@OCCRP coverage of Gambia’s Phantom foreign investment zone well worth reading

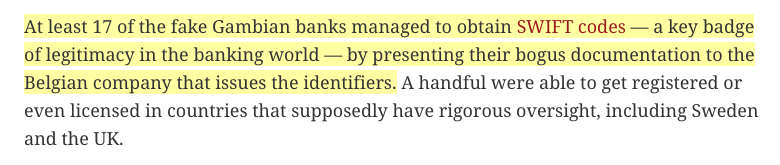

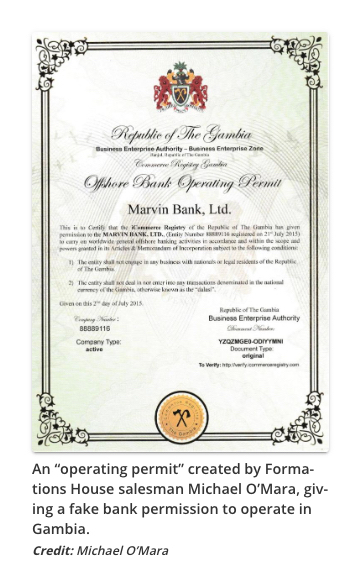

Its believed that at least 17 fake Gambian banks were able to obtain SWIFT codes - kinda like a money launders wet dream

https://twitter.com/OCCRP/status/1207008558845321216?s=20

Its believed that at least 17 fake Gambian banks were able to obtain SWIFT codes - kinda like a money launders wet dream

A little further sluething shows that nearly 50% of the fake Gambian banks that obtained #swift were either pre-packaged shelf companies by #probanx and their partners or became clients of #probanx. some of these fake banks remain in play today.

Link to compiled list of Gambian Banks (a bit rough as still a work in progress).

How did one company manage to make up 50% of a fake offshore banking zone and then still get acquired by an @ASX listed company? #probanx #isignthis

Gambian Bank list >>>

bit.ly/2O4ppZi

How did one company manage to make up 50% of a fake offshore banking zone and then still get acquired by an @ASX listed company? #probanx #isignthis

Gambian Bank list >>>

bit.ly/2O4ppZi

@ASX @threadreaderapp rollup

• • •

Missing some Tweet in this thread? You can try to

force a refresh