Last week, ECB president Lagarde acknowledged mismeasurement of output gaps. This seems a technical side note. In fact, it has huge implications for monetary and fiscal policy. Here is a thread on what it implies for EU fiscal policy-making and assessing the fiscal stance: /1

Lagarde: “revisions to potential output mistook cyclical changes for structural trends”. Implication: official estimates of what €Z economies should be able to produce without generating inflationary pressures have been systematically too pessimistic. /2

ecb.europa.eu/press/key/date…

ecb.europa.eu/press/key/date…

Output gaps were large before Corona, implying severe underutilization of resources. Implication: Policy-makers should have been using more expansionary policy measures to stimulate production and employment to reduce big output gaps. /3

It’s important to see Europe’s most powerful monetary policy-maker acknowledge output gap nonsense in public, but it's essential for the European Commission to follow up on this – because it’s very relevant both for ex-post fiscal assessments as well as for the future stance. /4

Lagarde’s remarks imply that the fiscal stance in €countries was too restrictive before Corona. Biased output gap estimates pushed fiscal policy towards austerity, which amplified the downturn in economic activity and validated the initial pessimistic view on output gaps. /5

The European Commission’s potential output model is especially important. It's the technical backbone of EU fiscal surveillance. Model-based estimates are used for evaluating member states’ fiscal performance and underlie recommendations related to budgetary objectives. /6

Lagarde’s remarks finally acknowledge research that provides analysis on revisions in potential output estimates in the aftermath of the global financial crisis. Important: countries most affected by the crisis suffered the largest downward revisions in potential output. /7

Via the institutionalisation of structural balances in the EU’s fiscal regulation framework, downward revisions in potential output (implying smaller output gaps) increased fiscal consolidation pressures especially in the countries with the largest downward revisions. /8

