Serving the Second District and the Nation. Tweets from President John Williams are signed -JCW.

How to get URL link on X (Twitter) App

Some lessons I’ve taken from two crises that occurred during my time implementing monetary policy: the Global Financial Crisis (GFC) and the coronavirus pandemic shock. I’ll discuss liquidity shocks and how central bank actions address them.

Some lessons I’ve taken from two crises that occurred during my time implementing monetary policy: the Global Financial Crisis (GFC) and the coronavirus pandemic shock. I’ll discuss liquidity shocks and how central bank actions address them.

“The ongoing transition away from LIBOR has ramifications for institutions, markets, and regulators across the globe, making cooperation at the international level of critical importance.”

“The ongoing transition away from LIBOR has ramifications for institutions, markets, and regulators across the globe, making cooperation at the international level of critical importance.”

Given the ongoing #COVID19 outbreak, the April survey (fielded between April 2 and 30) unsurprisingly shows a number of sharp changes in consumers’ spending behavior and outlook.

Given the ongoing #COVID19 outbreak, the April survey (fielded between April 2 and 30) unsurprisingly shows a number of sharp changes in consumers’ spending behavior and outlook.

In early to mid-March, amid extreme volatility across financial markets triggered by the coronavirus pandemic, several markets at the center of the U.S. financial system were severely disrupted.

In early to mid-March, amid extreme volatility across financial markets triggered by the coronavirus pandemic, several markets at the center of the U.S. financial system were severely disrupted.

The importance of small businesses to our nation’s economy cannot be overstated. They account for 47.5% of the private-sector workforce and are vital to the fabric of local communities. → bit.ly/3aX7GfW

The importance of small businesses to our nation’s economy cannot be overstated. They account for 47.5% of the private-sector workforce and are vital to the fabric of local communities. → bit.ly/3aX7GfW

[Today’s highlighted work] gave me goosebumps which you don’t normally hear about this kind of data. - David Erickson, Ph.D., @NewYorkFed

[Today’s highlighted work] gave me goosebumps which you don’t normally hear about this kind of data. - David Erickson, Ph.D., @NewYorkFed

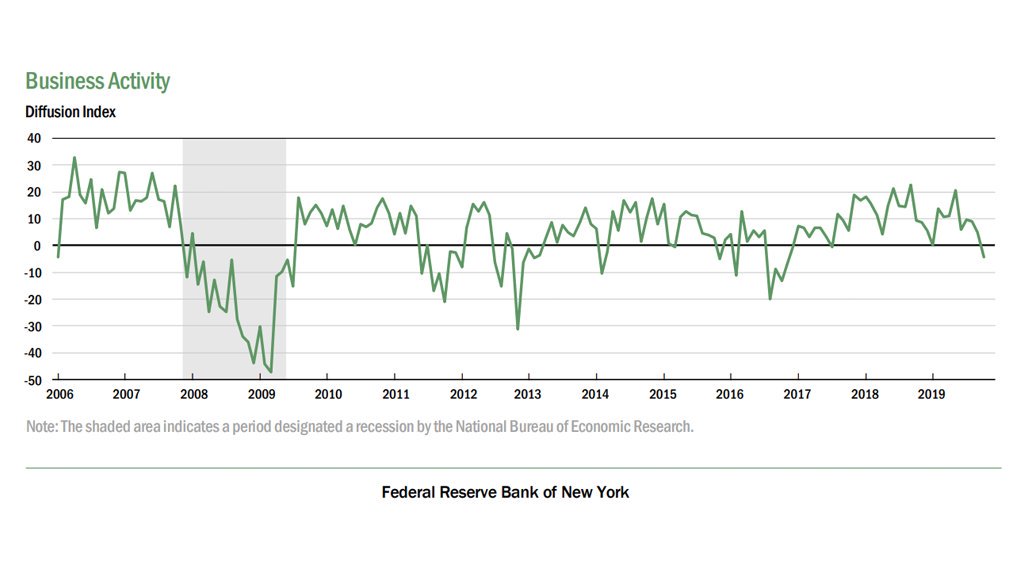

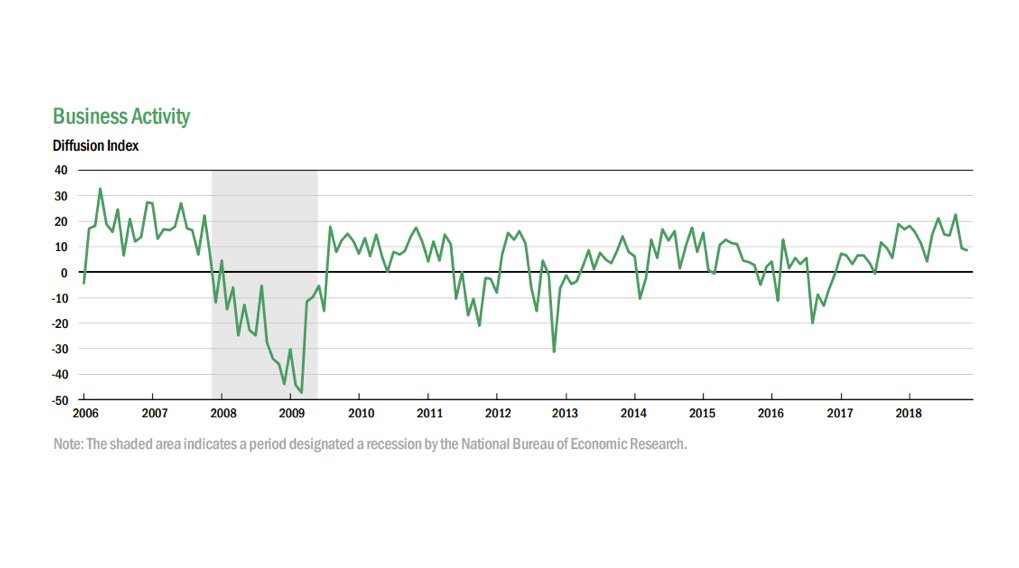

The survey’s headline business activity index dropped 9 points to -4.3—the first negative reading in more than two years. #BusinessLeadersSurvey

The survey’s headline business activity index dropped 9 points to -4.3—the first negative reading in more than two years. #BusinessLeadersSurvey

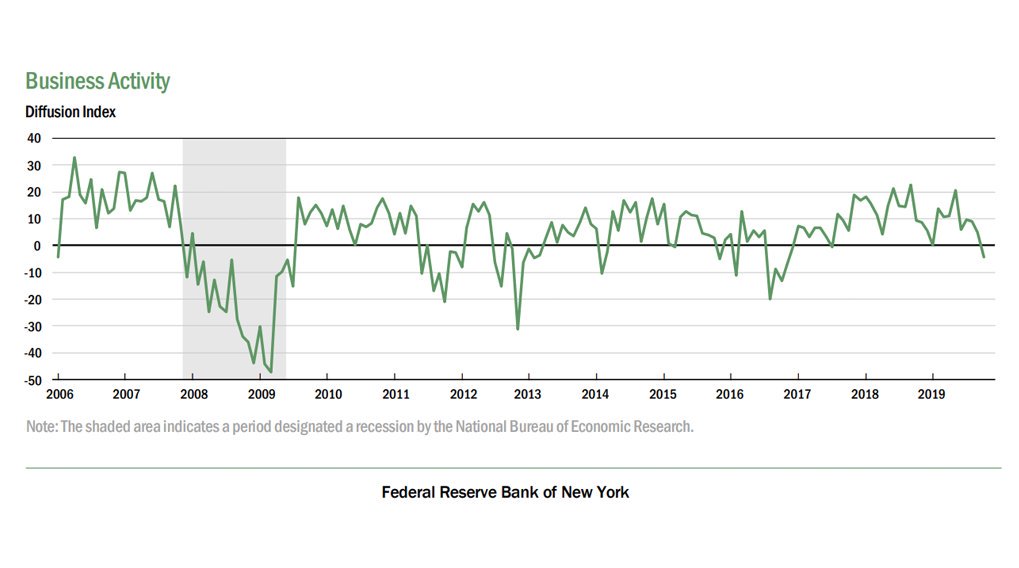

Supplementary questions to the August Empire State Manufacturing Survey and Business Leaders Survey focused on the effects of recent changes in trade policies—and specifically tariffs—on businesses in the region. #BLS #ESMS

Supplementary questions to the August Empire State Manufacturing Survey and Business Leaders Survey focused on the effects of recent changes in trade policies—and specifically tariffs—on businesses in the region. #BLS #ESMS

I’m strongly considering a PhD in Economics, but I’m not firmly committed to that as I also want to think about an MBA or a Master’s in Public Policy. In the meantime, I’m enjoying my work as a Research & Statistics Summer Analyst. #NYFedInterns #NationalInternDay

I’m strongly considering a PhD in Economics, but I’m not firmly committed to that as I also want to think about an MBA or a Master’s in Public Policy. In the meantime, I’m enjoying my work as a Research & Statistics Summer Analyst. #NYFedInterns #NationalInternDay

Aggregate household debt balances ticked up in the first quarter of 2019 for the 19th consecutive quarter, and are now $993 billion (7.8%) higher than the previous (2008Q3) peak of $12.68 trillion. #HHDC

Aggregate household debt balances ticked up in the first quarter of 2019 for the 19th consecutive quarter, and are now $993 billion (7.8%) higher than the previous (2008Q3) peak of $12.68 trillion. #HHDC

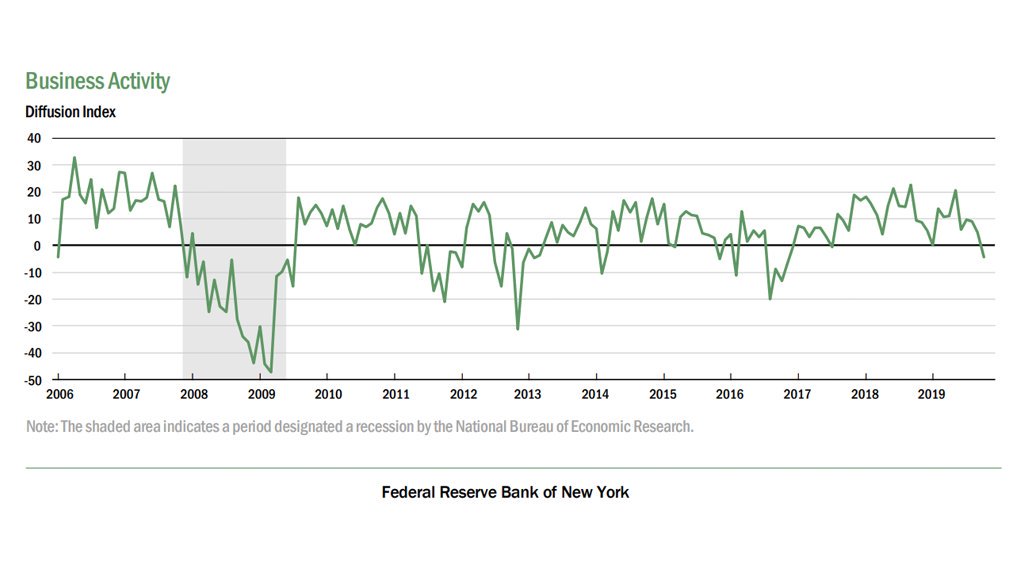

The headline business activity index held steady at 8.6. #businessleaderssurvey

The headline business activity index held steady at 8.6. #businessleaderssurvey

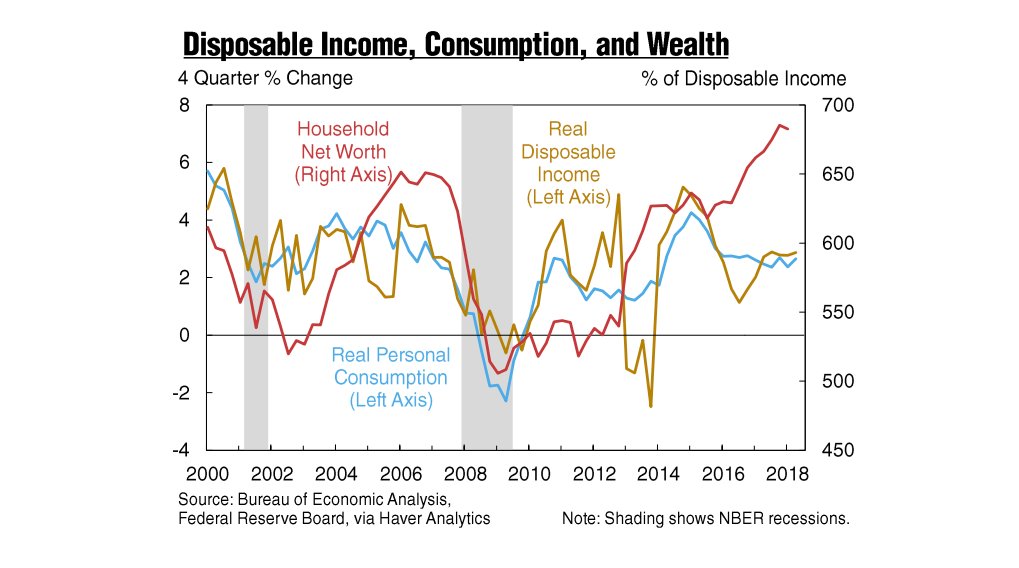

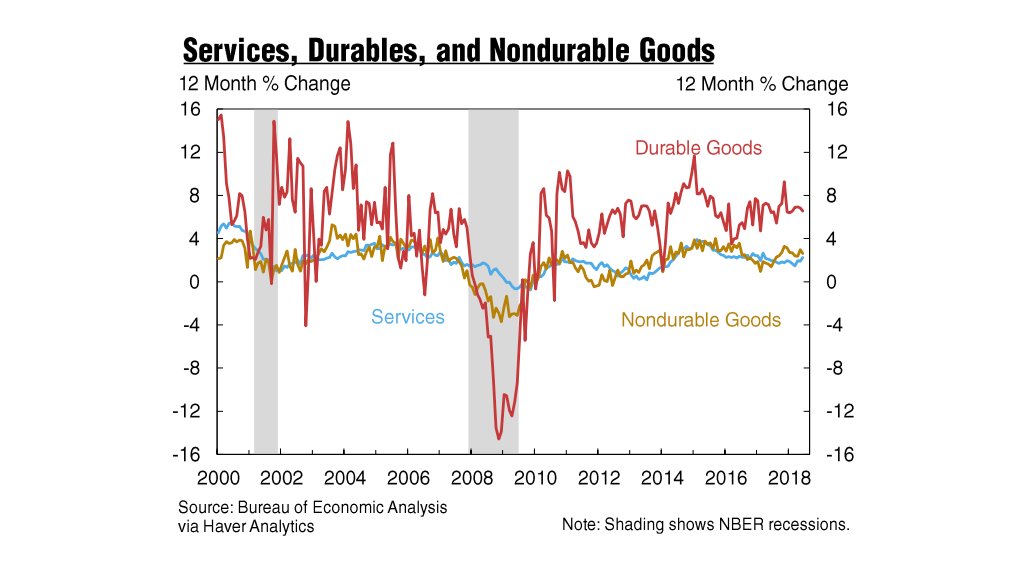

Real consumer spending increased in June at a pace similar to that in May, as real spending rose robustly in Q2. The rise in spending for June was led by services and durable goods expenditures. #EconomySnapshot

Real consumer spending increased in June at a pace similar to that in May, as real spending rose robustly in Q2. The rise in spending for June was led by services and durable goods expenditures. #EconomySnapshot

“We are approaching the ten-year anniversary of the worst financial crisis in generations.” -Beverly Hirtle, EVP Research & Statistics @NewYorkFed #BankingReform

“We are approaching the ten-year anniversary of the worst financial crisis in generations.” -Beverly Hirtle, EVP Research & Statistics @NewYorkFed #BankingReform