Trader (equities, FX, crypto). Behavior specialist.

To join Matrix trading community:

https://t.co/gggoC51BqD

11 subscribers

How to get URL link on X (Twitter) App

To this point i have not seen any other known-by-name "heavy weight and still legal" who comes close to carrying the process so obviously and in the open. Its much quicker to learn about rigged stuff when its done from individual rather than just process (no-name) basis.

To this point i have not seen any other known-by-name "heavy weight and still legal" who comes close to carrying the process so obviously and in the open. Its much quicker to learn about rigged stuff when its done from individual rather than just process (no-name) basis.

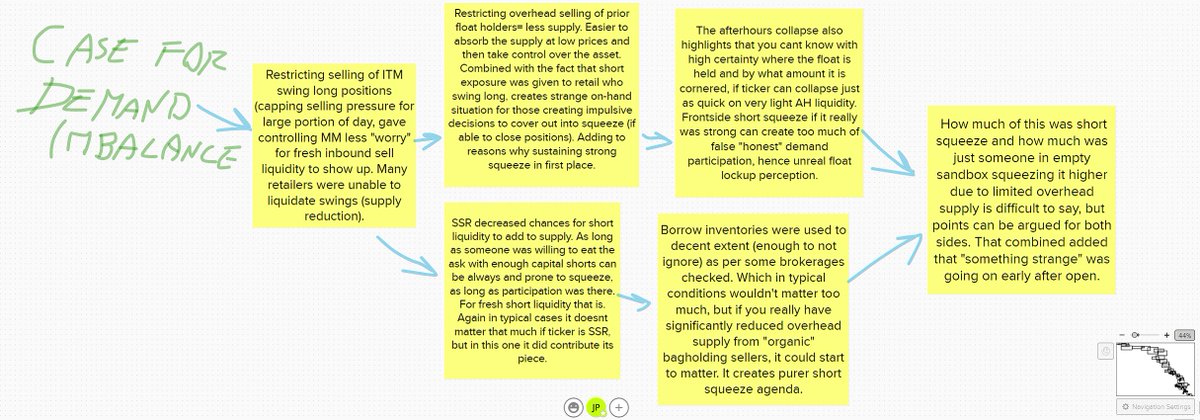

Whether there really was failure to adjust the split correctly before market open or it was done intentionally it doesnt matter. Due to selling restrictions by many, the supply was limited. It created purer fresh squeeze agenda, and less overhead participation.

Whether there really was failure to adjust the split correctly before market open or it was done intentionally it doesnt matter. Due to selling restrictions by many, the supply was limited. It created purer fresh squeeze agenda, and less overhead participation.

Day2 liquidity increase is something I track closely. SMMT had two days ago significant increase in d2 liquidity and squeeze unlike majority of past tickers for entire month. Disconnect of theme. Significant factor.

Day2 liquidity increase is something I track closely. SMMT had two days ago significant increase in d2 liquidity and squeeze unlike majority of past tickers for entire month. Disconnect of theme. Significant factor.

In early stage of every strong cycle there is one 0.5 USD ticker that gaps up, and then goes into halt squeeze mode. ( $APDN in August). The structure of this tickers is always the same (price/volatility/volumes). Its a pattern. But recognizing it can be difficult:

In early stage of every strong cycle there is one 0.5 USD ticker that gaps up, and then goes into halt squeeze mode. ( $APDN in August). The structure of this tickers is always the same (price/volatility/volumes). Its a pattern. But recognizing it can be difficult: