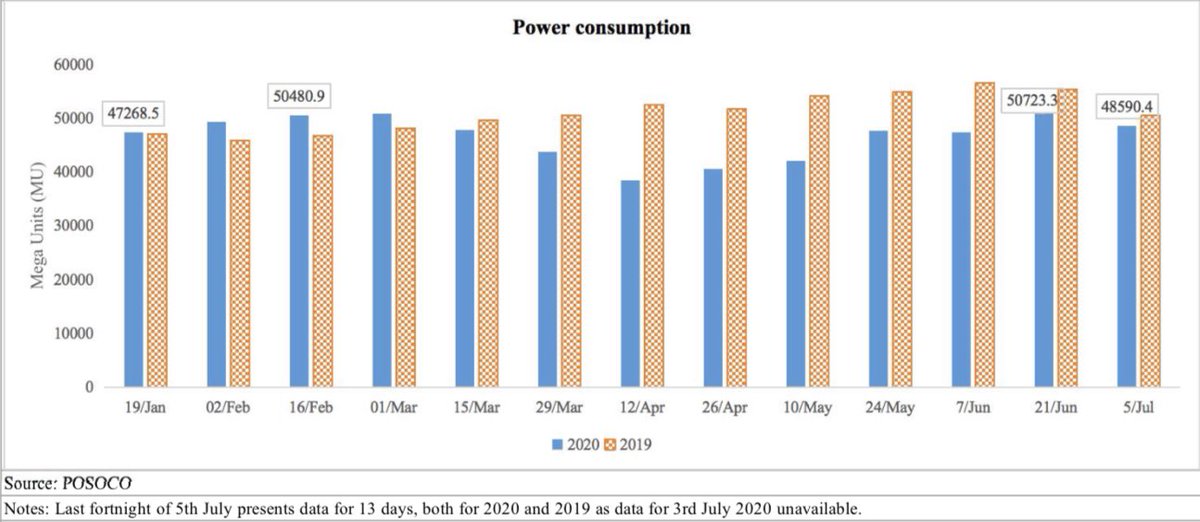

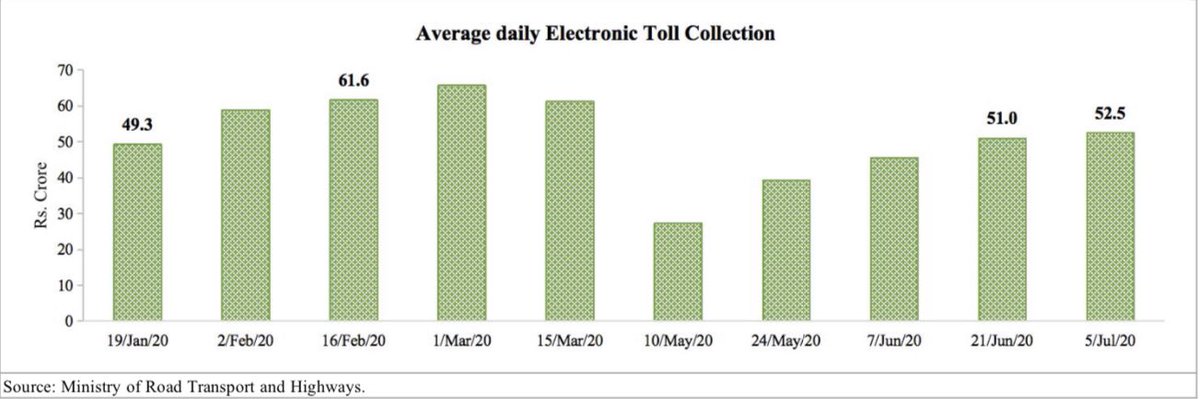

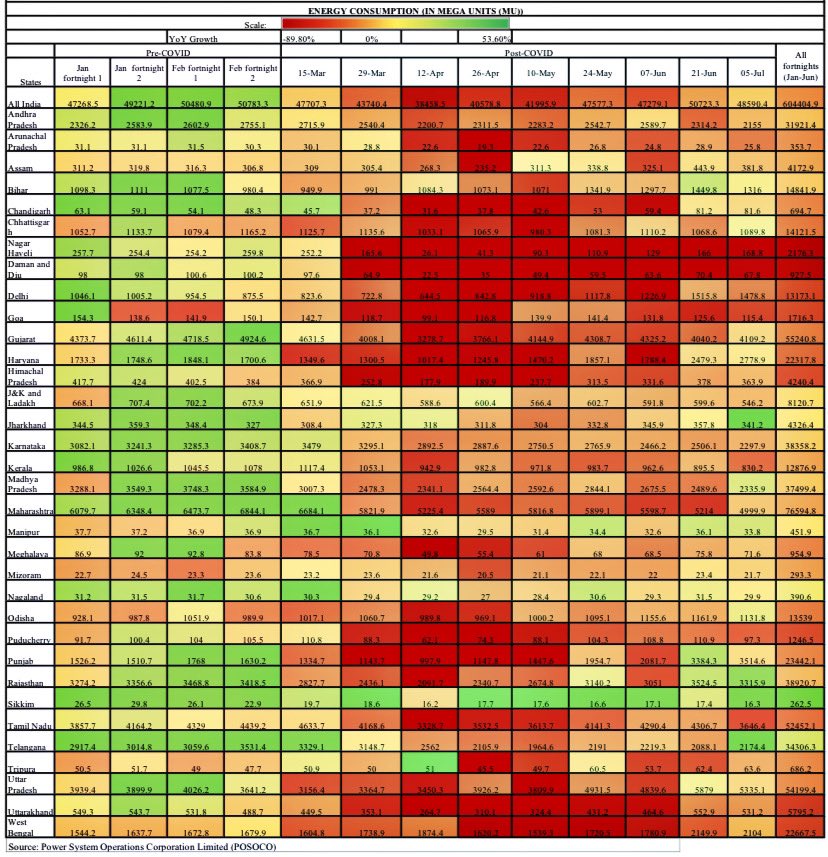

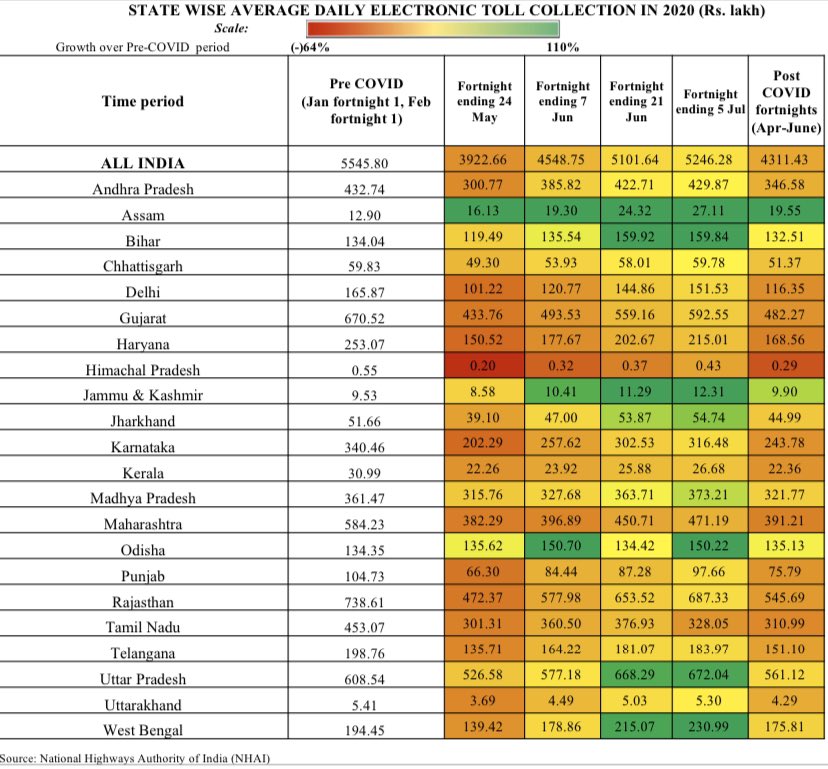

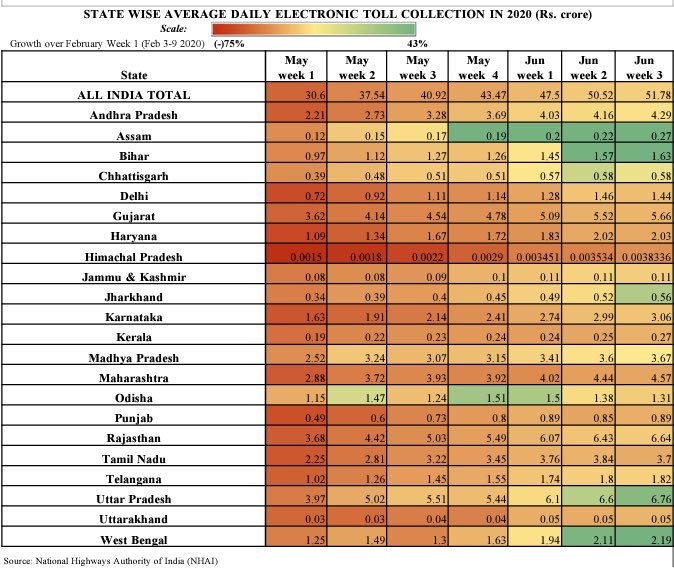

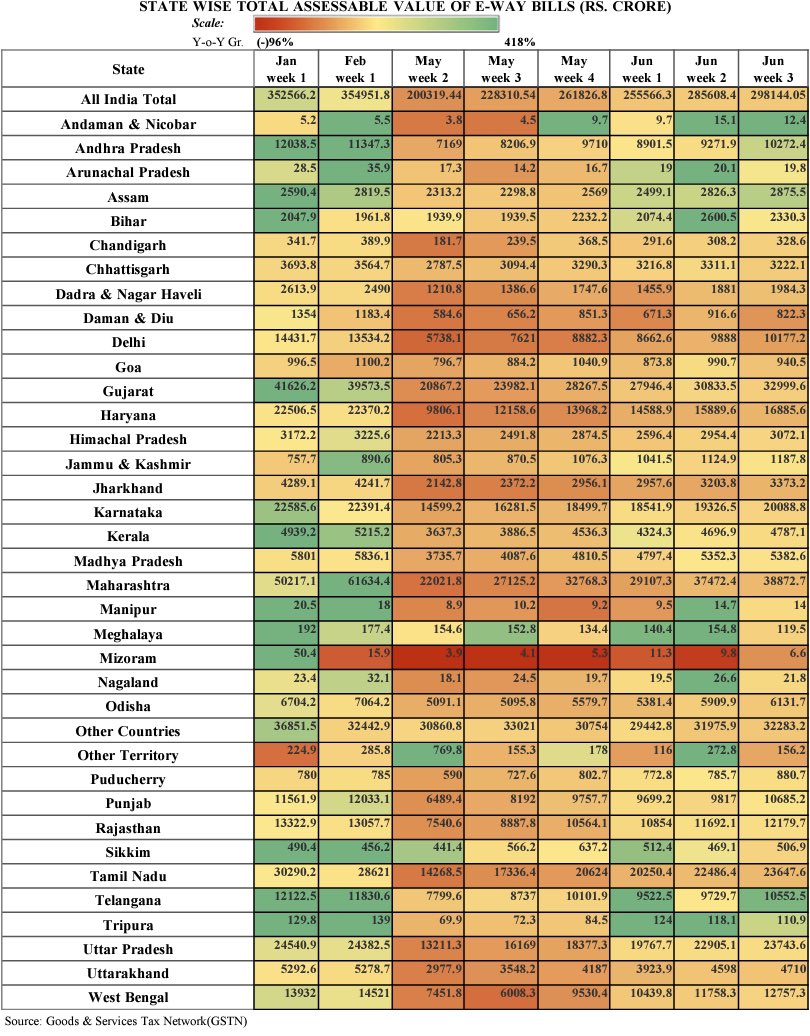

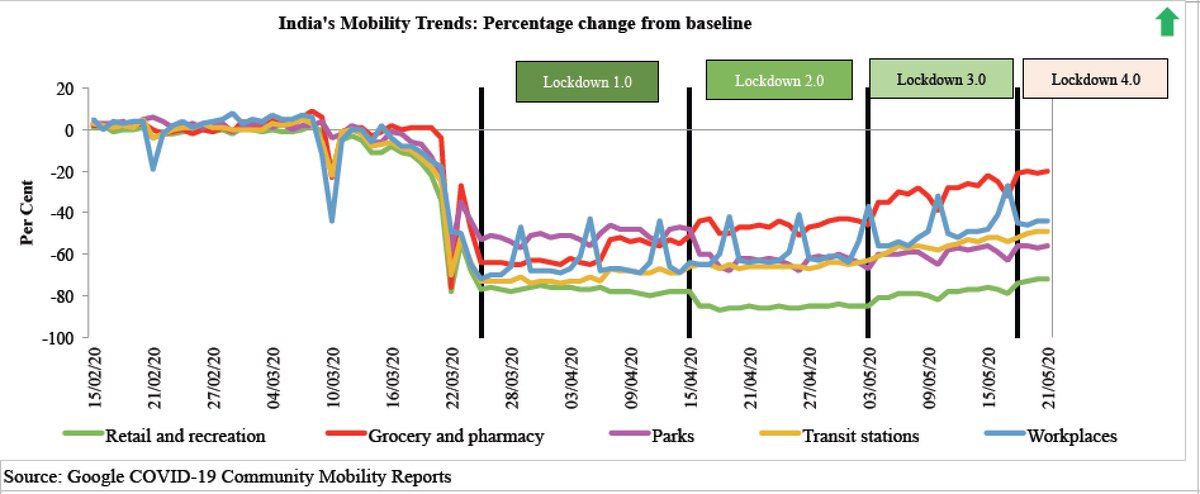

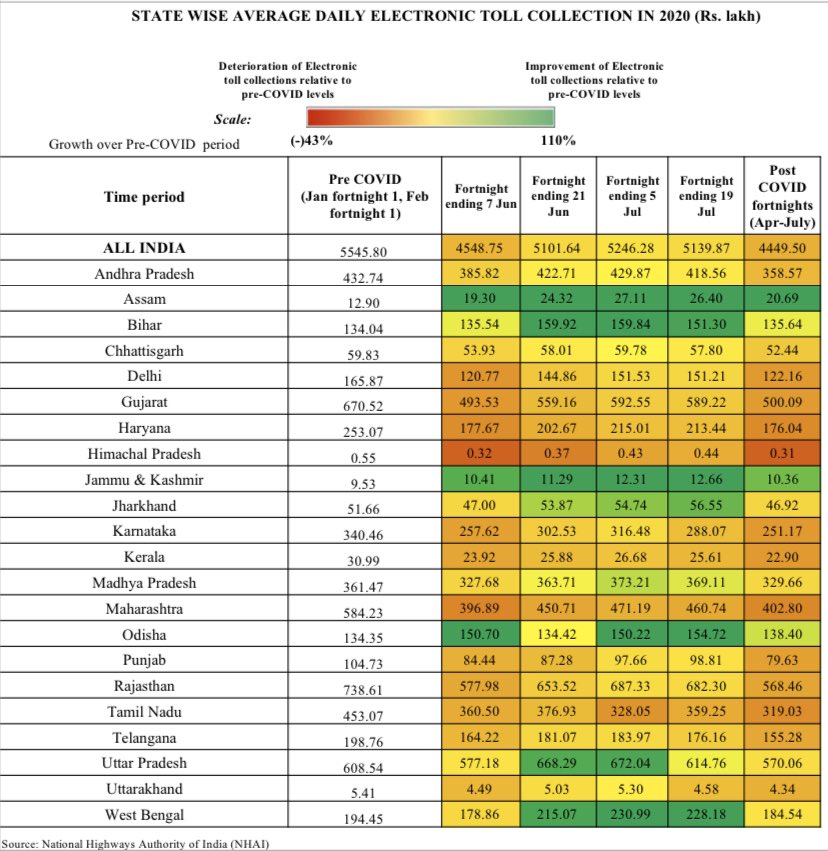

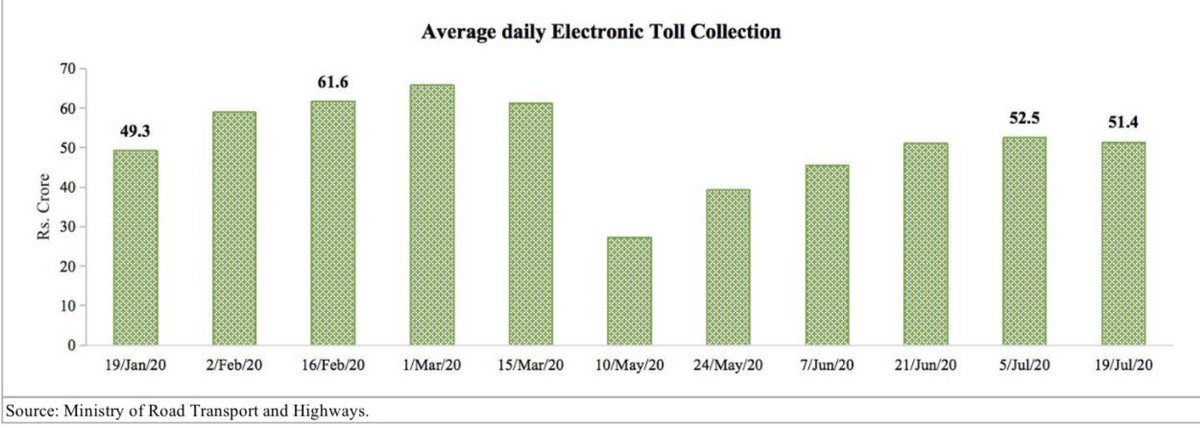

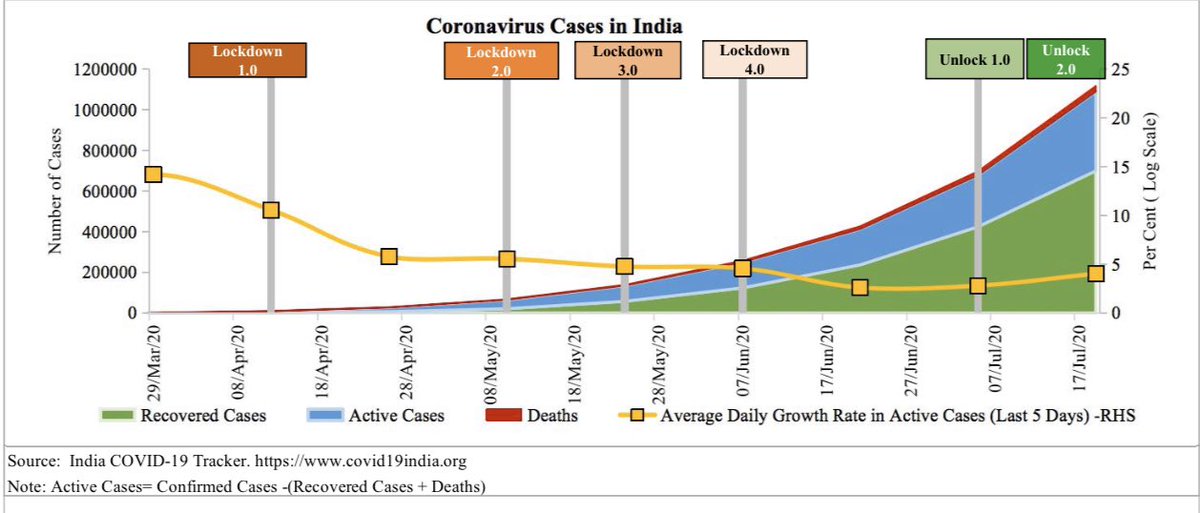

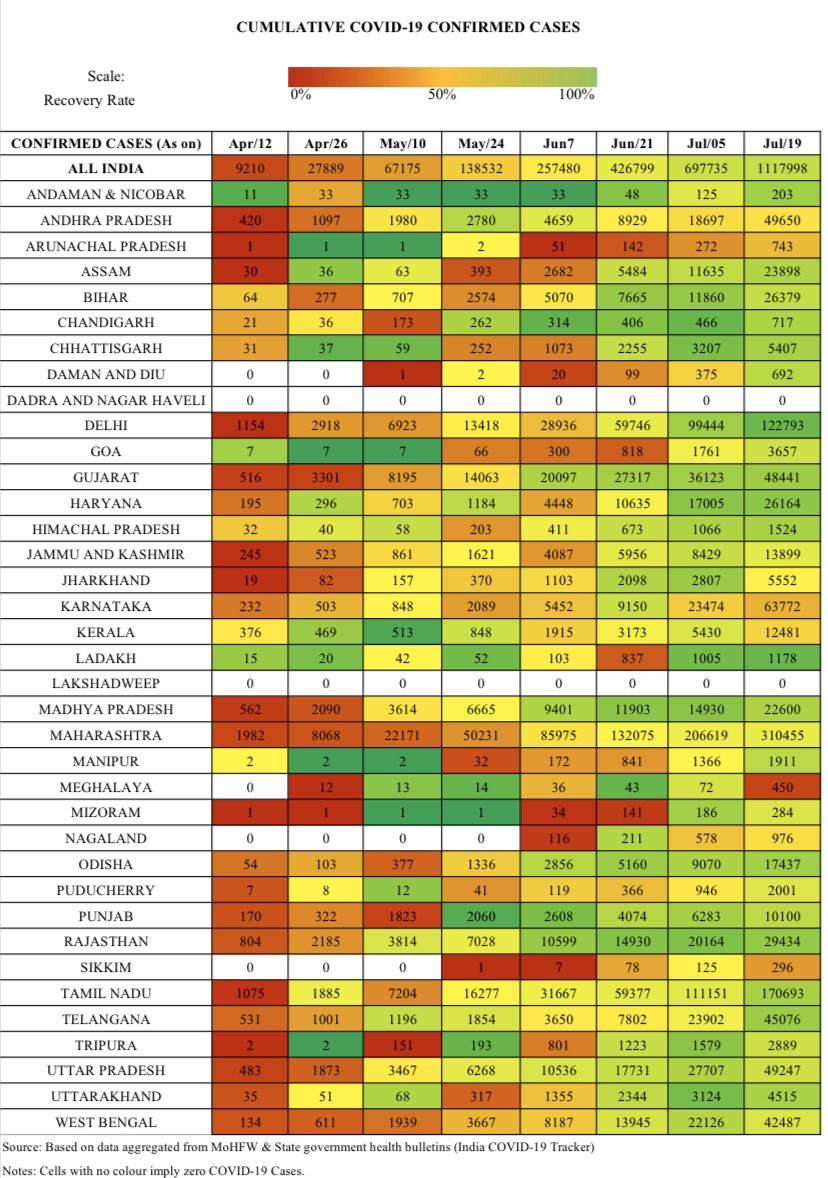

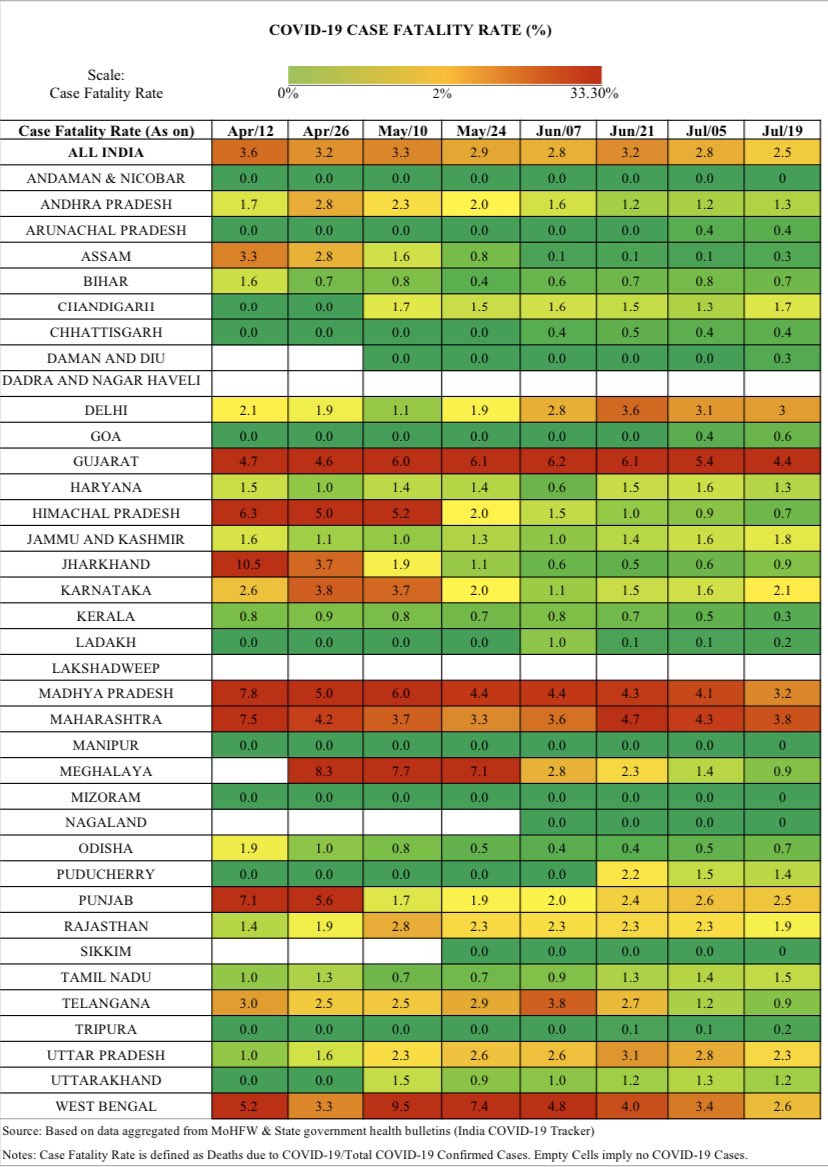

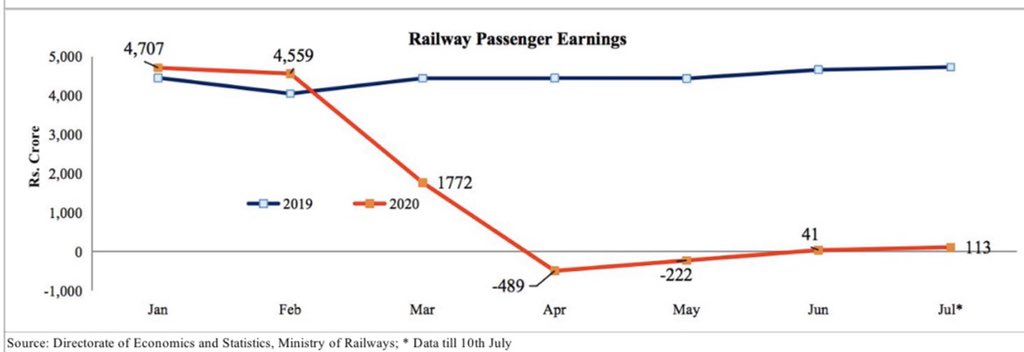

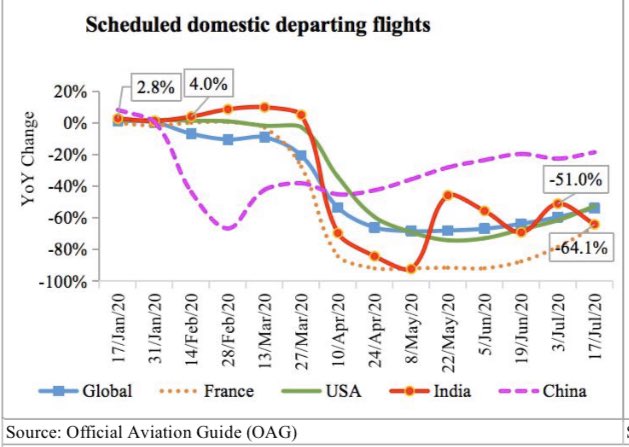

