How to get URL link on X (Twitter) App

https://twitter.com/DeFi_initiate/status/1824379509115687371

Quarterly projections:

Quarterly projections:

https://twitter.com/DeFi_initiate/status/1612074399825281024

As expected, $BTC has moved up considerably since November. However, there remains a large upside and it's still a good time to start (or continue) DCA buying.

As expected, $BTC has moved up considerably since November. However, there remains a large upside and it's still a good time to start (or continue) DCA buying.

https://twitter.com/DeFi_initiate/status/1535580334330347522

I reverted the latest model change of May 7. Explanation:

I reverted the latest model change of May 7. Explanation:

https://twitter.com/DeFi_initiate/status/1535578499175546882

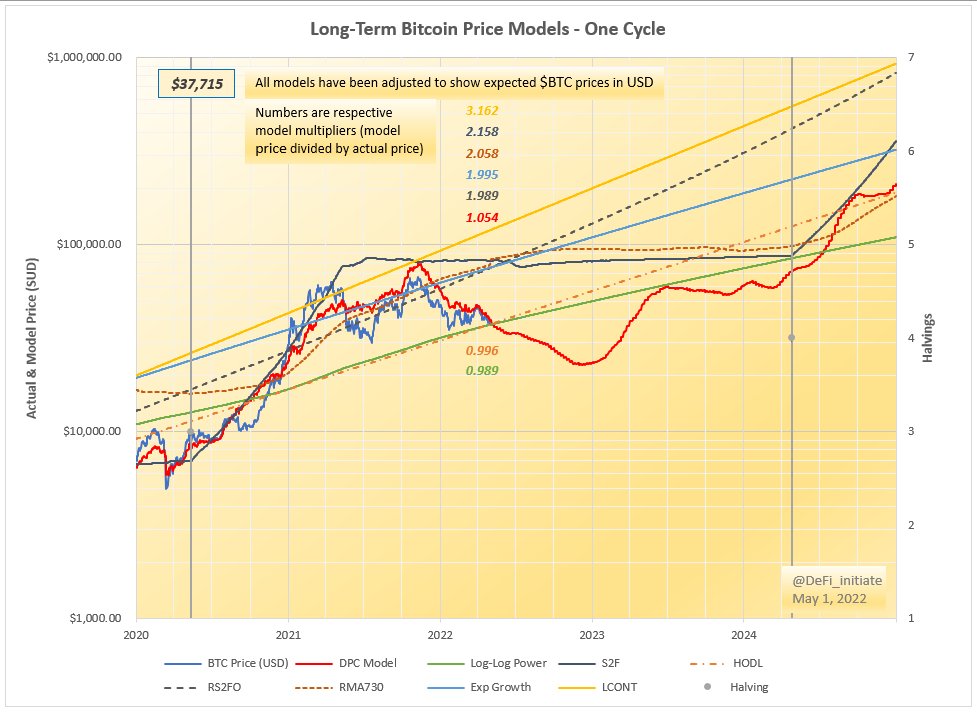

Model multiples (projected model price divided by price of #bitcoin):

Model multiples (projected model price divided by price of #bitcoin):

https://twitter.com/DeFi_initiate/status/1533072170838024192

Main messages:

Main messages:

https://twitter.com/DeFi_initiate/status/1533063259347202049

Model multiples (projected model price divided by price of #bitcoin):

Model multiples (projected model price divided by price of #bitcoin):https://twitter.com/DeFi_initiate/status/1528433571408519170With current prices & rewards, initial investment will be recovered (ROI) after the following number of days:

https://twitter.com/DeFi_initiate/status/1528331351300128768

Main messages:

Main messages:

https://twitter.com/DeFi_initiate/status/1519978417881550848

Page 1/4 (2% discount)

Page 1/4 (2% discount)

https://twitter.com/DeFi_initiate/status/1518189237715320832

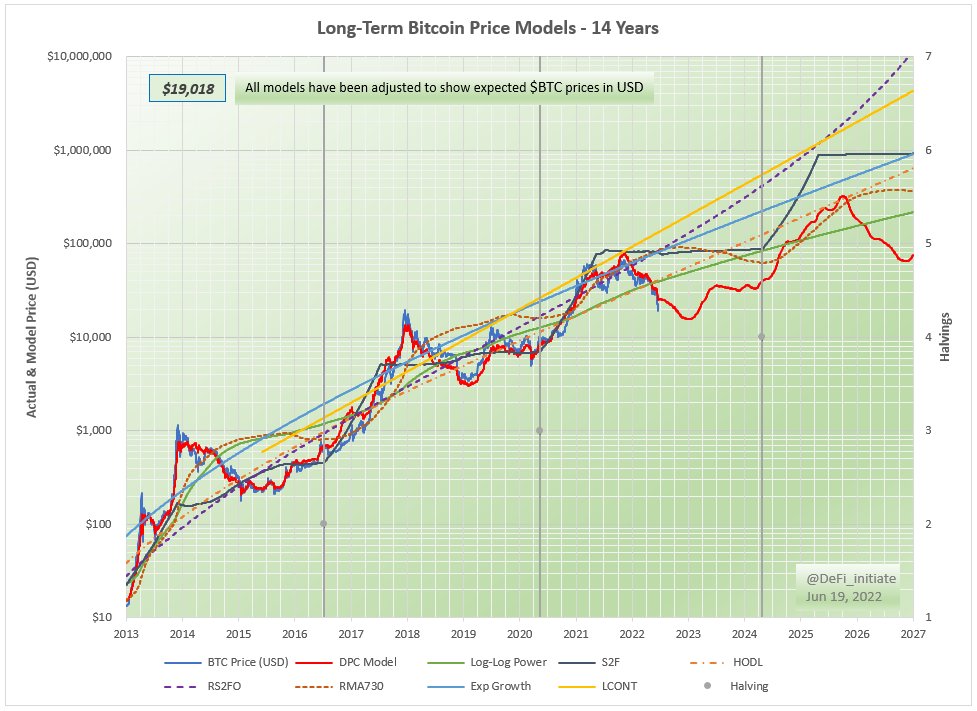

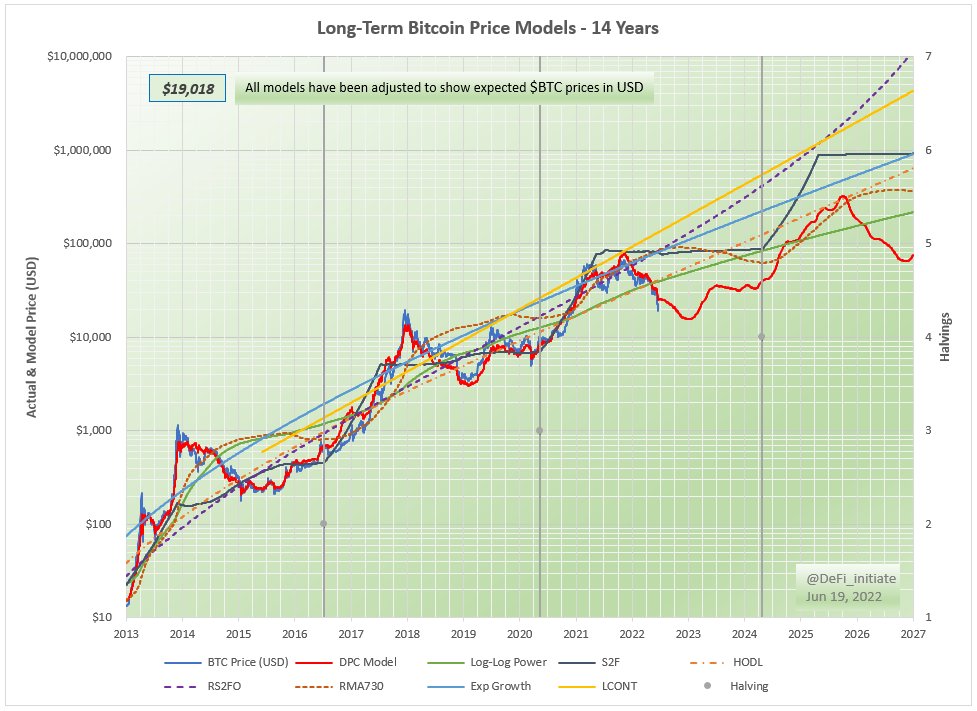

Time span of charts: 16 years & 5 years

Time span of charts: 16 years & 5 years

1. The annual chart above shows that, indeed, #number just keeps going up. What about those red candles though? Can we avoid losing money in the red years? Is there a #pattern to them?

1. The annual chart above shows that, indeed, #number just keeps going up. What about those red candles though? Can we avoid losing money in the red years? Is there a #pattern to them? https://twitter.com/DeFi_initiate/status/1475212710551769088

https://twitter.com/DeFi_initiate/status/1490074936634871808

https://twitter.com/DeFi_initiate/status/1490195229504200705

https://twitter.com/DeFi_initiate/status/14903737921362493441. Latest weekly model update:

https://twitter.com/DeFi_initiate/status/1489939862274789376

https://twitter.com/DeFi_initiate/status/1487837760324964354

https://twitter.com/DeFi_initiate/status/1490074936634871808

https://twitter.com/DeFi_initiate/status/1490195229504200705

https://twitter.com/DeFi_initiate/status/1489939862274789376

https://twitter.com/DeFi_initiate/status/14878377603249643541. We have seen that the foundation of this model is the power law and the halving cycle. As these two components work with average values, they can sometimes be too slow to adjust to changing circumstances. Therefore, a third component is needed to add agility to the model.

https://twitter.com/DeFi_initiate/status/1490074936634871808

https://twitter.com/DeFi_initiate/status/1489939862274789376

https://twitter.com/DeFi_initiate/status/1487837760324964354

https://twitter.com/DeFi_initiate/status/1487837803249815552?s=20&t=HFkDpFdwT8C_iIQUUs2i-A

https://twitter.com/DeFi_initiate/status/1487837806298742787?s=20&t=HFkDpFdwT8C_iIQUUs2i-A

Legend

Legend

1. The red line on the chart above shows how the median price of bitcoin is expected to unfold over the next 3 years. Today's closing price is projected between $30K and $73K (median: $47K). Time uncertainty is ±34 days, and price tolerance is -36%/+56% (at 95% confidence).

1. The red line on the chart above shows how the median price of bitcoin is expected to unfold over the next 3 years. Today's closing price is projected between $30K and $73K (median: $47K). Time uncertainty is ±34 days, and price tolerance is -36%/+56% (at 95% confidence).