N Period High Low breakout strategy: A thread

Complete credit to @theProfessorDev. I have just modified it to be more user friendly.

So, what's different in this?

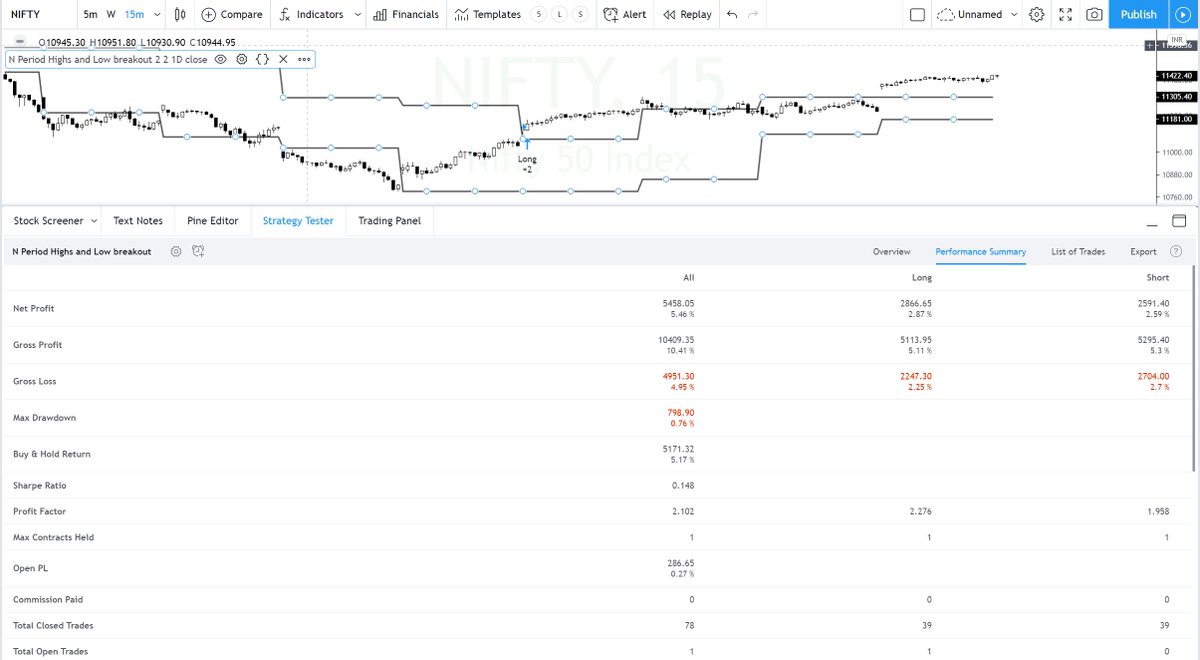

- You can now backtest this strategy on the time period you want - it is no more an indicator alone 1/n

Complete credit to @theProfessorDev. I have just modified it to be more user friendly.

So, what's different in this?

- You can now backtest this strategy on the time period you want - it is no more an indicator alone 1/n

- You can also backtest this strategy for any N period high low break. Usually, you will find traders using Day/Week high and low breaks. But, I've made this strategy generic to even test a 1/2/3/4 hour high/low breakout. 2/n

Example: You can test a 5 hour high/low breakout on a 15 min TF and trade this strategy.

Find the Tradingview strategy code here - pastebin.com/g7ZBmJwA

Paste this code in tradingview pinescript section and add to chart 3/n

Find the Tradingview strategy code here - pastebin.com/g7ZBmJwA

Paste this code in tradingview pinescript section and add to chart 3/n

How to use it?

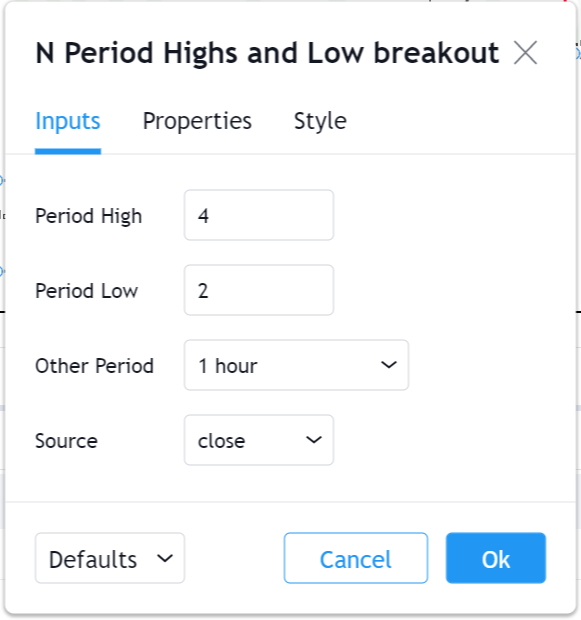

Let's say you want to test 5-day High and 2-day Low breakout on a 15 min TF.

Select the following in settings

Period High: Input 5

Period Low: Input 2

Other Period: Select 1 day

Source: Select Close (closing price)

Select 15 min TF in tradingview 4/n

Let's say you want to test 5-day High and 2-day Low breakout on a 15 min TF.

Select the following in settings

Period High: Input 5

Period Low: Input 2

Other Period: Select 1 day

Source: Select Close (closing price)

Select 15 min TF in tradingview 4/n

• • •

Missing some Tweet in this thread? You can try to

force a refresh