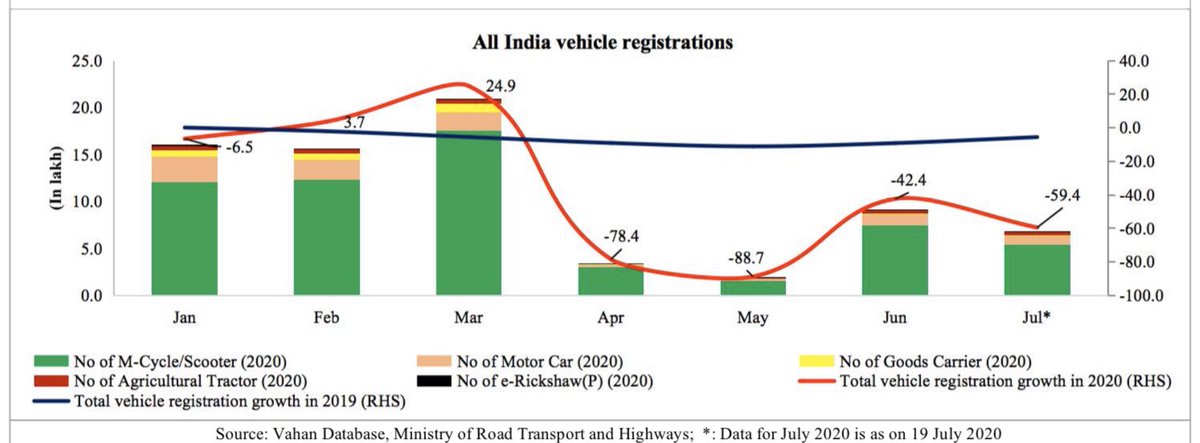

Tentative real activity stabilisation amid re-emerging state lockdowns and monsoons

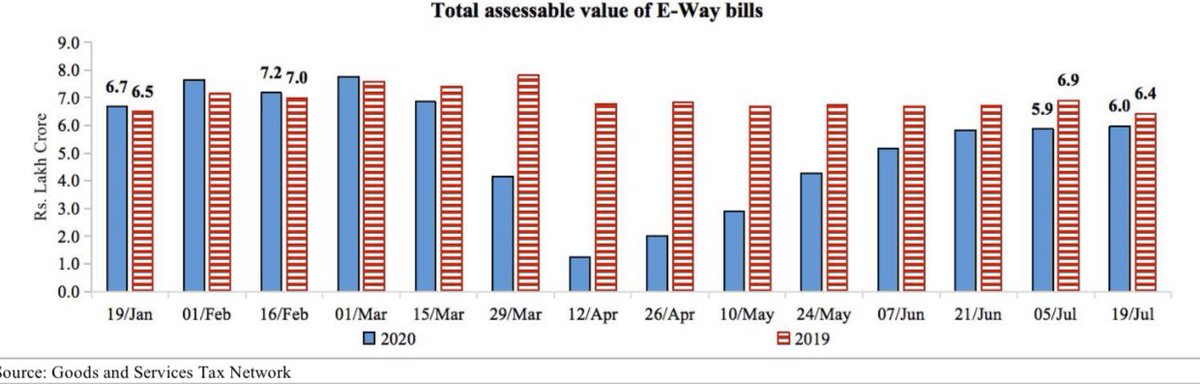

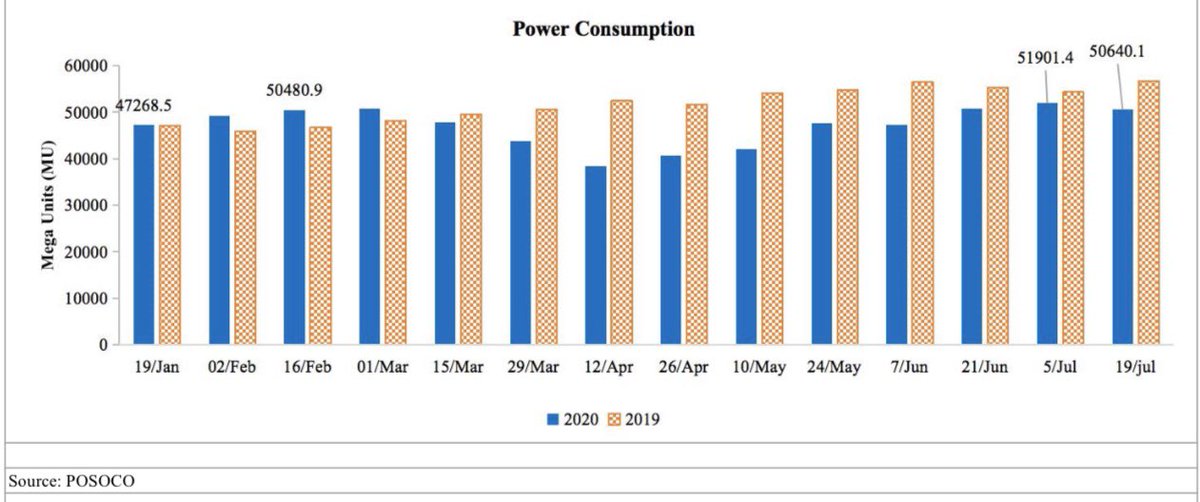

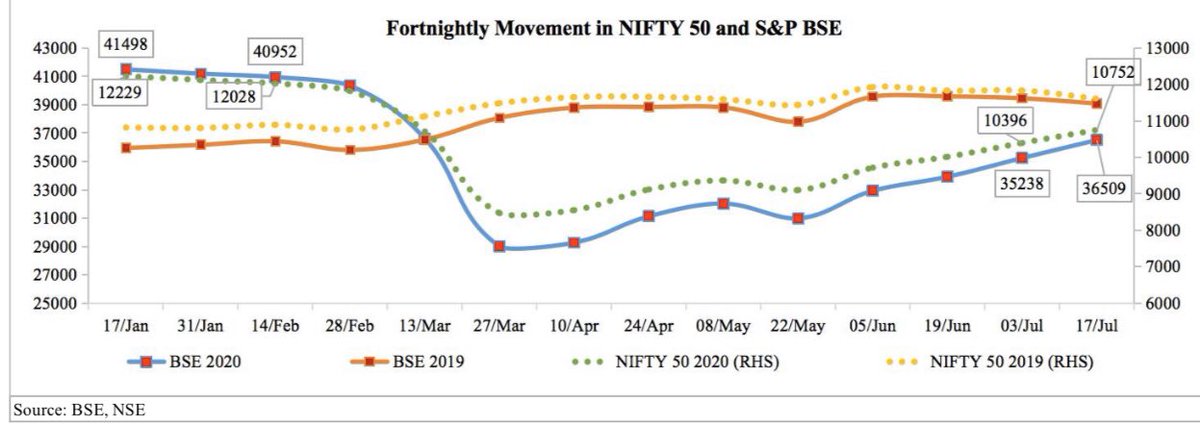

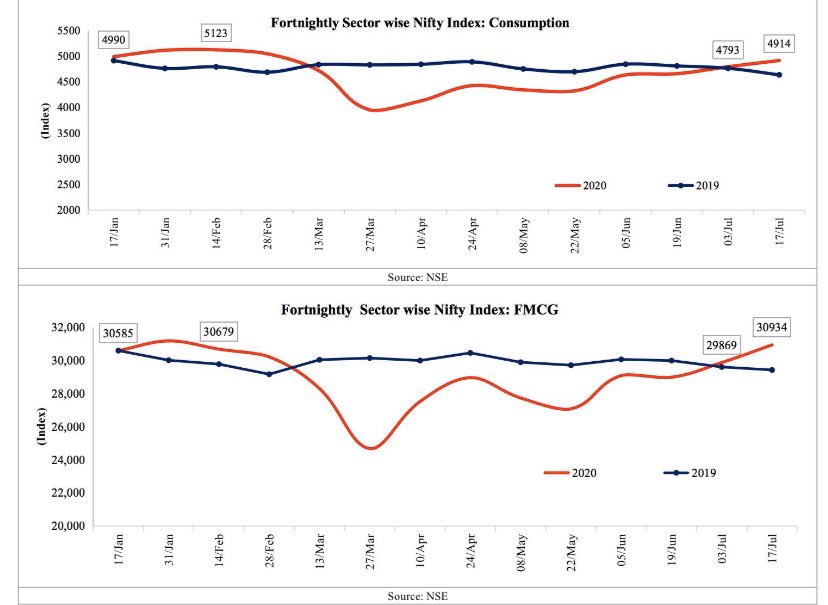

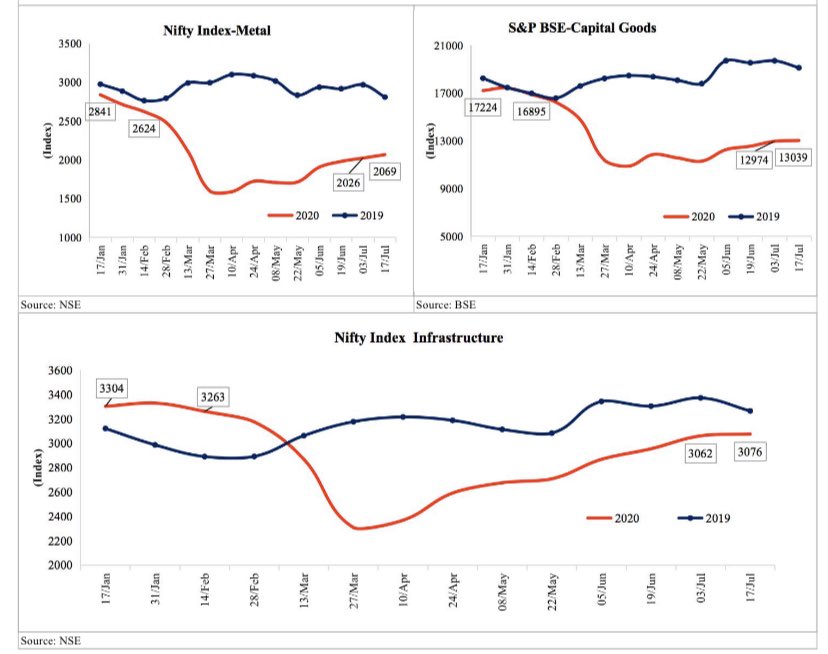

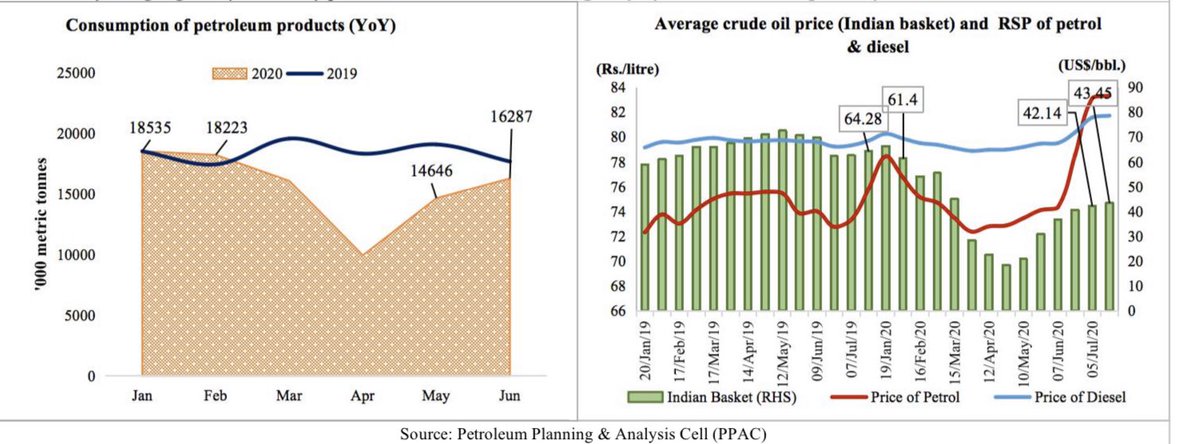

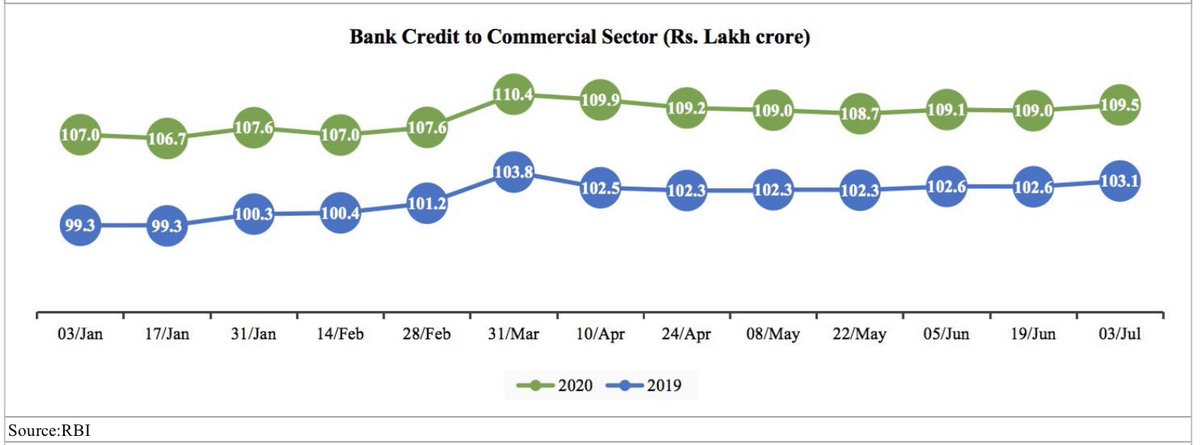

Inching previous year levels. Upbeat growth of consumption stocks.

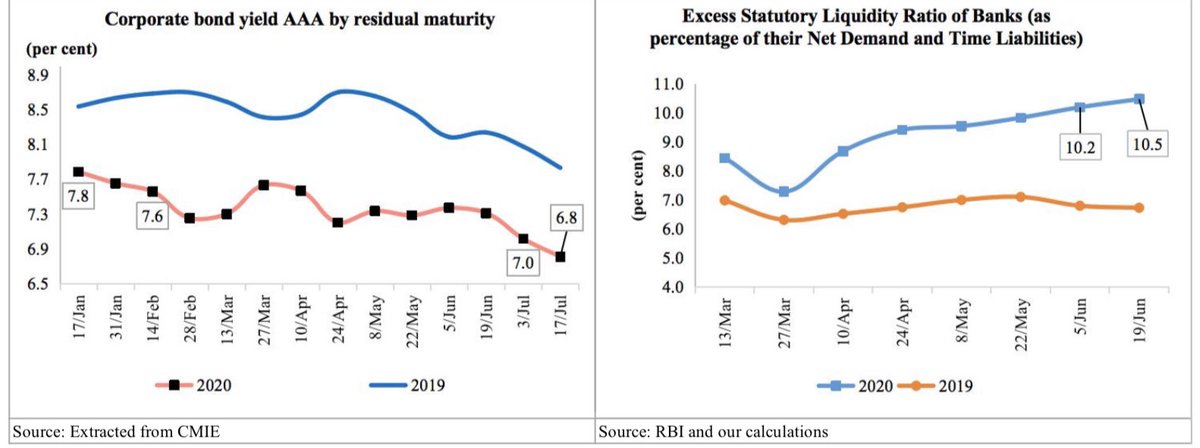

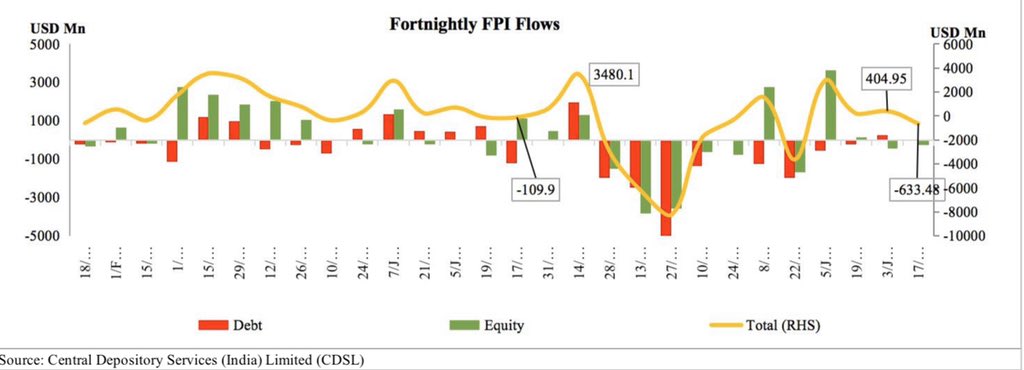

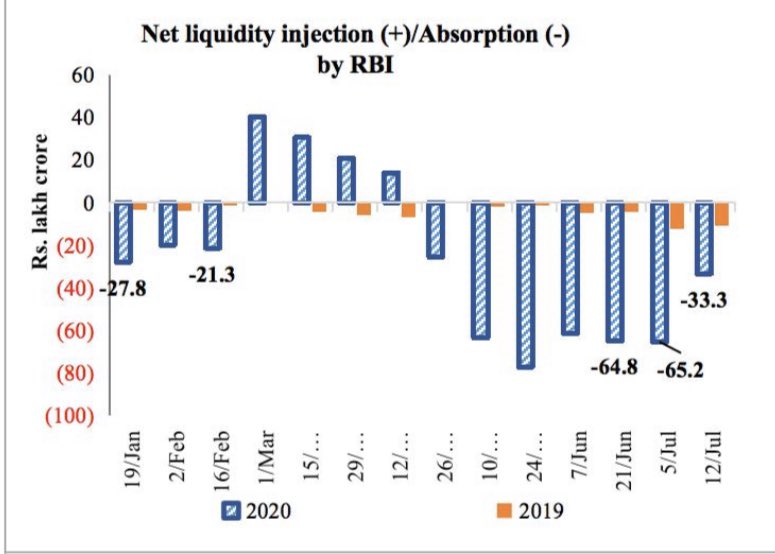

Corporate bond yields easing, on average, for 3 consecutive fortnights on account of RBI’s TLTROs. @tulsipriya_rk