I will be live tweeting. #TaxTwitter

Follow yourself here: dekamer.be/media/index.ht…

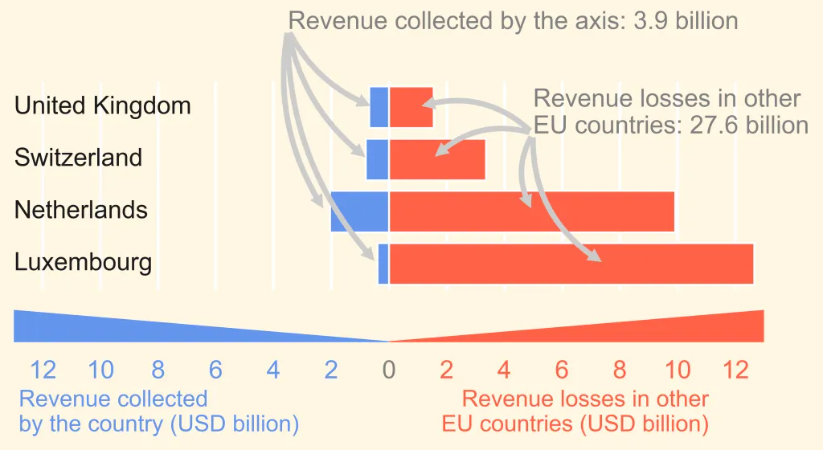

Belgium has defended so far a not too ambitious position. On pillar 2 it defends an extremely weak position. More below.

taxfoundation.org/patent-box-reg…

Public comments still allowed till 15th of July.

federalregister.gov/documents/2020…

Good to know is that Belgium is strongly considering to introduce a unilateral digital services tax.

Interestingly:

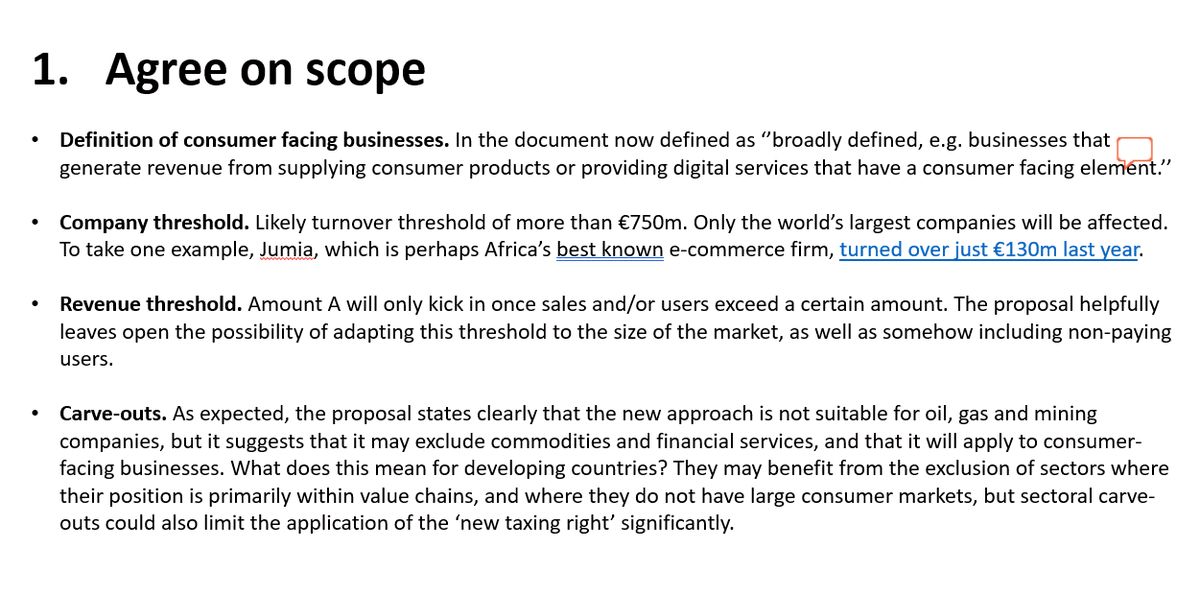

(-) Nexus is still under discussion. Threshold of 1-3 million sales. Linking with GDP seems hard for a relative nexus.

(-) Amount C still under heavy discussion.

(-) Less sectors will be excluded in pillar 2. But investment funds/vehicles will

(-) What is the best blending in pillar 2?

(-) Why does Belgium defend a weak position?

(-) Were there other scenarios calculated?

(-) BEPS 2.0 and COVID19?

(-) Will minimum tax lead to race to the bottom?

(-) Should BE go unilateral?

Johnson & Johnson exempted 1,4 billion EUR profits thanks to the Belgian patent box in 2018. Yes shocking.

(-) Why are rich countries against subject to tax rule knowing it is in the interest of developing countries?

(-) Should the EU act if the OECD fails?

(-) Out of scope but okay: why is the OECD blacklist so weak?

(-) Countries are sovereign. Yes. But all other countries are sovereign as well. I.e countries can tackle transactions to another leading to trade/tax wars. Tax cooperation is better than unilateralism.

(-) We have had a non-regulated globalisation.

(-) Technically we are very well advanced on pillar 2. There is a proposal by UK, Spain, Italy & France to find a final agreement.

(-) Threshold on 750 million EUR for pillar 2. A lot of profits (93%), little companies.

(-) Carve outs: OECD is looking into substance. Confirming the formulaic carve out proposal.

(-) No consensus needed in pillar 2! Watch out with vetos.

(-) Negotiations through zoom are hard. No ''coffee-breaks''.

(-) A tax war going into a trade war is not what the world economy needs.

(-) Understands frustration of not taxing digital giants, in particular now.

(-) Keeps on defending the patent box & FHTP carve-outs.

(-) Defends global blending. Arguments are not clear.

(-) Somehow BE wants simplicity but does defend carve-outs.🤪 Love it when conservatives defend the undefendable with weak arguments.

(-) Criticizes the idea of the subject to tax rule as it would disrupt cash flow of companies and it would make it hard to recover WHT back.

dekamer.be/kvvcr/media/in…