1/ Notes from @modestproposal1 episode @InvestLikeBest

One common denominator for Patrick's guests is just how much they ooze their passion for the great game of investing.

It reverberates through the audio in a tangible manner. This episode was, of course, no different.

One common denominator for Patrick's guests is just how much they ooze their passion for the great game of investing.

It reverberates through the audio in a tangible manner. This episode was, of course, no different.

2/ Investing is about underwriting the past vs the future.

Multiple-based "value investors" are likely to have their work cut out in the current context of investing landscape.

Multiple-based "value investors" are likely to have their work cut out in the current context of investing landscape.

4/ Every time I come across the data that $FB has ~3 Bn users, I just marvel at the scale.

It's mind numbingly yuge!

It's mind numbingly yuge!

5/ @modestproposal1 sounds bullish on ridesharing. If you read my "deep dive on Uber", you know I'm bearish.

mbi-deepdives.com/deep-dive-on-u…

mbi-deepdives.com/deep-dive-on-u…

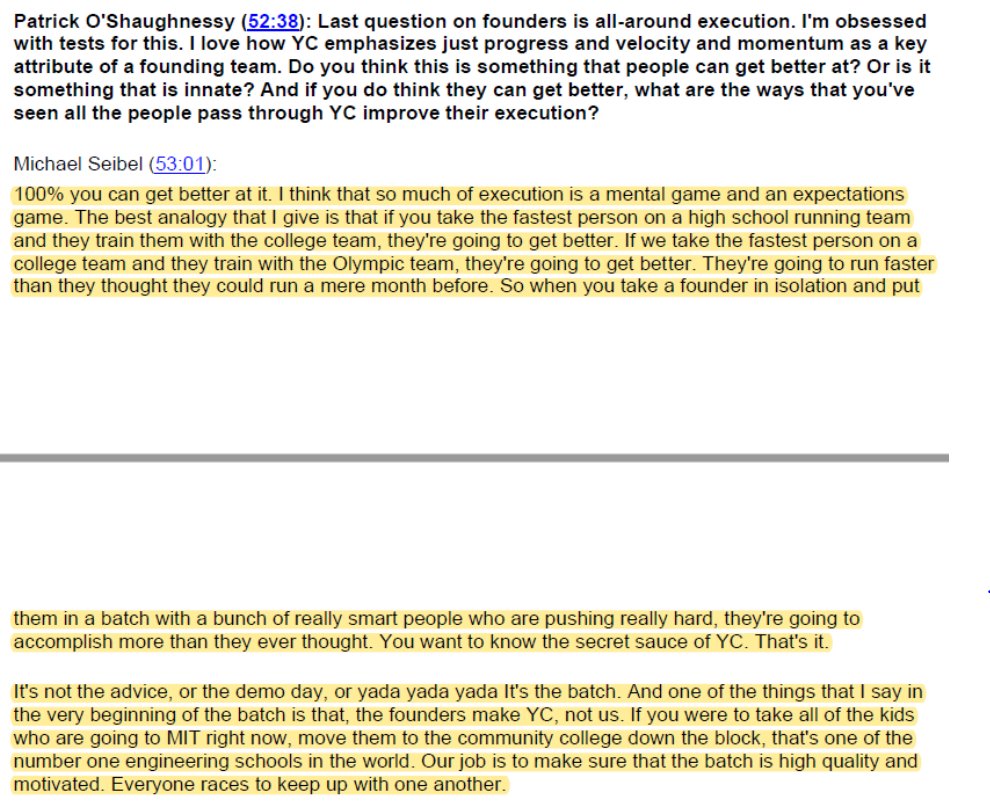

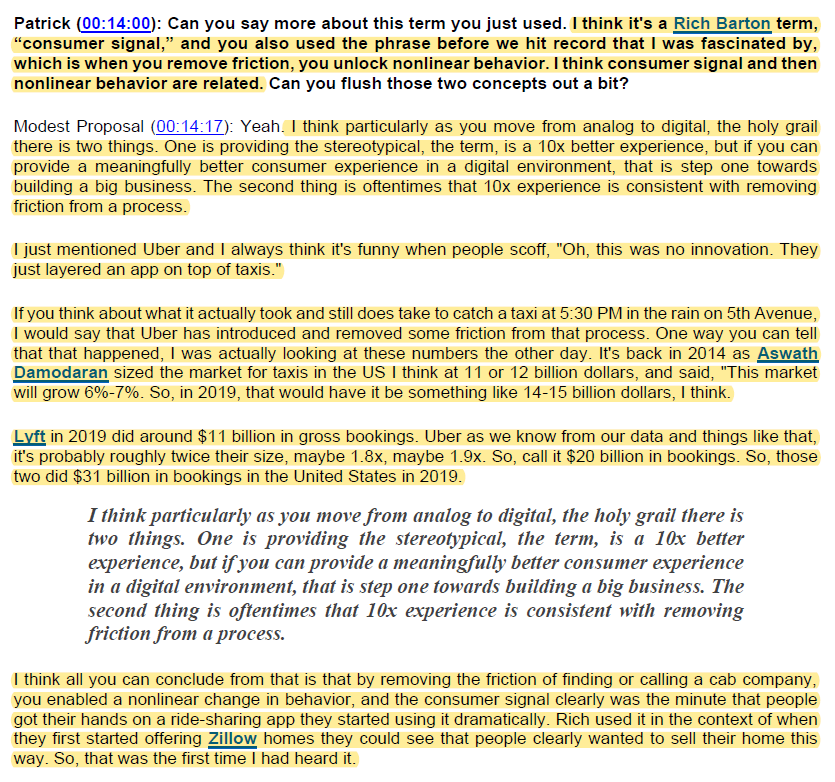

6/ One of my bearish points was TAM is lot lower than many people think.

It's telling that this point has always been sort of the case. And $Uber and $LYFT certainly beat expectations in the past.

I would be curious to see if that remains the case in next 5-10 years.

It's telling that this point has always been sort of the case. And $Uber and $LYFT certainly beat expectations in the past.

I would be curious to see if that remains the case in next 5-10 years.

8/ "if you let a business survive long enough, it will eventually sell ads."

Some examples here: Instacart, $AMZN, $EBAY, $UBER, $ETSY

Some examples here: Instacart, $AMZN, $EBAY, $UBER, $ETSY

9/ Now that offline players were forced to compete online, competitive intensity will increase manifold which can have dramatic, nonlinear effect on CAC.

10/ Interesting thesis on $SYY. Their competitive intensity is likely to ease in the post-Covid world.

11/ $ANGI bull thesis: "There's almost no reason to believe it won't exist in 10 years. It's just what's the path there."

15/ Should $IAC trade at conglomerate discount given the 25-year history of mid to high teen IRR, especially when SPACs are trading 8-20% premium?

16/ $FB, Zuck, and his team have been "hyper aware" of the next platform shift.

If the the next 20 years for Zuck is anything remotely close to last 15 years, Bezos may appear "poor" at some point in front of the Zuck empire!

It won't be easy just as it wasn't for Bezos.

If the the next 20 years for Zuck is anything remotely close to last 15 years, Bezos may appear "poor" at some point in front of the Zuck empire!

It won't be easy just as it wasn't for Bezos.

End/ Episode: investorfieldguide.com/modest-proposa…

Transcript: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

Transcript: investorfieldguide.com/wp-content/upl…

All my twitter threads: mbi-deepdives.com/twitter-thread…

• • •

Missing some Tweet in this thread? You can try to

force a refresh