🔮🐶🔮 I like data, defi and degening | intern @lighter_xyz | 💬 https://t.co/boLwACvoUe

How to get URL link on X (Twitter) App

Watch out for sudden increases in price and OI(~1b)

Watch out for sudden increases in price and OI(~1b)

2/ @kingfisher_btc provides something called a GEX chart which calculates the gamma positions of option traders.

2/ @kingfisher_btc provides something called a GEX chart which calculates the gamma positions of option traders.

Selling vs Buying Options

Selling vs Buying Options

Option Basics

Option Basics

Started filtering out sources first with their ML-based yield prediction column.

Started filtering out sources first with their ML-based yield prediction column.

https://twitter.com/Mark2work/status/1571263994983333889

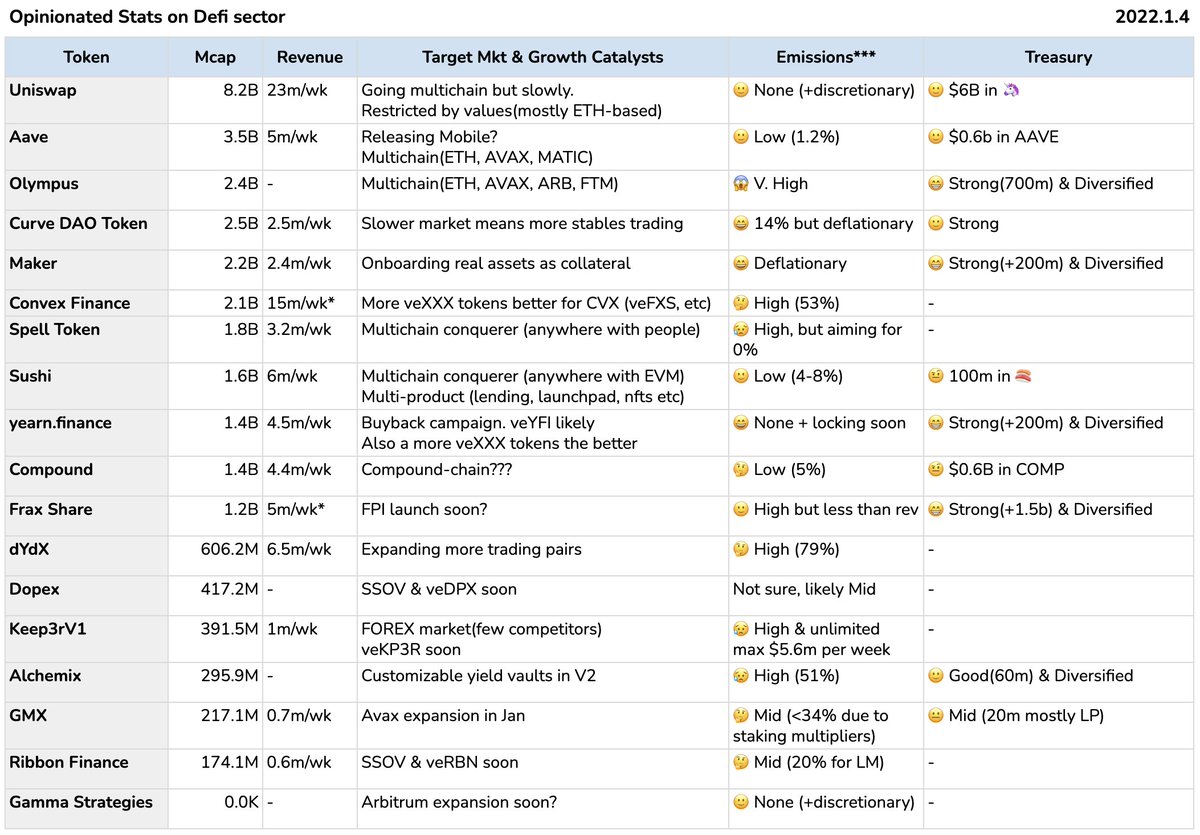

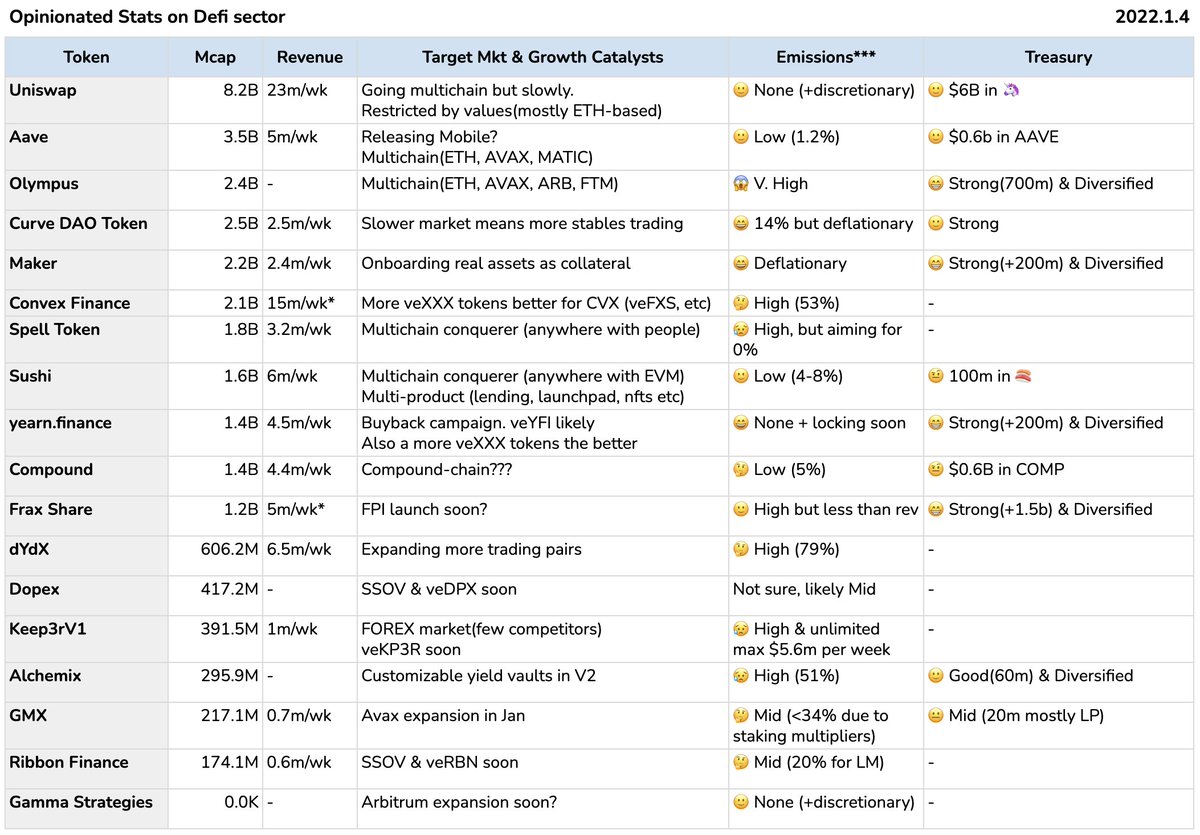

2/n Splitting the two into two tiers seems to make more sense.

2/n Splitting the two into two tiers seems to make more sense.

