Chief Strategist AFC Iraq Fund @AsiaFrontierCap, Visiting Fellow @LSEMiddleEast, Sr Fellow @IRISmideast, Sr Non-Resident Fellow @AtlanticCouncil

How to get URL link on X (Twitter) App

This, however, hasn’t translated, at least not yet, to higher demands for imports to satisfy consumption - given the high dependence on imports – as seen from the CBI’s USD sales volume as of 30/11 (using demand for USD as a proxy for import demand) ... more data is needed.

This, however, hasn’t translated, at least not yet, to higher demands for imports to satisfy consumption - given the high dependence on imports – as seen from the CBI’s USD sales volume as of 30/11 (using demand for USD as a proxy for import demand) ... more data is needed.

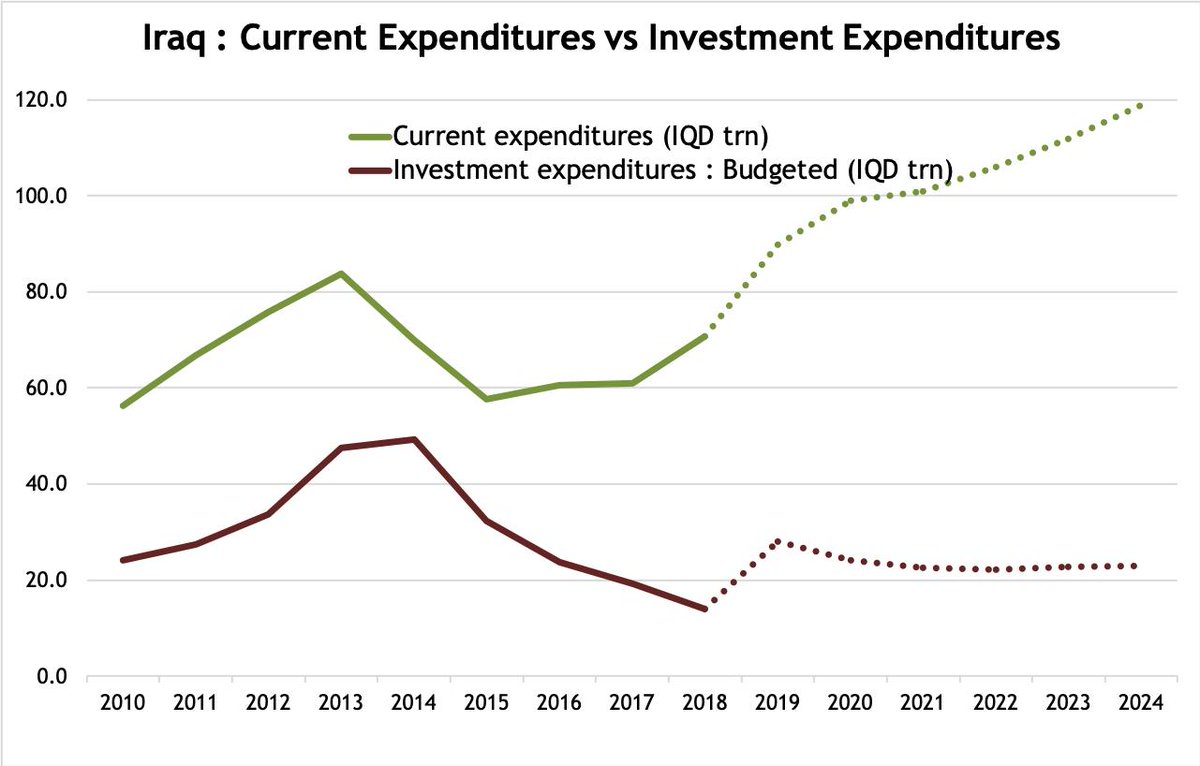

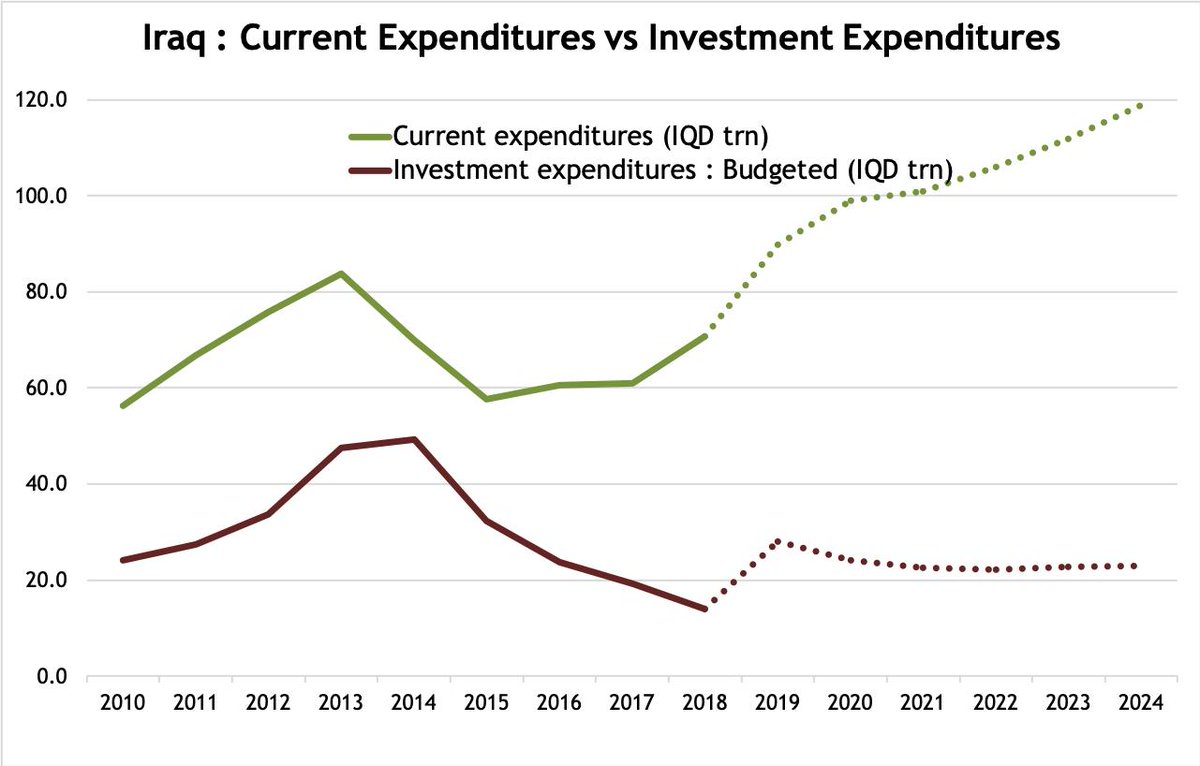

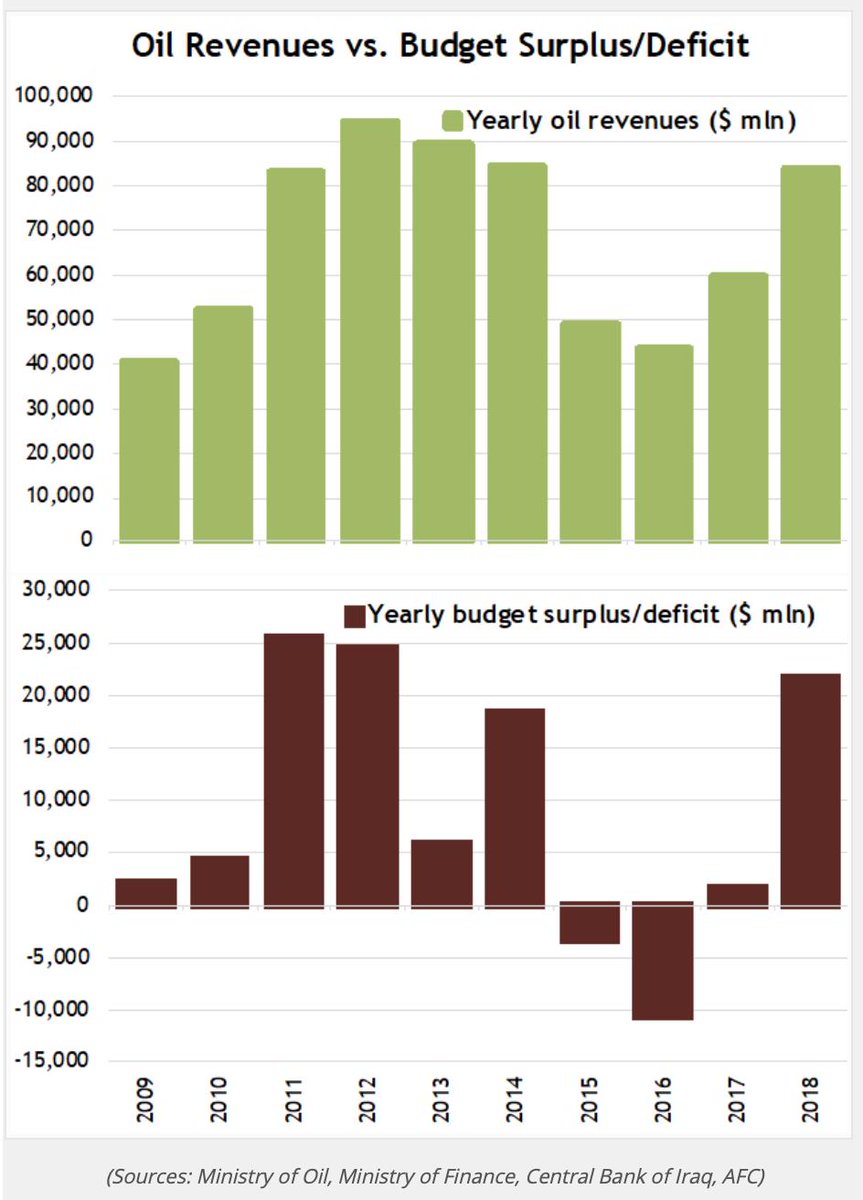

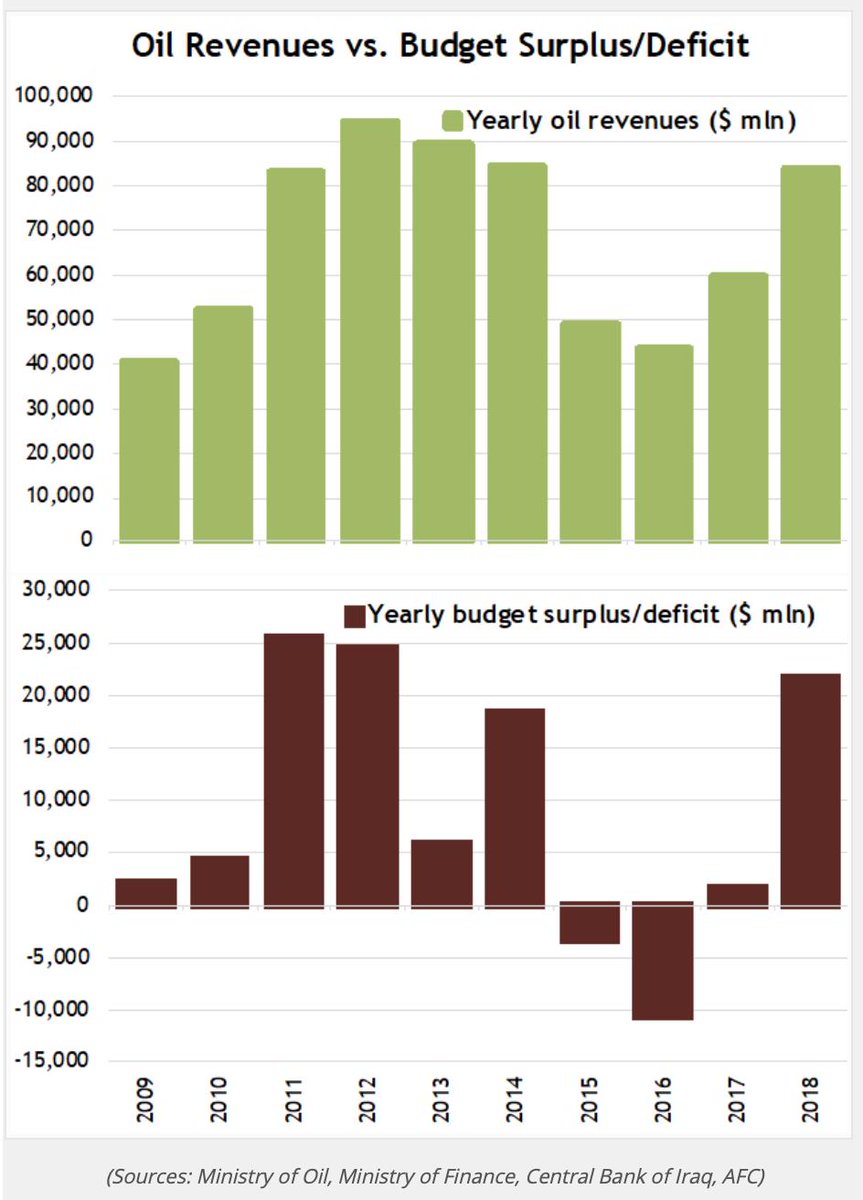

#Iraq has been fortunate that higher oil prices & exports led to a budget surplus of over $27.5bn by end of Jul 2019. Revenue-expenditure gap is pushed forward in time. But, it is only a matter of when, not if, expenditures will overtake revenues.

#Iraq has been fortunate that higher oil prices & exports led to a budget surplus of over $27.5bn by end of Jul 2019. Revenue-expenditure gap is pushed forward in time. But, it is only a matter of when, not if, expenditures will overtake revenues.https://twitter.com/AMTabaqchali/status/1181559159453564928?s=20

... to give ourt readers, investors & friends a sense of the change that #Iraq has gone through over the last 18 monthss –– a significant social & economic transformation, brought on by the combination of the improved security & an expansionary budget ...

... to give ourt readers, investors & friends a sense of the change that #Iraq has gone through over the last 18 monthss –– a significant social & economic transformation, brought on by the combination of the improved security & an expansionary budget ...

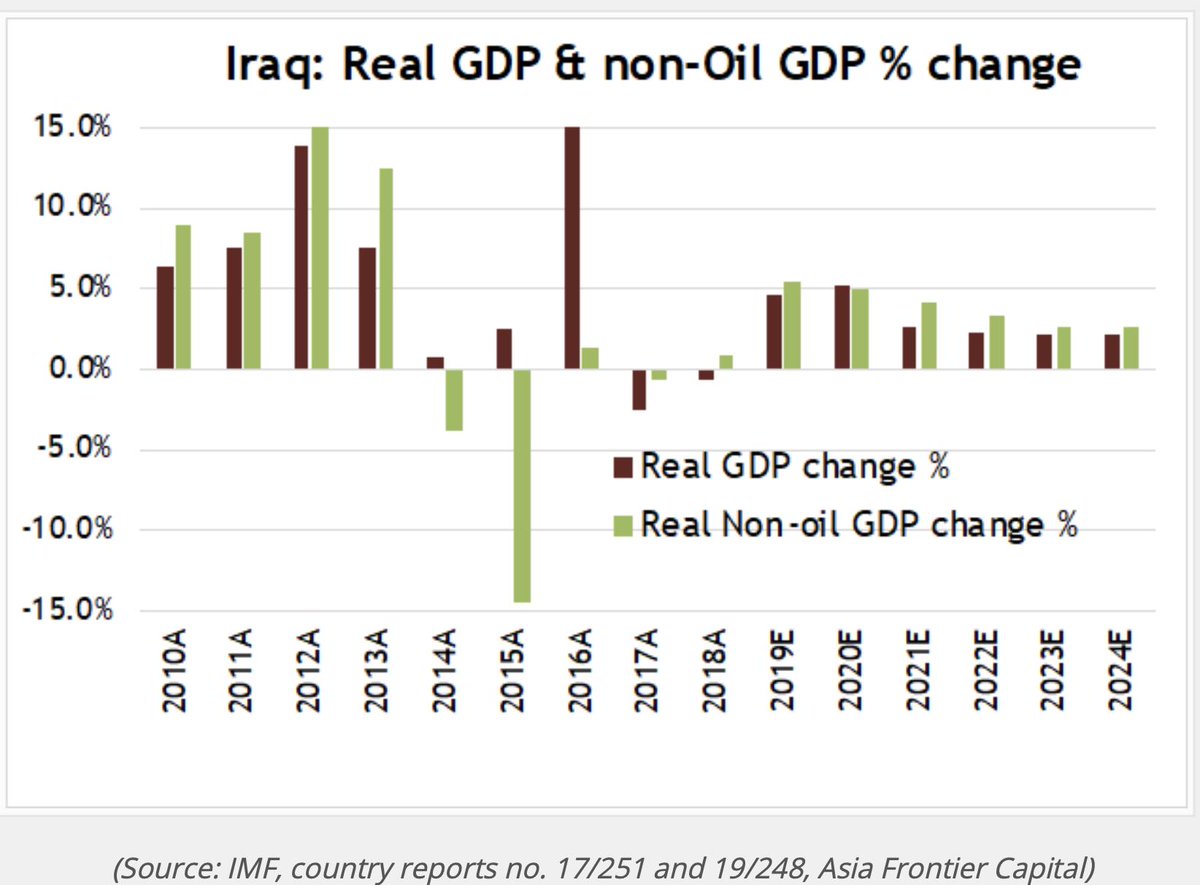

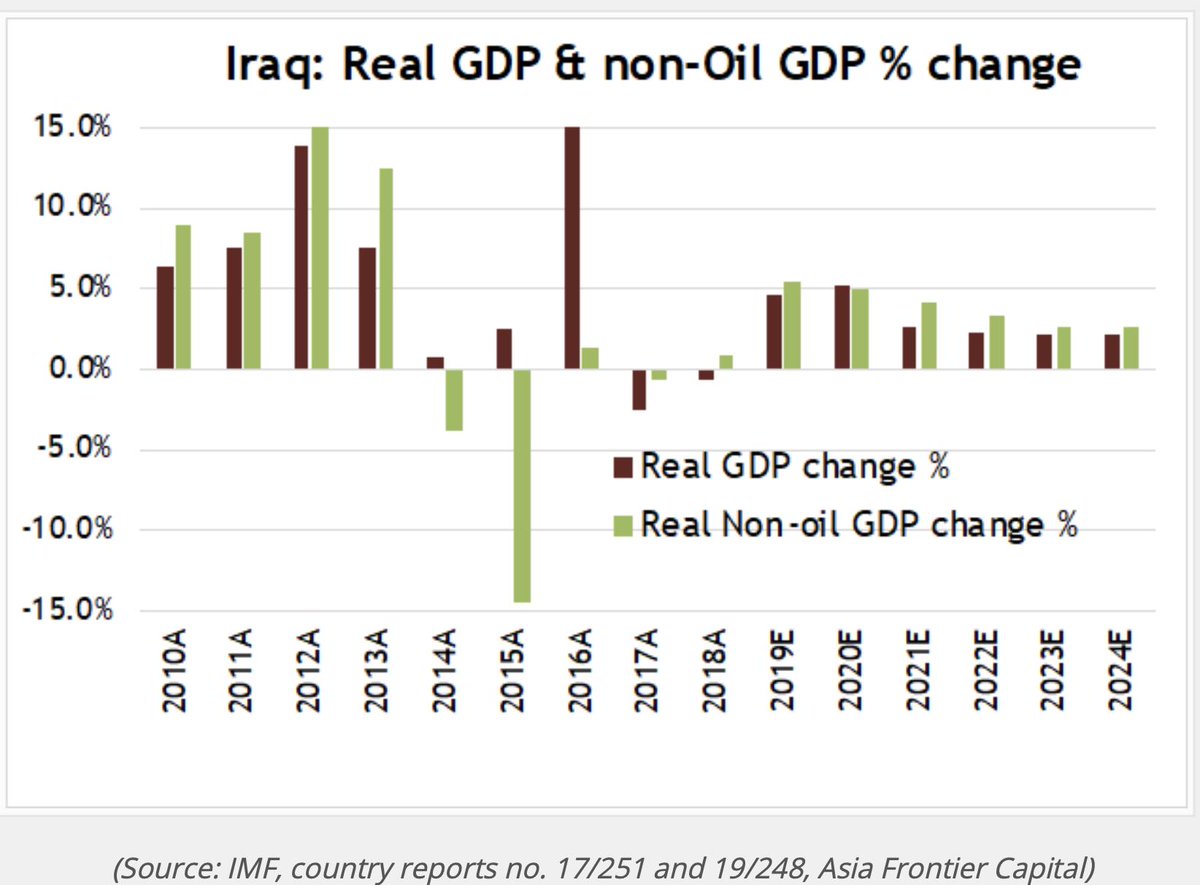

While, 2018, the 1st year following the conflict, was the 2nd year of a deep recession with a contraction of -0.6% on the back of the prior year’s -2.5% decline, instead of being a 1st year of an economic recovery, at +2.9%, following a shallower decline of -0.4%.

While, 2018, the 1st year following the conflict, was the 2nd year of a deep recession with a contraction of -0.6% on the back of the prior year’s -2.5% decline, instead of being a 1st year of an economic recovery, at +2.9%, following a shallower decline of -0.4%.

which, based on current spending patterns & reported oil revenues, could grow to about $4.2bn by the end of June. Helped by the healing effects of increasing oil revenues, this surplus is on top of surpluses of $1.6bn for 2017 & $21.6bn for 2018 (chart)

which, based on current spending patterns & reported oil revenues, could grow to about $4.2bn by the end of June. Helped by the healing effects of increasing oil revenues, this surplus is on top of surpluses of $1.6bn for 2017 & $21.6bn for 2018 (chart)

