Emerging market bonds. Econ PhD @bondvigilantes. Former @worldbank. Climate-social lens to investing/ ESG. Author: Africa debt book. Not investment advice.

How to get URL link on X (Twitter) App

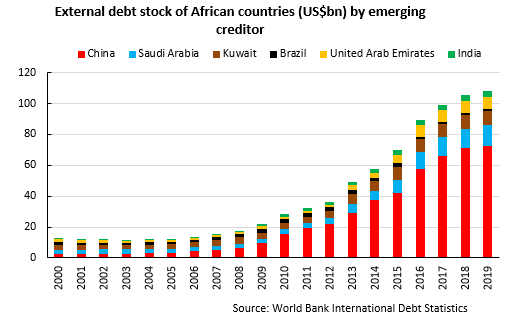

2. Key areas reform for investors to watch 1/ FX. 2/ Balancing budget & stabilising debt. 3/ Privatisation program. Each important to gov & for keeping $3.7bn IMF program on-track (crucial for eurobond investors & China’s exposure). S&P has #Angola on a B- rating with neg outlook

2. Key areas reform for investors to watch 1/ FX. 2/ Balancing budget & stabilising debt. 3/ Privatisation program. Each important to gov & for keeping $3.7bn IMF program on-track (crucial for eurobond investors & China’s exposure). S&P has #Angola on a B- rating with neg outlook