2/n Ethereum

2/n Ethereum

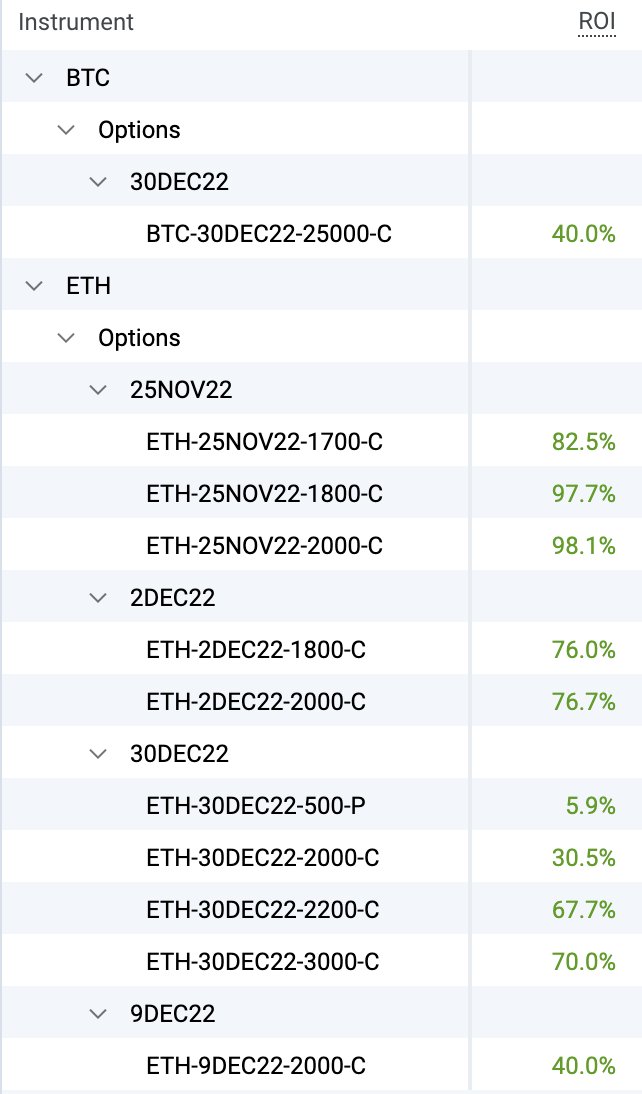

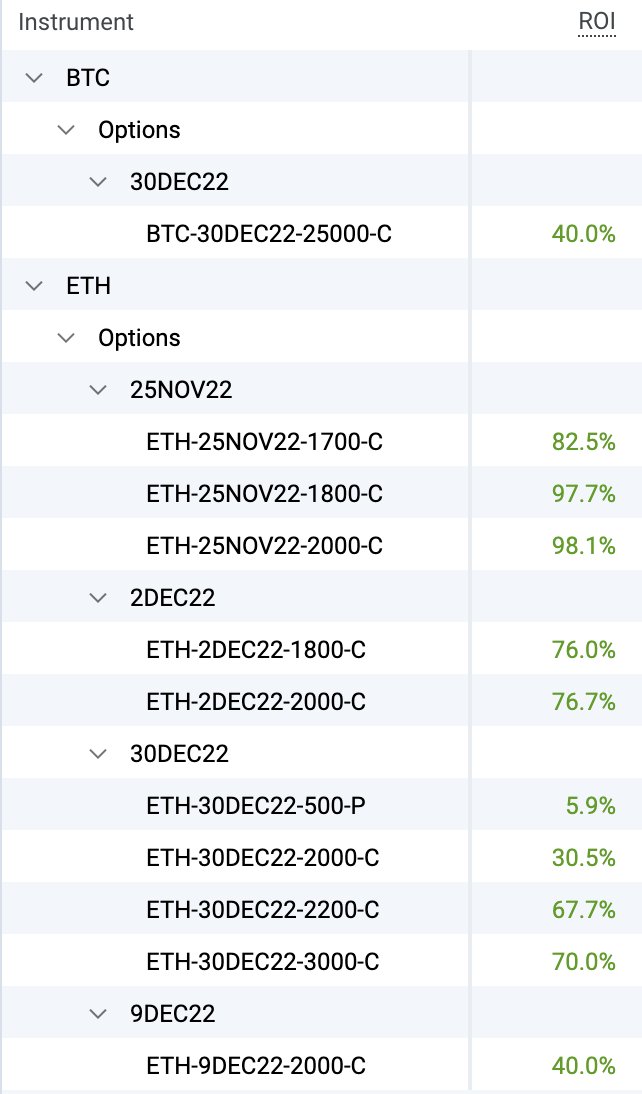

2/4 Interesting patterns

2/4 Interesting patterns

https://twitter.com/opyn_/status/1468765218822098946