Case Study for Candle Shunting!.

.

At the end of the 24th Slide you will draw Momentum & Indecision (MI) Zones.

.

You may just change the way you ever looked in Price Flow.

1/n

.

At the end of the 24th Slide you will draw Momentum & Indecision (MI) Zones.

.

You may just change the way you ever looked in Price Flow.

1/n

As per Nimblr TA this is the strength candle marked with a star which has a Candle Body that is more than 50% of Candle Height. It is called a Momentum Candle and when seen on the breakout line is also referred as Breakout Candle.

3/n

3/n

Next slide is with the arrival of Indecisive Candle which has a Body less than 50% of Candle and could be PinBar, Dojis etc., Here on wards forget naming them.

5/n

5/n

The next candle is strength candle marked by star in the direction of earlier trend

.

It's open higher than close of previous strength Candle

.

This is case of Body Overlap

.

The tiny body indecisive candle provides the range Resistance and Support.

.

This is Candle Shunting

6/n

.

It's open higher than close of previous strength Candle

.

This is case of Body Overlap

.

The tiny body indecisive candle provides the range Resistance and Support.

.

This is Candle Shunting

6/n

In a way, Momentum Zones are values Zones covered by the Body of Momentum Candles.

.

Momentum Zones provide free price conductivity as if every price value is a free electron which can freely move on either side within the value zones.

.

8/n

.

Momentum Zones provide free price conductivity as if every price value is a free electron which can freely move on either side within the value zones.

.

8/n

Indecisive Zones have their Highs and Low that can provide minor resistances and supports.

9/n

9/n

Next candle is a reversed direction strength candle and its high covers the free zone offered by conductivity of previous momentum candle.

The word locomotive is important as one ahead of the other and not in reverse direction.

10/n

The word locomotive is important as one ahead of the other and not in reverse direction.

10/n

Although this is a strength candle it is not in locomotive manner as in a locomotive.

.

Send Questions after reading slide details too.

.

Do send them.

.

Send Questions after reading slide details too.

.

Do send them.

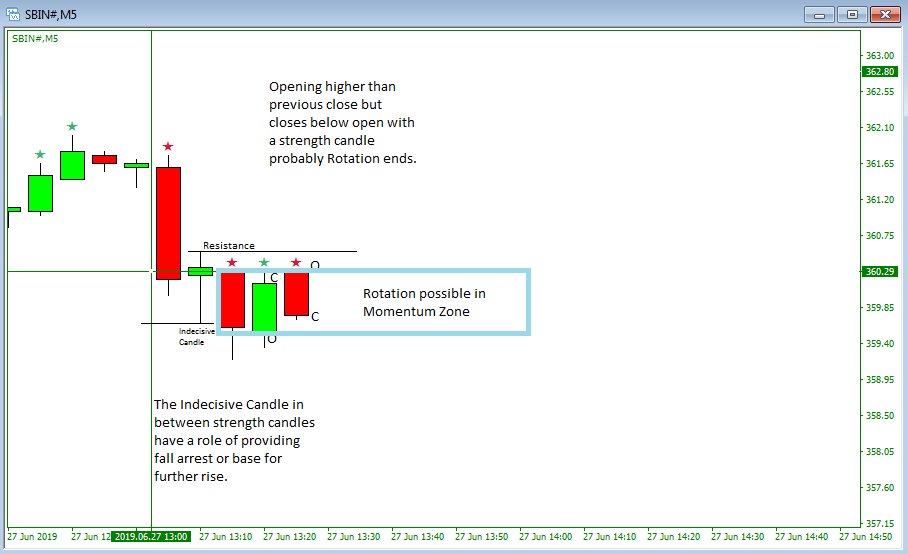

Next is strength candle in the direction of original trend and how Momentum Candle provides free rotation within the Body of Candle.

.

Note the role of Single Indecision Candle clubbed between two strength candle earlier.

.

10/n

.

Note the role of Single Indecision Candle clubbed between two strength candle earlier.

.

10/n

Note I am totally doing without naming any candles instead talking the core basic of Momentum and Indecision as Generic Names as a result you can forget names of candles.

11/n

11/n

The next candle has an open which is a Gap down and a high that enters the free body flow range provided by previous strength candle

.

