Using algorithms to beat Wall Street. Institutional data and quant models simplified for the everyday investor. It’s not financial advice. Believe in something.

How to get URL link on X (Twitter) App

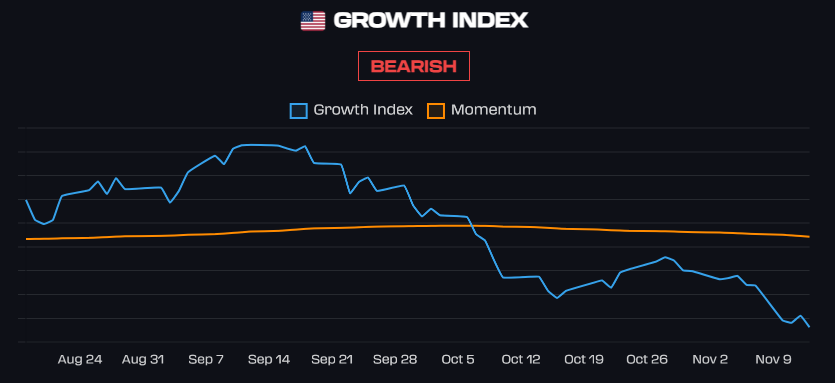

Since the Risk-Off trigger on October 13, growth signals have weakened while inflation impulses have held up enough to fuel hawkish expectations.

Since the Risk-Off trigger on October 13, growth signals have weakened while inflation impulses have held up enough to fuel hawkish expectations.

Sovereign credit default swaps (CDS) are a type of derivative that allows investors to protect themselves against the risk of a country defaulting on its debt. Essentially, the buyer of a CDS contract pays a premium to a seller. Think of it like a put option on a country.

Sovereign credit default swaps (CDS) are a type of derivative that allows investors to protect themselves against the risk of a country defaulting on its debt. Essentially, the buyer of a CDS contract pays a premium to a seller. Think of it like a put option on a country.

A trend shift in the dollar will add more confirmation to the Risk-On regime, which has been brewing under the surface for over a month now. Market Illiquidity improving is supporting the narrative of a possible shift. This really comes down to how the major components trade...

A trend shift in the dollar will add more confirmation to the Risk-On regime, which has been brewing under the surface for over a month now. Market Illiquidity improving is supporting the narrative of a possible shift. This really comes down to how the major components trade...

$EUR (largest $DXY component)

$EUR (largest $DXY component)

$EUR (largest $DXY component)

$EUR (largest $DXY component)