Thread on Volume Spread Analysis (VSA) of NIFTY(SPOT) in relation to trade activity that took place on 16/10/2019

If found useful "RT"

Tagging @prodigal_trader and @ST_PYI for their reviews

#nifty50

If found useful "RT"

Tagging @prodigal_trader and @ST_PYI for their reviews

#nifty50

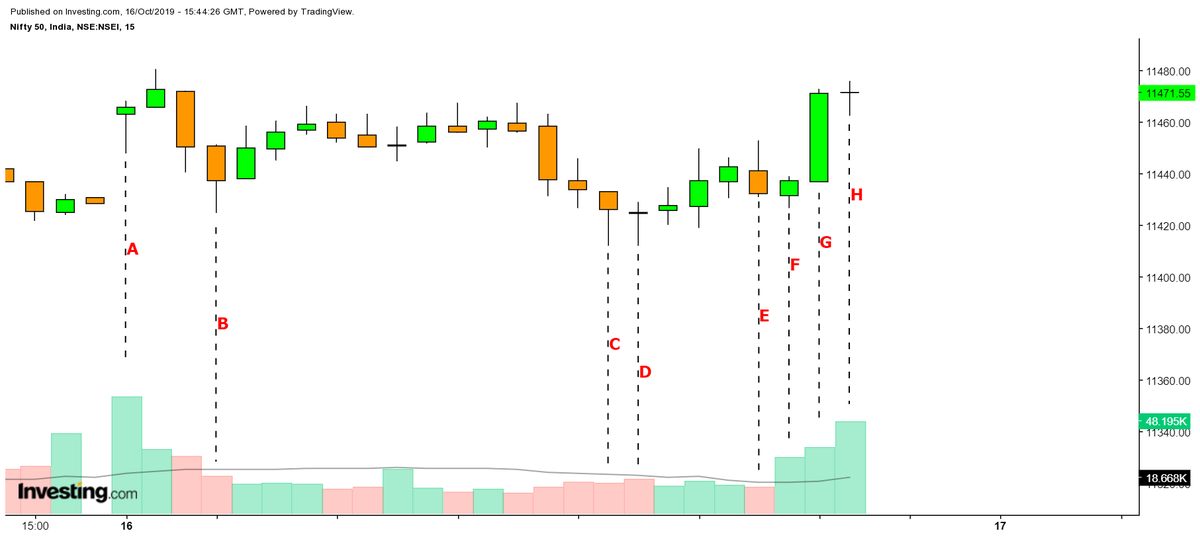

POINT-A: The day started with an UP-BAR and that too combined with GAP-UP which locked most of the traders who held SHORT trades from last trading session but remember this move was not enough because who has more money will always over-rule and thus SMART HANDS initiated "SELL"

Bars following POINT-A: If you have a question "Why SMART MONEY initiated SELL?", because they must have seen that still many RETAILERS are either holding SHORTS so to make them feel "complacent" and trap the FOMO RETAILERS who were left to "SHORT INDEX" and make them participate

POINT-B: This is "SIGN OF STRENGTH" because the SPREAD is good along with this operation is taking place at LOW VOLUMES which means it was more of "RETAILERS" who were getting into play and SMART HANDS were not interested in SELL SIDE trades and following bars we saw up moves

Cont..Bars following POINT-B: Due to selling absorption by SMART MONEY market almost reached that point from where market opened and it was RETAILERS who kept on SELLING because of feeling complacent and seeing the first hour play RETAILERS made up their mind that it SELL ON RISE

But if you see most of the bars following POINT-B you will find that most of the bars were not having "attractive spread" and "even if they were having attractive spread they were lacking in volumes"

Cont..

Cont..

Classic example of "EFFORTS VS RESULTS" wherein RETAILERS are making EFFORTS to "drag the market" but "NO RESULTS"

There was NO RESULT because most of the SELL ORDERS were getting absorbed by SMART MONEY because see some of the bars are UP-BARS and DOWN-BARS "CLOSING" at MIDPOINT

There was NO RESULT because most of the SELL ORDERS were getting absorbed by SMART MONEY because see some of the bars are UP-BARS and DOWN-BARS "CLOSING" at MIDPOINT

POINT-C & POINT-D: See the bars are "CLOSING" at MID-POINT this is very conclusive to say that

"SMART MONEY" is doing two things

>ROTATING ORDERS which is giving a down tick to INDEX and "RETAILERS" feeling they are on CORRECT SIDE

>ACCUMULATING in bits and pieces

"SMART MONEY" is doing two things

>ROTATING ORDERS which is giving a down tick to INDEX and "RETAILERS" feeling they are on CORRECT SIDE

>ACCUMULATING in bits and pieces

Bars following POINT-C & D are UP-BARS which is again indicative that ACCUMULATION is "GOING ON"and bar at POINT-E is DOWN-BAR but with certainly less volumes which means "LACK OF SUPPLY"

POINT-F//G//H: During the last 40-45 mins SMART MONEY came into play with more power and they were "ACCUMULATING" earlier and at this juncture also they "ACCUMULATED" a good chunk reason:

>UP-BARS with good SPREAD

>Volumes getting registered which are considerable

>UP-BARS with good SPREAD

>Volumes getting registered which are considerable

Thus following things are concluded:

>In today's session it was "RETAILERS" who were mostly taking the SELL SIDE

>There was LACK OF SUPPLY in the market

>The point from where SMART HANDS started "ACCUMULATING" in today's session they added more during the last hour

>In today's session it was "RETAILERS" who were mostly taking the SELL SIDE

>There was LACK OF SUPPLY in the market

>The point from where SMART HANDS started "ACCUMULATING" in today's session they added more during the last hour

Also late comers were trapped on both ends i.e. FOMO SHORTS got trapped due to ABSORPTION BY SMART HANDS and FOMO LONGS got trapped due to LIQUIDATION BY SMART HANDS

>Learning: Never RUN behind PRICE let it come to your level and then trade and most importantly stick to your plan

>Learning: Never RUN behind PRICE let it come to your level and then trade and most importantly stick to your plan

• • •

Missing some Tweet in this thread? You can try to

force a refresh