1) A Bollinger Band is an observation of historical REALIZED VOLATILITY above/below a simple moving average of the price trend. It's an adaptive trading band as it adjusts to volatility swings in price. We can see volatility is dynamic, not static, over time. THREAD:

2) Placing a channel of volatility above/below the price trend allows us to see if prices are high/low on a relative basis. By definition, the price is HIGH at the UPPER band and the price is LOW at the LOWER band. The odds are best when the price trends outside the range.

3) Here I used Netflix as an example. Euphoria drove its price WAY above its *normal* range, suggesting the outlier move was likely to retract back to a normal range. That is, the "price was high" and while momentum is good, when it's too good it's prone to fail.

4) ... and it did.

It's probabilistic, never a sure thing, but price has indeed declined -11% since to get it driving back inside the normal trading range. In fact, it's right back to its 20-day average price.

It's probabilistic, never a sure thing, but price has indeed declined -11% since to get it driving back inside the normal trading range. In fact, it's right back to its 20-day average price.

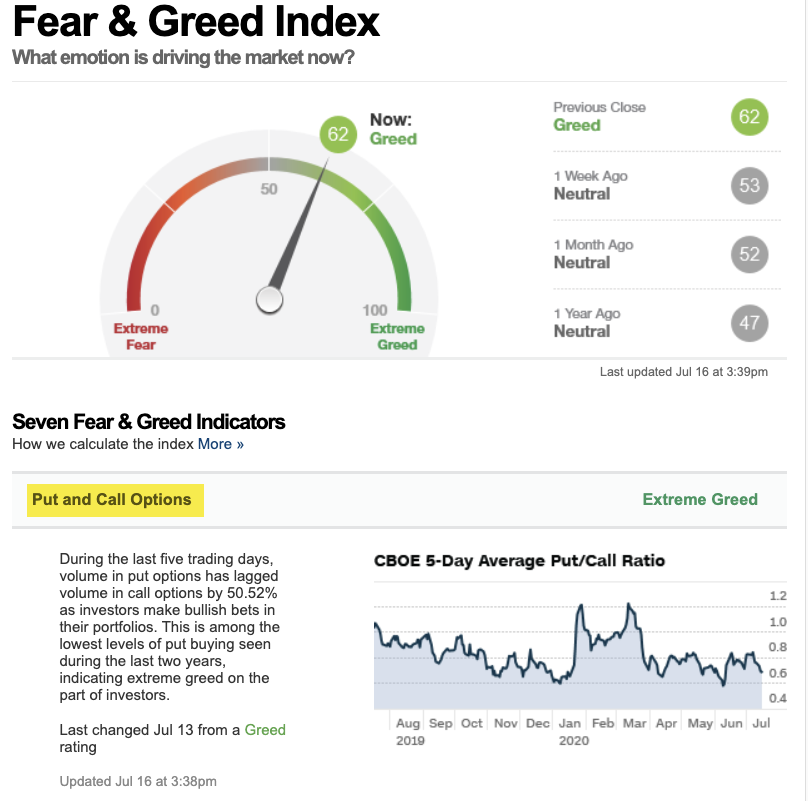

5) ... again, it's probabilistic, never a sure thing, but we can stack the odds in our favor by understanding price action, trends, momentum, and volatility. When we see prices are spreading out too much, higher/lower, we can increase/decrease exposure, hedge, and such.

6) Neither I nor my firm/clients directly owns shares of at this time, but if I did, I may have reduced exposure, or hedged by selling calls or buying puts, around July 10-11th when it trended above a normal range.

7) Such a volatility expansion may have triggered a decision point. I may have explored such options as this:

1. Selling shares to reduce/eliminate exposure to a price decline.

2. Selling call options if the premium received + call price is sufficient.

3. Buying puts.

1. Selling shares to reduce/eliminate exposure to a price decline.

2. Selling call options if the premium received + call price is sufficient.

3. Buying puts.

8) ... and deciding which choice to go with depends on the relative value of the put/call options, which is determined by relative values between their implied volatility and historical vol, and such. To me, these are the kind of alternatives that make active, active.

9)

4. We could stop and reverse; sell, sell short.

I always say "the exit, not the entry, determines the outcome" and these are just some examples of alternative ways we determine how to exit or reduce exposure to the possibility of loss. I hope it helps.

-end.

4. We could stop and reverse; sell, sell short.

I always say "the exit, not the entry, determines the outcome" and these are just some examples of alternative ways we determine how to exit or reduce exposure to the possibility of loss. I hope it helps.

-end.

• • •

Missing some Tweet in this thread? You can try to

force a refresh