#nowreading Debt, by David Graeber

David’s teaches anthropology at LSE. He’s written other books like “Toward an Anthropological Theory of Value”, “Fragments of an Anarhist Anthropology” and “Lost People: Magic and the Legacy of Slavery in Madagascar”. He worked with OWS and coined the slogan “We are the 99%”

Book opens with a conversation David had with an activist-attorney who provided legal support for anti-poverty groups in London. David told her about his participation in the “global justice movement”, which the media usually calls “anti-globalization movement” 🤔🤔

her: did all the tear gas and street battles really accomplish anything?

david: we managed to almost completely destroy the IMF

her: ?

david: the IMF are the world’s debt enforcers; high-finance equivalent of the guys who come to break your legs

david: we managed to almost completely destroy the IMF

her: ?

david: the IMF are the world’s debt enforcers; high-finance equivalent of the guys who come to break your legs

DG: during the ‘70s oil crisis, OPEC countries poured so much of their riches into Western banks that the banks couldn’t figure out where to invest the money

So Citibank and Chase sent agents persuading Third World dictators to take out loans (“go-go banking”)

So Citibank and Chase sent agents persuading Third World dictators to take out loans (“go-go banking”)

DG: they started with very low interest rates that almost immediately skyrocketed to 20%+ due to tight US money policies in early ‘80s

This led to Third World debt crisis

IMF stepped in, insisted that poor countries had to abandon price supports on food, etc for refinancing

This led to Third World debt crisis

IMF stepped in, insisted that poor countries had to abandon price supports on food, etc for refinancing

DG: this led to the collapse of the most basic supports for some of the poorest and most vulnerable people on earth –poverty, looting of public resources, societal collapse, violence, malnutrition, hopelessness, broken lives

Her: but what was *your* position?

DG: abolish the IMF and Third World debt. Debt amnesty, like the biblial Jubilee. 30 years of money flowing from poorest countries to richest was quite enough

Her: but they borrowed the money! Surely one has to pay one’s debts

DG: hoo boy

DG: abolish the IMF and Third World debt. Debt amnesty, like the biblial Jubilee. 30 years of money flowing from poorest countries to richest was quite enough

Her: but they borrowed the money! Surely one has to pay one’s debts

DG: hoo boy

DG: these loans were taken out by unelected dictators who placed most of it directly in their Swiss bank accounts

contemplate the justice of insisting that the lenders be repaid not by the dictator or his cronies, but by literally taking food from the mouths of hungry children

contemplate the justice of insisting that the lenders be repaid not by the dictator or his cronies, but by literally taking food from the mouths of hungry children

DG: also, these countries have already paid back what they borrowed 3-4x over, but through the miracle of compound interest, there’s no significant dent in the principal

DG: to obtain refinancing, countries have to follow some orthodox free-market economic policy designed in Washington or Zurich that their citizens had never agreed to and never would

DG: also kinda dishonest to insist that countries adopt democratic constitutions, but whoever gets elected has no control over their country’s policies anyway

DG: the remarkable thing about the statement “one has to pay one’s debts” is that even according to standard economic theory, it isn’t true – a lender is supposed to accept a certain degree of risk

DG: if all loans, no matter how idiotic, were still retrievable – if there were no bankruptcy laws – the results would be disastrous. What reason would lenders have not to make a stupid loan?

DG: imagine if I walked into a branch of the Royal Bank of Scotland and said “I just got a really great tip on the horses; think you could lend me a couple of million quid?” Obviously they’ll laugh me off – but that’s because they know that they won’t get their money back

DG: but imagine there was a law that said they were guaranteed to get their money back no matter what happened, even if I have to sell my daughter into slavery or harvesting my organs or something. In that case, why not?

That’s the situation the IMF created at a global level

That’s the situation the IMF created at a global level

The phrase “surely one has to pay one’s debts” is not an economic statement, it’s a moral one. The apparent self-evidence is what makes the statement so insidious, what makes terrible things appear bland and unremarkable

David lived 2 years in Madagascar. When he arrived, there had been a malaria outbreak. It took money to maintain the mosquito eradication program. Govt had to cut it owing to IMF-imposed austerity program. 10,000 people died. He met mothers grieving for lost children

“One might think that it would be hard to make a case that the loss of ten thousand human lives is really justified in order to ensure that Citybank wouldn’t have to cut its losses on one irresponsible loan that wasn’t particularly important to its balance sheet anyway.”

Why is the concept of debt so powerful?

- consumer debt is lifeblood of economy

- all modern nation-states built on deficit spending

- debt is central issue of international politics

Yet nobody seems to know exactly what it is, or how to think about it

- consumer debt is lifeblood of economy

- all modern nation-states built on deficit spending

- debt is central issue of international politics

Yet nobody seems to know exactly what it is, or how to think about it

History shows that there is no better way to justify violence, to make violence seem moral, than by reframing it in the language of debt – because it immediately makes it seem that it’s the victim who’s doing something wrong.

