#NIFTY Close-Open of last 3 days:

31st Oct'19: -13pts (NSE TO: 50.8k crs being expiry day)

01st Nov'19: +4pts (NSE TO: 42.8k crs)

04th Nov'19: +16pts (NSE TO: 40k crs)

Today's high 11989.15

Largecaps arent looking healthy at current levels.

View changes > 12042

31st Oct'19: -13pts (NSE TO: 50.8k crs being expiry day)

01st Nov'19: +4pts (NSE TO: 42.8k crs)

04th Nov'19: +16pts (NSE TO: 40k crs)

Today's high 11989.15

Largecaps arent looking healthy at current levels.

View changes > 12042

View is intact.. maintain SL 12042..

Today's high was 12002.90

Midcap and Smallcaps are showing some weakness

Breadth wasnt good today despite the rally in Banknifty.

Today's high was 12002.90

Midcap and Smallcaps are showing some weakness

Breadth wasnt good today despite the rally in Banknifty.

View is intact.. maintain SL 12042..

Today's high was 12034.15 but..

close was 11908.

First close below previous day low after 21 sessions.

Breadth continues to deteriorate.

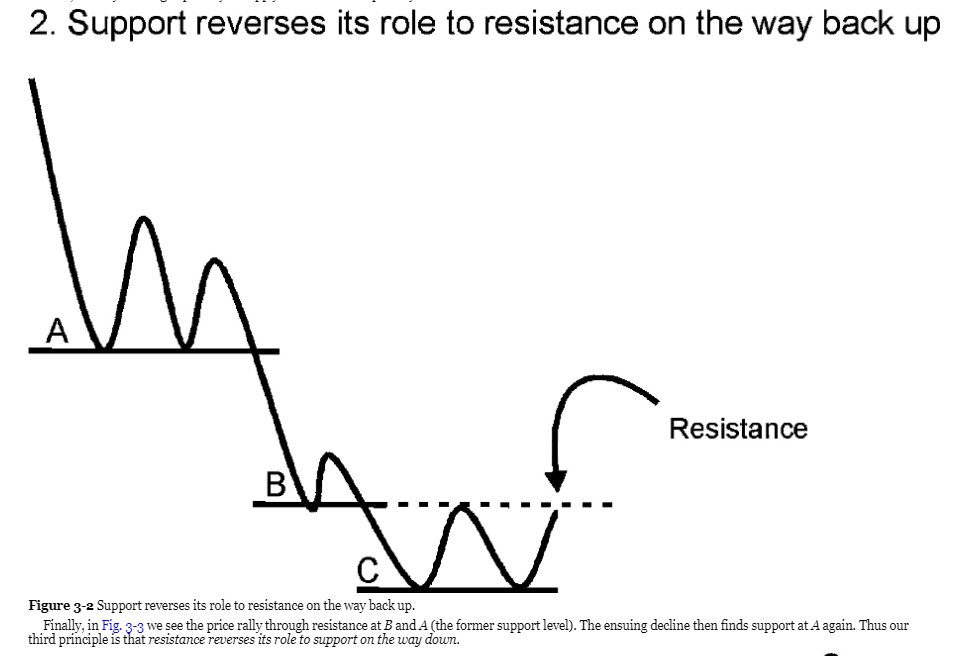

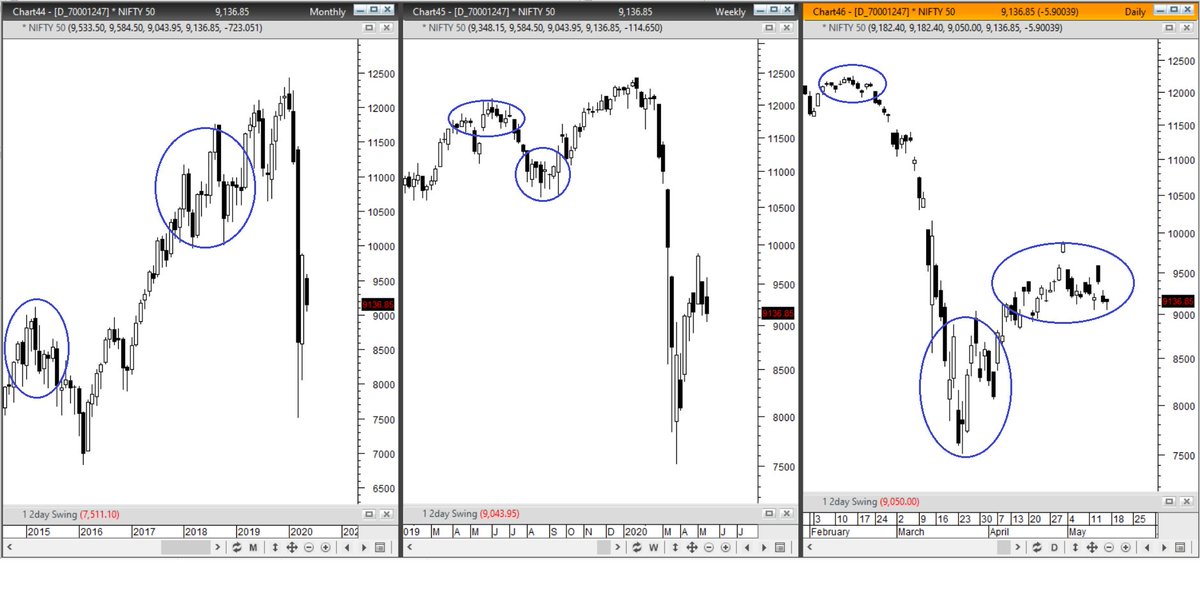

#MeanReversion to at-least 20 SMA likely.. maybe 50 SMA also

Today's high was 12034.15 but..

close was 11908.

First close below previous day low after 21 sessions.

Breadth continues to deteriorate.

#MeanReversion to at-least 20 SMA likely.. maybe 50 SMA also

View is intact.. revise SL to 11982

Today's close was 11840.

Second close below previous day low after 24 sessions.

Breadth continues to deteriorate.

#MeanReversion to at-least 20 SMA likely.. maybe 50 SMA also

Today's close was 11840.

Second close below previous day low after 24 sessions.

Breadth continues to deteriorate.

#MeanReversion to at-least 20 SMA likely.. maybe 50 SMA also

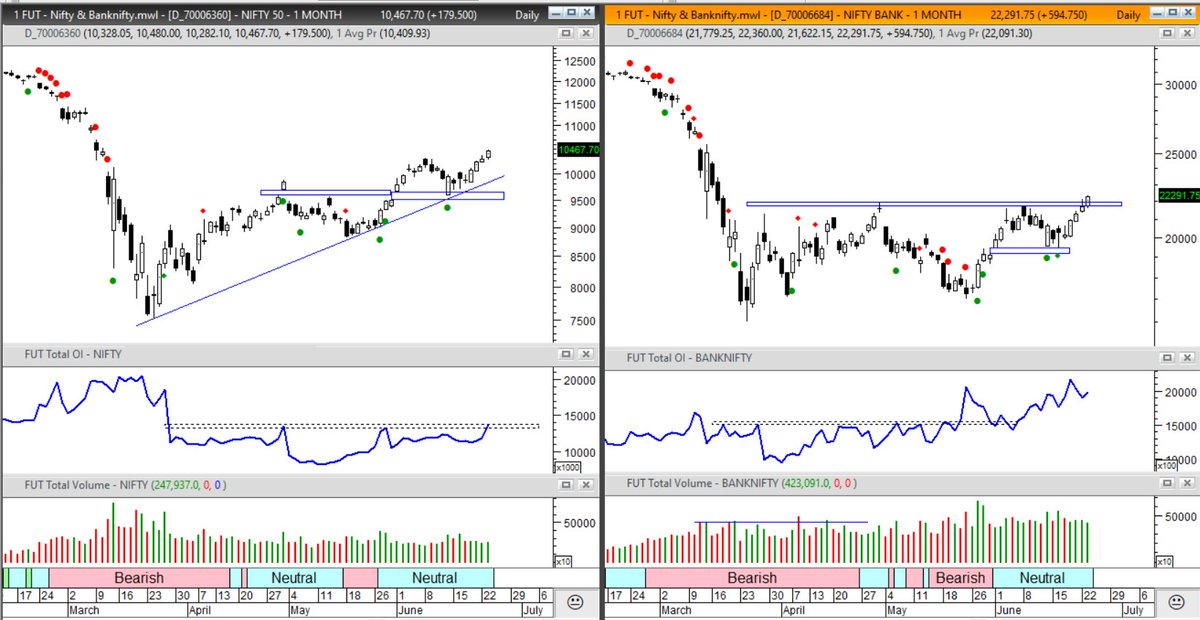

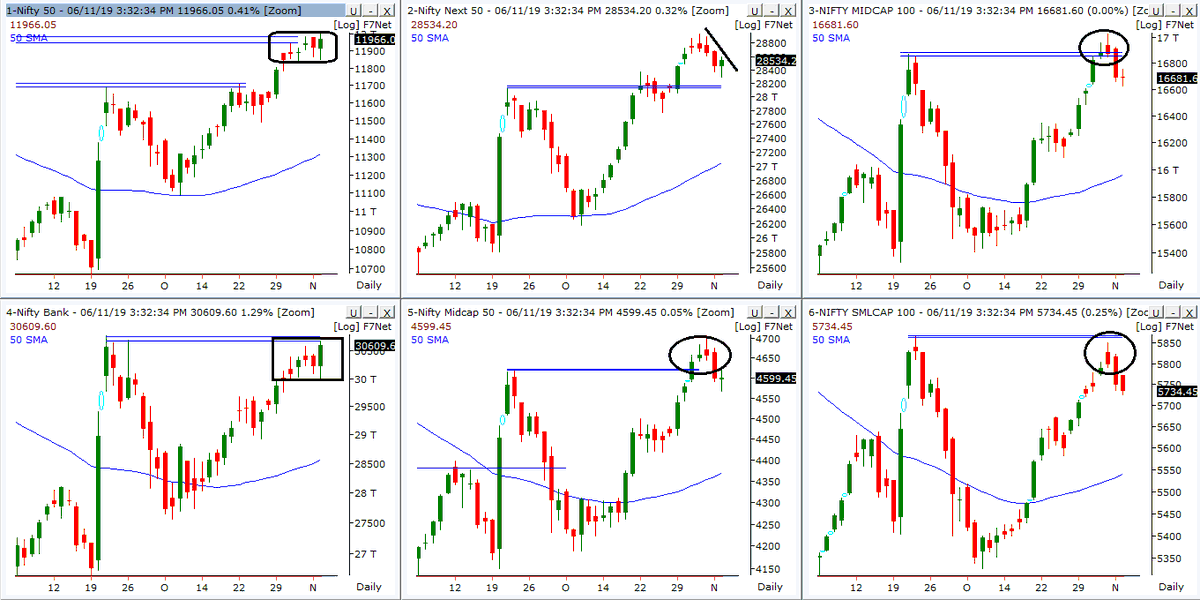

View changes to BULLISH. Price did not mean revert as much as expected. Fresh breakout with Bullish Breadth.

#NIFTY (#MIDCAP50 may outperform #NIFTY)

#NIFTY (#MIDCAP50 may outperform #NIFTY)

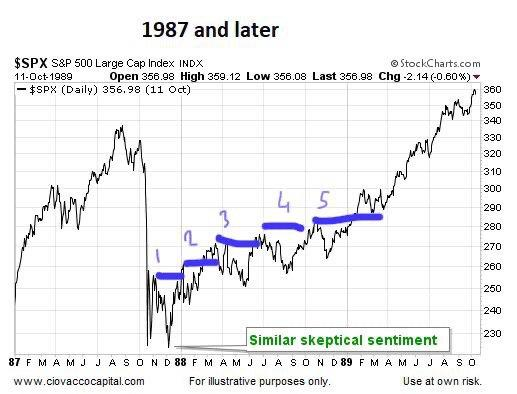

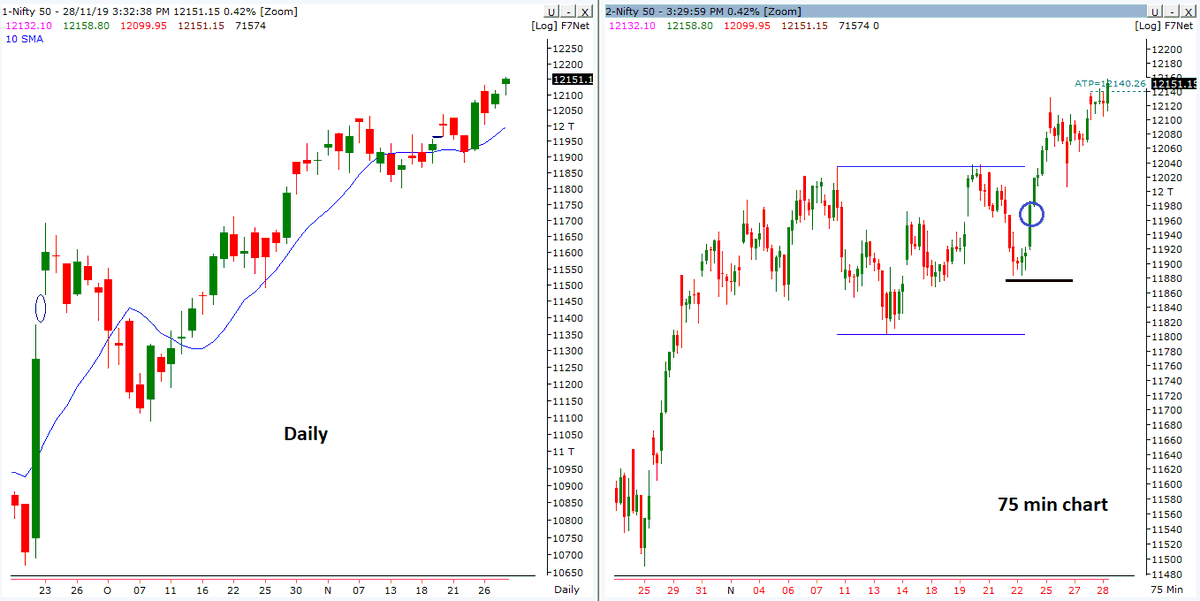

Maintain #BULLISH stance. Price did not retrace 50% while Time retracement is crossing 100% is a classical Bullish setup (on 75 min chart). #NIFTY

SL now: 11880

SL now: 11880

#NIFTY 100pts more after morning update.. TREND is gaining strength..

#Nifty +175 pts since previous update. From hereon, I am more Bullish on MIDCAP50 Index vs NIFTY50.

MIDCAP50 CMP 4751

SL is 10 SMa (4650)

MIDCAP50 CMP 4751

SL is 10 SMa (4650)

• • •

Missing some Tweet in this thread? You can try to

force a refresh