As the close is lower than the open of current candle it leaves a Body Gap between the two strength candles.

12/n

.

As the close is lower than the open of current candle it leaves a Body Gap between the two strength candles.

12/n

Candle Shunting Rule:

.

Current Open must have common values between it and previous candle close. Here it is not and hence a case of Body Gap and not Candle Shunting.

.

13/n

.

Current Open must have common values between it and previous candle close. Here it is not and hence a case of Body Gap and not Candle Shunting.

.

13/n

Though the immediate –previous close candle was not overlapped in value an earlier strength candle common value condition was met and that common value could be even one single point value.

.

Watch the horizontal line provided by Open of current candle. It provides overlap.

14/n

.

Watch the horizontal line provided by Open of current candle. It provides overlap.

14/n

Let me have a few questions at this stage.

.

Let me make it more memorable than the videos and webinar.

15/n

.

Let me make it more memorable than the videos and webinar.

15/n

Next strength falling candle arrives and its a case of Candle Shunting in a locomotive manner.

.

The C=O is acronym for Carbon-Oxygen atom double bond in our case previous close C and current candle Open.

17/n

.

The C=O is acronym for Carbon-Oxygen atom double bond in our case previous close C and current candle Open.

17/n

The full fall is in a way has its Bodies Shunted.

.

The Blue Line draws connecting the Close of these strength body shunted candles.

.

Any Questions?

19/n

.

The Blue Line draws connecting the Close of these strength body shunted candles.

.

Any Questions?

19/n

We are halfway through.

Start keeping a tab on body shunted strength candles.

Note their Open and Close values and you can start fixing targets easily.

.

We will begin tomorrow after 10am!

.

20/n

Start keeping a tab on body shunted strength candles.

Note their Open and Close values and you can start fixing targets easily.

.

We will begin tomorrow after 10am!

.

20/n

Meanwhile some live intra day case studies of yesterday !

Tisco 30min chart !

.

How Two Strength Candles provided a range trading!

.

21/n

Tisco 30min chart !

.

How Two Strength Candles provided a range trading!

.

21/n

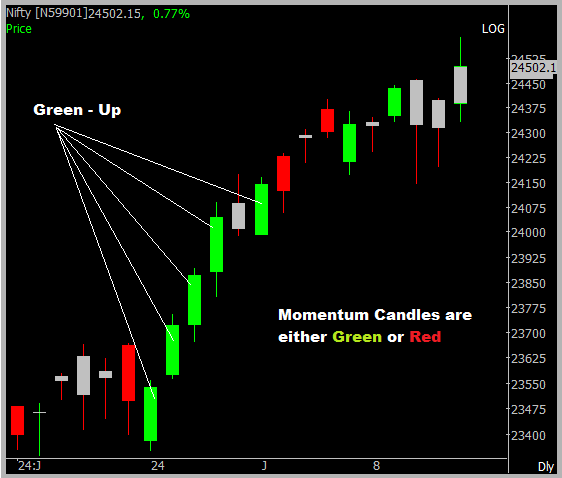

Nifty 30min chart

Momentum & Indecision Zoning (MI).

.

Indecision Zone 11046-11108 can provide support.

A Strength Candle closing into the Momentum Zone 10849-11046 i.e strength candle close below 11046 likely to see 10849.

22/n

Momentum & Indecision Zoning (MI).

.

Indecision Zone 11046-11108 can provide support.

A Strength Candle closing into the Momentum Zone 10849-11046 i.e strength candle close below 11046 likely to see 10849.

22/n

We move on to the arrival of next candle which is non-star Indecision Candle with dual price flow and as a result provide us with the High and Low as resistance and support.

.

Though the body looks reasonably tall it does not meet our criteria of 50% for a strength candle.

23/n

.

Though the body looks reasonably tall it does not meet our criteria of 50% for a strength candle.

23/n

Next candle too is an indecision candle with Candle Body much smaller providing new resistance and support.

24/n

.

24/n

.

If carefully observed the high of this second indecision candle matches with earlier strength candle body open due to free flow of price within the body of momentum candles.

.

As earlier said price moves freely within the body of a strength candle, here is that example.

.