Mafiosi, conquerors and violent men: you owe me

Mafiosi, conquerors and violent men: you owe me

Germany had to pay massive reparations after WW1

Iraq is still paying Kuwait for Saddam’s 1990 invasion

But... Third World debt works the other way around. These are countries that were attacked and conquered by European countries, and then owe their conquerors money

Iraq is still paying Kuwait for Saddam’s 1990 invasion

But... Third World debt works the other way around. These are countries that were attacked and conquered by European countries, and then owe their conquerors money

In 1865, France invaded Madagascar, disbanded the government, declared it a French colony. They imposed heavy taxes on the Malagasy population, and slaughtered a hundred thousand Malagasy people during a revolt in 1947. Madagascar has never done any comparable damage to France

To this day, the Malagasy people are still held to owe France money. The rest of the world accepts the justice of this arrangement. When the “international community” perceives a moral issue, it’s usually when they feel the Malagasy government is being slow to pay their debts.

Haiti. Nation founded by former plantation slaves who rebelled, and defeated the armies Napoleon sent to return them to bondage. France insisted that the new republic owed it 150,000,000 Francs in damages for the plantations and failed military expeditions

“All other nations (?!) including the United States agreed to impose an embargo on the country until it was paid. The sum was intentionally impossible (equivalent to $18B) and the resultant embargo ensured that Haiti = debt, poverty and human misery ever since.”

“Sometimes though, debt seems to mean the opposite.

In the 1980s, the US, which insisted on strict terms for the repayment of Third World debt, itself accrued debts that easily dwarfed the entire Third World combined, mainly fueled by military spending.”

In the 1980s, the US, which insisted on strict terms for the repayment of Third World debt, itself accrued debts that easily dwarfed the entire Third World combined, mainly fueled by military spending.”

“US foreign debt, though, takes the form of treasury bonds held by institutional investors in countries (Germany, Japan...) that are in most cases, effectively US military protectorates, covered in US bases full of arms and equipment paid for with that very deficit spending”

“This has changed a little now that China has gotten in on the game – even China finds the fact that it holds so many US treasury bonds makes it to some degree beholden to US interests, rather than the other way around” 🤔

“In the past, military powers that maintained hundreds of military bases outside their own home territory were ordinarily referred to as “empires”, and empires regularly demanded tribute from subject peoples. The US government, of course, insists that it is not an empire...”

“... but one could easily make a case that the only reason it insists on treating these payments as “loans” and not as “tribute” is precisely to deny the reality of what’s going on.”

In the 1720s, the British public was scandalized when the press exposed that debtors’ prisons were divided into aristocrats (wined and dined by liveried servants and prostitutes) and commoners (shackled in tiny cells, suffered to die without pity, of hunger)

“In a way you can see current world economic arrangements the same way: The US being the Cadillac debtor, Madagascar the pauper starving in the next cell, while the Cadillac debtor’s servants lecture him on how his problems are due to his own irresponsibility”

What’s the difference between a gangster pointing a gun and demanding you give him $1000 of “protection money”, and the USA pulling out a gun and demanding a $1000 “loan”?

“In the case of US debt to Korea or Japan, were the balance of power to shift, were America to lose its military supremacy, were the gangster to lose his henchmen, that “loan” might start being treated very differently. But the crucial element would still seem to be the gun.”

In order to run a regime based on violence effectively, one needs to establish some kind of rules. The rules can be completely arbitrary. [...] The problem is, the moment one starts framing things in terms of debt, people will inevitably start asking who really owes what to whom.

“For most of human history – at least, the history of states and empires – most human beings have been told they are debtors. [...] The struggle between rich and poor has largely taken the form of conflicts between creditors and debtors...

...of arguments about the rights and wrongs of interest payments, debt peonage, amnesty, repossession, restitution, the sequestering of sheep, seizing of vineyards, and the selling of debtors’ children into slavery.”

For the last 5,000 years, popular insurrections = ritual destruction of the debt records – tablets, papyri, ledgers, whatever. (After that, records of landholding and taxes.)

Moses Finley: all revolutionaries have the same agenda: cancel the debts and redistribute the land

Moses Finley: all revolutionaries have the same agenda: cancel the debts and redistribute the land

Our tendency to overlook this is peculiar – consider how much of our contemporary moral and religious language originates from these conflicts. “Reckoning” and “redemption” are taken directly from ancient finance. Also “guilt”, “freedom”, “forgiveness”, even “sin”.

Arguments about who really owes what to whom have played a central role in shaping our basic vocabulary of right and wrong.

The fact that so much of this language took shape in arguments about debt have left the concept strangely incoherent. “After all, to argue with the king, one has to use the king’s language, whether or not the initial premises make sense.”

DG: The history of debt is one of profound moral confusion.

Most people everywhere hold the following beliefs:

1- paying back money one has borrowed is a simple matter of morality

2- anyone in the habit of lending money is evil

Opinions on the latter do shift back and forth

Most people everywhere hold the following beliefs:

1- paying back money one has borrowed is a simple matter of morality

2- anyone in the habit of lending money is evil

Opinions on the latter do shift back and forth

1970s, French anthropologist Jean-Claude Galey was in the eastern Himalayas.

The low-ranking castes were referred to as the “vanquished ones” – thought to be descended from a population conquered by the current landlord caste many centuries before – lived in permanent debt

The low-ranking castes were referred to as the “vanquished ones” – thought to be descended from a population conquered by the current landlord caste many centuries before – lived in permanent debt

Landless and penniless, they solicited loans from landlords simply to eat – not for money (sums too paltry), but because they were expected to pay the interest in the form of work, and were fed then.

Basically a tedious and elaborate form of slavery

Basically a tedious and elaborate form of slavery

For the “vanquished”, as for most people, the most significant life expenses were weddings and funerals. These required money, which had to be borrowed. It was common practice for high-caste moneyleners to demand one of the borrower’s daughters as security

Often the security would be the bride herself. She was expected to report to the lender’s household after her wedding, spend a few months there as his concubine. Once he grew bored, she’d be sent off to a timber camp for a year or two, to work as a prostitute to pay father’s debt

While this practice seems shocking, Galey does not report any widespread feeling of injustice. “That’s just how things work.”

Neither was there much concern voiced among local Brahmins, who were the ultimate arbiters in matters of morality... and the most prominent moneylenders

Neither was there much concern voiced among local Brahmins, who were the ultimate arbiters in matters of morality... and the most prominent moneylenders

Compare this with medieval France, where the moral status of moneylenders was seriously in question. The Catholic Church had always forbidden the practice of lending money at interest

The Church hierarchy authorized preaching campaigns, sending friars to travel from town to town warning usurers that unless they repented and made full restitution of all interest extracted from their victims, they would surely go to Hell

These sermons, many of which have survived, are full of horror stories of God’s judgement on unrepentant lenders: stories of rich men struck down by madness or terrible diseases, haunted by deathbed nightmares of the snakes or demons who would soon rend or eat their flesh

“Looking over world literature, it’s almost impossible to find a single sympathetic representation of a professional moneylender. It’s remarkable when one considers that unlike executioners, usurers often rank among the richest & most powerful people in their communities.”

Historically, 2 effective ways for a lender to wriggle out of the disgrace

1 - shunt off responsibility onto some third party (medieval European lords employing Jews as surrogates, denying them all other means of making a living)

2 - insist that the borrower is even worse

1 - shunt off responsibility onto some third party (medieval European lords employing Jews as surrogates, denying them all other means of making a living)

2 - insist that the borrower is even worse

In medieval Hindu law codes, not only were interest-bearing loans permissible (main stipulation: interest should never exceed principal), but it was emphasized that a debtor who did not pay would be reborn as a slave of his creditor – or his horse, or ox

All the great religious traditions seem to bang up against this quandary. All human relations involved debt – are they all morally compromised? OTOH, when we say someone acts like they “don’t owe anything to anybody”, we’re hardly describing that person as virtuous

In the secular world, morality consists largely of fulfilling our obligations to others, & we have a stubborn tendency to imagine those obligations as debts. Ascetic monks might escape it, but the rest of us appear condemned to live in a universe that doesn’t make a lot of sense.

Who really owes what to whom?

The moment we ask the question, we have begin to adopt the creditor’s language. Unreasonable creditors too will “repay”.

Even karmic justice can thus be reduced to the language of a business deal

The moment we ask the question, we have begin to adopt the creditor’s language. Unreasonable creditors too will “repay”.

Even karmic justice can thus be reduced to the language of a business deal

A debt is the obligation to pay a certain sum of money.

Debt, unlike any other form of obligation, can be precisely quantified.

This allows debts to become simple, cold and impersonal – which allows them to be *transferable*.

Debt, unlike any other form of obligation, can be precisely quantified.

This allows debts to become simple, cold and impersonal – which allows them to be *transferable*.

If you owe me a favor, it’s owed to me specifically.

But if you owe $40,000 at 12% interest, it doesn’t really matter *who* the creditor is.

Neither party has to think about what the other party needs, wants, or is capable of.

One does not need to calculate the human effects

But if you owe $40,000 at 12% interest, it doesn’t really matter *who* the creditor is.

Neither party has to think about what the other party needs, wants, or is capable of.

