How to get URL link on X (Twitter) App

https://twitter.com/blur_io/status/1651964504148959236

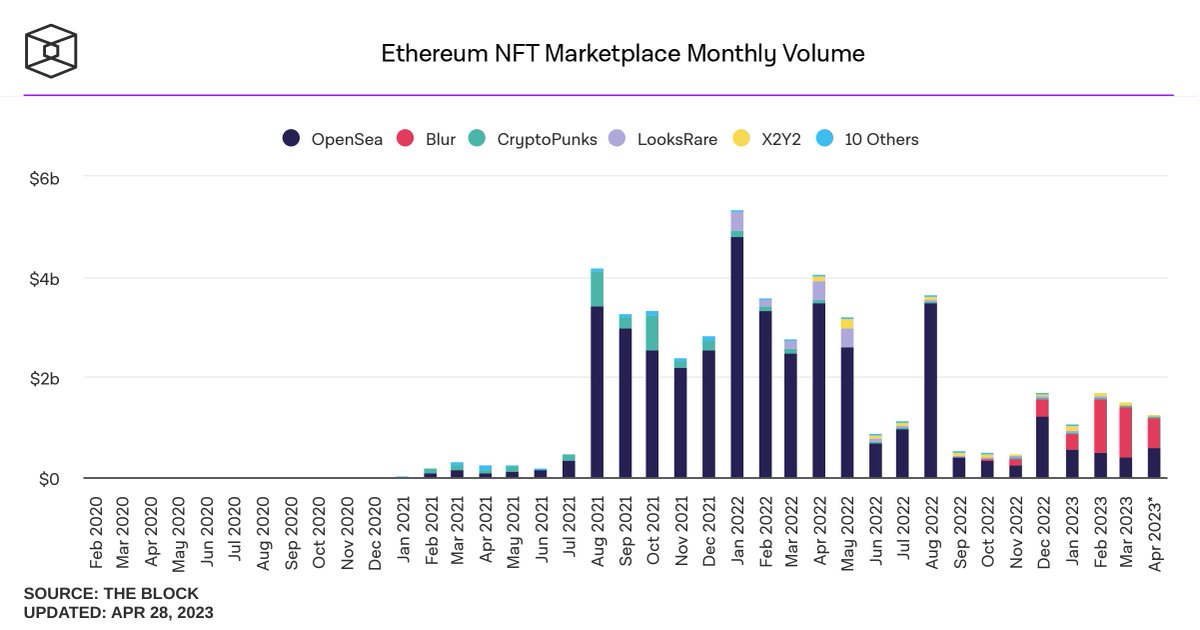

I am not naive when looking at the state of NFTs, keep in mind a lot of $BLUR volume has been washtrading to farm points.

I am not naive when looking at the state of NFTs, keep in mind a lot of $BLUR volume has been washtrading to farm points.

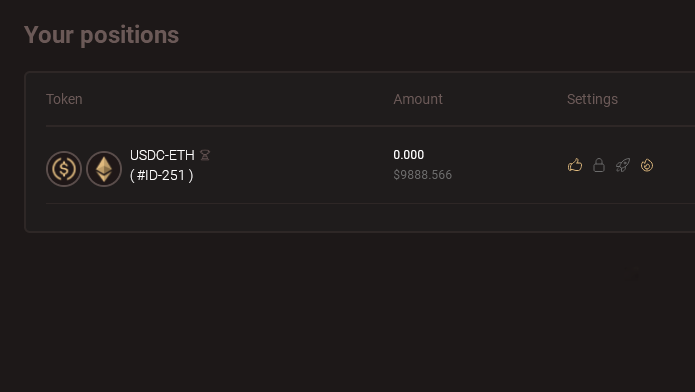

Launched 2 hours ago, and I did lp $10k

Launched 2 hours ago, and I did lp $10khttps://twitter.com/TheMerlinDEX/status/1650541882953302016

Obviously we dont have any friends, so whats the best thing to do now?

