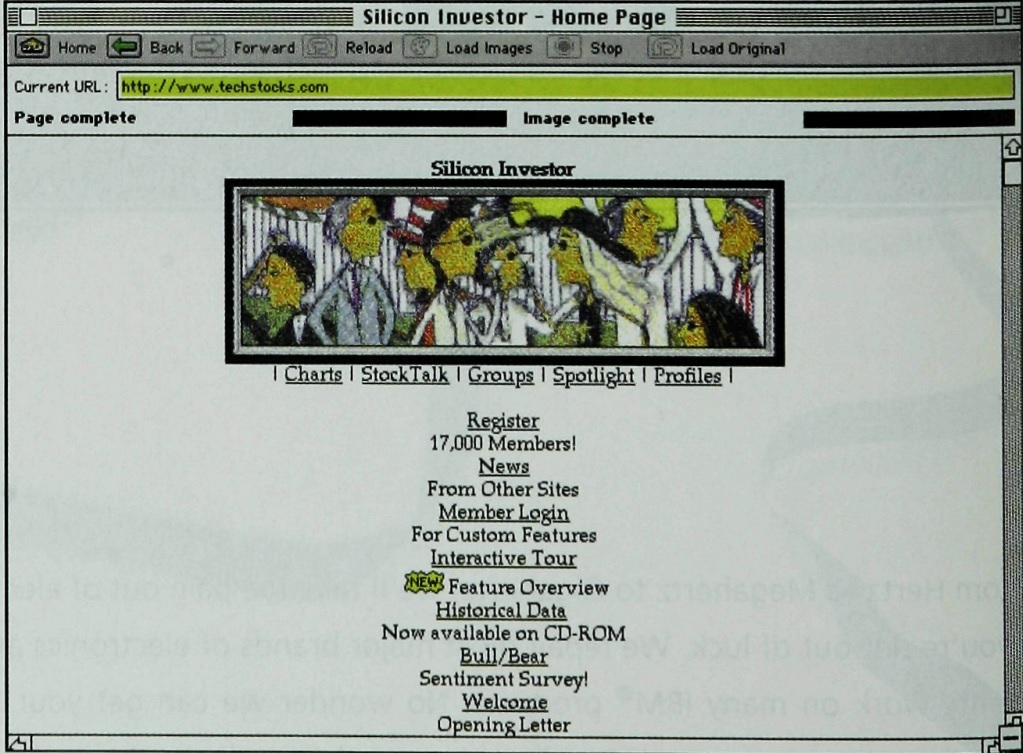

Some notes from the book Dot.con "How America Lost Its Mind and Money in the Internet Era," a play-by-play of the dotcom bubble.

Written in 2003 the pessimism around the web is striking in hindsight.

"Online economy... grossly exaggerated. Internet not a disruptive technology"

Written in 2003 the pessimism around the web is striking in hindsight.

"Online economy... grossly exaggerated. Internet not a disruptive technology"

"Most internet startups failed because they were based on the mistaken premise that the internet represented a revolutionary new business model, which it didn't." Oof.

"Any retailer is basically a distributor. And arduous and costly operation."

"Any retailer is basically a distributor. And arduous and costly operation."

Yes, there were bears. But many had been bearish long before the actual bubble took off.

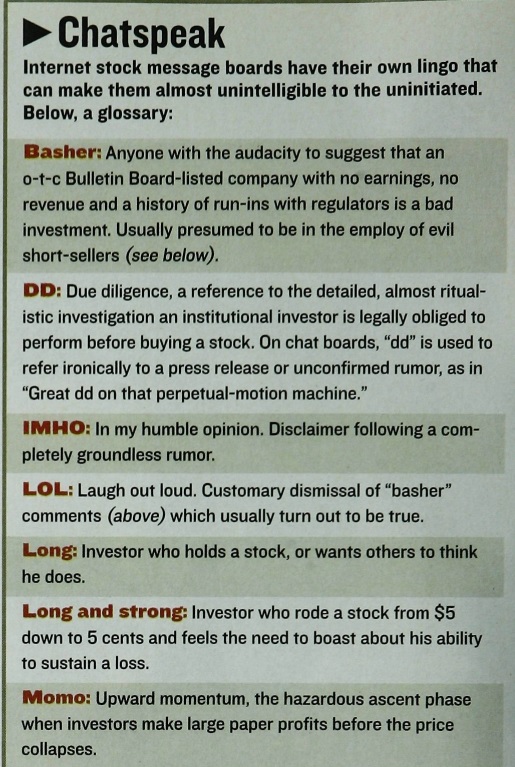

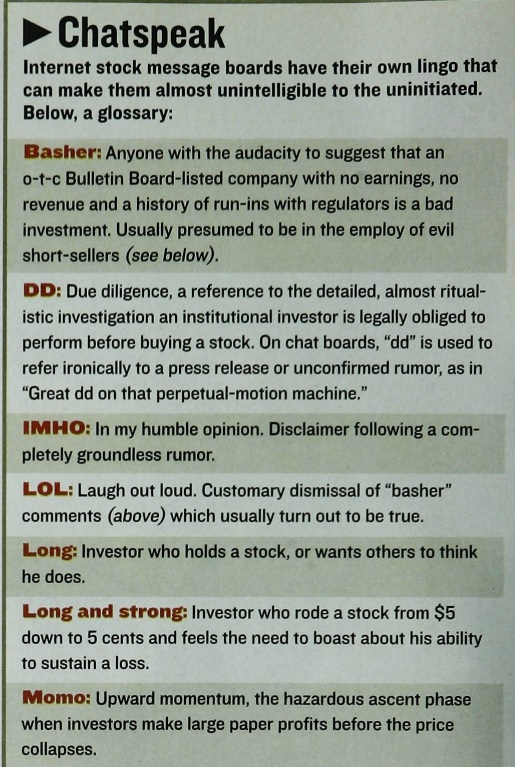

"You've got companies going public that don't even have earnings."

"Everybody is tired of being bearish and wrong. Clients don't want to raise cash."

"You've got companies going public that don't even have earnings."

"Everybody is tired of being bearish and wrong. Clients don't want to raise cash."

Bears also lost their jobs.

"Amazon, the the single most expensive piece of equity, ever" - "resigned" and moved to "Wit Capital, an online brokerage"

Replaced by "Amazon's valuation is more art than science" Blodget

"Amazon, the the single most expensive piece of equity, ever" - "resigned" and moved to "Wit Capital, an online brokerage"

Replaced by "Amazon's valuation is more art than science" Blodget

"We are seeing the second generation of Internet entrepreneurs, and they have market cap envy of the Jerry Yangs and Marc Andreessens."

"Well, if he's a billionaire, then I've gotta be a billionaire, too."

"Well, if he's a billionaire, then I've gotta be a billionaire, too."

"The overall internet phenomenon may well be a 'bubble,' but... there are great fundamental reasons to own these stocks. The companies underneath these stocks are (1) growing amazingly quickly, and (2) threatening the status quo in multiple sectors of the economy."

“When Yahoo! went public, it looked like the biggest joke in history—a list of Web sites with $1 million in revenue and a $1 billion valuation. But it was actually trading at an absurdly cheap 10X Q4 1998 annualized earnings."

Greenspan's lottery principle:

"People pay more for a claim on a very big pay-off, and that’s where the profits from lotteries have always come from. There is a lottery premium built into the prices of Internet stocks."

"People pay more for a claim on a very big pay-off, and that’s where the profits from lotteries have always come from. There is a lottery premium built into the prices of Internet stocks."

The book argues two factors ended the bubble: the Fed and the high cash burn rate that required sustained high prices to raise capital.

Greenspan joked traders should only be allowed to buy stock if they could identify the company's products😂

Greenspan joked traders should only be allowed to buy stock if they could identify the company's products😂

Barron's wrote about the cash burn and March-April 2000 was a bloodbath.

AOL held up because it was merging with Time Warner. As Rupert Murdoch said: “It was a brilliant piece of financial engineering. He jumped in and bought something with $6 billion in cash flow.”

AOL held up because it was merging with Time Warner. As Rupert Murdoch said: “It was a brilliant piece of financial engineering. He jumped in and bought something with $6 billion in cash flow.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh