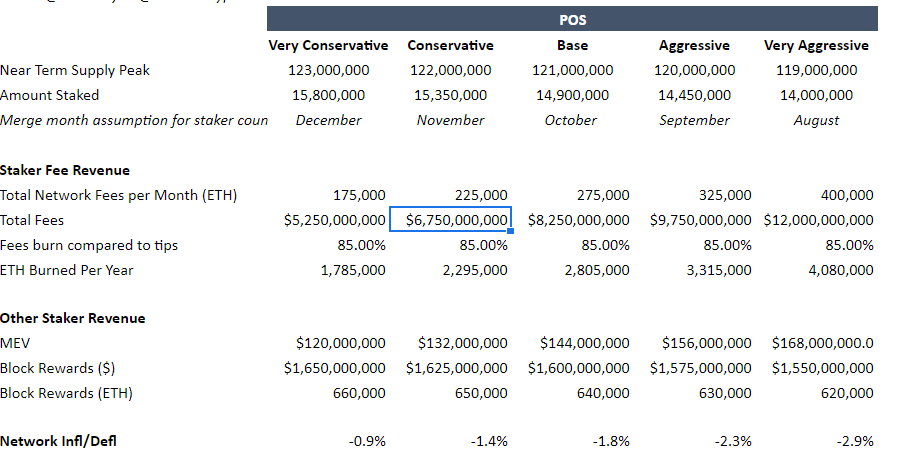

Estimating #ETH yield + valuation post-merge has been a challenge. There are great models built but many are now out of date

W/ the merge in focus, I built a fresh set of models (h/t @drakefjustin, @Data_Always, @Saypien_) for you to mess with

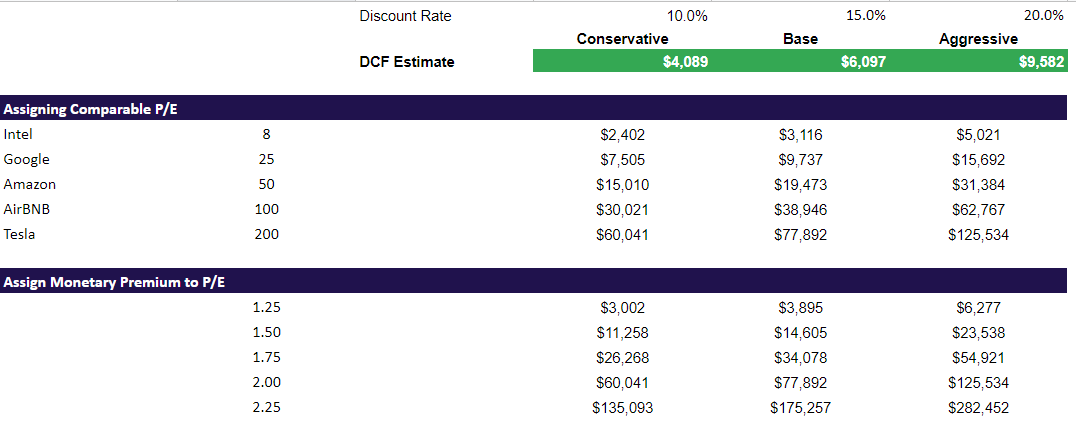

TLDR ~10% yields and est $6k ETH

W/ the merge in focus, I built a fresh set of models (h/t @drakefjustin, @Data_Always, @Saypien_) for you to mess with

TLDR ~10% yields and est $6k ETH

Staker Yield Model Prediction: Real yields of 7% to 13% at the time of the merge. These will scale down over time.

Some assumptions-> Eth Fees per month here (dune.com/queries/877691) are the biggest variable. Hist best month Jan ~425k ETH. Worst month March ~150k ETH. Amount staked also key 600k per month per is LT avg but we have been more like 300-450k recently.

Baseline DCF Prediction: $6.1k ETH. With P/E expansion or monetary premium assigned could be much, much higher. Scenarios primarily vary based on blockchain fees. Bc we are converting to $, the conversion factor is also key. You can adjust these factors yourself in the model.

Think my assumptions are off? I have my rationale in the sheet, but go ahead and make your own. The full model will be published in our piece tmrw as part of a broader exploration into the merge and its investment implications. We also explore a flows based analysis.

@evan_van_ness @TrustlessState @scottmelker @CryptoGucci @sassal0x @thedefiedge @BanklessHQ @pythianism @michaelbatnick @Tetranode @antiprosynth @0x_b1 @ericgoldenx @ryanallis @NorthRockLP @APompliano @divine_economy

@evan_van_ness @TrustlessState @scottmelker @CryptoGucci @sassal0x @thedefiedge @BanklessHQ @pythianism @michaelbatnick @Tetranode @antiprosynth @0x_b1 @ericgoldenx @ryanallis @NorthRockLP @APompliano @divine_economy The full piece is available here messari.io/article/the-in…

• • •

Missing some Tweet in this thread? You can try to

force a refresh