Vuk (eng. Wolf). Oxford PhD, runs a hedge fund @OraclumCapital (follow at https://t.co/RK3vtZ9iUK). Author of Elite Networks. Loves his family & cooking.

14 subscribers

How to get URL link on X (Twitter) App

When a country runs a trade deficit, i.e. a current account deficit (CA-), in pure accounting terms this means it’s running a capital account surplus (CP+)

When a country runs a trade deficit, i.e. a current account deficit (CA-), in pure accounting terms this means it’s running a capital account surplus (CP+)

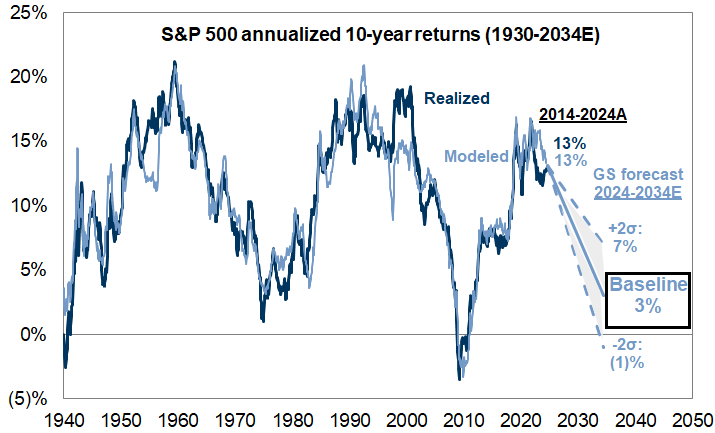

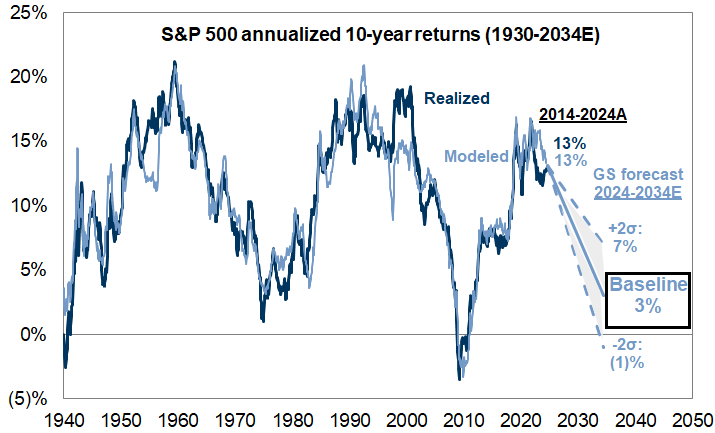

First of all, this is an unusually bearish outlook, esp given that SPX averaged an annualized 13% during the past 10 years.

First of all, this is an unusually bearish outlook, esp given that SPX averaged an annualized 13% during the past 10 years.

https://twitter.com/OraclumIS/status/16081250941189775361/

For the record, our performance in 2020:

For the record, our performance in 2020: https://twitter.com/oraclumis/status/1323855379986526209

1/

1/

https://twitter.com/NobelPrize/status/1579408493211422721One of the reasons why Bernanke was chosen to run the Fed back in the day was his contribution to studying the Great Depression and the failures of central banks.

1/

1/

The set-up:

The set-up:

https://twitter.com/OraclumIS/status/15569801697133527051/

@michaeljburry 1/

@michaeljburry 1/

https://twitter.com/wolf_vukovic/status/15403781416124211211/

@RayDalio 1/

@RayDalio 1/

1/

1/https://twitter.com/wolf_vukovic/status/1491079485663240194

1/ Are investors just brutal warmongers looking to benefit from other people's misery?

1/ Are investors just brutal warmongers looking to benefit from other people's misery?

https://twitter.com/wolf_vukovic/status/1491079485663240194