Transforming Data into Financidal Insight ll CMA || MBA || Working in Global Chemical MNC || Student of MKT || Lifelong Learner || Value Investor || Avid Reader

7 subscribers

How to get URL link on X (Twitter) App

✍️Revenue: Domestic 85% & Export 15%

✍️Revenue: Domestic 85% & Export 15%

https://twitter.com/ketanmba03/status/1091250654083981312?s=20✍️ IOLCP is having 30% World Mkt Share of Ibuprofen

👉 India's MF Industry's consistent growth @21% CAGR (From 12.75 Lakh Crs to 27.26 lakh Crs in 2019)

👉 India's MF Industry's consistent growth @21% CAGR (From 12.75 Lakh Crs to 27.26 lakh Crs in 2019)

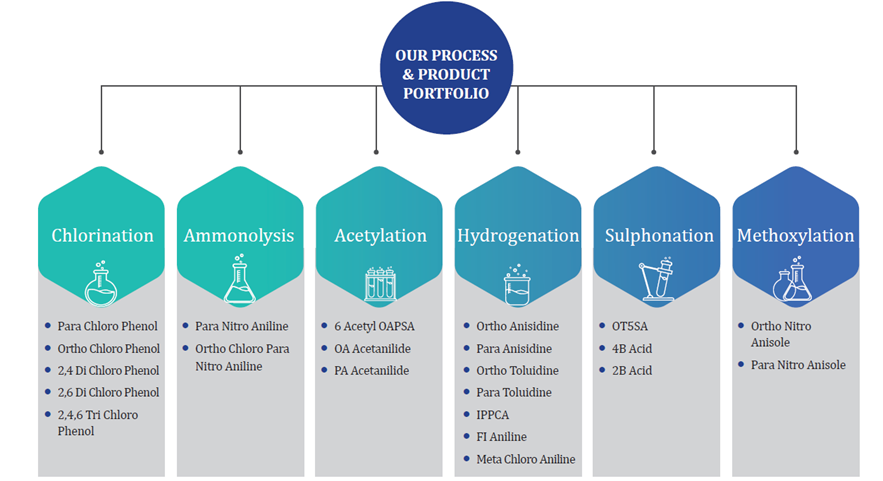

Diversified & De-risked Portfolio

Diversified & De-risked Portfolio

https://twitter.com/ketanmba03/status/1216540585063936001?s=19👍 A pick-up in project execution drove the revenue in EPC

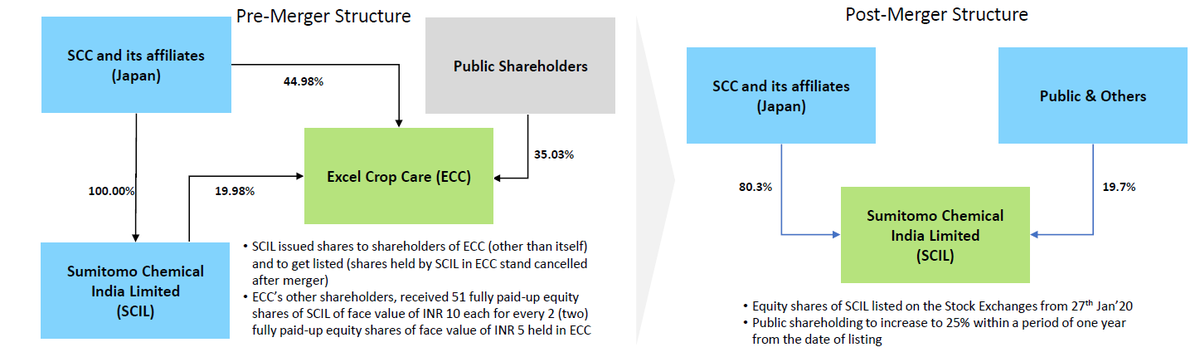

𝗢𝗽𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗩𝗮𝗹𝘂𝗲 𝗖𝗿𝗲𝗮𝘁𝗶𝗼𝗻

𝗢𝗽𝗲𝗿𝗮𝘁𝗶𝗼𝗻𝗮𝗹 𝗩𝗮𝗹𝘂𝗲 𝗖𝗿𝗲𝗮𝘁𝗶𝗼𝗻