Obviously we dont have any friends, so whats the best thing to do now? https://twitter.com/trmachine888/status/1648813160223080448

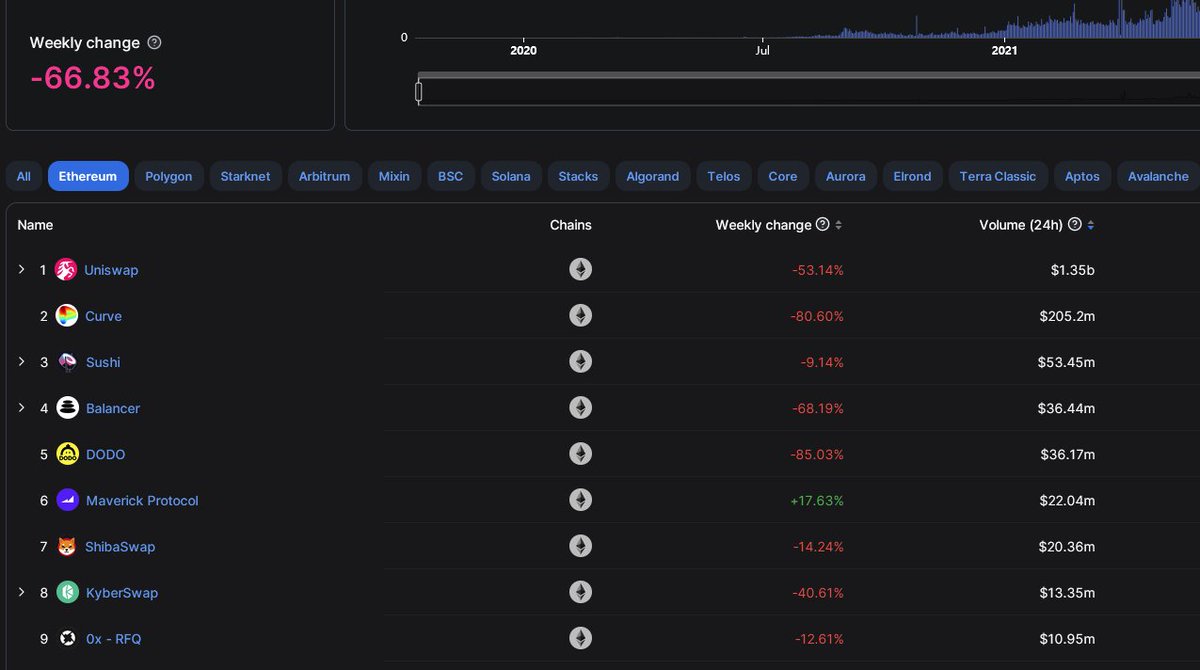

"But what if most people dont care about $BTC and trade altcoins?"🤣

"But what if most people dont care about $BTC and trade altcoins?"🤣

Now lets compare it with #Avalanche $AVAX , you can clearly see the "boom and bust" cycle it went through, the rapid decline started around May 9.

Now lets compare it with #Avalanche $AVAX , you can clearly see the "boom and bust" cycle it went through, the rapid decline started around May 9.

The low IQ take here is that the Arbitrum ecosystem is quite dead at the moment, but this project got one of the biggest $ARB airdrops and has lower marketcap than all the others above.

The low IQ take here is that the Arbitrum ecosystem is quite dead at the moment, but this project got one of the biggest $ARB airdrops and has lower marketcap than all the others above.

https://twitter.com/lookonchain/status/1647924763640340480

1. You would have had to pick the perfect alts (very unlikely)

1. You would have had to pick the perfect alts (very unlikely)

https://twitter.com/trmachine888/status/1643216378235703299

https://twitter.com/DegenSpartan/status/1645097191441301509We had @NorthRockLP with the assumption that staking % will not increase in a rapid manner and there will be a selloff, meanwhile @DegenSpartan took the other side of the coin.

The next address only holds 28m tokens and sent the remaining 17m to another address

The next address only holds 28m tokens and sent the remaining 17m to another address

1/ @ribbonfinance is an options protocol with decentralized vaults, you basically provided USDC/ETH and earned yield as the protocol sells puts/calls. Its actually a cool concept for sustainable yield and the team built something useful.

1/ @ribbonfinance is an options protocol with decentralized vaults, you basically provided USDC/ETH and earned yield as the protocol sells puts/calls. Its actually a cool concept for sustainable yield and the team built something useful.

https://twitter.com/sector_fi/status/1636454794490413056

https://twitter.com/Spartadex_io/status/1638587985485602817You just have to join their discord and do some quests. Took me 5minutes.

https://twitter.com/mavprotocol/status/1633468266751434753