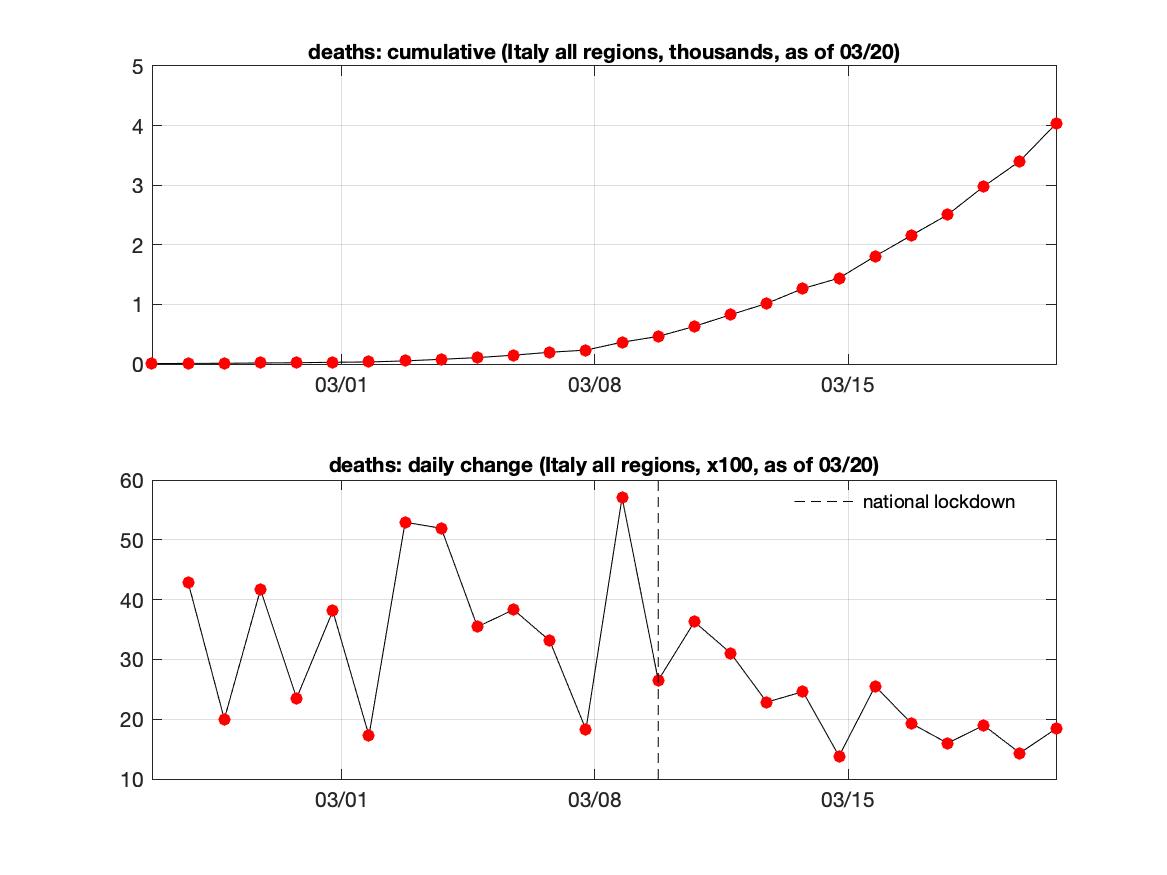

#coronavirus Update March 20 -- The number of infected in Italy increased by 5986 units (+14% previous day), and the number of deaths by 627 (+18% previuos day). Another dramatic day for #Italy. Growth rates not declining, but flat.

1/ Good news is that the growth rate in the number of people admitted to ICU (6%) went down from yesterday, and has been flat in the last few days. Hopefully it declines even further soon #StayAtHome

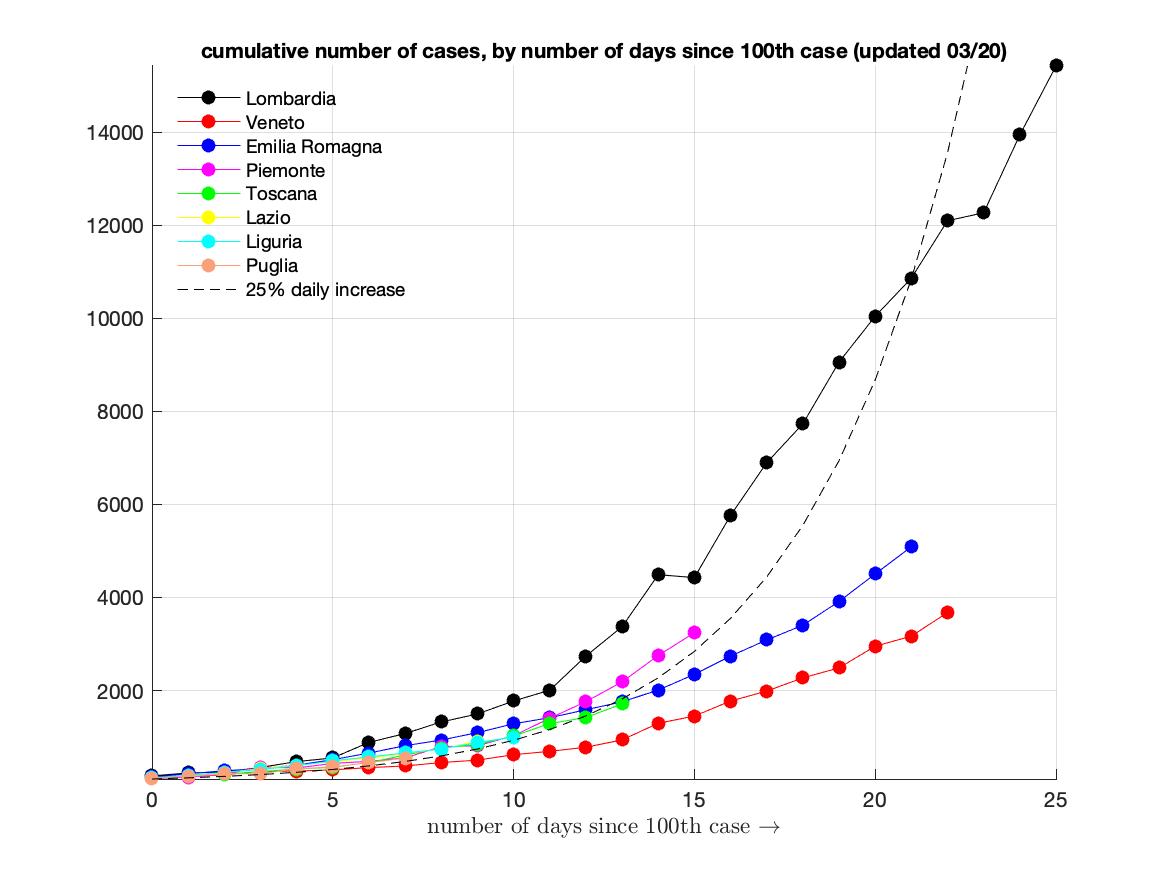

2/ In terms of breakdown by regions, in terms of number of deaths, Piemonte, Liguria, Toscana seem to be following the path of Lombardia. For Puglia is too early to draw conclusions. Figures are both in levels and log scale

3/ The evolution of the infected by regions tracks the evolution of the number of deaths. Veneto and Emilia seem to be fairing better than Piemonte.

4/ An interesting fact is that on average 20% of the tests ran daily nationally result in a new positive case. It is clear we are testing mostly individuals with synthoms

5/ Finally, we have a large number of open cases. Unfortunately, this indicates the number of deaths will keep increasing dramatically. We should be seeing the effects of the containment measures soon. #StayHome #StaySafeStayHome #StayStrong and we will make it.

• • •

Missing some Tweet in this thread? You can try to

force a refresh