Watch at this link:

Stay tuned for updates

@gstindia @askGST_GoI @cbic_india

Finance Minister @nsitharaman will address a media briefing shortly afterwards

Watch LIVE ➡️

Stand by for updates in English and Marathi

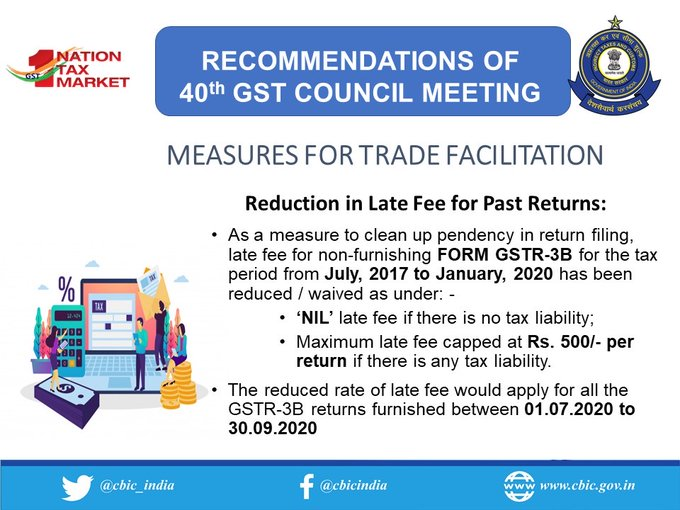

For all those who have no tax liability but have not filed GST returns for tax period July 2017 - Jan 2020 (prior to #COVID19 period), there shall be no late fee at all

This will apply to all returns submitted during Jul 1, 2020 - Sep 30, 2020

- FM #NirmalaSitharaman

- Finance Minister #NirmalaSitharaman

Watch LIVE:

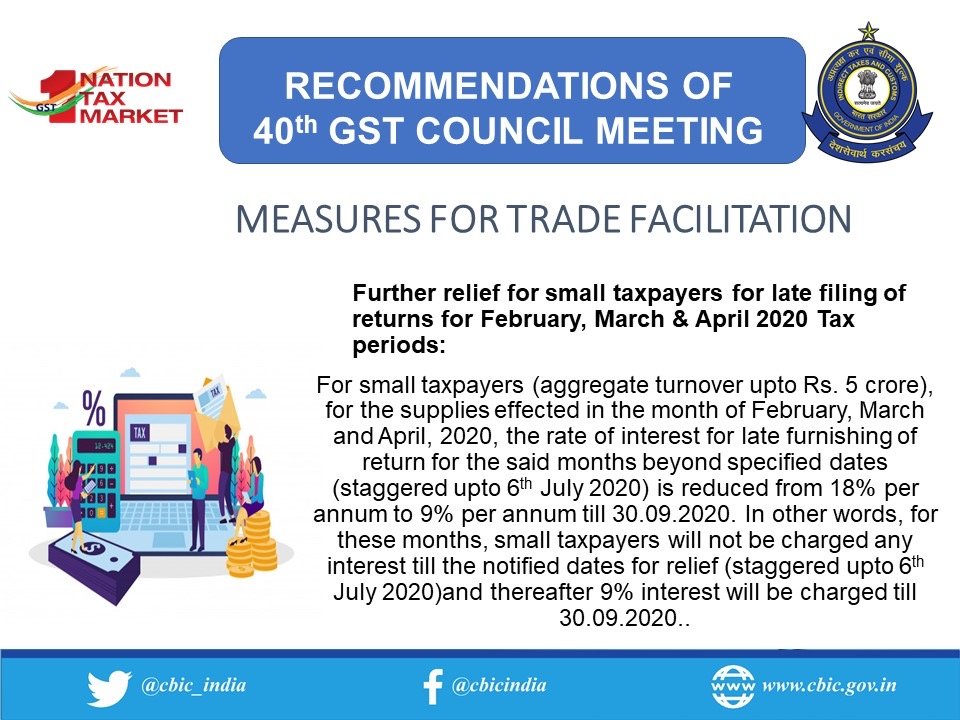

Further relief is being offered to small tax payers for late filing of returns for February, March and April 2020 (the #COVID19 period)

- Finance Minister #NirmalaSitharaman

- FM #NirmalaSitharaman

- FM #NirmalaSitharaman announces @GST_Council decisions

- FM @nsitharaman

Tax payers who could not get cancelled GST registrations restored in time are being given an opportunity to apply for revocation of cancellation of registration up to September 30, 2020

In all cases where registration has been cancelled till June 12, 2020

- @nsitharaman

A special one-agenda GST Council meeting will be held in July 2020 to discuss compensation cess, which has to be given to states, and who should pay for the borrowing, if required

- FM @nsitharaman, briefing on @GST_Council decisions

Correction of inversion of duties has been taken up in today's @GST_Council meeting as well

There has been a unanimity that inversion causes revenue generation problems and unexpected refunds, the question was when this is to be corrected

- FM @nsitharaman

While the principle regarding correction of inversion of duties has been agreed upon by everybody, the question of the right time to make the correction remained, hence this decision has been postponed, explains Finance Minister @nsitharaman

- FM @nsitharaman, briefing on 40th @GST_Council meeting decisions

@TexMinIndia @smritiirani

Before the introduction of formula-based sharing of IGST between centre and states, there was a huge accumulation of IGST from 2017-'18, which led to an ad hoc decision of sharing accumulated IGST in two halves. This anomaly had to be corrected.

- FM @nsitharaman

Here are the decisions taken by the Council

📗pib.gov.in/PressReleasePa… #GSTCouncilMeet #GSTCouncilMeeting