25/n

.

As earlier said price moves freely within the body of a strength candle, here is that example.

.

25/n

Here on we would always keep a track of Open and Close Values of Strength Candles as they may be attained by price flow many a times

.

26/n

.

26/n

The next candle is a strength candle and could be the start of a reversal.

Note the C=O Shunt.

C is close of previous strength candle and is shown

O is Open of current rising green strength Candle.

There is a Gap between them.

Hence no Body Shunting but Body Gap

.

27/n

Note the C=O Shunt.

C is close of previous strength candle and is shown

O is Open of current rising green strength Candle.

There is a Gap between them.

Hence no Body Shunting but Body Gap

.

27/n

Here we mark the Indecision Zone which as a result of Value zones covered by the two Indecision Candles till the Open of Strength Candle.

..

Questions welcomed.

28/n

..

Questions welcomed.

28/n

As mentioned earlier, due to candle shunting the falling trail of close will see a 'V' Bounce.

.

This is also a case of when 'V' Bounces can be expected.

.

Please read the fine details in slide.

.

Questions!

29/n

.

This is also a case of when 'V' Bounces can be expected.

.

Please read the fine details in slide.

.

Questions!

29/n

OK .. I am taking a break.. will be back at 12;30.

.

Meanwhile you can convey your queries.

.

We are now not using any candle names.

Just two classification - Momentum & Indecision Candles.

29/n

.

Meanwhile you can convey your queries.

.

We are now not using any candle names.

Just two classification - Momentum & Indecision Candles.

29/n

Another strength candle occurs and now we have two strength candles hence confirmation of Reversal and Bottom.

.

The close of strength candle also enters into the body of the first fall candle and the free flow will ensure it rises till the top of the first red fall candle.

30/n

.

The close of strength candle also enters into the body of the first fall candle and the free flow will ensure it rises till the top of the first red fall candle.

30/n

Observe the high of the strength candle is same as the high of Indecision Candle earlier after the first fall candle.

.

This goes to prove Indecision Candle High and Low will matter somewhere.

31/n

.

This goes to prove Indecision Candle High and Low will matter somewhere.

31/n

Next Candle is an Indecision Candle and its low may need to be noted as a possible short term support.

.

Indecision Candles have a stellar role.

.

32/n

.

Indecision Candles have a stellar role.

.

32/n

Going back to 31/n let me present the slide of Bottom Formation for records.

.

As per Nimblr TA Rule two consecutive strength candles provide a Bottom.

33/n

.

As per Nimblr TA Rule two consecutive strength candles provide a Bottom.

33/n

After a Indecision Candle, we need a strength candle that is expected to move above high of the line shown.

.

The Indecision Candle (here on wards the I Candle) makes a high and low into the free flow conductive range of previous momentum candle. is to be noted.

.

34/n

.

The Indecision Candle (here on wards the I Candle) makes a high and low into the free flow conductive range of previous momentum candle. is to be noted.

.

34/n

What arrives is indeed a strength candle that enters and nearly consumes the value range of the free conductive price range of the first falling strength candle and we have nearly touched where the fall started.

.

It also has a Candle Shunting overlap between C=O

.

35/n

.

It also has a Candle Shunting overlap between C=O

.

35/n

The tweets are rolled and available for study.

.

Questions welcomed.

.

We are now at Gates of Alibaba asking to open the door for a Breakout.

.

How difficult is it?

.

The thought process is interesting

.

36/n

.

Questions welcomed.

.

We are now at Gates of Alibaba asking to open the door for a Breakout.

.

How difficult is it?

.

The thought process is interesting

.

36/n

Next Candle is an Indecision Candle that too consumes a good percentage of free movement available from the previous Momentum (M) Candle.

.

Note the support it takes on previous high of an Indecision

Candle.

.

37/n

.

Note the support it takes on previous high of an Indecision

Candle.

.

37/n

The Indecision candle arrived has established new a new Support and Resistance level at the immediate micro level.

.

38/n

.

38/n

Next Candle too is an Indecision Candle within the High Low of previous Indecision Candle.

.

If any violation above the high or below the low on time frame’s closing basis it would provide the next directional trend.

.

39/n

.

If any violation above the high or below the low on time frame’s closing basis it would provide the next directional trend.

.

39/n

Next is a strength candle but the close is exactly is as per the previous momentum candle.

Although open is below previous close for a Candle Shunting the close of current candle must be higher in a rising strength candle to be called Candle’s Body Shunting.

39 a/n

Although open is below previous close for a Candle Shunting the close of current candle must be higher in a rising strength candle to be called Candle’s Body Shunting.

39 a/n

Here it is purely Candle's Body Overlap and it remains to live as an Inside Candle only.

.

For rising strength candle the close must be higher than previous strength candle close.

.

Hence not a Body Shunting

39 b/n

.

For rising strength candle the close must be higher than previous strength candle close.

.

Hence not a Body Shunting

39 b/n

Price Flow is going through indecision and the traders tenacity comes to the fore and a few may prematurely exit.

.

A clear logical process can keep timidity and impatience at bay. Process therefore matters in a long trail and Big Gains that support one's staying in a Trade. 40/n

.

A clear logical process can keep timidity and impatience at bay. Process therefore matters in a long trail and Big Gains that support one's staying in a Trade. 40/n

One more Indecision Candle testing one's tenacity to remain in the trade.

.

The Blue Box is the Momentum Zone.

The Pink Box the Indecision Zone.

.

Every Wave has a Body formed by the Candle Shunting of strength Candles. The Blue Box is the Body of the Wave. 41a /n

.

The Blue Box is the Momentum Zone.

The Pink Box the Indecision Zone.

.

Every Wave has a Body formed by the Candle Shunting of strength Candles. The Blue Box is the Body of the Wave. 41a /n

Intermittent Indecision Candles in between strength candles that are good for the health of the wave. They are like fall arrest or steps in a stair which provide SL fixing below those Indecision Candles.

Current Indecision Candle is within the previous momentum candle.

.

41 b/n

Current Indecision Candle is within the previous momentum candle.

.

41 b/n

We have now arrived at the peak of our understanding. Our understanding will be tested by the occurrence of the next candle.

.

On the way I could have highlighted some of these notes.

.

That they were missing is just the true reality.

42/n

.

On the way I could have highlighted some of these notes.

.

That they were missing is just the true reality.

42/n

New Candle appearing on the scene is continuing testing our tenacity and is yet another Indecision Candle with along tail and body above the rest of any of the earlier candles. Candle is Volatile.

.

Note it consumed the free flow movement allowed by a Momentum Candle 43a/n ...

.

Note it consumed the free flow movement allowed by a Momentum Candle 43a/n ...

and touched nearly the open or the base of the previous strength candle. This is an eye opener to never keep a SL in the body of a Momentum Candle. Go deep below to the next Indecision Candle and use its Low for fixing SL. This Single Advice will save a lot of your Money.

43b/n

43b/n

SL fixing therefore has to be qualitative and not based on some fixed percentage of 0.5% or based on ATR. It has to be based on High or Low of nearest Indecision Candle and for that reason if you have to compromise a bit on the lucrativeness of your RR, please accept it.

.

43c/n

.

43c/n

Note the support levels now shown in the slide and appreciate the larger context of SL Fixing.

.

Once again repeating the Strength Candle Momentum value range offers free flow of price and is evident here.

.

Questions welcomed.

.

Continue tomorrow 9am as per market time.

43d/n

.

Once again repeating the Strength Candle Momentum value range offers free flow of price and is evident here.

.

Questions welcomed.

.

Continue tomorrow 9am as per market time.

43d/n

#Crude 15min chart ... 14;32

Next Candle is a star marked strength candle with Open O above the Open of the starting fall candle indicating and even closes above the Previous Top as shown by horizontal drawn lines. The fresh Support for SL fixing is previous Indecision Candle as shown.

44/n

44/n

The New Breakout and Indecision Zoning i.e.MI Zoning is as in chart.

.

With the slide, let me convey my sincere thanks for being patient with me.

.

Next is using Multiple Time Frame to Ascertain trading the larger trend based on Candles.

45/n

.

With the slide, let me convey my sincere thanks for being patient with me.

.

Next is using Multiple Time Frame to Ascertain trading the larger trend based on Candles.

45/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh