Use Decentralized Exchanges to buy/sell tokens, then simply hold them in your wallet

Uses DeFi applications for a only a brief moment in time, limited attack surface, but avoid infinite token approvals!

@UniswapProtocol @KyberSwap @1inchExchange @DEXAG_TokenWire

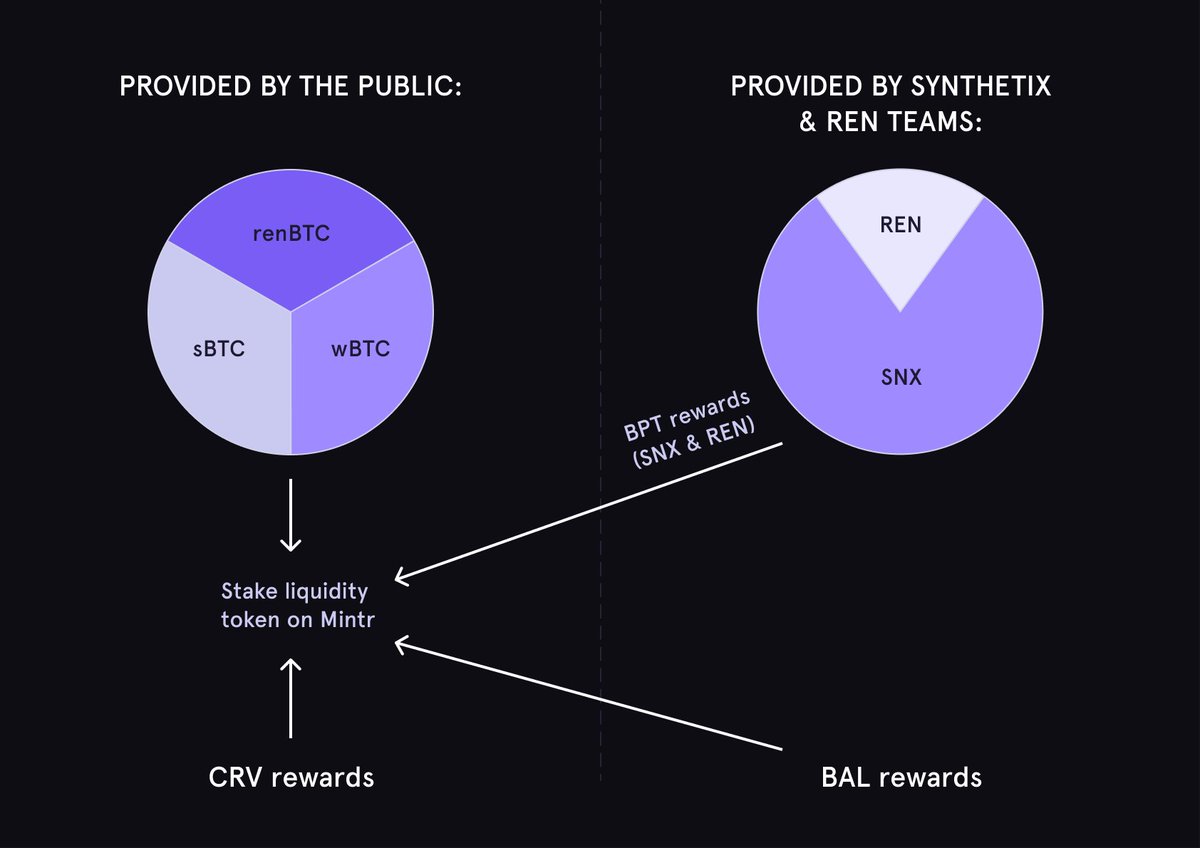

Lend tokens to a Money Market or Automated Market Maker and earn interest / trading fees

This and below have higher risk as your funds are held in a smart contract that may have an admin key or governance risk

@compoundfinance @AaveAave @CurveFinance @BalancerLabs

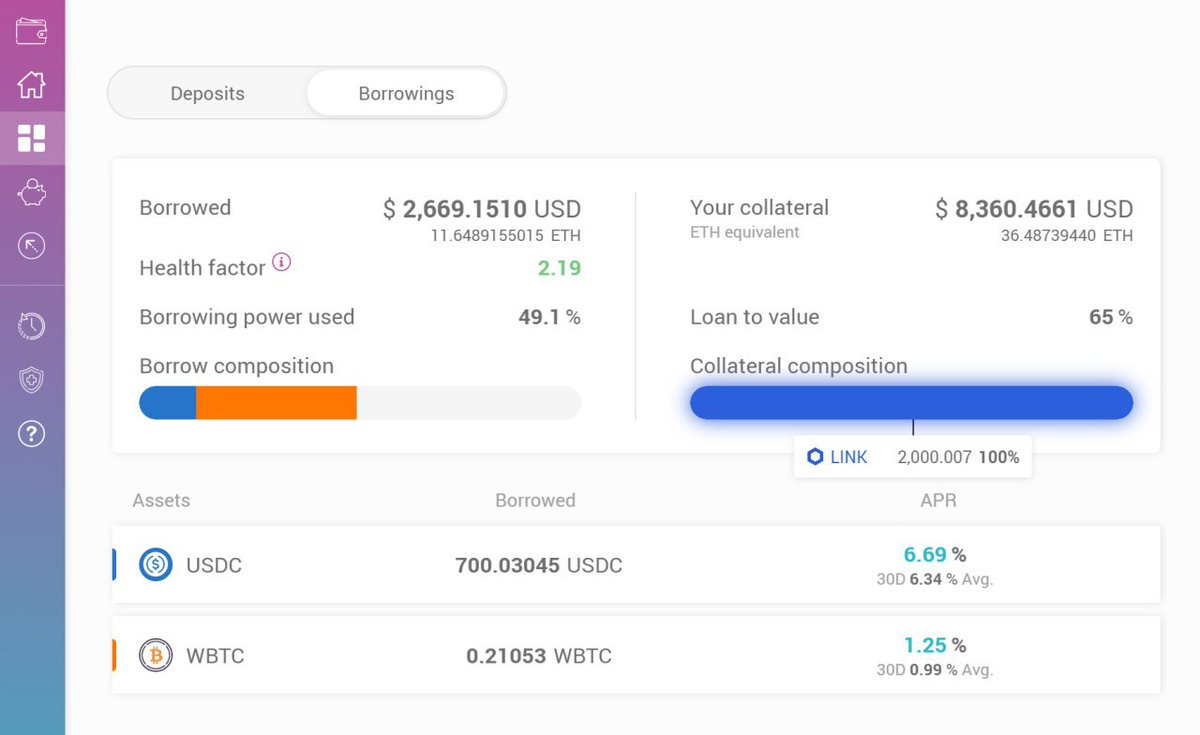

Deposit tokens to a money market to use as collateral for a loan to go leveraged long or hedge risk

Subject to liquidations if collateral drops in value and/or borrowing asset increase in value, includes price oracle risk