One does not need to calculate the human effects

Money has the capacity to turn morality into a matter of impersonal arithmetic – and by doing so, to justify things that would otherwise seem outrageous or obscene

The difference between a “debt” and a mere moral obligation is not the presence or absence of violence, but the creditor’s ability to specify, numerically, *exactly how much* the debtor owes

But when you look closer, you’ll find that violence & quantification are intimately linked. It’s almost impossible to find one w/o the other. French usurers had powerful friends & enforcers, capable of bullying Church authorities. How else to collect technically-illegal debts?

Violence, or the threat of violence, turns human relations into mathematics. It’s the ultimate source of the moral confusion surrounding the topic of debt. We can trace it throughout recorded history, and it still lies under the essential fabric of our institutions today

The state, the market, our most basic conceptions of the nature of freedom, morality, sociality –

all have been shaped by a history of war, conquest and slavery

in ways we’re no longer capable of even perceiving

because we can no longer imagine things any other way

all have been shaped by a history of war, conquest and slavery

in ways we’re no longer capable of even perceiving

because we can no longer imagine things any other way

DG remembers going to conferences in ‘06, ‘07 where “trendy social theorists” presented papers arguing that “new forms of securitization heralded a looming transformation in the very nature of power, time, possibility – reality itself” 😂 Then came Financial Crisis of ‘08

David describes similarity between the mortgages sold to poor families and what banks did lending money to dictators in Bolivia and Gabon – irresponsible, predatory lending done with the confidence that politicians would scramble to bail them out

“Surveys showed that an overwhelming majority of Americans felt that the banks should not be rescued, whatever the economic consequences – that it was the ordinary citizens with bad mortgages that should be bailed out.” articles.latimes.com/2008/sep/24/na…

DG found this extraordinary – America has historically been extremely unsympathetic to debtors. (Ironic, since America was largely *settled* by absconding debtors). US was one of the last countries in the world to adopt a law of bankruptcy

“The US government effectively put a $3,000,000,000,000 band-aid over the problem and changed nothing.”

That was CHAPTER ONE, THE EXPERIENCE OF MORAL CONFUSION

Now on to...

CHAPTER TWO: THE MYTH OF BARTER

Now on to...

CHAPTER TWO: THE MYTH OF BARTER

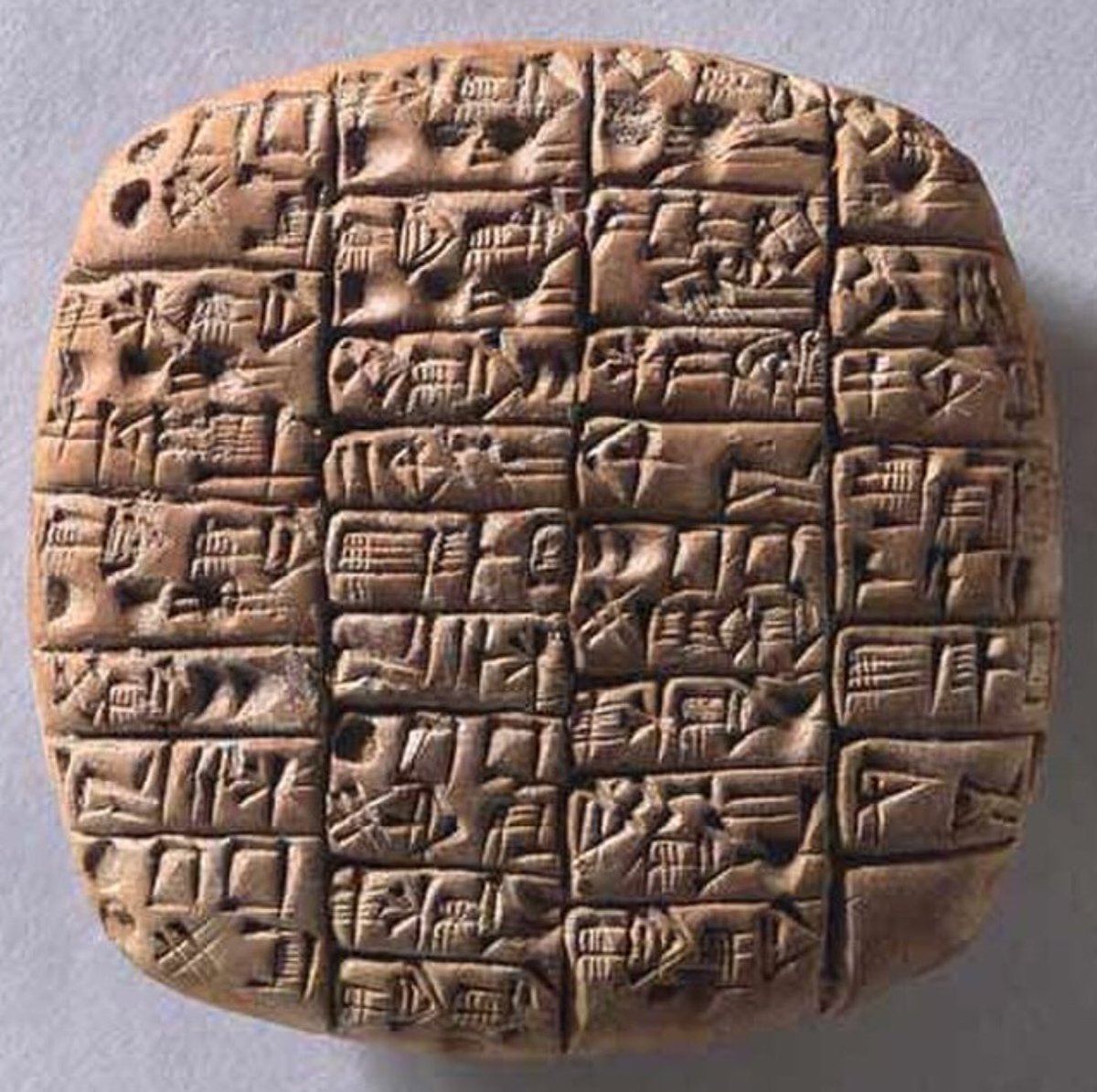

The difference between a debt and an obligation is that a debt can be precisely quantified

Some of the first written documents are Mesopotamian tablets recording credits, debits, temple rations, money owned, the value of each precisely specified grain and silver

Some of the first written documents are Mesopotamian tablets recording credits, debits, temple rations, money owned, the value of each precisely specified grain and silver

Some of the earliest works of moral philosophy, in turn, are reflections on what it means to imagine morality as debt – that is, in terms of money

History of debt is necessarily a history of money. Wanna understand debt, gotta follow the money

History of debt is necessarily a history of money. Wanna understand debt, gotta follow the money

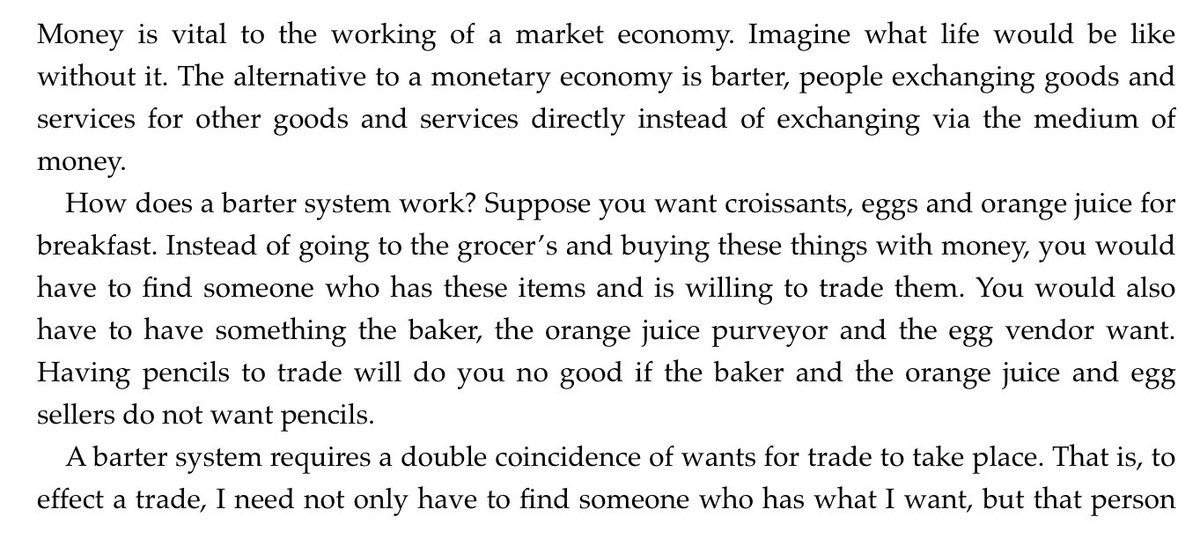

When economists speak of the origin of money, debt is always something of an afterthought. First comes barter, then money, then credit.

Books on the history of money tend to focus on coins, and rarely mention credit arrangements at all

Books on the history of money tend to focus on coins, and rarely mention credit arrangements at all

DG: some of the focus on coins is a matter of archeology – easier to find coins than credit arrangements.

But deeper than that, “the existence of credit and debt has always been something of a scandal for economists...”

But deeper than that, “the existence of credit and debt has always been something of a scandal for economists...”

Economists dislike how “it’s almost impossible to pretend that those lending and borrowing money are acting on purely “economic” motivations (for instance, that a loan to a stranger is the same as a loan to one’s cousin)”

So Econs 101 pretends money predates credit and debt!!

So Econs 101 pretends money predates credit and debt!!

“Economists generally speak of three functions of money:

- medium of exchange

- unit of account

- store of value

All economics textbooks treat the first as primary. Here’s a fairly typical extract from Economics by Case, Fair, Gartner, and Heather (1996)

- medium of exchange

- unit of account

- store of value

All economics textbooks treat the first as primary. Here’s a fairly typical extract from Economics by Case, Fair, Gartner, and Heather (1996)

These are purely imaginary exercises!

“Imagine a barter economy”

“Imagine the difficulty you would have today if you had to exchange your labor directly for the fruits of someone else’s labor”

“Imagine you hate roosters but you want roses”

“Imagine a barter economy”

“Imagine the difficulty you would have today if you had to exchange your labor directly for the fruits of someone else’s labor”

“Imagine you hate roosters but you want roses”

“The story of money for economists always begins with a fantasy world of barter. The problem is *where* to locate this fantasy in time and space. Cavemen? Pacific Islanders? The American frontier?”

DG: Aristotle, in 330BC, speculated that families must’ve produced everything they needed for themselves, then gradually specialized in corn and wine, swapping one for another, and that money must’ve emerged from this process. But he was never clear as to how

DG next spends several pages analyzing Adam Smith, who he says, “objected to the notion that money was a creation of government”, and “insisted that property, money and markets not only predated political institutions, but were the very foundation of human society”

Smith: “Humans, if left to their own devices, will inevitably begin swapping and comparing things. Even logic and conversation are really just forms of trading, and as in all things, humans will always try to seek their own best advantage, to seek the greatest profit they can.”

DG: In the standard version of this story, governments only have one limited role – to guarantee the money supply – and tend to do it badly, since unscrupulous kings have often cheated by debasing the coinage, causing inflation and other sorts of political havoc

DG: The problem with this “we used to barter, and it was hard, so we invented money, then came banking and credit” story, as ubiquitous as it is...

... is that there’s no evidence for it, and lots of evidence suggested that it did not.

... is that there’s no evidence for it, and lots of evidence suggested that it did not.

For centuries, explorers have been trying unsuccessfully to find this fabled land of barter.

The main economic institution among the Iroquois nations were longhouses where most goods were stockpiled and then allocated by women’s councils. No one ever traded arrowheads for meat

The main economic institution among the Iroquois nations were longhouses where most goods were stockpiled and then allocated by women’s councils. No one ever traded arrowheads for meat

In the late 1800s, missionaries, adventurers and colonial administrators fanned out across the world, discovering an endless variety of economic systems – but not one where transactions between neighbours was “I’ll give you twenty chickens for that cow.”

Barter did exist – but not between fellow villagers. It takes place between strangers, even enemies. Eg: the Nambikwara of Brazil. Small bands of ~100 people each. They have this interesting festival-game of arguing and snatching

DG describes other similar one-off trades

DG describes other similar one-off trades

DG: mainstream “economics” assumes a division between different spheres of human behavior that, for people like the Gunwinngu and the Nambikwara, simply don’t exist.

These divisions are made possible by very specific institutional arrangements: lawyers, prisons, police...

These divisions are made possible by very specific institutional arrangements: lawyers, prisons, police...

... ensuring that people who don’t like each other very much, who have no interest in developing any kind of ongoing relationship, but are simply interested in getting their hands on as much as possible, will nonetheless refrain from the most obvious expedient (theft).

What DG has been circling around I think is this: basically people in the past didn’t barter with their kin because they were bonded by ties of hospitality and kinship to begin with

Bartering would’ve been rude, impolite, calculative, selfish. People tended to each other

Bartering would’ve been rude, impolite, calculative, selfish. People tended to each other

An economic textbook:

“Henry needs shoes, but all he has are potatoes. Joshua has an extra pair of shoes, but he didn’t really need potatoes. Since money has not been invented yet, they have a problem. What are they to do?”

It depends on their relationship and context:

“Henry needs shoes, but all he has are potatoes. Joshua has an extra pair of shoes, but he didn’t really need potatoes. Since money has not been invented yet, they have a problem. What are they to do?”

It depends on their relationship and context:

The problem of “double coincidence of wants” so endlessly evoked in the economics textbooks is a non-issue for actual IRL neighbours – if you don’t have something I want, no worries – it’s only a matter of time before you will!

Interestingly, elaborate barter systems *do* now crop up in modern times when money becomes unreliable. Cigarettes in prisons are a famous example. But here too, we’re talking about people who grew up using money and now have to make do without it

Mesopotamian cuneiform pushed back scholars’ knowledge of written history from 800BC to 3,500 BC – and revealed that credit systems preceded coinage by thousands of years

Sumerian silver did not circulate very much. Most of it just sat around in Temple and Palace treasuries, some of it carefully guarded in the same place for thousands of years. It would’ve been easy to turn it into standardized coin, but nobody saw the need to do so

While debts were calculated in silver, they didn’t have to be *paid* in silver – they could be paid in almost anything! People who owed money settled their debts mostly in barley, but also goats, furniture, lapis lazuli. The Temples were huge; they could find a use for anything

In the marketplaces that cropped up in Mesopotamian cities, some merchants did use silver in transactions – but mostly did their dealings on credit – people ran up tabs with “ale women” and local innkeepers, settling them at harvest time in barley or anything else they had.

People have known decisively that the conventional barter-and-coin story is bullshit for over a century

Why was I still taught this nonsense in school in 2007? Boo!

Why was I still taught this nonsense in school in 2007? Boo!

CHAPTER THREE: PRIMORDIAL DEBTS

Economics textbooks begin with imaginary villages because it’s impossible to talk about real ones.

But why has this persisted?

Economists have jettisoned other elements of The Wealth of Nations – eg Smith’s labor theory of value, and disapproval of joint-stock corporations...

But why has this persisted?

Economists have jettisoned other elements of The Wealth of Nations – eg Smith’s labor theory of value, and disapproval of joint-stock corporations...

DG: The answer seems to be that the Myth of Barter cannot go away because it is central to the entire discourse of economics.

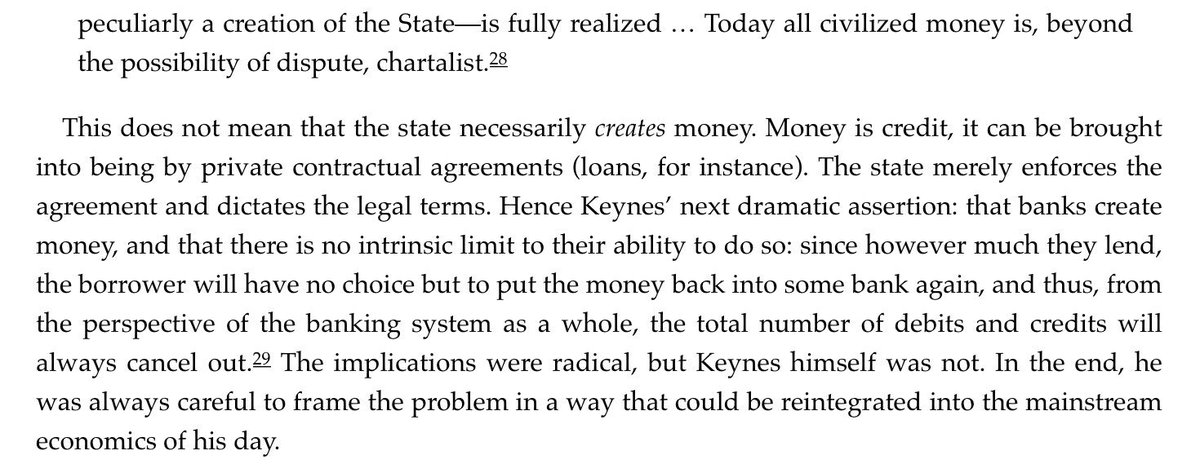

Mitchel-Innes was an exponent of what came to be known as the Credit Theory of money: the idea that money is not a commodity, but an accounting tool. Ie, it is not a “thing” at all.

To a Credit Theorist, you can no more touch a dollar than an hour or a cubic centimeter.

To a Credit Theorist, you can no more touch a dollar than an hour or a cubic centimeter.

As the credit theorists correctly note, historically, abstract systems of accounting emerged long before the use of any particular token of exchange.

If money is a yardstick, what does it measure? Debt! A coin is an IOU. A banknote is simply the promise to pay *something*.

If money is a yardstick, what does it measure? Debt! A coin is an IOU. A banknote is simply the promise to pay *something*.

How could credit money come about? Back to the economist’s imaginary village. Suppose A gives B his shoes, and B gives him an IOU. Suppose A then gives B’s IOU to someone else. The debt is passed on! The IOU could circulate around town for years as long as people have faith in B.

This happens! Anthropologist Keith Hart’s brother was a soldier stationed in HK in the 50’s. Soldiers paid bar tabs by writing checks on English accounts. Local merchants would pass them around as currency. Hart once saw one of his own checks, covered with 40 tiny inscriptions

What if the IOU were a gold coin instead? It’s the same thing! It’s a promise to pay something else. One accepts it because one assumes others will.

So... the value of a unit of currency is really a measure of one’s trust in other human beings!

So... the value of a unit of currency is really a measure of one’s trust in other human beings!

But trust suffers from the fraud problem. How do you trust a piece of paper? Couldn’t anyone else sign your name on an IOU? This sytem works in small-ish communities where everyone can keep track of everyone else, but it doesn’t scale beyond that.

Historian G.F. Knapp: Emperors and kings are almost always concerned to establish uniform systems of weights and measures throughout their kingdoms. And such systems remain remarkably stable over time (people don’t really care as long as it works well enough for them)

During Henry II’s reign (1154-1189), most of Western Europe was using the monetary system established by Charlemagne 350 years earlier – pounds, shillings and pence. The coins varied tremendously in size, weight, purity, and value – but that didn’t matter. It was uniform enough

Funny thing you may have noticed about the original IOU system – it only works as long as the person issuing the IOU doesn’t actually pay his debt! Because then the IOU would be voided. And... that’s how the Bank of England was founded. For real!

In 1694, a consortium of English bankers loaned £1.2m to the king. They got 8% annual interest for the original loan, and the right to advance IOUs for a portion of the money the king now owed them, to any inhabitant of the kingdom willing to borrow. This loan has never been paid

Why do kings make subjects pay taxes as all? Seems self-evident; rulers want money. But if Smith was right, and gold becomes money through the natural workings of markets, independent of governments, why not just... control the gold mines? (That IS what ancient kings did!) But...

Why extract the gold, stamp your face on it, circulate it among your subjects, then demand they give it back to you...?

It makes perfect sense once you realize that money and markets do NOT emerge spontaneously.

Distributing gold is how you *bring markets into being*.

It makes perfect sense once you realize that money and markets do NOT emerge spontaneously.

Distributing gold is how you *bring markets into being*.

You’re a king. You want an army of 50,000 men. How do you feed them?? They’ll consume anything edible within 10 miles of their camp. You’d have to employ a second army just for logistics. (And how do you feed THEM?)

Coin! You pay the soldiers in coin, and you tax the families in the kingdoms in turn. In one blow, you turn your entire national economy into a vast machine for the provisioning of soldiers, since families must find some way to give soldiers what they want. Market created!

- Kautilya’s Arthasastra

- Sassanian “circle of sovereignty”

- Chinese “Discourses on Salt and Iron”

^ most ancient rulers spent a great deal of their time thinking about the relation between mines, soldiers, taxes and food

Historically, states *create* markets

- Sassanian “circle of sovereignty”

- Chinese “Discourses on Salt and Iron”

^ most ancient rulers spent a great deal of their time thinking about the relation between mines, soldiers, taxes and food

Historically, states *create* markets

DG: Anthropologists have been complaining about the Myth of Barter for about a century.

Economists sometimes point out exasperatedly that they’re telling the same story because anthropologists haven’t given them a better one yet.

(Reminds me of Taleb & predictions)

Economists sometimes point out exasperatedly that they’re telling the same story because anthropologists haven’t given them a better one yet.

(Reminds me of Taleb & predictions)

DG: there *is* no story. Money was no more “invented” than music or math or jewelry. What we call “money” isn’t a “thing” at all, it’s a way of comparing things in proportion to one another. Get more specific than that, and we encounter extremely diverse habits and practices.

“Stories about rulers using taxes to create markets in conquered territories, or to pay for soldiers or other state functions, are not particularly inspiring.”

TIL that Keynes actually was open to alternative perspectives, and even spent years studying the Mesopotamian cuneiform banking records himself.

Respect for Keynes +10

Respect for Keynes +10

French researchers – economists, anthropologists, historians and classicists – created “primordial debt theory”, amidst debates about the nature of the Euro.

Core argument: any attempt to separate monetary policy from social policy is ultimately wrong

Core argument: any attempt to separate monetary policy from social policy is ultimately wrong

Primordial-debt theorists insist that monetary policy IS social policy. Govts use taxes to create money – they are the guardians of the debt that all citizens have to one another. This debt is the essence of society itself, predating money & markets, which are just manifestations

Initially, debt was expressed not through the state but through religion. Early Sanskrit literature – Vedas and Brahmanas – constitute the earliest known historical reflections on the nature of debt, treated synonymously with guilt and sin

Wow this bit from French economist Bruno Theret is a galaxy-brain level take. There’s a relationship between the debt of human existence itself, to the Gods, and the debt we have to each other...? Wild. I ship it.

“If the king has simply taken over guardianship of that primordial debt we all owe to society for having created us, this provides a very neat explanation for why the government feels it has the right to make us pay taxes.”

But how do you turn such a “cosmic” or “spiritual” debt... into dollars and cents? How many sheep, or fish, or chunks of silver does it take to repay the debt of your existence?

Primordial-debt theorists: we start by calculating the price of small sins: fines, fees, penalties

Primordial-debt theorists: we start by calculating the price of small sins: fines, fees, penalties

• • •

Missing some Tweet in this thread? You can try to

force a refresh