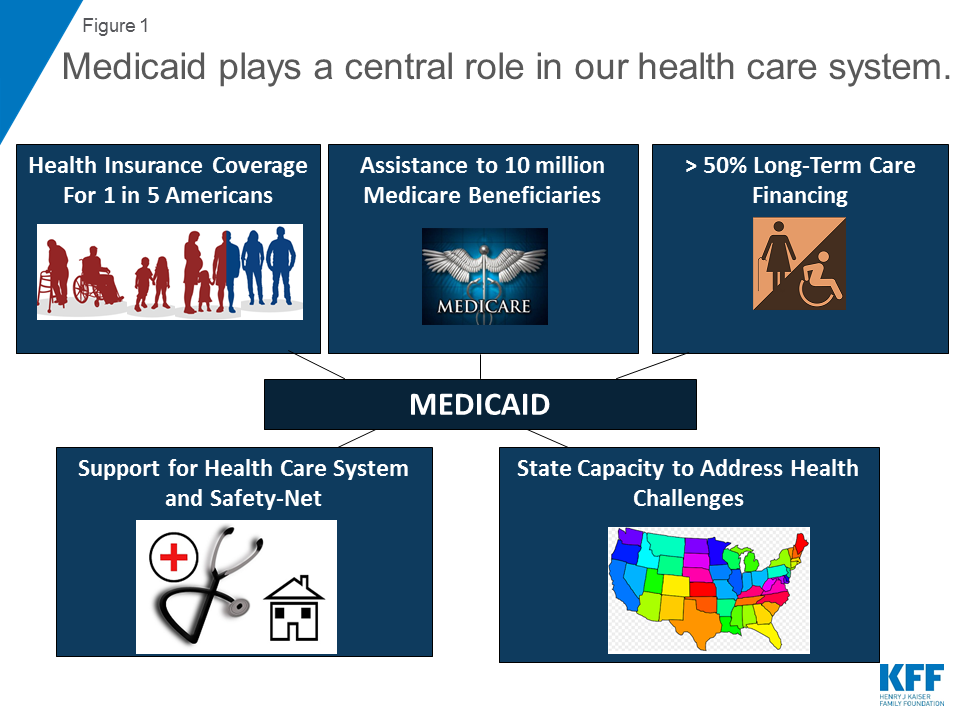

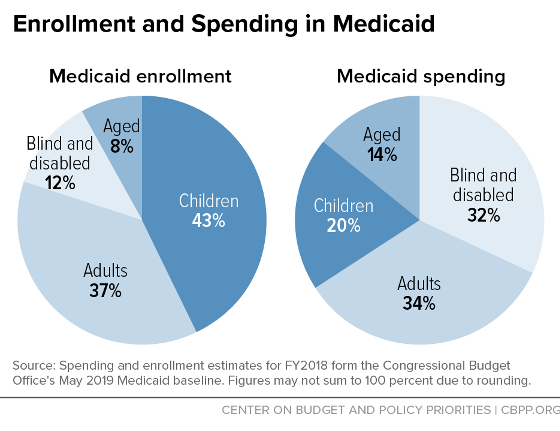

A1a: #Medicaid is a pillar of this country’s health care system, providing coverage to 1 in 5 Americans. #TodaysVoicesTues

cbpp.org/research/healt…

cbpp.org/research/healt…

A1b: It’s a joint federal – state partnership that covers a diverse population & provides a broad range of services. #TodaysVoicesTues

kff.org/medicaid/issue…

kff.org/medicaid/issue…

A1c:#Medicaid is important source of coverage for people with low incomes, ensuring access to care for millions. In a given month, it covers 32 million kids, 28 million adults, 6 million seniors & 9 million people with disabilities. #TodaysVoicesTues

cbpp.org/research/healt…

cbpp.org/research/healt…

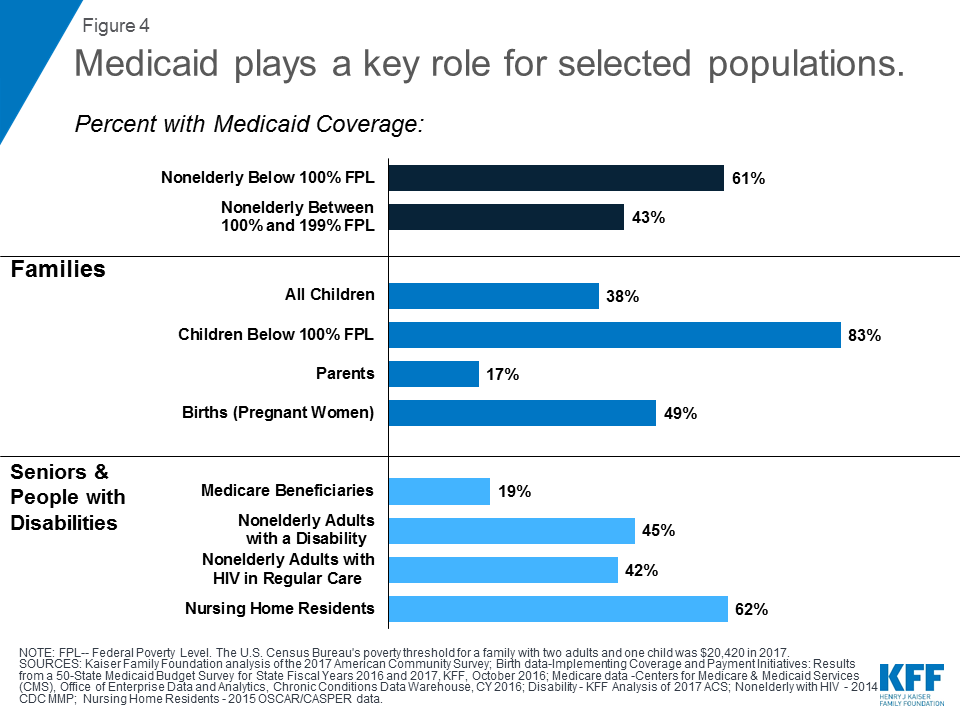

A1d: #Medicaid is a crucial source of coverage for people with disabilities - more than 1 in 3 adults under 65 enrolled in #Medicaid have a disability. #TodaysVoicesTues

A1e: It’s the primary payor of long term services & supports, helping people get the care they need in their homes & communities. #TodaysVoicesTues

cbpp.org/research/healt…

cbpp.org/research/healt…

A1f: #Medicaid is especially important for children with special health care needs, providing coverage to nearly half of these children. And for children with SHCN enrolled in Medicaid in 2017, over 60% are children of color. #TodaysVoicesTues

kff.org/medicaid/issue…

kff.org/medicaid/issue…

• • •

Missing some Tweet in this thread? You can try to

force a refresh