@MakerDAO @AaveAave @compoundfinance @futureswapx

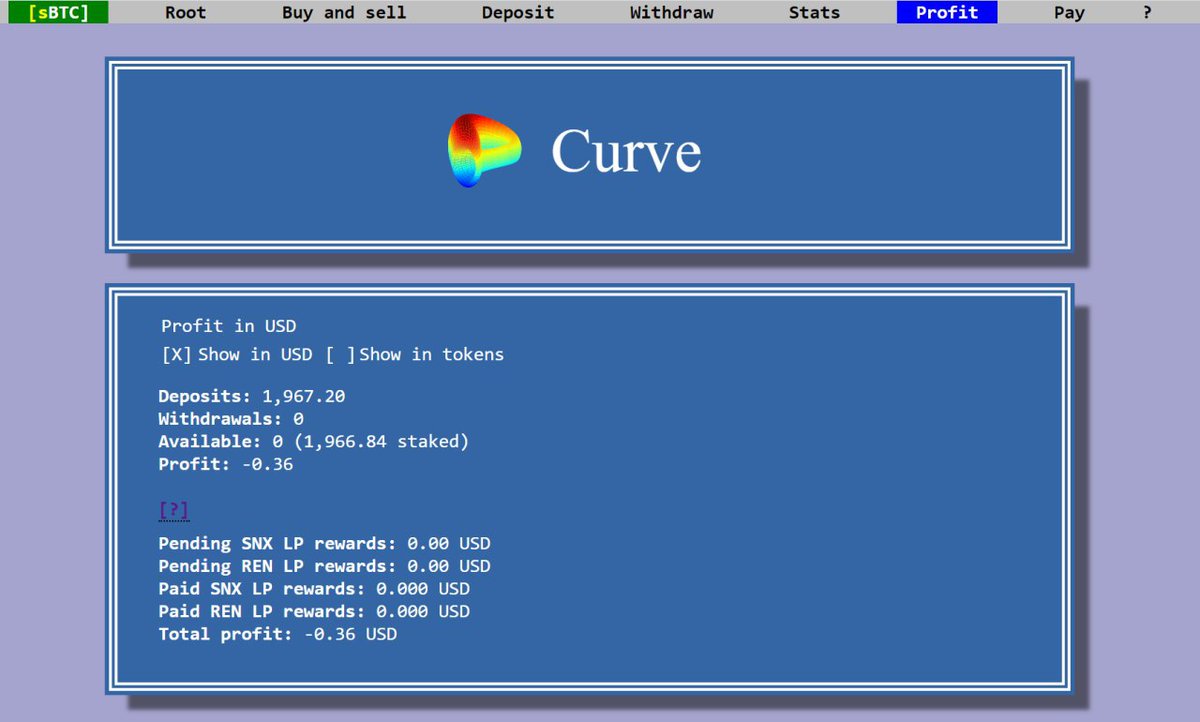

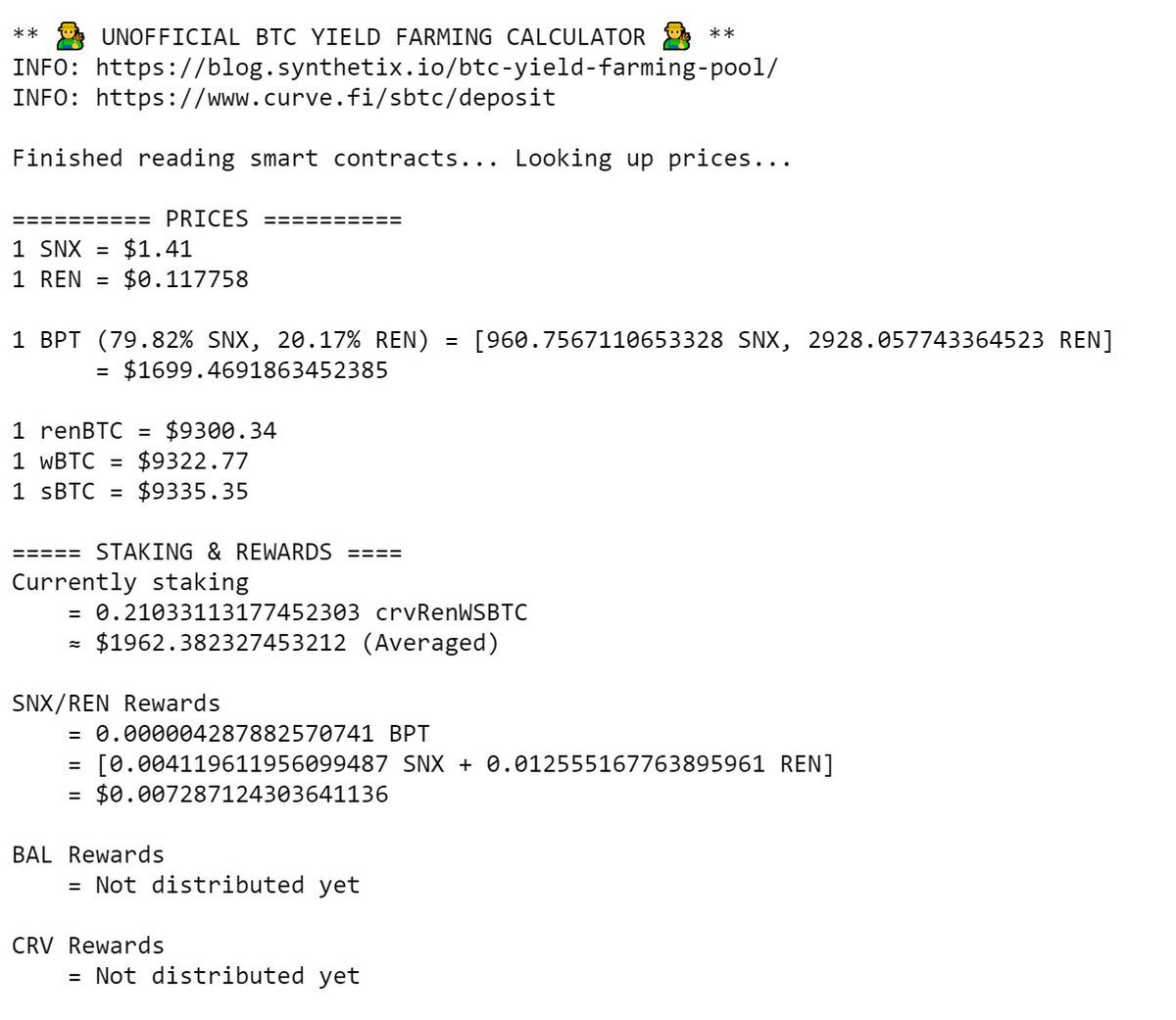

Full out degen yield farming mode, basically any of the yield farming threads I have been posting that uses six or more DeFi protocols/tokens at a time

Your risk increases proportionally to every additional exciting but unproven protocol used

Always do your own research

If you don't know what you're doing, take a step back, absorb info, process it, make a plan, then take a slow but steady approach

There is a reason the APYs are so high, these returns come with strings attached

This could all come crashing down at any moment because of poor oracle practices, weak security models, lack of audits, etc