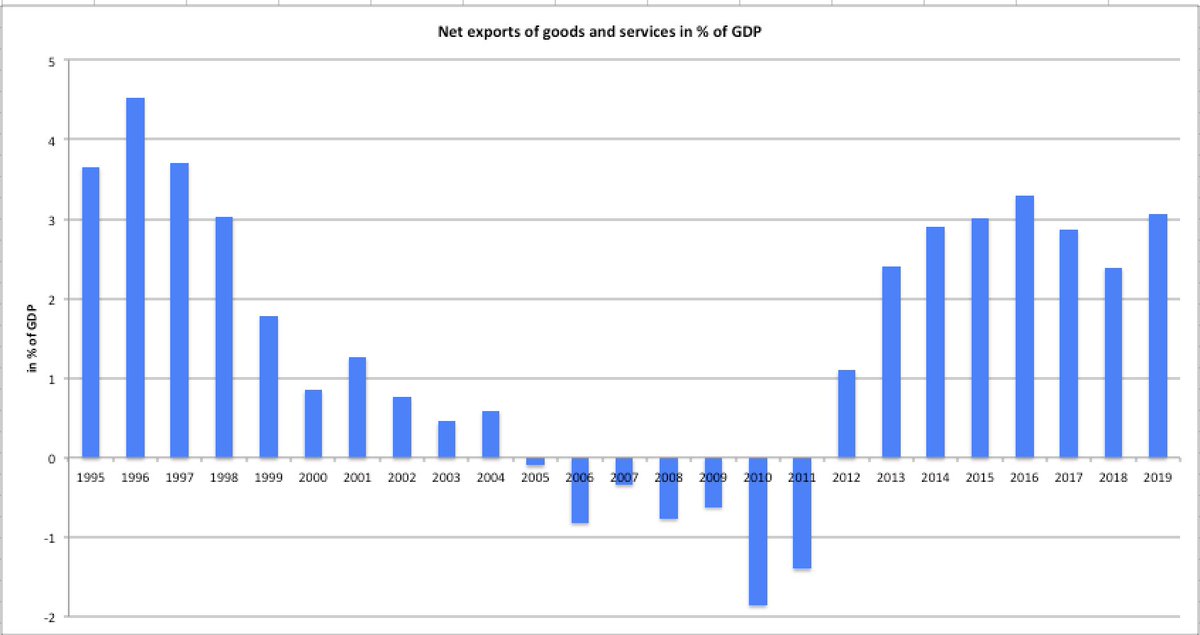

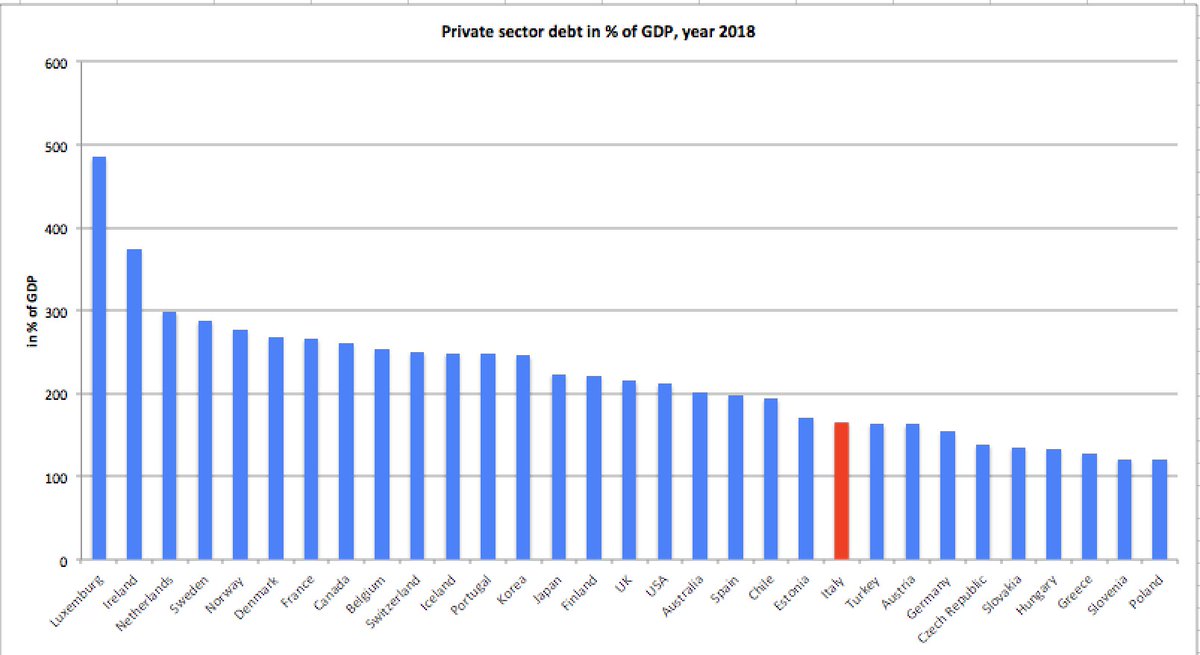

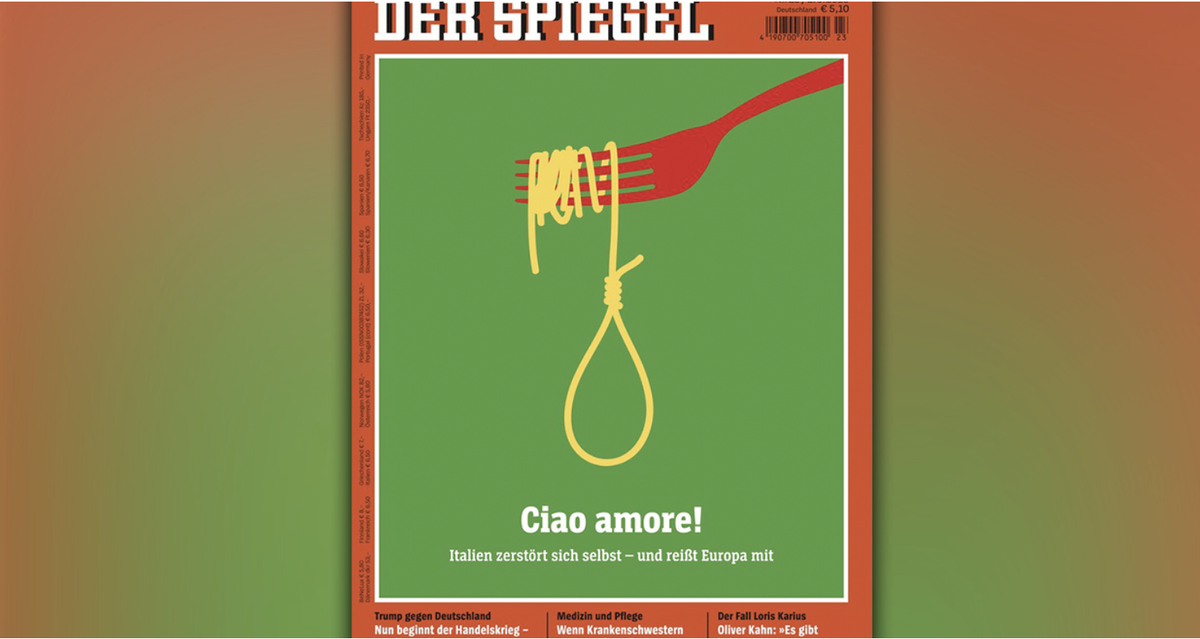

We can use the example of Italy for illustration. Before the COVID-19 shock hit, the Commission estimated that the Italian fiscal deficit would come in at 2.2% of GDP in 2019. Given small official estimates of the output gap, the ‘structural’ deficit was estimated to be large. /9

However, alternative estimates of the output gap pointing to a higher degree of resource underutilization would have reduced the fiscal consolidation pressure on the Italian government. Recommendations for lower government expenditures would have been obsolete. /10

Especially in the period 2010 to 2014, the reliance on pessimistic views of potential output triggered pro-cyclical adjustments in fiscal policy with negative economic growth effects:

intereconomics.eu/contents/year/… /11

intereconomics.eu/contents/year/… /11

Fiscal consolidation caused hysteresis effects, leading to successive rounds of downward revisions in potential output that partly validated the original pessimistic potential output forecasts and, in turn, caused further fiscal consolidation requirements. /12

There is first evidence that revisions in response to the COVID19 crisis again lead to smaller output gaps. The danger is that we will see the problem of systematic mismeasurement that Lagarde hinted at repeated, with biased policy decisions. /13

intereconomics.eu/contents/year/…

intereconomics.eu/contents/year/…

Evaluation of the EU's fiscal rules currently under way. Commission: "[T]he framework relies heavily on variables that are not directly observable and frequently revised, such as the output gap and the structural balance,which hampers the provision of stable policy guidance.” /14

While the understanding of the problem is much better than in 2010, it still needs to translate into real improvement to avoid more counterproductive austerity in the future. First step: full public acknowledgement of past policy failures promoted by output gap mismeasurement./15

The conclusion here is that Lagarde’s sidenote in her speech last week is indeed technical, but it has huge implications for fiscal policy in Europe. When it comes to policy-making, we should never forget that the technical stuff is politically important. /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh