Newsletter is out.

Investors aspire to be "learning machines." Yet we get emotionally attached to the ideas that made us successful, they become part of our identity.

A beginner's mind is rare because it is uncomfortable to question the assumptions on which our success rests.

Investors aspire to be "learning machines." Yet we get emotionally attached to the ideas that made us successful, they become part of our identity.

A beginner's mind is rare because it is uncomfortable to question the assumptions on which our success rests.

Which is why I have a lot of respect for people who reinvent themselves.

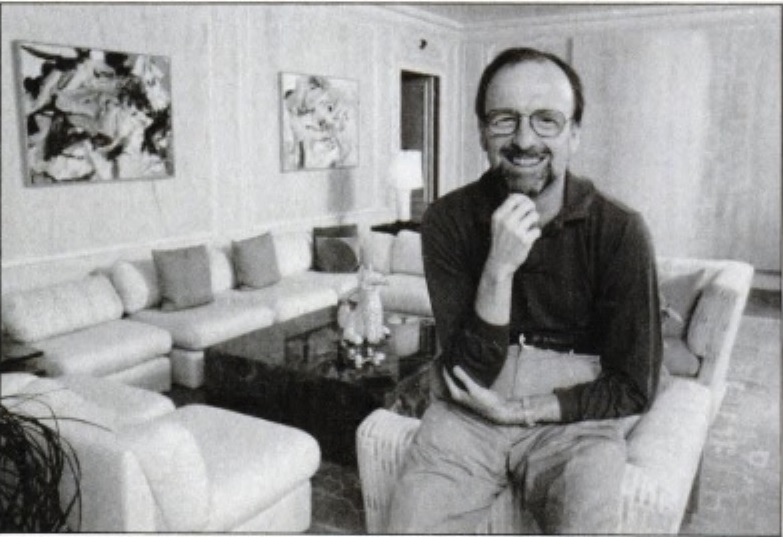

One of my favorite examples is Barry Diller’s descent from the pinnacle of Hollywood into the "new world" of interactive TV and later the internet.

One of my favorite examples is Barry Diller’s descent from the pinnacle of Hollywood into the "new world" of interactive TV and later the internet.

Diller rose rapidly in Hollywood: from the mailroom of the William Morris agency to ABC where he spearheaded made-for-TV movies.

He was picked by Charlie Bluhdorn to run their Paramount Pictures studio. Then he ran Fox for Rupert Murdoch.

He was picked by Charlie Bluhdorn to run their Paramount Pictures studio. Then he ran Fox for Rupert Murdoch.

But Diller wanted to be an owner.

He felt the world was about to change - but he didn't know how. He needed to learn.

He taught himself how to use an Apple PowerBook and set out on a road trip (well, really a private plane trip) to meet Steve Jobs, Bill Gates, John Malone.

He felt the world was about to change - but he didn't know how. He needed to learn.

He taught himself how to use an Apple PowerBook and set out on a road trip (well, really a private plane trip) to meet Steve Jobs, Bill Gates, John Malone.

This was in the pre-internet days. @pmarca:

“Believing in the whole idea of the Internet was pretty contrarian back then. The dominant metaphor was the information superhighway. People saw advantages to more information. At some point we got 500 TV channels instead of 3"

“Believing in the whole idea of the Internet was pretty contrarian back then. The dominant metaphor was the information superhighway. People saw advantages to more information. At some point we got 500 TV channels instead of 3"

Diller gravitated to the cable titans. “Everything blew my mind.”

“You find that people in the leadership of cable are students of technology and spend vast amounts of time and capital thinking issues through.”

“You find that people in the leadership of cable are students of technology and spend vast amounts of time and capital thinking issues through.”

His future wife Diane von Fürstenberg was selling a line of clothing on a new shopping channel called QVC. Diller tagged along to see her in action. Watching the phones ring he had an epiphany.

“I had only known screens for narrative storytelling purposes. Here I saw a screen being used at this primitive convergence of telephones, televisions and computers.”

“I thought, this is going to change things. I did not know how or where or why, but I knew that interactivity at scale, which was what I was watching, was going to be powerful.”

He joined QVC, a move his friends didn't understand. David Geffen: “Barry’s had one of the most unusual careers of anybody in America. When he decided he was going to take over QVC I was shocked. I didn’t think that was good enough, or big enough, or important enough.”

Not that Diller cared. “All they care about is status. That's why they can't understand why I'm doing this. They say 'It's not very glamorous.’”

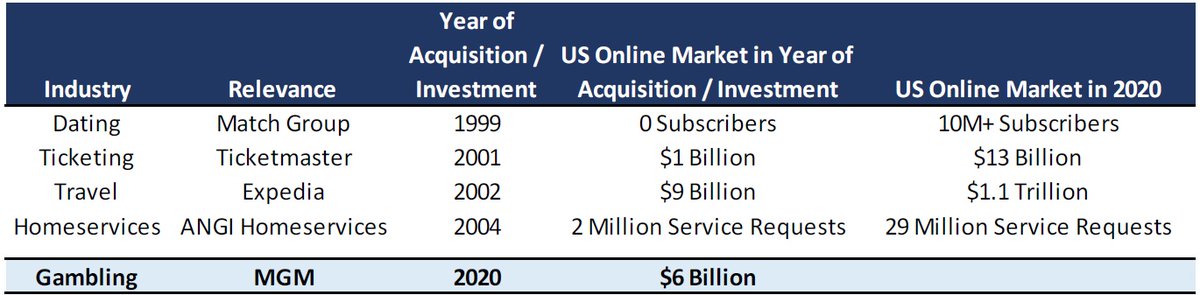

The path to IAC wasn't straightforward. After a failed bid for Paramount Diller left QVC and started again at a small outfit called Silver King Broadcasting. It took years of dealmaking for him to acquire assets in areas such as travel, dating, ticketing.

“Interactivity, the Internet, allowed scale and leverage. The next thing that came up was Ticketmaster, which had scale and leverage properties that I recognized. I made a relationship between the two in my mind. But all of it was opportunistic. None of it was strategic.”

“The course of my life has been curiosity and serendipity. I didn't have a single thought in my head other than, I don't know what this is, but I'm fascinated by it and I want to learn it.”

Here you can find my full piece about Diller's road trip, the challenge of retaining an open mind, and one of my favorite scenes from True Detective.

neckar.substack.com/p/barry-diller…

neckar.substack.com/p/barry-diller…

"People get stuck as they get older. Our minds are electrochemical computers. You are really etching chemical patterns. In most cases, people get stuck in those patterns, just like grooves in a record. There are some people who are innately curious,but they’re rare” Steve Jobs

• • •

Missing some Tweet in this thread? You can try to

force a refresh