The story of how Masa Son of SoftBank got started is wild and kinda inspirational

At age 16 he moved to the US to graduate from high school and then enroll at Berkeley. He returned to Japan and founded Softbank in 1981. Here is a 1992 interview with him

hbr.org/1992/01/japane…

At age 16 he moved to the US to graduate from high school and then enroll at Berkeley. He returned to Japan and founded Softbank in 1981. Here is a 1992 interview with him

hbr.org/1992/01/japane…

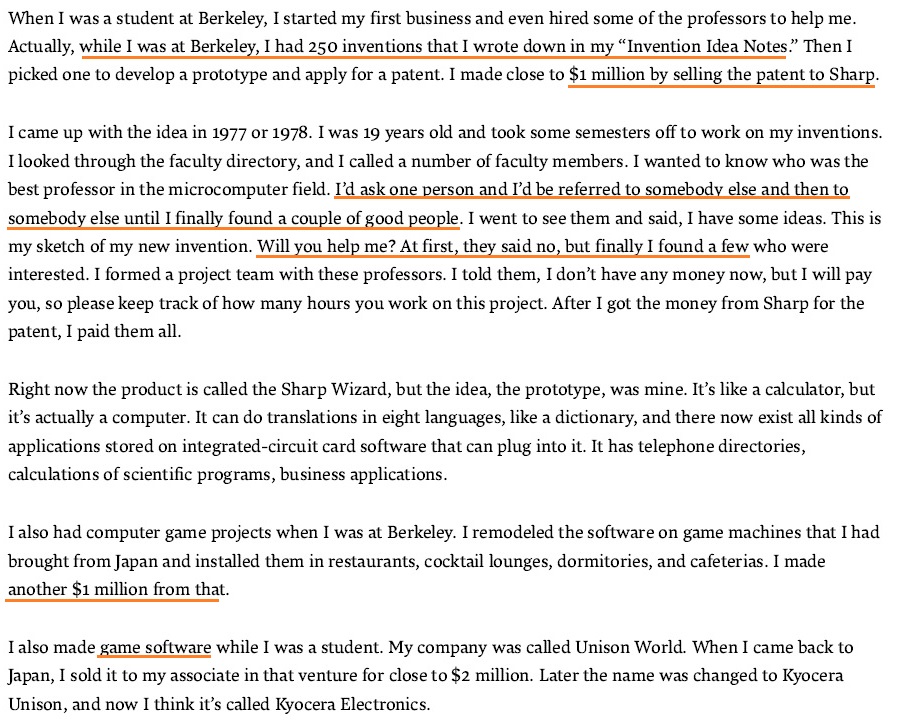

At Berkeley he keeps a journal with 250 invention ideas

He asks enough people until he finds professors willing to help him with his prototype. Which he then sells to Sharp for $1 million

That's not enough: he also imports game machines and writes software (another $3mm..)

He asks enough people until he finds professors willing to help him with his prototype. Which he then sells to Sharp for $1 million

That's not enough: he also imports game machines and writes software (another $3mm..)

He returns to Japan to research and plan

Has a matrix with "40 business ideas and 25 success measures"

Key criteria:

-Love the business for 50 years "at least"

"Choose one I would feel more and more excited about as the years passed"

-Unique

-Become number one

-Growing market

Has a matrix with "40 business ideas and 25 success measures"

Key criteria:

-Love the business for 50 years "at least"

"Choose one I would feel more and more excited about as the years passed"

-Unique

-Become number one

-Growing market

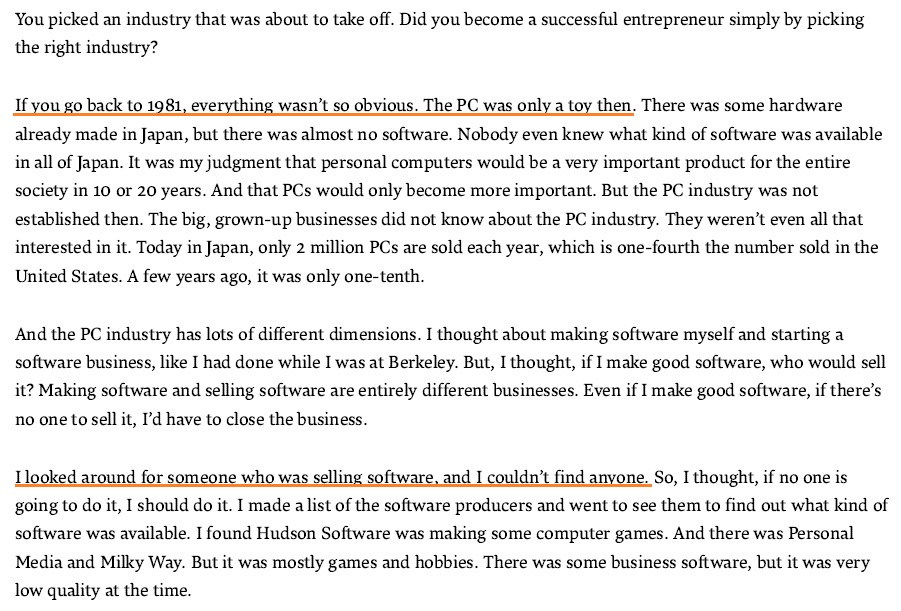

Starts SoftBank as a software distributor

"The PC was only a toy then"

"I looked around for someone selling software and I couldn't find anyone"

"I want to be the number one in the business of supplying wisdom and knowledge"

"The PC was only a toy then"

"I looked around for someone selling software and I couldn't find anyone"

"I want to be the number one in the business of supplying wisdom and knowledge"

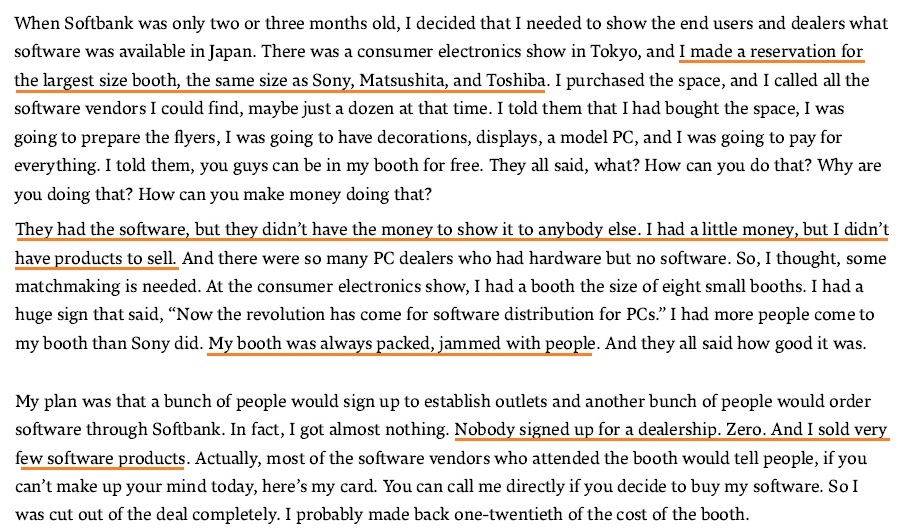

He's looking to make a splash and gets a huge booth at an electronics trade show

Software vendors had no marketing money, PC dealers had no software. "Some matchmaking is needed"

"My booth was jammed"

But he ended up with no sales

Software vendors had no marketing money, PC dealers had no software. "Some matchmaking is needed"

"My booth was jammed"

But he ended up with no sales

"People were laughing at me. He's a nice guy, but dumb"

"OK, I'm dumb. But I'm going to keep at it"

A few weeks after the show he gets a call. It's the third largest home electronics dealer. They need software for their new computer stores...

"OK, I'm dumb. But I'm going to keep at it"

A few weeks after the show he gets a call. It's the third largest home electronics dealer. They need software for their new computer stores...

The sheer guts

"I have little money, no product, nothing"

Except "the greatest enthusiasm and desire"

"The number one guy in software distribution is me. I have no evidence, but I strongly believe it"

"I'm going to get all the PC software that's available in Japan. Everything."

"I have little money, no product, nothing"

Except "the greatest enthusiasm and desire"

"The number one guy in software distribution is me. I have no evidence, but I strongly believe it"

"I'm going to get all the PC software that's available in Japan. Everything."

• • •

Missing some Tweet in this thread? You can try to

force a refresh