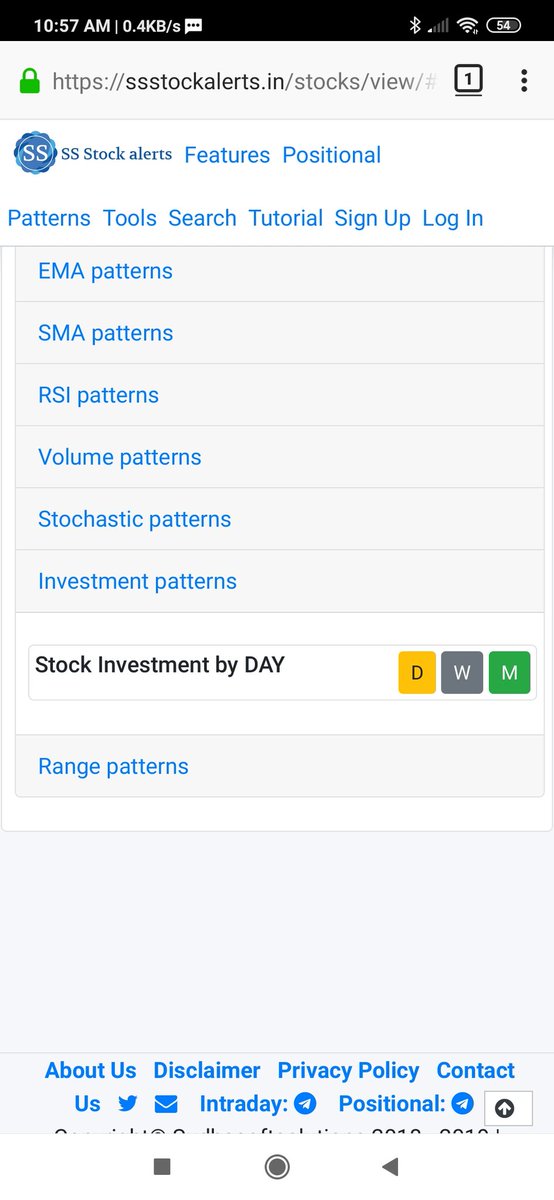

Added a scanner to scan the nse stocks based below conditions.

#ssstockalerts

With advanced patterns, much stocks can be filtered.

#ssstockalerts

With advanced patterns, much stocks can be filtered.

https://twitter.com/Rishikesh_ADX/status/1190913395005902850

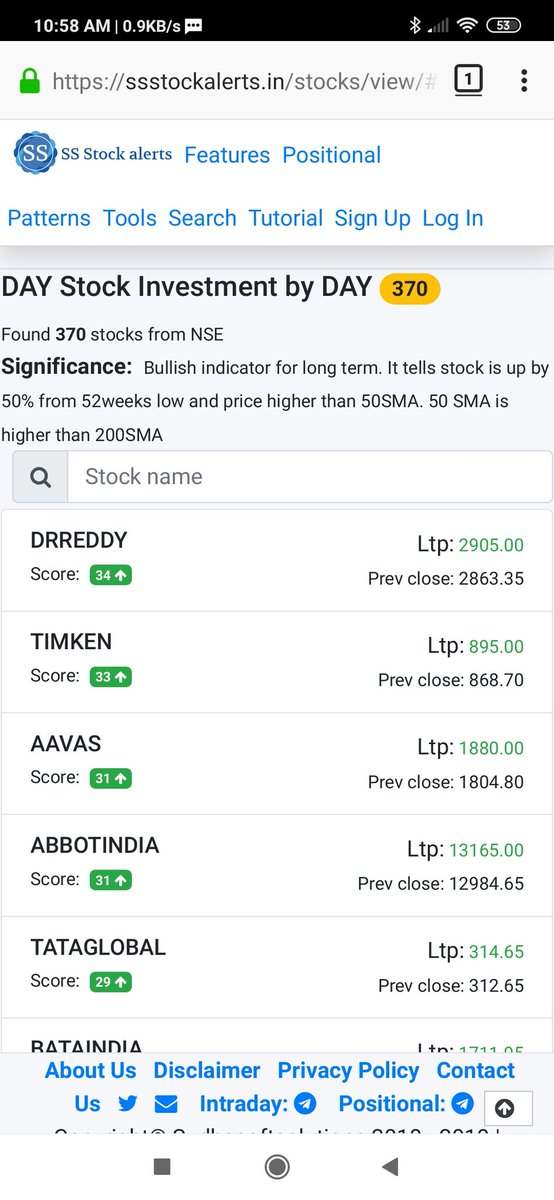

Stock investment pattern and positional buy pattern gives the best results for investment.

Positional Buy: cmp > ema5 > ema20 > ema50 and cci > 100 (alignment + momentum)

Stock investment: cmp is 50% up from 52weeks low and cmp > sma50 > sma200.

#investment

Positional Buy: cmp > ema5 > ema20 > ema50 and cci > 100 (alignment + momentum)

Stock investment: cmp is 50% up from 52weeks low and cmp > sma50 > sma200.

#investment

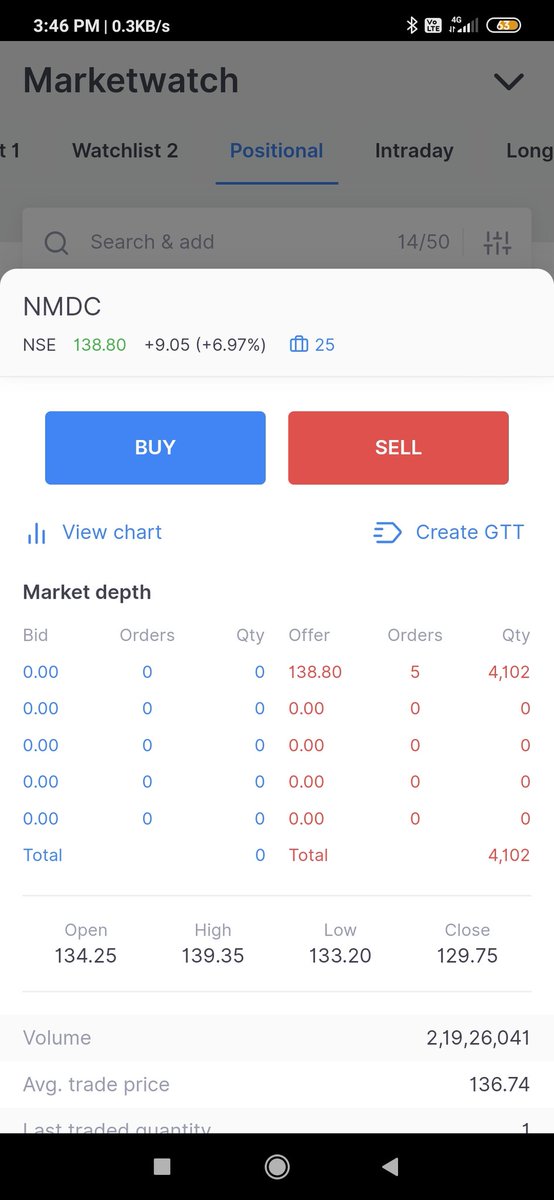

Investment pick based on above patterns.

Multi time frame upside.

#NMDC

Why this stock?

Stock is more than 50% up from 52weeks low and trading above 50 sma and 200 sma and cci > 100

Recently break out.

Targets 140, 155

SL: 116

Multi time frame upside.

#NMDC

Why this stock?

Stock is more than 50% up from 52weeks low and trading above 50 sma and 200 sma and cci > 100

Recently break out.

Targets 140, 155

SL: 116

Always has risk reward ratio and do the position size. Never risk more than 1% in a single trade.

Here is a example:

If my entry at 126 and sl:116, risk: 10

Target: 150, Reward: 24

Risk:Reward=2.4

These made using position calculator

ssstockalerts.in/stocks/view/#/…

#ssstockalerts

Here is a example:

If my entry at 126 and sl:116, risk: 10

Target: 150, Reward: 24

Risk:Reward=2.4

These made using position calculator

ssstockalerts.in/stocks/view/#/…

#ssstockalerts

• • •

Missing some Tweet in this thread? You can try to

force a refresh