Fund Manager, Author of "In Gold we Trust report" & "Austrian School for Investors", Proud father of 3. Suffering fan of Rapid Wien. Tweets ≠ investment advice

3 subscribers

How to get URL link on X (Twitter) App

Stephen Miran (@smiran) has been chosen as the next Chairman of the Council of Economic Advisers (CEA).

Stephen Miran (@smiran) has been chosen as the next Chairman of the Council of Economic Advisers (CEA).

1️⃣ De-Dollarization & Central Bank Demand

1️⃣ De-Dollarization & Central Bank Demand

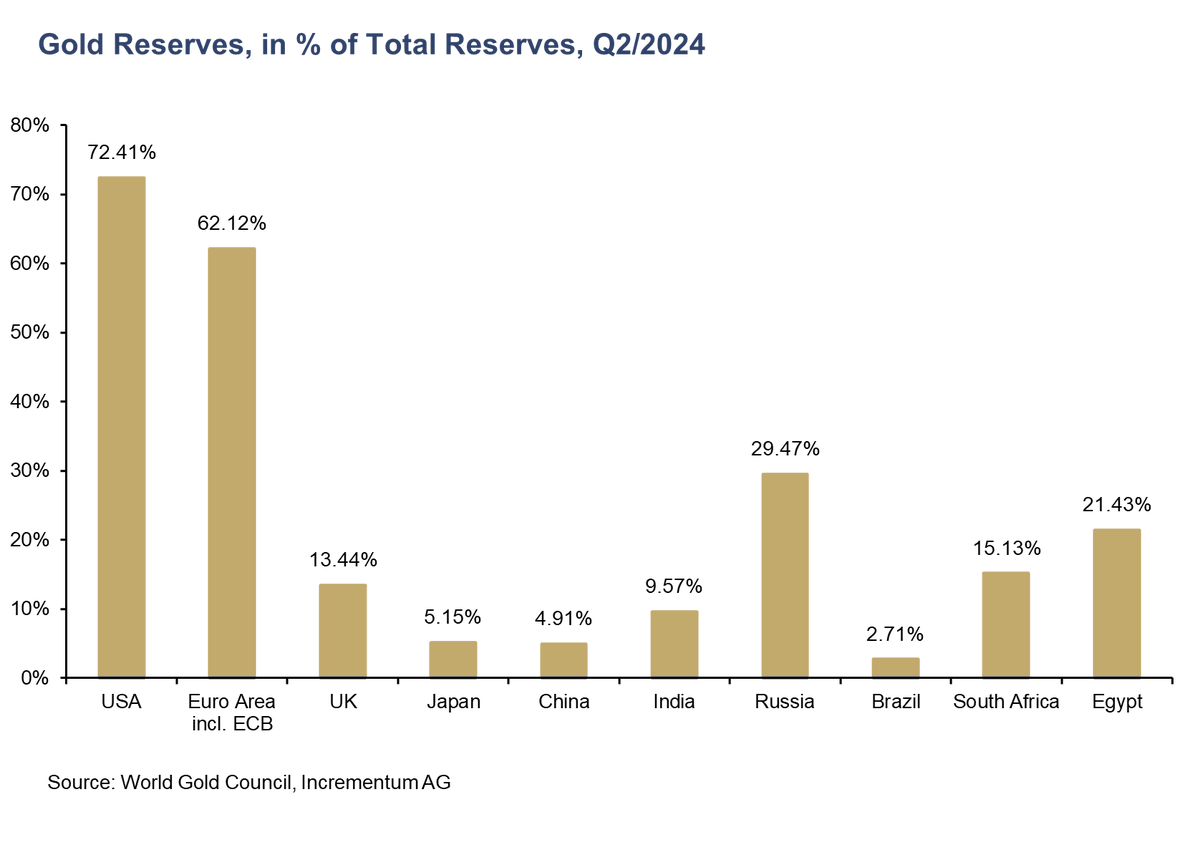

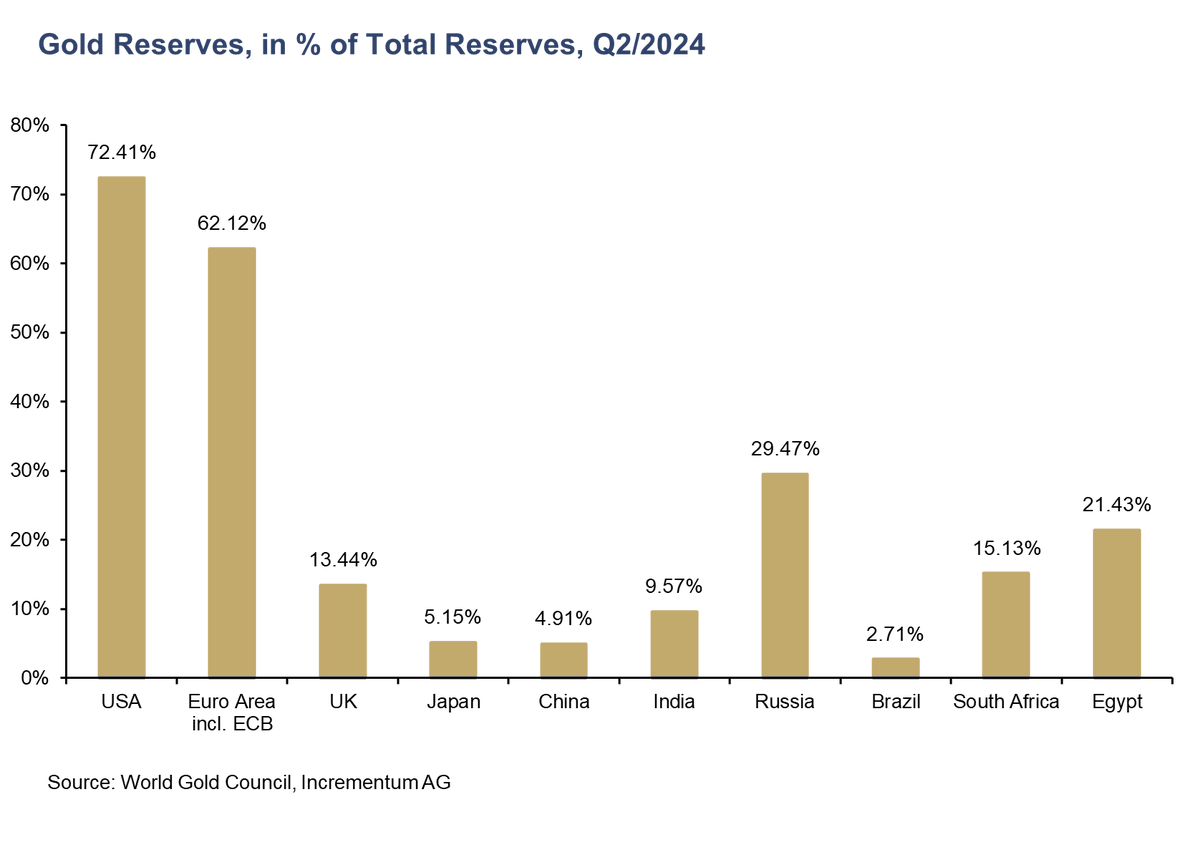

2/11 Recent gold purchases have largely come from emerging markets. These nations are bolstering their reserves amidst global economic shifts.

2/11 Recent gold purchases have largely come from emerging markets. These nations are bolstering their reserves amidst global economic shifts.

2/10 The US government finances have moved far beyond historical norms in recent years, especially post-Lehman. A clear illustration of fiscal dominance!

2/10 The US government finances have moved far beyond historical norms in recent years, especially post-Lehman. A clear illustration of fiscal dominance!

"... four “war” dispatches last year: War and Interest Rates, War and Industrial Policy, War and Commodity Encumbrance, and finally, War and Currency Statecraft. In these, I identified six fronts (..) in “macro-land” () where Great Powers were going “at it” in 2022:

"... four “war” dispatches last year: War and Interest Rates, War and Industrial Policy, War and Commodity Encumbrance, and finally, War and Currency Statecraft. In these, I identified six fronts (..) in “macro-land” () where Great Powers were going “at it” in 2022: