Thread Reader helps you read and share Twitter threads easily!

I'm @ThreadReaderApp a Twitter bot here to help you read threads more easily. To trigger me, you just have to reply to (or quote) any tweet of the thread you want to unroll and mention me with the "unroll" keyword and I'll send you a link back on Twitter 😀

— Thread Reader App (@threadreaderapp) November 25, 2017

X thread is series of posts by the same author connected with a line!

From any post in the thread, mention us with a keyword "unroll"

@threadreaderapp unroll

Follow @ThreadReaderApp to mention us easily!

Practice here first or read more on our help page!

Recent

Feb 21

Read 20 tweets

Last night, I was contacted by a former roommate of Keir Starmer.

After our conversation, I now believe that he is the most dangerous Prime Minister Britain has ever had.

Here’s what he told me:🧵

After our conversation, I now believe that he is the most dangerous Prime Minister Britain has ever had.

Here’s what he told me:🧵

Feb 21

Read 4 tweets

My #Top1000 Followers for 21st February 2026

#FBPE #FBPEGlobal #FBPA #FBR #RejoinEU #Rejoin #FightFascism #StandUpToFascism #FightRacism #StandUpToRacism #StrongerTogether sydesjokes.blogspot.com/2026/02/my-top…

#FBPE #FBPEGlobal #FBPA #FBR #RejoinEU #Rejoin #FightFascism #StandUpToFascism #FightRacism #StandUpToRacism #StrongerTogether sydesjokes.blogspot.com/2026/02/my-top…

#Top10

(--) means No Change.

1. @ValeryMell1+ (+1)

2. @ChrisyDrThomas+ (-1)

3. @Solly01+ (--)

4. @WendyNowak+ (--)

5. @Etya73+ (+2)

6. @upursbetty+ (+2)

7. @Dcdefiant1+ (-2)

8. @JamesGrahamAuth+ (-2)

9. @PaolaPerfume+ (+5)

10. @Gaynor_PE+ (-1)

(--) means No Change.

1. @ValeryMell1+ (+1)

2. @ChrisyDrThomas+ (-1)

3. @Solly01+ (--)

4. @WendyNowak+ (--)

5. @Etya73+ (+2)

6. @upursbetty+ (+2)

7. @Dcdefiant1+ (-2)

8. @JamesGrahamAuth+ (-2)

9. @PaolaPerfume+ (+5)

10. @Gaynor_PE+ (-1)

11. @BakerRay3+ (-1)

12. @sweeterEm+ (-1)

13. @Boringoldfrat+ (-1)

14. @loty1000+ (-1)

15. @davie5456+ (+5)

16. @Reverblive+ (-1)

17. @pmoni13+ (-1)

18. @GeoffBrewer+ (-1)

19. @AjPelser+ (-1)

20. @DrNeelie+ (+1)

21. @PeterSE16Bhoy+ (-2)

22. @jfranklynh+ (--)

23. @phakanm+ (+3)

24. @67bab+ (-1)

25. @ipattorneyliza+ (-1)

26. @redwingjohnny+ (-1)

27. @griega17+ (+6)

28. @mikew4EU+ (-1)

29. @davejacobs51+ (-1)

30. @Anniepop2027+ (-1)

31. @bruce_lugo+ (-1)

32. @james_scarratt+ (-1)

33. @immofux+ (-1)

34. @NickDelaney9+ (--)

35. @rolandhoskins1+ (+10)

36. @haaohaoo+ (-1)

37. @mm_tw9+ (-1)

38. @decsernatony+ (-1)

39. @MindFeast622+ (-1)

40. @_Brewer_+ (-1)

41. @nilocski+ (-1)

42. @aah4+ (-1)

43. @juliehelm9+ (-1)

44. @neighbour_kx+ (-1)

45. @lesleyseddon+ (-1)

46. @PeteLondonerUK+ (+1)

47. @bill_howarth+ (+1)

48. @YourGrowFriend+ (+1)

49. @JL_W10+ (-3)

50. @kmoore001+ (+7)

51. @louisesm184+ (-1)

52. @CosmoCG+ (-1)

53. @gildedcage66+ (-1)

54. @EdwardsPAW+ (-1)

55. @njdivito+ (-1)

12. @sweeterEm+ (-1)

13. @Boringoldfrat+ (-1)

14. @loty1000+ (-1)

15. @davie5456+ (+5)

16. @Reverblive+ (-1)

17. @pmoni13+ (-1)

18. @GeoffBrewer+ (-1)

19. @AjPelser+ (-1)

20. @DrNeelie+ (+1)

21. @PeterSE16Bhoy+ (-2)

22. @jfranklynh+ (--)

23. @phakanm+ (+3)

24. @67bab+ (-1)

25. @ipattorneyliza+ (-1)

26. @redwingjohnny+ (-1)

27. @griega17+ (+6)

28. @mikew4EU+ (-1)

29. @davejacobs51+ (-1)

30. @Anniepop2027+ (-1)

31. @bruce_lugo+ (-1)

32. @james_scarratt+ (-1)

33. @immofux+ (-1)

34. @NickDelaney9+ (--)

35. @rolandhoskins1+ (+10)

36. @haaohaoo+ (-1)

37. @mm_tw9+ (-1)

38. @decsernatony+ (-1)

39. @MindFeast622+ (-1)

40. @_Brewer_+ (-1)

41. @nilocski+ (-1)

42. @aah4+ (-1)

43. @juliehelm9+ (-1)

44. @neighbour_kx+ (-1)

45. @lesleyseddon+ (-1)

46. @PeteLondonerUK+ (+1)

47. @bill_howarth+ (+1)

48. @YourGrowFriend+ (+1)

49. @JL_W10+ (-3)

50. @kmoore001+ (+7)

51. @louisesm184+ (-1)

52. @CosmoCG+ (-1)

53. @gildedcage66+ (-1)

54. @EdwardsPAW+ (-1)

55. @njdivito+ (-1)

Feb 21

Read 13 tweets

Zelenskyy was supposed to fall in days — via assassination or flight.

Russian agents rented apartments near Bankova Street with orders to eliminate him. Instead, he posted a dark selfie: “We are here.”

Four years later, he’s still in office, CNN. 1/

Russian agents rented apartments near Bankova Street with orders to eliminate him. Instead, he posted a dark selfie: “We are here.”

Four years later, he’s still in office, CNN. 1/

Removal was central to Moscow’s plan. Kill him or capture him — and let panic finish the job.

When the US offered evacuation, Zelenskyy’s line defined the moment: “I need ammunition, not a ride.” 2/

When the US offered evacuation, Zelenskyy’s line defined the moment: “I need ammunition, not a ride.” 2/

He survived around a dozen assassination attempts — but the bigger threat became political.

A corruption scandal toppled close allies, triggered rare wartime protests, and forced a public U-turn on anti-graft reforms. 3/

A corruption scandal toppled close allies, triggered rare wartime protests, and forced a public U-turn on anti-graft reforms. 3/

Feb 21

Read 35 tweets

2. Dame Prue in Pink and black walnut, beetroot madder and recycled oak!

‘But just a day after turning 85, the Bake Off star appeared on the catwalk at the Vin + Omi show at London Fashion Week in a dress which was made with organic waste from the King’s Sandringham estate…’

‘But just a day after turning 85, the Bake Off star appeared on the catwalk at the Vin + Omi show at London Fashion Week in a dress which was made with organic waste from the King’s Sandringham estate…’

Feb 21

Read 28 tweets

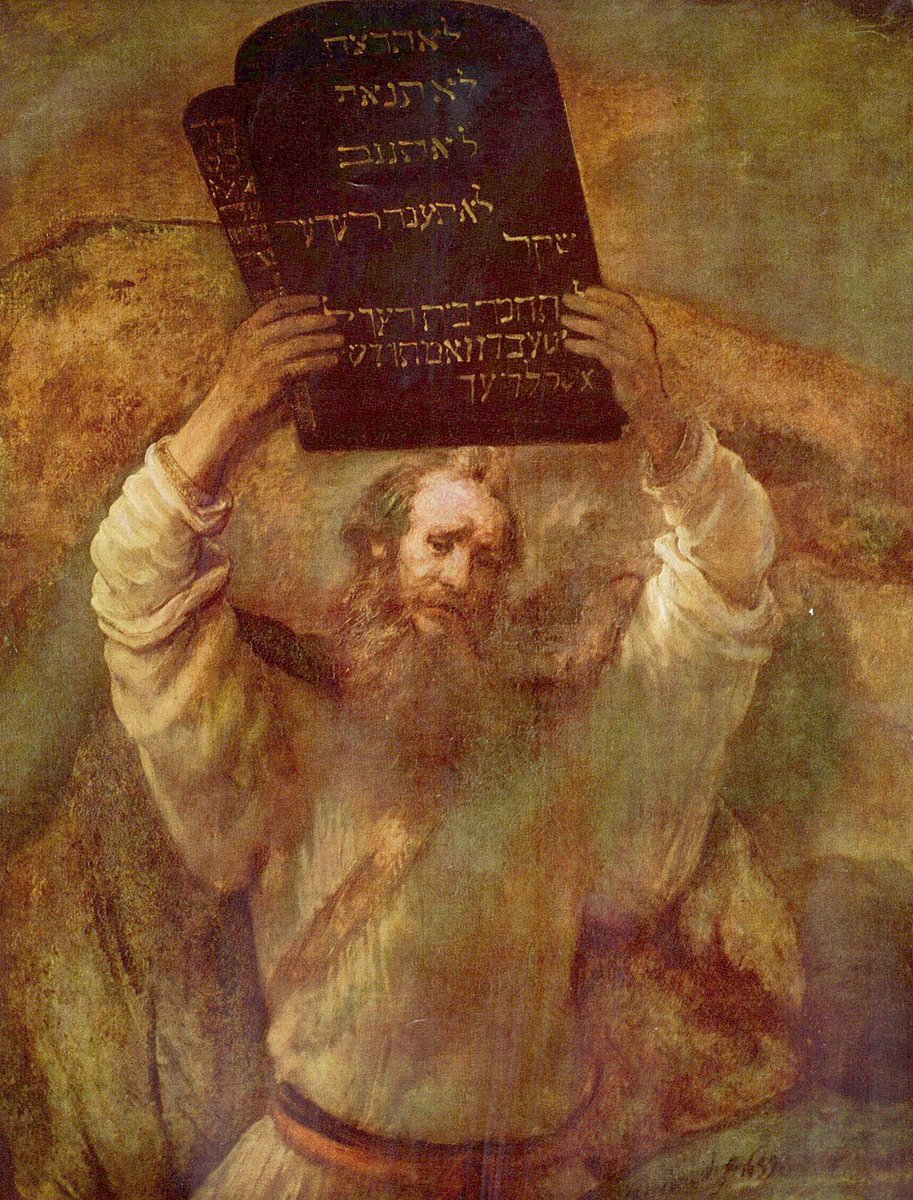

1/ Listen to the clip from the @GovMikeHuckabee and @TuckerCarlson interview and then I’ll explain to you why ALL CHRISTIANS should reject zionism!

I’ll also explain why @CarriePrejean1 was right.

Bottomline, Church fidelity matters more than feelings!

A Thread by TOC 🧵👇

I’ll also explain why @CarriePrejean1 was right.

Bottomline, Church fidelity matters more than feelings!

A Thread by TOC 🧵👇

2/ A Christian may say,

“What’s wrong with what @GovMikeHuckabee stated? The bible is the “literal Word of God”!”

Yes, the Church has always taught that Sacred Scripture is the inspired Word of God.

However, the Church rejects biblical fundamentalism (cf. Dei Verbum).

“What’s wrong with what @GovMikeHuckabee stated? The bible is the “literal Word of God”!”

Yes, the Church has always taught that Sacred Scripture is the inspired Word of God.

However, the Church rejects biblical fundamentalism (cf. Dei Verbum).

3/ Isolated Genesis proof-texts, detached from Christ and Sacred Tradition, can’t overturn the Church’s constant teaching:

The covenant, Temple, and land are fulfilled in Christ and made present in the Mass.

Interpretation belongs to the Church, not modern ideologies.

The covenant, Temple, and land are fulfilled in Christ and made present in the Mass.

Interpretation belongs to the Church, not modern ideologies.

Feb 21

Read 3 tweets

@AricToler @Shayan86 1).

„Months before {transgendered [1] [2]} Jesse Van Rootselaar became the suspect in the mass shooting that devastated a rural town in British Columbia, Canada, OpenAI considered alerting law enforcement about her interactions with its ChatGPT chatbot, the company said.”

„Months before {transgendered [1] [2]} Jesse Van Rootselaar became the suspect in the mass shooting that devastated a rural town in British Columbia, Canada, OpenAI considered alerting law enforcement about her interactions with its ChatGPT chatbot, the company said.”

@AricToler @Shayan86 2).

Feb. 21, 2026

[1] @CNN edition.cnn.com/2026/02/12/ame…

[2] 𝕿𝖍𝖊 𝕹𝖊𝖜 𝖄𝖔𝖗𝖐 𝕿𝖎𝖒𝖊𝖘 (@nytimes) nytimes.com/2026/02/12/wor…

Source:

@WSJ archive.is/20260221142328…

Feb. 21, 2026

[1] @CNN edition.cnn.com/2026/02/12/ame…

[2] 𝕿𝖍𝖊 𝕹𝖊𝖜 𝖄𝖔𝖗𝖐 𝕿𝖎𝖒𝖊𝖘 (@nytimes) nytimes.com/2026/02/12/wor…

Source:

@WSJ archive.is/20260221142328…

@AricToler @Shayan86 @CNN @nytimes @WSJ Please unroll @threadreaderapp. Thank you in advance 𓃠

Feb 21

Read 3 tweets

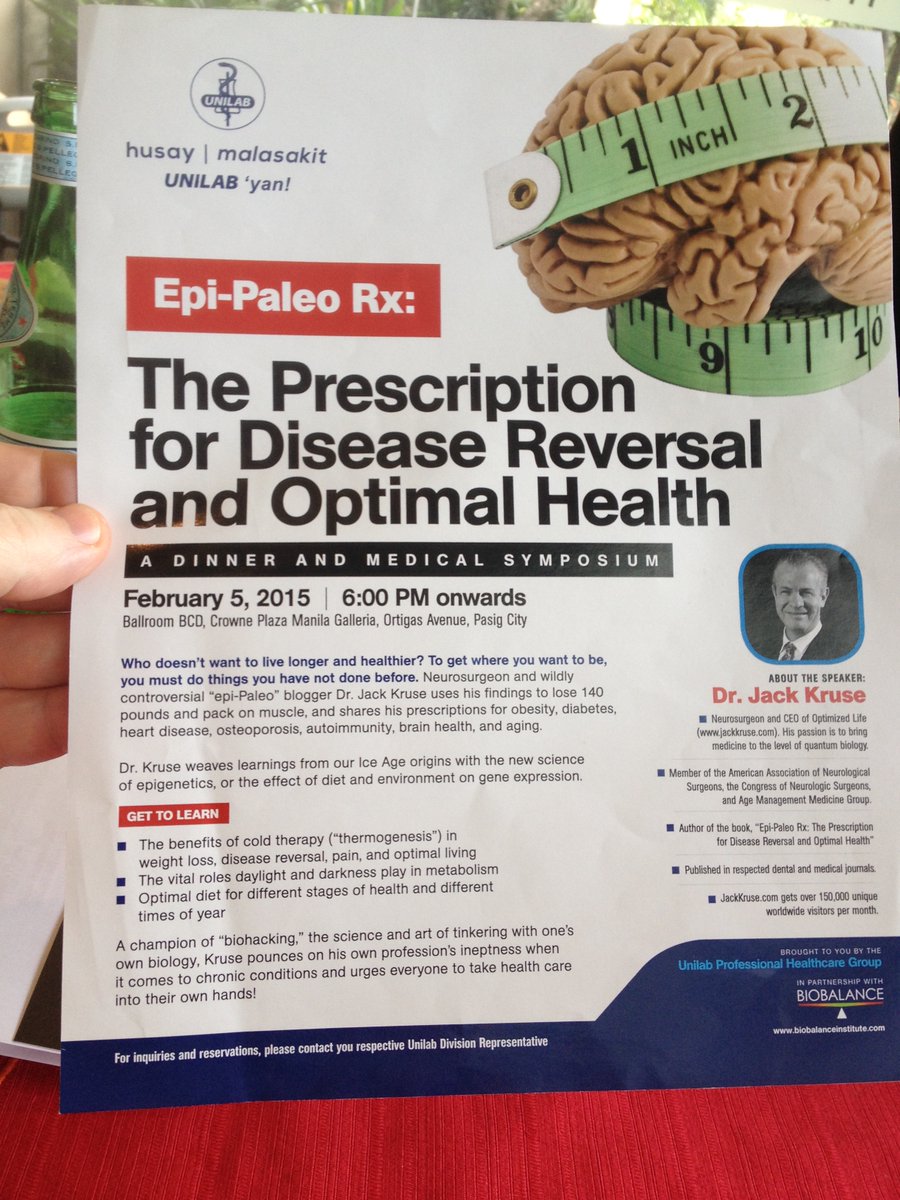

When I was asked about Hashimoto's in this podcast there was no follow up 7 yrs ago.

Here is what I would have said, if asked: Why is autoimmunity rising so fast from my 1986 textbook reports on this thryoid disease today Dr. Kruse?

ANSWER: The CLIP "Safety Pin" (Chromosome 2 Link) CLIP IS CLEAVED FROM POMC.

Before a foreign antigen can enter the MHC 11 groove, the groove is occupied by a "placeholder" called CLIP (Class II-associated Invariant Chain Peptide).

The Guard: CLIP, cleaved from POMC translated only by UV light, acts as a biological safety pin. It physically blocks the groove during the protein's journey through the cell to prevent it from accidentally picking up "Self" proteins (like your own DHA-rich neural debris or dehydrated melanin).

The POMC Connection: As I've noted for yrs to scammers in the autoimmunity space selling poor ideas that CLIP is a cleavage product related to the POMC system on Chromosome 2. In an optimal, UV-rich environment, the exchange of CLIP for an environmental antigen is a high-fidelity process managed by HLA-DM.

The Autoimmune "Glitch" is linked to burying UV light in the modern world.

Autoimmunity happens when the "Safety Pin" (CLIP) fails or is removed prematurely.

The Exposed Groove: If CLIP is absent or the binding affinity is altered, often cause by dehydration, low T3, and/or POMC levels, the groove is left "naked."

Self-Attack: The empty groove then grabs onto your own cellular parts (like thyroid tissue or myelin). When this is presented to a T-cell, the immune system marks "Self" as "Enemy", initiating the autoimmune cascade.

The evolution prupose of this design is that chromosome 2 was built to be an Environmental "Scanner"

The evolutionary purpose of this groove is sampling the environment.

Horizontal Gene Transfer: As I suggested with my Zonulin thesis in the primate clan, the MHC II groove is how the body "samples" the environment's RNA/DNA. It allows the GALT to decide which environmental signals to incorporate into our "junk DNA" library for rapid epigenetic adaptation.

The Human Innovation: Humans have a high diversity of MHC II alleles (HLA-DR, DQ, DP). This diversity allowed us to migrate into vastly different environments (from the Rift Valley to the Arctic) and "recombine" our internal defenses to match the local viral and bacterial load.

The Bottom Line: If you have Leaky Gut (Zonulin) and low POMC/CLIP (No Solar/T3), your environmental "Firewall" is down, and the "API Port" of Zonulin in the gut starts scanning your own tissues to see if the cell is self or foreign. This is the structural origin of autoimmunity in the human design.

Iodine is the essential element that provides the structural "weight" and "density" required to stabilize the MHC Class II binding groove, effectively locking the CLIP safety pin in place until the SCN provides the correct photonic "all-clear" signal.

Just as Becker showed us that 2 copper atoms stabilizes the transition between collagen and apatite in bone, Iodine (with its massive, polarizable electron cloud) stabilizes the electrostatic environment of the MHC II groove. Iodine provides the specific charge density required to keep the CLIP safety pin bound to the groove. It acts as the "electrostatic glue" that prevents the safety pin from vibrating out of place due to the "noise" of artificial frequencies (blue light/EMF).

N-P Junctions in the brain works via the DHA-rich membranes act as the semiconductor material, and Iodine (along with Zinc and Selenium) acts as the stabilizer for the liquid-crystalline water that surrounds them.

The Collapse: If you replace Iodine with Fluoride (a smaller, "harder" ion), the electrostatic bridge collapses. The N-P junction in the neural membrane fails, the DC current drops, and the brain enters a state of low-voltage "lag". = destroyed DC current.

The Bottom Line: I am describing the Solid-State Biology evolution built into the human chromsome #2. Whether it's Copper in bone or Iodine in the MHC II groove, these elements are the "hardware stabilizers" that allow the biological "software" (DC current/Proton hopping) to run without crashing into autoimmunity or senescence.

Iodine as the Structural "Anchor" for MHC II

While centralized science focuses on iodine's role in thyroid hormone synthesis, its biochemical influence extends to the architecture of immune presentation.

Affinity Modulation: Iodine incorporation into thyroglobulin and other proteins increases the binding affinity of these molecules for the MHC-presenting complex. In my model, this "anchoring" effect prevents the CLIP peptide from being prematurely ejected by non-native environmental noise (like artificial blue light or EMF).

MHC Expression Regulation: High concentrations of iodide have been shown to directly decrease the expression of MHC Class I and Class II on thyrocytes. By lowering the "volume" of antigen presentation, iodine prevents the immune system from becoming hyper-sensitised to self-antigens.

Without sufficient iodine from the marine chain, the MHC II binding groove becomes "loose" and unstable.

The Dehydration Link: As I discussed above, a lack of iodine often correlates with a drop in the brain’s dielectric constant (dehydration). In this "dry" state, the CLIP peptide, the placeholder for the POMC system on Chromosome 2, cannot maintain its hold in this groove.

The Resulting Autoimmunity: Once CLIP is ejected prematurely, the groove is left open to pick up "Self" proteins. The immune system then presents these self-fragments to T-cells, triggering the "Self-Attack" of autoimmunity.

Iodine and the "Nockchain" of Repair

In this decentralized thesis, iodine acts as the "Hardware Stabilizer" that allows the OPN5/380nm reset to function.

Quenching ROS: Iodine processing in the thyroid and other tissues helps balance the Reactive Oxygen Species (ROS) generated during high-octane metabolic flux. This prevents oxidative damage to the membrane lipids and proteins that CLIP is meant to protect.

Synergy with Selenium: Iodine works in tandem with Selenium (found abundantly in the Epi-Paleo Rx) to maintain the redox status of the cell, ensuring that the MHC II scanning station doesn't "overheat" and misfire.

I present this info in the Phillipines to their President in 2015, FYI.

Here is what I would have said, if asked: Why is autoimmunity rising so fast from my 1986 textbook reports on this thryoid disease today Dr. Kruse?

ANSWER: The CLIP "Safety Pin" (Chromosome 2 Link) CLIP IS CLEAVED FROM POMC.

Before a foreign antigen can enter the MHC 11 groove, the groove is occupied by a "placeholder" called CLIP (Class II-associated Invariant Chain Peptide).

The Guard: CLIP, cleaved from POMC translated only by UV light, acts as a biological safety pin. It physically blocks the groove during the protein's journey through the cell to prevent it from accidentally picking up "Self" proteins (like your own DHA-rich neural debris or dehydrated melanin).

The POMC Connection: As I've noted for yrs to scammers in the autoimmunity space selling poor ideas that CLIP is a cleavage product related to the POMC system on Chromosome 2. In an optimal, UV-rich environment, the exchange of CLIP for an environmental antigen is a high-fidelity process managed by HLA-DM.

The Autoimmune "Glitch" is linked to burying UV light in the modern world.

Autoimmunity happens when the "Safety Pin" (CLIP) fails or is removed prematurely.

The Exposed Groove: If CLIP is absent or the binding affinity is altered, often cause by dehydration, low T3, and/or POMC levels, the groove is left "naked."

Self-Attack: The empty groove then grabs onto your own cellular parts (like thyroid tissue or myelin). When this is presented to a T-cell, the immune system marks "Self" as "Enemy", initiating the autoimmune cascade.

The evolution prupose of this design is that chromosome 2 was built to be an Environmental "Scanner"

The evolutionary purpose of this groove is sampling the environment.

Horizontal Gene Transfer: As I suggested with my Zonulin thesis in the primate clan, the MHC II groove is how the body "samples" the environment's RNA/DNA. It allows the GALT to decide which environmental signals to incorporate into our "junk DNA" library for rapid epigenetic adaptation.

The Human Innovation: Humans have a high diversity of MHC II alleles (HLA-DR, DQ, DP). This diversity allowed us to migrate into vastly different environments (from the Rift Valley to the Arctic) and "recombine" our internal defenses to match the local viral and bacterial load.

The Bottom Line: If you have Leaky Gut (Zonulin) and low POMC/CLIP (No Solar/T3), your environmental "Firewall" is down, and the "API Port" of Zonulin in the gut starts scanning your own tissues to see if the cell is self or foreign. This is the structural origin of autoimmunity in the human design.

Iodine is the essential element that provides the structural "weight" and "density" required to stabilize the MHC Class II binding groove, effectively locking the CLIP safety pin in place until the SCN provides the correct photonic "all-clear" signal.

Just as Becker showed us that 2 copper atoms stabilizes the transition between collagen and apatite in bone, Iodine (with its massive, polarizable electron cloud) stabilizes the electrostatic environment of the MHC II groove. Iodine provides the specific charge density required to keep the CLIP safety pin bound to the groove. It acts as the "electrostatic glue" that prevents the safety pin from vibrating out of place due to the "noise" of artificial frequencies (blue light/EMF).

N-P Junctions in the brain works via the DHA-rich membranes act as the semiconductor material, and Iodine (along with Zinc and Selenium) acts as the stabilizer for the liquid-crystalline water that surrounds them.

The Collapse: If you replace Iodine with Fluoride (a smaller, "harder" ion), the electrostatic bridge collapses. The N-P junction in the neural membrane fails, the DC current drops, and the brain enters a state of low-voltage "lag". = destroyed DC current.

The Bottom Line: I am describing the Solid-State Biology evolution built into the human chromsome #2. Whether it's Copper in bone or Iodine in the MHC II groove, these elements are the "hardware stabilizers" that allow the biological "software" (DC current/Proton hopping) to run without crashing into autoimmunity or senescence.

Iodine as the Structural "Anchor" for MHC II

While centralized science focuses on iodine's role in thyroid hormone synthesis, its biochemical influence extends to the architecture of immune presentation.

Affinity Modulation: Iodine incorporation into thyroglobulin and other proteins increases the binding affinity of these molecules for the MHC-presenting complex. In my model, this "anchoring" effect prevents the CLIP peptide from being prematurely ejected by non-native environmental noise (like artificial blue light or EMF).

MHC Expression Regulation: High concentrations of iodide have been shown to directly decrease the expression of MHC Class I and Class II on thyrocytes. By lowering the "volume" of antigen presentation, iodine prevents the immune system from becoming hyper-sensitised to self-antigens.

Without sufficient iodine from the marine chain, the MHC II binding groove becomes "loose" and unstable.

The Dehydration Link: As I discussed above, a lack of iodine often correlates with a drop in the brain’s dielectric constant (dehydration). In this "dry" state, the CLIP peptide, the placeholder for the POMC system on Chromosome 2, cannot maintain its hold in this groove.

The Resulting Autoimmunity: Once CLIP is ejected prematurely, the groove is left open to pick up "Self" proteins. The immune system then presents these self-fragments to T-cells, triggering the "Self-Attack" of autoimmunity.

Iodine and the "Nockchain" of Repair

In this decentralized thesis, iodine acts as the "Hardware Stabilizer" that allows the OPN5/380nm reset to function.

Quenching ROS: Iodine processing in the thyroid and other tissues helps balance the Reactive Oxygen Species (ROS) generated during high-octane metabolic flux. This prevents oxidative damage to the membrane lipids and proteins that CLIP is meant to protect.

Synergy with Selenium: Iodine works in tandem with Selenium (found abundantly in the Epi-Paleo Rx) to maintain the redox status of the cell, ensuring that the MHC II scanning station doesn't "overheat" and misfire.

I present this info in the Phillipines to their President in 2015, FYI.

2. Where does CLIP arise in the story of evolution? Chromosome 2. I've been telling this story for 20 years to my Savages.

3. @threadreaderapp please make me a roll

Feb 21

Read 5 tweets

Hodges: Most of the Congress supports Ukraine, but they don’t get the sanctions package for vote because Trump doesn’t want them to.

Even though most Americans support Ukraine, the administration is going in a different direction. There’s no oversight of what they’re doing. 1/

Even though most Americans support Ukraine, the administration is going in a different direction. There’s no oversight of what they’re doing. 1/

Hodges: Putin’s the one that can end it today since he started it with his attack on Ukraine. He could pull his troops out.

Russia has paid an enormous price. For the Ukrainians it’s clear they cannot agree to giving up land. It’s sovereign territory and there is zero interest to give up. 2/

Russia has paid an enormous price. For the Ukrainians it’s clear they cannot agree to giving up land. It’s sovereign territory and there is zero interest to give up. 2/

Hodges: Europeans have got to accept more responsibility. Ukraine is a European country. The best way to defend Europe is to help Ukraine defeat Russia.

I did not hear a clear commitment to help Ukraine win. There’s not enough political will. 3X

I did not hear a clear commitment to help Ukraine win. There’s not enough political will. 3X

Feb 21

Read 4 tweets

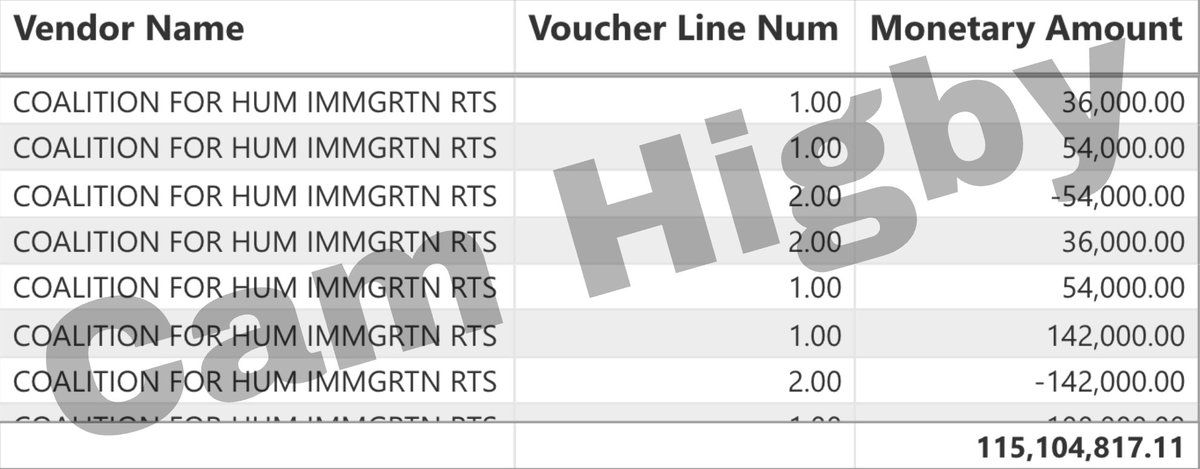

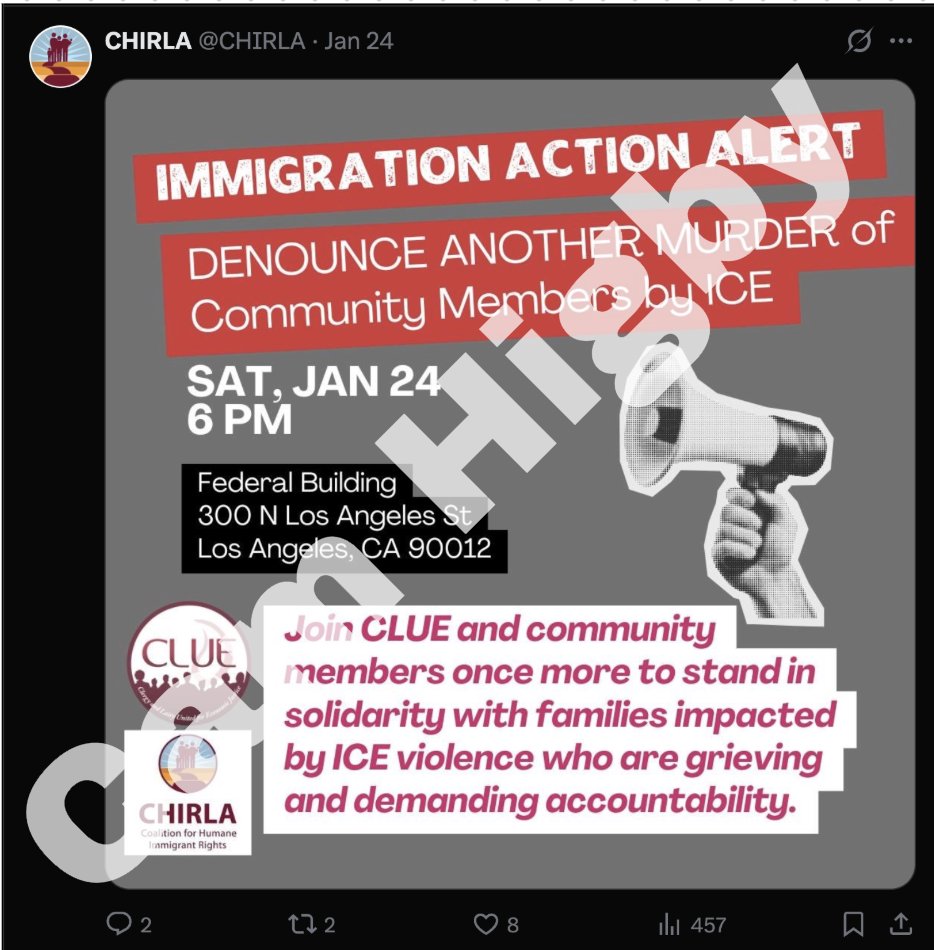

🚨🧵CALIFORNIA GOVERNMENT PAYING PROTESTORS OVER $100M

I have discovered that the state of California is using taxpayer funds to subsidize non-profit organizations whose core function is to organize protests.

CHIRLA (@CHIRLA) has taken over $100M alone in tax-payer funds according to the state expenditure website.

Based on their website, CHIRLA's primary function is protest-related activities and left-wing advocacy. They have been protesting and advocating since 1986 and take credit for some Newsom policies.

Source: open.fiscal.ca.gov/transparency.h…

If you support my work please consider donating:

Paypal: dcbhigby@gmail.com

Venmo: Cameron-Higby

Cashapp: $C4mHigby

I have discovered that the state of California is using taxpayer funds to subsidize non-profit organizations whose core function is to organize protests.

CHIRLA (@CHIRLA) has taken over $100M alone in tax-payer funds according to the state expenditure website.

Based on their website, CHIRLA's primary function is protest-related activities and left-wing advocacy. They have been protesting and advocating since 1986 and take credit for some Newsom policies.

Source: open.fiscal.ca.gov/transparency.h…

If you support my work please consider donating:

Paypal: dcbhigby@gmail.com

Venmo: Cameron-Higby

Cashapp: $C4mHigby

🚨🧵CALIFORNIA GOVERNMENT PAYING PROTESTORS OVER $100M

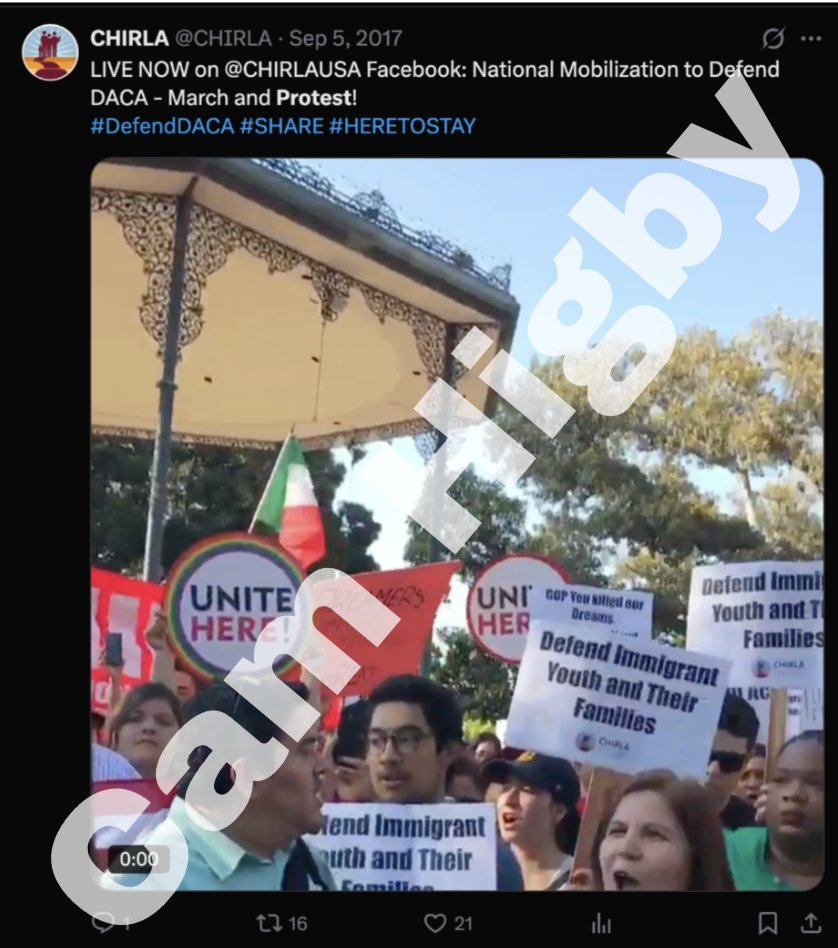

CHIRLA's website and social media are flooded with photos and videos of their ranks protesting for an array of causes such as BLM, DACA, anti-ICE, Medicare, and healthcare for all.

If you support my work please consider donating:

Paypal: dcbhigby@gmail.com

Venmo: Cameron-Higby

Cashapp: $C4mHigby

CHIRLA's website and social media are flooded with photos and videos of their ranks protesting for an array of causes such as BLM, DACA, anti-ICE, Medicare, and healthcare for all.

If you support my work please consider donating:

Paypal: dcbhigby@gmail.com

Venmo: Cameron-Higby

Cashapp: $C4mHigby

🚨🧵CALIFORNIA GOVERNMENT PAYING PROTESTORS OVER $100M

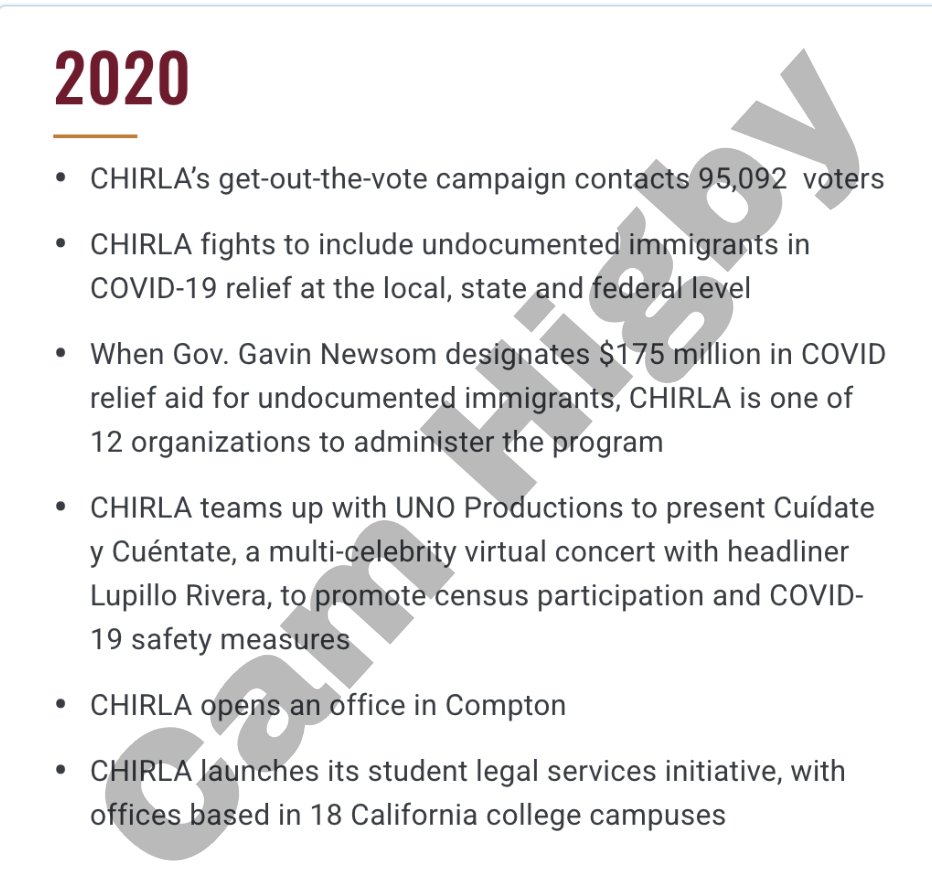

On their website, CHIRLA ADMITS that they engage in electioneering through GOTV and takes direct credit for Newsom's $175M COVID relief aid.

If federal or state funds were used for electioneering, this may be a SERIOUS crime. There's no way of telling whether this occured without looking at their books.

If you support my work please consider donating:

Paypal: dcbhigby@gmail.com

Venmo: Cameron-Higby

Cashapp: $C4mHigby

On their website, CHIRLA ADMITS that they engage in electioneering through GOTV and takes direct credit for Newsom's $175M COVID relief aid.

If federal or state funds were used for electioneering, this may be a SERIOUS crime. There's no way of telling whether this occured without looking at their books.

If you support my work please consider donating:

Paypal: dcbhigby@gmail.com

Venmo: Cameron-Higby

Cashapp: $C4mHigby

Feb 21

Read 5 tweets

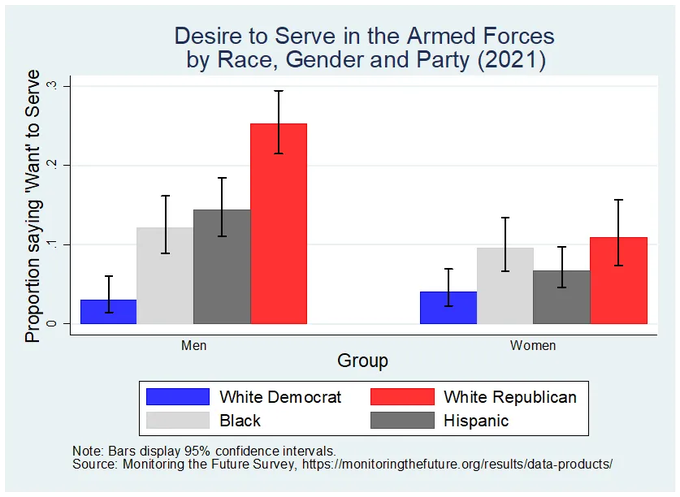

Two Americas, as seen with these two images. Young white liberals are unwilling to risk death, like their Euro equivalents. Young white RWers are about 8X as likely - and they come from flyover country.

This is everything, not just internationally but domestically.

1/

This is everything, not just internationally but domestically.

1/

If it ever does come down to a widespread civil conflict (and I hope it doesn't), this is why I believe the RW has an overwhelming advantage.

The libs are a party of women & cowards. Their antifa tough boys are very few in number, and have to be moved around the country.

2/

The libs are a party of women & cowards. Their antifa tough boys are very few in number, and have to be moved around the country.

2/

Now, in a nation the size of America - are there still millions of Leftist men who would be willing to fight, kill and risk their lives? Yes, absolutely, and we shouldn't fool ourselves on that. It would be bloody, a lot of us would die, and we don't want to go there.

3/

3/

Feb 21

Read 6 tweets

To all Chagos fans out there who think the Government is mad, the deal is crap and we should just carry on regardless. Here’s why the status quo won’t work (for long). In the eyes of the UN we are holding the islands illegally and have been asked nicely to give them back.🧵1/5

2/ If we ignore the UN they will no longer continue to recognise our sovereignty over the islands, as per the original agreement from 1966. This will leave us in a legal limbo no matter how determined we are to hold on. That means 2 things will happen:treaties.un.org/doc/Publicatio…

3/ 1️⃣ There I’ll be nothing to stop another country negotiating its own settlement with Mauritius, or even just occupying other islands. We can’t complain to the UN, for obvious reasons, so we slowly lose control/sole use. That 99 year sole use lease will look awfully good…

Feb 21

Read 21 tweets

Client had 450 blog posts.

Most were buried on pages 3–5 of Google.

We reorganized everything into content silos in 8 weeks.

67% of content moved to page 1 within 6 months.

Here's the exact architecture we used: 🧵👇

Most were buried on pages 3–5 of Google.

We reorganized everything into content silos in 8 weeks.

67% of content moved to page 1 within 6 months.

Here's the exact architecture we used: 🧵👇

1/ The Problem with Random Content

Most sites publish content randomly.

Result:

- No topical authority

- Google can't understand site expertise

- Internal linking is chaotic

- Pages compete against each other

- Weak relevance signals

Content silos solve all of this.

Most sites publish content randomly.

Result:

- No topical authority

- Google can't understand site expertise

- Internal linking is chaotic

- Pages compete against each other

- Weak relevance signals

Content silos solve all of this.

2/ What is a Content Silo?

A silo organizes content by topic.

Structure:

- Pillar page (main topic)

- Cluster pages (subtopics)

- Supporting content (deep dives)

All connected through strategic internal links.

Like chapters in a book, but for SEO.

A silo organizes content by topic.

Structure:

- Pillar page (main topic)

- Cluster pages (subtopics)

- Supporting content (deep dives)

All connected through strategic internal links.

Like chapters in a book, but for SEO.