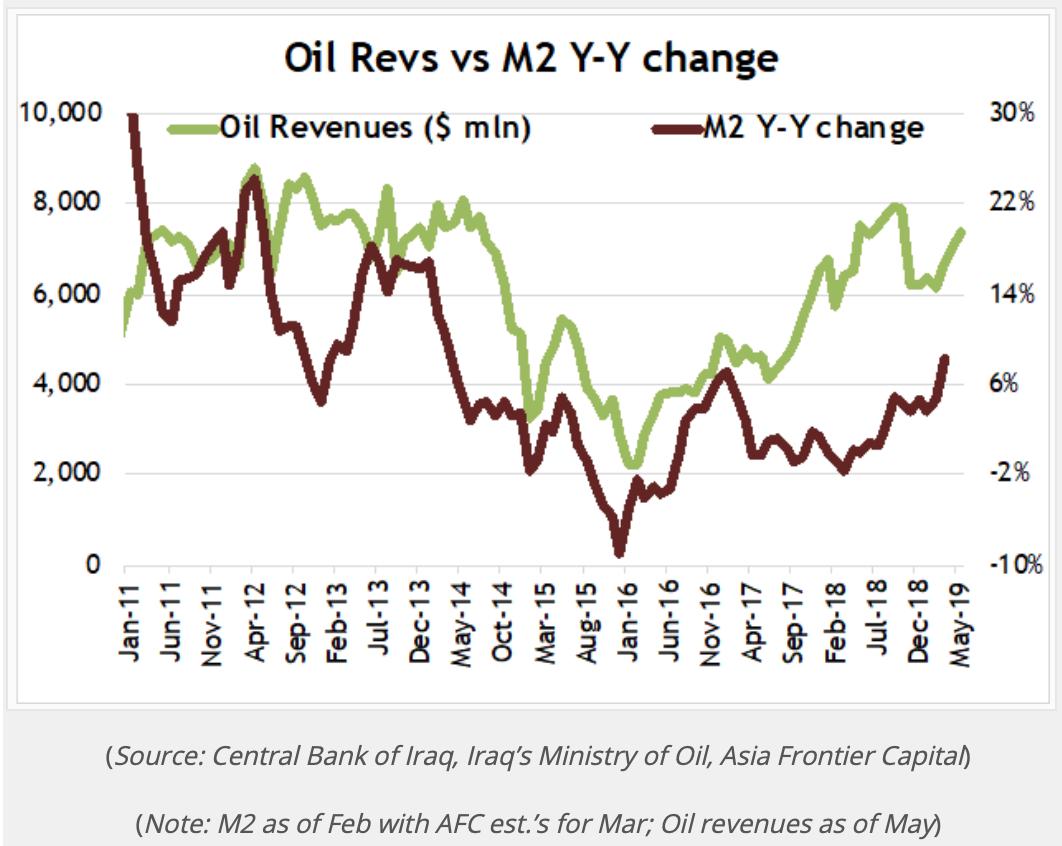

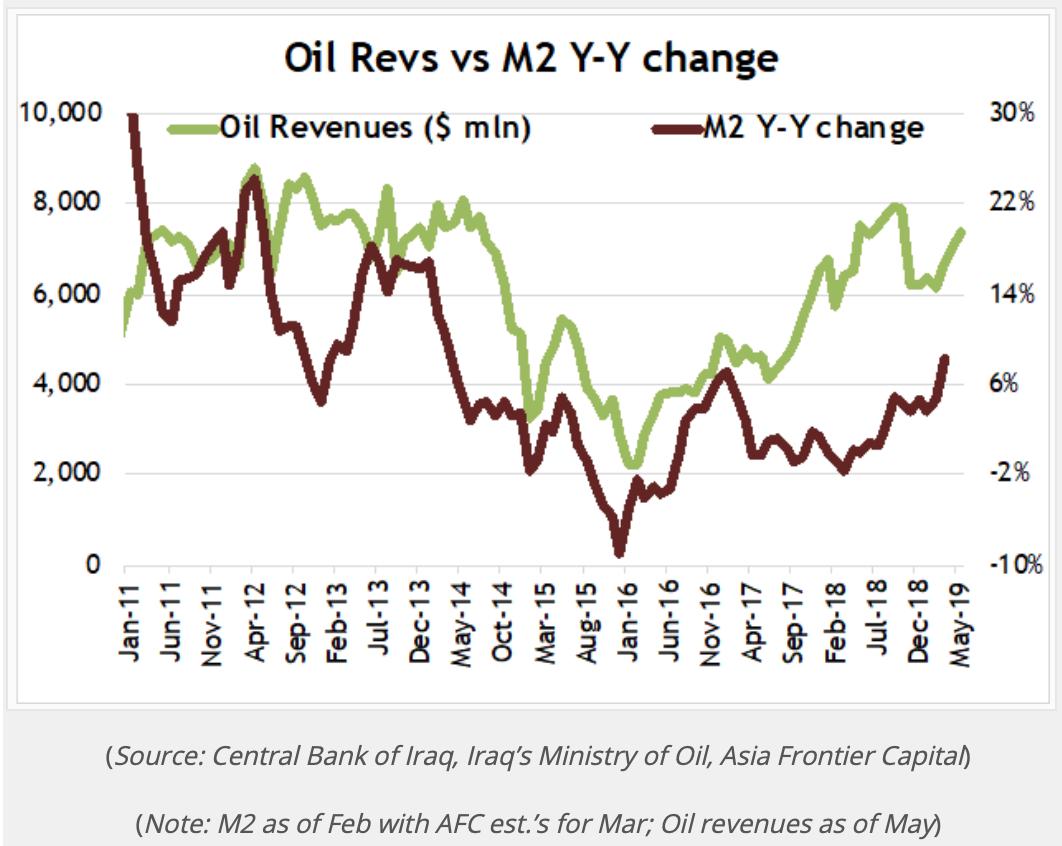

After, what seems like forever, it’s looking increasingly likely that year-over-year growth in M2 (a proxy for economic activity) is finally tracking increasing oil revenues, however, more data points are needed before this short-term trend can become sustainable

After, what seems like forever, it’s looking increasingly likely that year-over-year growth in M2 (a proxy for economic activity) is finally tracking increasing oil revenues, however, more data points are needed before this short-term trend can become sustainable