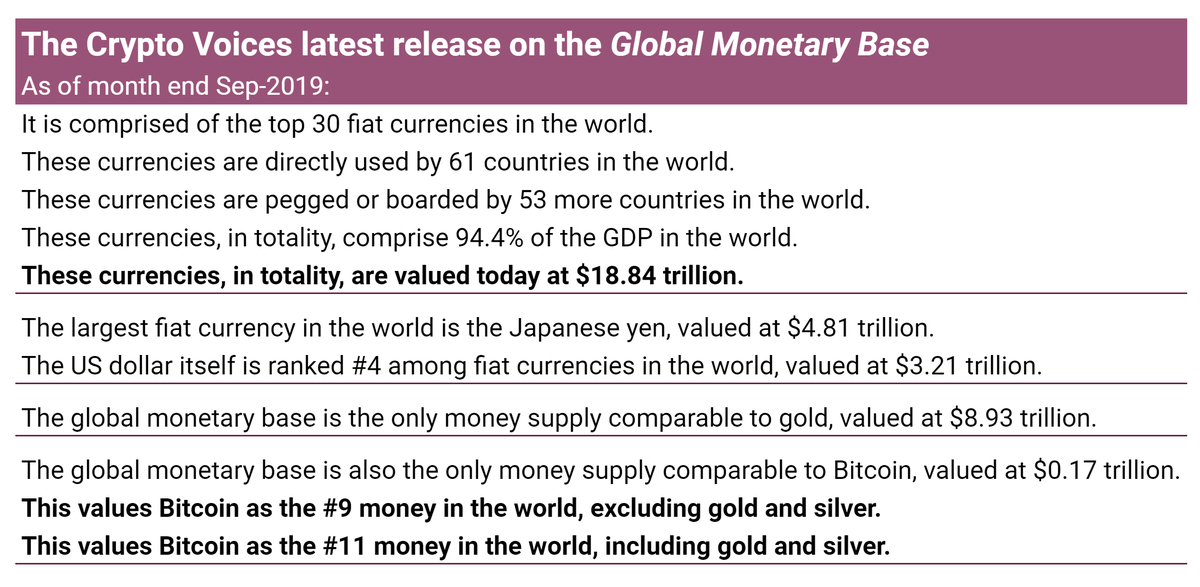

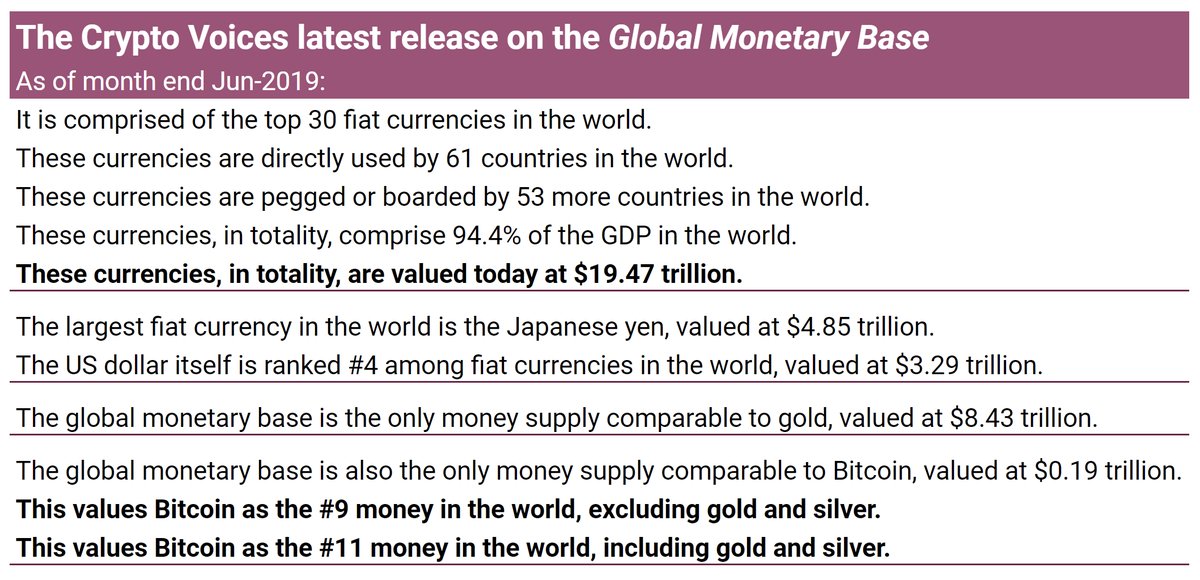

2/ Gold & silver is base money of the past. Government fiat is base money today. It comprises both physical cash… and a digital cash component. Bitcoin may be base money of the future. Before we get to the charts, it's important to clarify a few common misconceptions in money.

2/ Gold & silver is base money of the past. Government fiat is base money today. It comprises both physical cash… and a digital cash component. Bitcoin may be base money of the future. Before we get to the charts, it's important to clarify a few common misconceptions in money.

2/ Gold & silver is base money of the past. Government fiat is base money today. It comprises both physical cash… and a digital cash component! Bitcoin may be base money of the future. Before we get to the charts, it's important to clarify a few common misconceptions in money.

2/ Gold & silver is base money of the past. Government fiat is base money today. It comprises both physical cash… and a digital cash component! Bitcoin may be base money of the future. Before we get to the charts, it's important to clarify a few common misconceptions in money.

2/ Gold & silver is base money of the past. Government fiat is base money today. It comprises both physical cash… and a digital cash component! Bitcoin may be base money of the future. Before we get to the charts, it's important to clarify a few common misconceptions in money.

2/ Gold & silver is base money of the past. Government fiat is base money today. It comprises both physical cash… and a digital cash component! Bitcoin may be base money of the future. Before we get to the charts, it's important to clarify a few common misconceptions in money.

2/ Gold & silver is base money of the past. Government fiat is base money today. It comprises both physical cash… and a digital cash component! Bitcoin may be base money of the future. Before we get to the charts, it's important to clarify a few common misconceptions in money.

2/ Gold & silver is base money of the past. Government fiat is base money today. It comprises both physical cash… and a digital cash component! Bitcoin may be base money of the future. Before we get to the charts, it's important to clarify a few common misconceptions in money.

2/ To begin, it's important to understand the universal accounting identity: Assets = Debt + Equity. Today, it's true that all fiat money is debt-based. But before exploring fiat money, let's look at asset-based money.

2/ To begin, it's important to understand the universal accounting identity: Assets = Debt + Equity. Today, it's true that all fiat money is debt-based. But before exploring fiat money, let's look at asset-based money.