As part of @AsiaFrontierCap’s continuing on the ground research in the countries we invest in, I report on my year in #Iraq ..

asiafrontiercapital.com/travel-reports…

1/5

asiafrontiercapital.com/travel-reports…

1/5

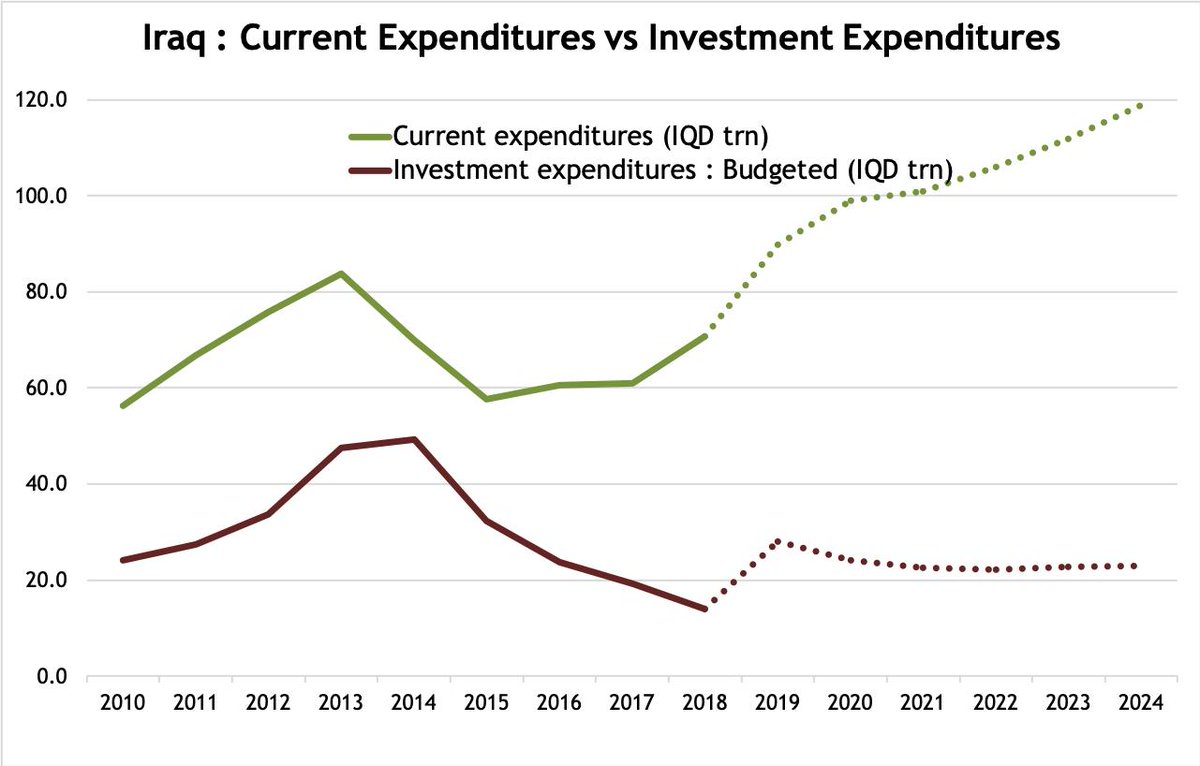

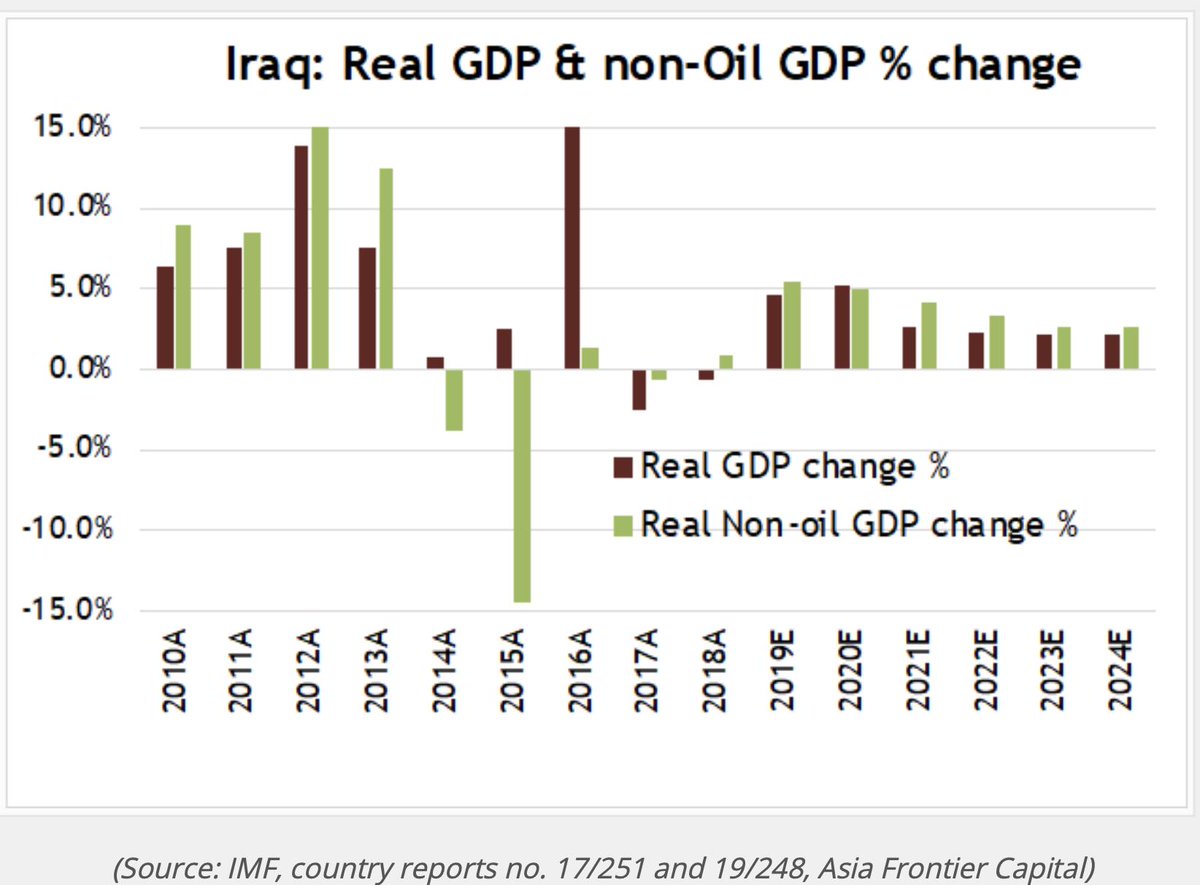

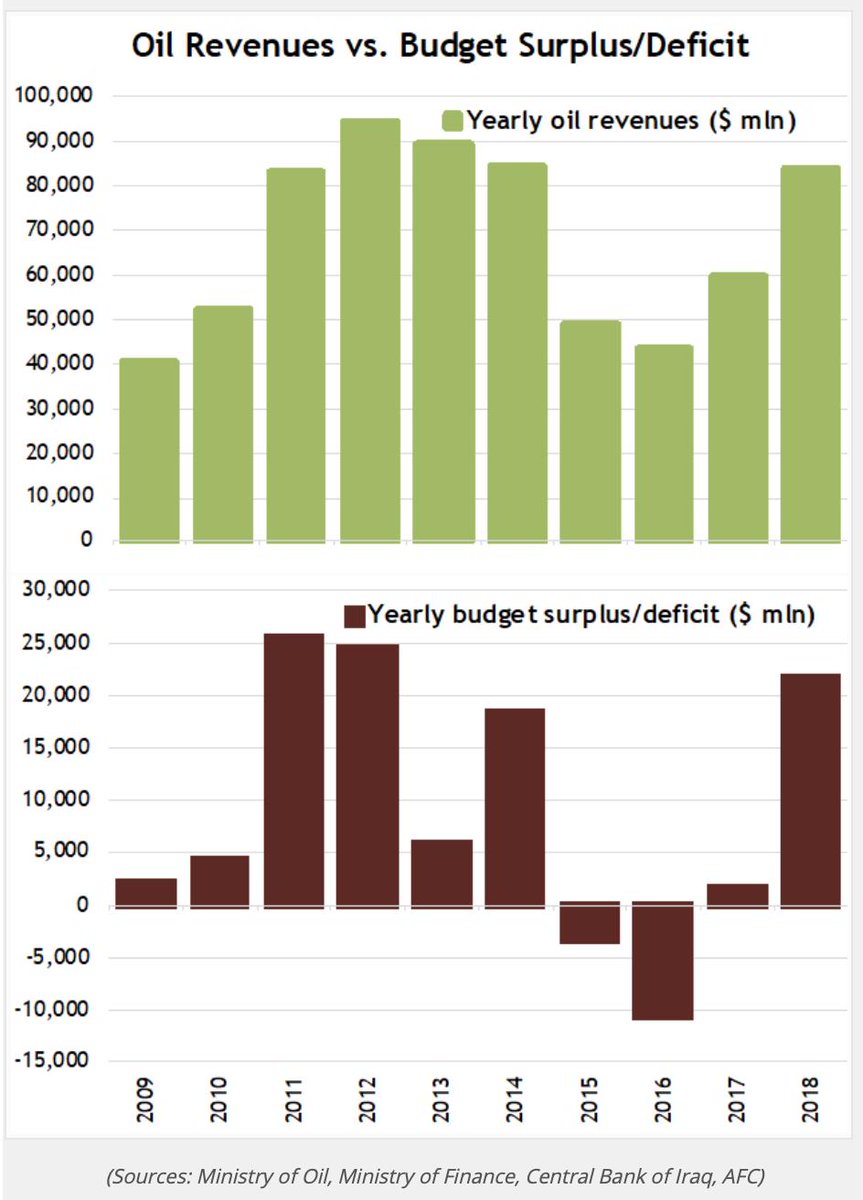

... to give ourt readers, investors & friends a sense of the change that #Iraq has gone through over the last 18 monthss –– a significant social & economic transformation, brought on by the combination of the improved security & an expansionary budget ...

2/5

2/5

... by a government flush with the bounty bequeathed by higher oil prices.

The focus, is on transformation that #Baghdad, “ست البلاد”, has gone through, from the return of the social & economic life, the increased signs of construction activity in the city, ...

3/5

The focus, is on transformation that #Baghdad, “ست البلاد”, has gone through, from the return of the social & economic life, the increased signs of construction activity in the city, ...

3/5

... the vibrant entrepreneurial space operating in #Baghdad & elsewhere in Iraq, a visit to the wonderous Iraqi museum, my old school-Madame Adel School in Al Al-Sa'adoon Park, before ending at the city’s literary heart-Al-Mutanabbi Street.

4/5

4/5

As a native of #Baghdad, despite having spent the bulk of my life living in so many beautiful cities all over the world, can only marvel at how she maintained her grace, charm & much of her beauty in-spite of the calamities that have befallen her.

5/5

@threadreaderapp #unroll

5/5

@threadreaderapp #unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh