Thread: Today’s #JobsReport shows a labor market that, despite improvements since April, remains devastated by the #COVID19 recession. #JobsDay

Here are six signs showing why.

cbpp.org/blog/6-signs-t…

Here are six signs showing why.

cbpp.org/blog/6-signs-t…

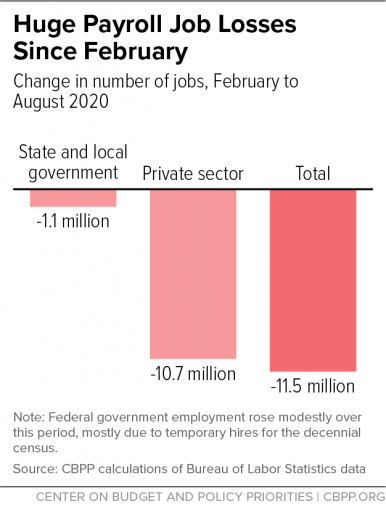

1. The jobs “hole” that opened in March & April remains huge.

Private payroll employment remains 10.7 million jobs below its February level & state & local government payrolls remain 1.1 million jobs below.

cbpp.org/blog/6-signs-t…

Private payroll employment remains 10.7 million jobs below its February level & state & local government payrolls remain 1.1 million jobs below.

cbpp.org/blog/6-signs-t…

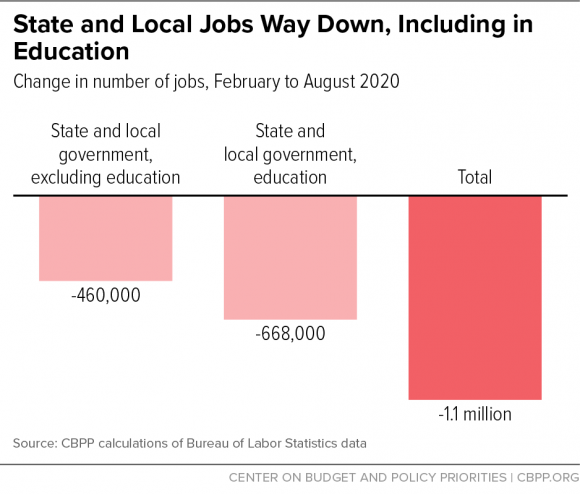

2. State & local job losses, many in education, remain large due to budget cuts.

In April alone, more state & local workers were furloughed or laid off than in the Great Recession of a decade ago & its aftermath. #JobsDay

In April alone, more state & local workers were furloughed or laid off than in the Great Recession of a decade ago & its aftermath. #JobsDay

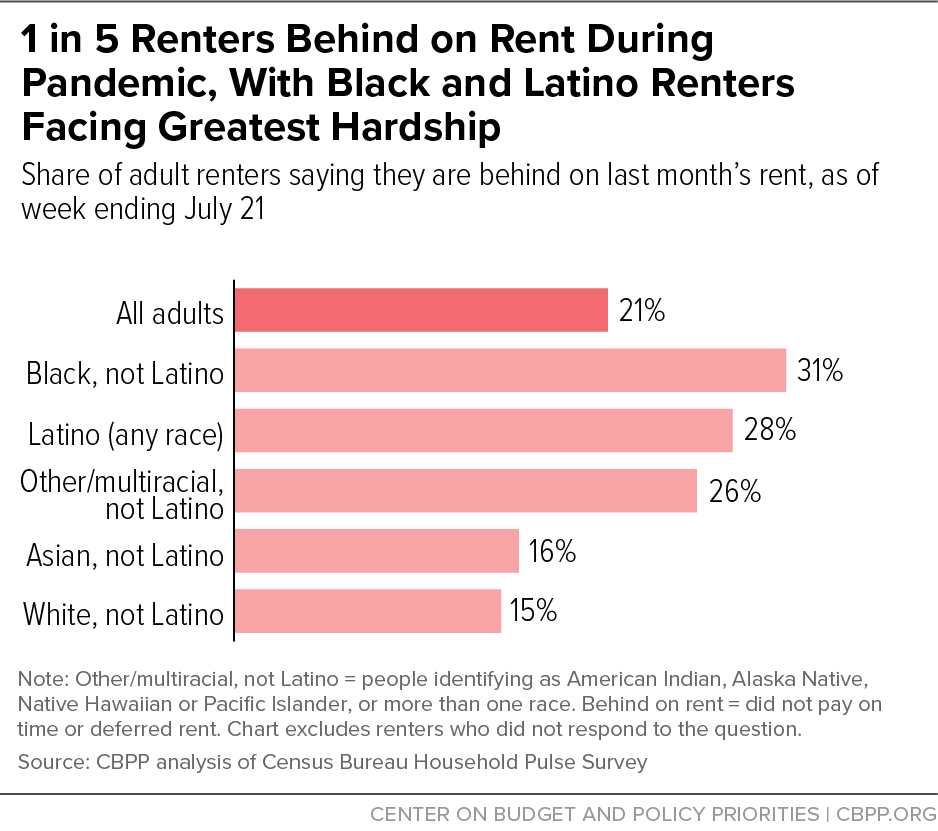

3. Most job losses have occurred in industries that pay low average wages, where a disproportionate number of workers are people of color.

The shares of Black, Latino, & immigrant workers in the lowest-wage group of industries exceed their shares of the overall population.

The shares of Black, Latino, & immigrant workers in the lowest-wage group of industries exceed their shares of the overall population.

5. Unemployment was higher for Black & Hispanic workers than for white workers before the crisis hit & has risen more for them since then.

These patterns have endured in recessions & recoveries & are rooted in this nation’s history of structural racism.

cbpp.org/blog/6-signs-t…

These patterns have endured in recessions & recoveries & are rooted in this nation’s history of structural racism.

cbpp.org/blog/6-signs-t…

6. The crisis also widened racial & ethnic disparities in the share of prime-age workers with a job.

cbpp.org/blog/6-signs-t…

cbpp.org/blog/6-signs-t…

With #COVID19 still not under control & labor market conditions still poor, we need a robust, bipartisan #COIVDRelief bill now. #JobsDay

• • •

Missing some Tweet in this thread? You can try to

force a refresh