==============================

What is the meaning of Taxpayer Identification Number (TIN)?

Tax Identification Number is simply a UNIQUE NUMBER identification...

It is dedicated to ONE taxpayer alone. It is not transferable.

A TIN is primarily issued in order to guide the tax payer in the remittance of his tax liabilities...

It is also tied to many operations of government.

For example, before you are issued a

New UBER operator is expected to obtain a TIN before he/she can operate.

As we progress, business owners all over the country will be issued a TIN because it is only through that the F.I.R.S will be able to maintain a...

One of the major reasons why TIN is hooked to your company account is because business transactions done in your business name will be captured at the portal of the FIRS and so monies due to the government in the form of withholding taxes...

In other words, there is no hiding place for the taxpayer who defaults in making remittances & other appropriate returns to the Government.

TIN registration is a legal obligation of every person who operates a business in Nigeria.

Then, ...

What do I mean?

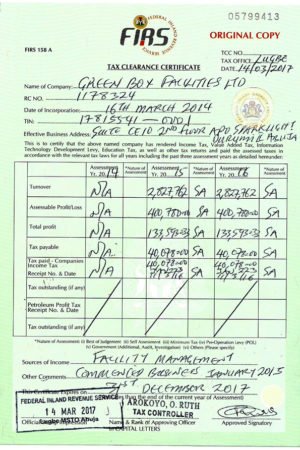

Let’s assume, you applied for a Tax Clearance Certificate in March 2017. The face value of your TCC will reflect taxes paid three years backward excluding the year 2017 in which...

It will show taxes paid in the year 2014, 2015 & 2016.

You won’t be penalized and denied your Tax Clearance Certificate if you are yet to pay your tax for the current year 2017.

This is what is meant by 'Preceding Year Tax.'

There’s a formula for..

Listed below are some of the crucial reasons why you need a Tax Clearance Certificate.

1. Application for certificate of occupancy

2. Application for award of contracts by Government, its agencies and registered companies

3. Application for Government loan for

4. Application for plot of land

5. Application for import or export license

6. Application for approval of building plans

7. Application for foreign exchange or exchange control permission to remit funds outside Nigeria

8. Registration of Motor Vehicle...

10. Confirmation of appointment by Government as chairman or member of a public board, institution, commission, company or to any other similar position made by the Government

11. Appointment or election into public office...

13. Application for transfer of real property

14. Application for trade license

15. Application for pools or gaming license

16. Application for firearms license

17. Application for agent license and any other...

Watch out for Part 3 of this series.

I'll dive deep into practical situations business owners encounter and what to do about it

Chidera ANELE

KitemarkSolutions.com