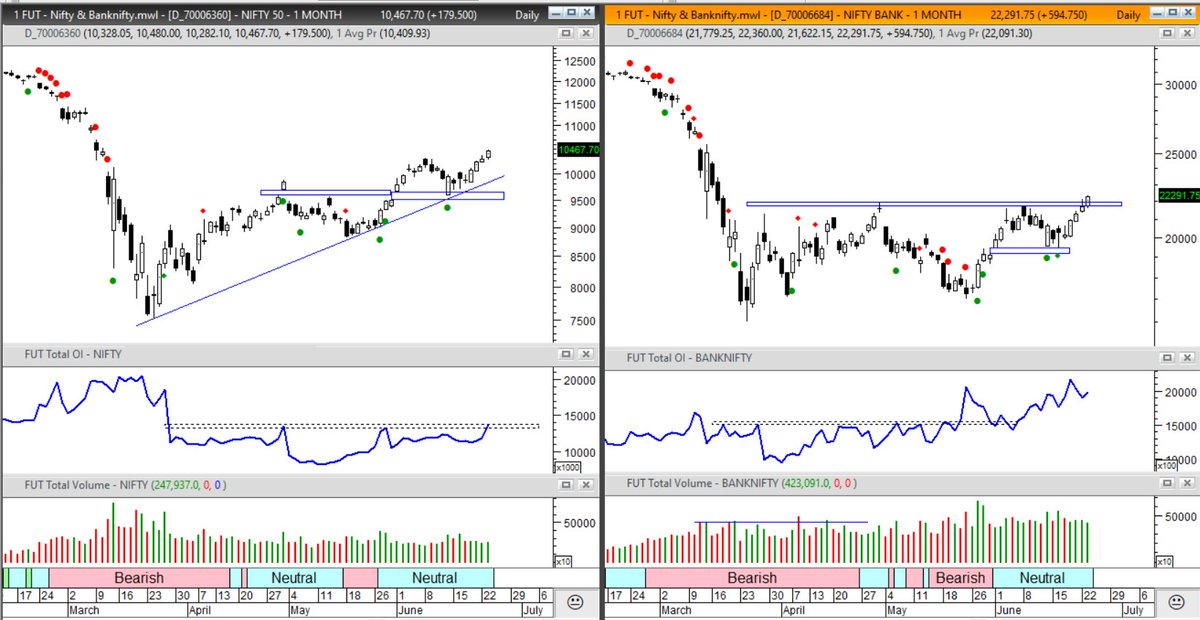

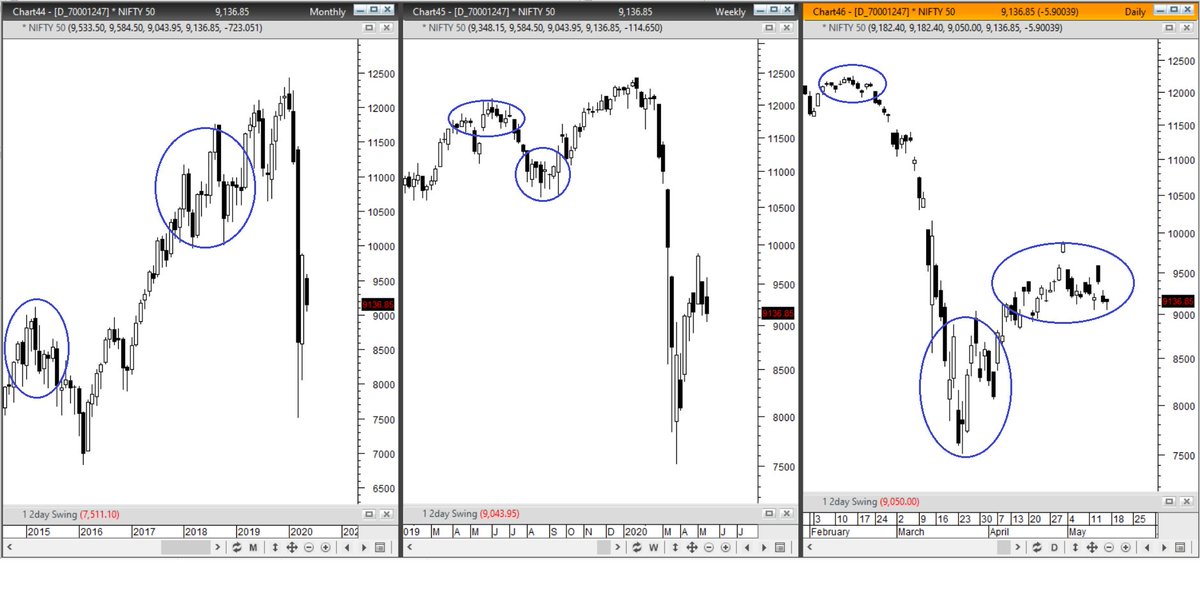

#PSUBANK index - beaten down and oversold makes a case for mean reversion from here.

#PSUBANK Index is up +3% already from observed level in 3 hours.

Updated chart as of today #PSUBANK Index

#PSUBANK Index +7% till now since start of this thread... appropriate mean reversion would be a breach of 2600 levels.. (CMP 2307).. still a long way to go.

(view will be negated if previous week's low is breached)

(view will be negated if previous week's low is breached)

#PSUBANK Index CMP 2301.. Maintain Bullish stance.. revise SL for Bullish view 2170 (current week's low)

#PSUBANK Index CMP 2532 (nearly 18%+ now)

It was a MEAN reversion trade.

MEAN is at 2600

Its ok to leave the last leg.

It was a MEAN reversion trade.

MEAN is at 2600

Its ok to leave the last leg.

• • •

Missing some Tweet in this thread? You can try to

force a refresh